Fintech: Page 16

The latest fintech news for banking professionals.

-

Senate bill would let SMBs use SBA loans to cover fintech fees

The Financial Technology Association is backing a bill that would clarify that loans made through the Small Business Administration’s flagship lending program can be used to pay for fintech services.

By Anna Hrushka • Oct. 4, 2023 -

Shift4 acquires SpotOn unit for $100M

With the purchase of SpotOn’s sports and entertainment business unit, Shift4 scoops up its rival’s customers in that market.

By Caitlin Mullen • Oct. 3, 2023 -

Explore the Trendline➔

Explore the Trendline➔

da-kuk via Getty Images

da-kuk via Getty Images Trendline

TrendlineArtificial intelligence

Banks are enthusiastic about AI’s promises. But can they get customers on board, and will regulators let the innovation happen?

By Banking Dive staff -

Banking events for the 2023-24 conference season

It’s time to plan for the rest of this year and beyond. Banking Dive has you covered with a running list of industry conferences, expos and meetings.

By Dan Ennis • Sept. 29, 2023 -

Modern Treasury CEO targets bigger customers

The digital payment services company brought on a chief revenue officer last year to better serve larger companies, according to CEO Dimitri Dadiomov.

By James Pothen • Sept. 27, 2023 -

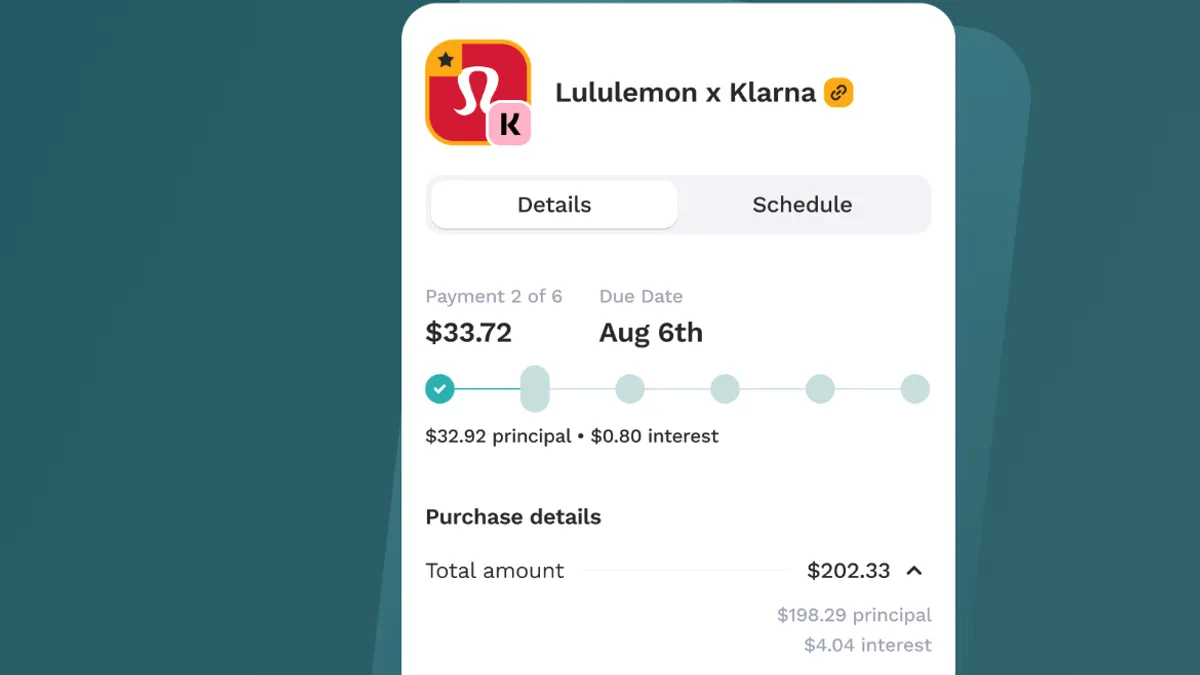

Keeping track of multiple BNPL loans? There’s an app for that.

