Fintech: Page 15

The latest fintech news for banking professionals.

-

New Fed unit to supervise crypto, nonbank partnerships

The central bank clarified that any state bank it supervises must get the regulator’s green light before issuing, holding or transacting in dollar tokens, such as stablecoins, to facilitate payments.

By Anna Hrushka • Aug. 9, 2023 -

MoneyLion faces suit over stock, earn-out payments

The founders of Malka Media Group, a creator network MoneyLion acquired in 2021, claim the neobank is withholding millions of dollars and using “delay tactics to drag out the resolution process.”

By Anna Hrushka • Aug. 9, 2023 -

Explore the Trendline➔

Explore the Trendline➔

da-kuk via Getty Images

da-kuk via Getty Images Trendline

TrendlineArtificial intelligence

Banks are enthusiastic about AI’s promises. But can they get customers on board, and will regulators let the innovation happen?

By Banking Dive staff -

PayPal launches stablecoin

PayPal is planting a flag in the stablecoin space despite the slow uptake of digital assets in consumer payments and the lingering crypto chill.

By Caitlin Mullen • Aug. 8, 2023 -

Revolut halts US crypto trading

U.S. customers will no longer be able to buy tokens on the neobank’s platform as of Sept. 2, and crypto access for those users will be disabled a month later, the neobank said.

By Anna Hrushka • Aug. 4, 2023 -

Figure withdraws bank charter application

The blockchain startup applied for a charter in 2020, then included plans to seek deposit insurance after the Conference of State Bank Supervisors sued.

By Gabrielle Saulsbery • Aug. 2, 2023 -

Bunq CEO: US regulators ‘tough but fair’ amid license wait

“At Bunq we’d rather do things right than rush things,” said Ali Niknam, who founded the Dutch fintech in 2012. “And the only way for us to be able to do that is by having our own bank.”

By Anna Hrushka • Aug. 2, 2023 -

Shopify taps Ramp to save on corporate expenses

E-commerce company Shopify is adopting more artificial intelligence by automating its corporate expenses through Ramp.

By James Pothen • Aug. 1, 2023 -

How banks could fit into Elon Musk’s plans for an ‘everything app’

The billionaire’s intent to bring the social media platform into the banking and payments landscape presents both opportunities and risks for traditional banks, experts said.

By Anna Hrushka • July 31, 2023 -

Upgrade acquires BNPL firm Uplift for $100M

The deal, Upgrade’s first acquisition, more than doubles the neobank’s customer base by adding 3.3 million users to its existing 2.5 million, CEO Renaud Laplanche said.

By Anna Hrushka • July 27, 2023 -

Fintechs ‘deeply concerned’ with Senate SBA bill

A bill aimed at reining in the SBA’s 7(a) expansion plan would subject nonbanks to unfair and overly burdensome regulations, fintech trade groups said.

By Anna Hrushka • July 26, 2023 -

Fintech trade group grows educational arm

The American Fintech Council is partnering with professional services firm FORVIS to offer compliance and training opportunities aimed at improving the fintech ecosystem, AFC CEO Phil Goldfeder said.

By Gabrielle Saulsbery • July 26, 2023 -

Greenwood