Cushion CEO Paul Kesserwani felt overwhelmed when he tried to keep track of several BNPL loans at once, so he shifted his fintech’s focus to help others in the same boat.

By Gabrielle Saulsbery • Sept. 27, 2023 -

OCC taps agency insider to head new fintech office

Donna Murphy, who is also the deputy comptroller for compliance risk policy at the OCC, took over the unit in September. An OCC spokesperson declined to comment on the former CFTO’s exit.

By Rajashree Chakravarty • Sept. 27, 2023 -

Retrieved from Business Wire on September 27, 2023

Retrieved from Business Wire on September 27, 2023

Square adds merchant tools

Block’s merchant business, facing stiffer competition in the point-of-sale space, has added about a dozen new features for its sellers.

By Caitlin Mullen • Sept. 27, 2023 -

Envestnet taps BlackRock, Treasury alum for CFO

Joshua Warren will take on the CFO seat as the company deals with continued headwinds in the wealth management sector.

By Grace Noto • Sept. 26, 2023 -

BNPL users ‘financially fragile,’ NY Fed says

Consumers using BNPL have lower credit scores, have been delinquent on a loan or have been rejected for a credit application over the past year, New York Fed researchers said.

By Caitlin Mullen • Sept. 26, 2023 -

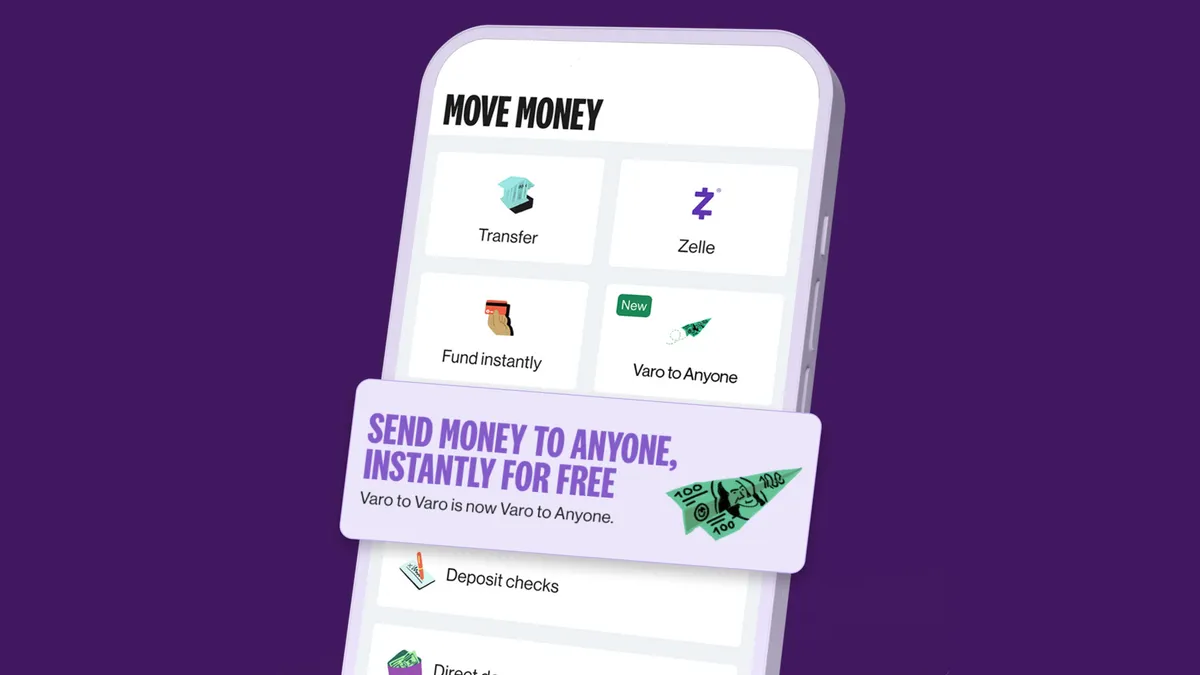

Varo aims to displace Venmo, Cash App volume with new P2P feature

The bank on Thursday launched a feature enabling Varo account holders to instantly transfer funds at no cost to anyone with a U.S. debit card.

By Anna Hrushka • Sept. 21, 2023 -

JPMorgan taps Gusto to offer embedded payroll services

Chase Payment Solutions’ small and medium-size business customers can use Gusto to combine the payroll process with financial operations.

By Rajashree Chakravarty • Sept. 20, 2023 -

New guidance encourages banks to define a fintech’s maturity level

Guidance released by the Alloy Labs Alliance aims to give banks an idea of how risk-management oversight may change or evolve as their fintech partner’s maturity develops.

By Anna Hrushka • Sept. 20, 2023 -

Goldman in advanced talks to sell GreenSky: reports

The group of potential buyers includes investment firms Sixth Street, Pimco and KKR, according to The Wall Street Journal. A deal would be worth roughly $500 million, the outlet’s sources said.

By Dan Ennis • Sept. 20, 2023 -

Rakuten withdraws bid for NCUA charter

The Japanese e-commerce firm previously tried three times to gain a charter via an industrial loan company application, only to withdraw each bid months later.

By Anna Hrushka • Sept. 19, 2023 -

Brex adds more AI to CFOs’ expense management arsenal

Brex is one of many software vendors that are racing to bet on AI following the swift rise of ChatGPT, created by Microsoft-backed OpenAI.

By Alexei Alexis • Sept. 19, 2023 -

Square CEO to depart

Alyssa Henry, CEO of Block’s merchant business Square, will leave the company Oct. 2, handing over the post to co-founder Jack Dorsey.

By Caitlin Mullen • Sept. 18, 2023 -

Citi sells SMB loan platform to Foro

As part of the deal, Citi becomes a minority shareholder in Charlotte, North Carolina-based Foro, which counts former Bank of America CEO Hugh McColl Jr. as one of its founding investors.

By Anna Hrushka • Sept. 13, 2023 -

Connecticut fintech launches small-business credit card

Owners Bank, a fintech born out of 201-year-old Liberty Bank, is looking to solve funding challenges facing small businesses.

By Gabrielle Saulsbery • Sept. 13, 2023 -

Stax CEO zeroes in on embedded payments

Stax is honing its strategy to build on embedded payments as the company pushes its payment facilitation offering, CEO Paulette Rowe said.

By Caitlin Mullen • Sept. 12, 2023 -

5 takeaways from Michael Barr’s views on CBDCs, stablecoins and more

The Federal Reserve’s vice chair for supervision spoke about “responsible innovation” Friday at a Philadelphia Fed fintech conference.

By Suman Bhattacharyya • Sept. 11, 2023 -

Deep Dive

Goldman’s strategy retreat leaves GreenSky in limbo

The installment-lending fintech, which Goldman is looking to sell, faces an uncertain future as the investment bank distances itself from an ambitious retail strategy.

By Anna Hrushka • Sept. 7, 2023 -

JPMorgan Chase revs up payments lab hiring

The bank is venturing further into fintech and payments for new product development at its lab in Greece.

By Tatiana Walk-Morris • Sept. 7, 2023 -

Finotta uses gamification to increase banks’ user engagement

The embedded fintech says its personalized financial guidance platform has helped boost user engagement on banks’ mobile apps.

By Rajashree Chakravarty • Sept. 6, 2023 -

Growth in fintech sector spurs specialty college programs

Worcester Polytechnic Institute launched both a fintech undergraduate and graduate degree program last week. The prestigious technology school is far from the first.

By Gabrielle Saulsbery • Sept. 6, 2023 -

Upgrade sets sights on auto loans as legacy banks pull back

The neobank is venturing into a sector many traditional firms have been exiting amid mounting concerns about credit quality.

By Anna Hrushka • Sept. 1, 2023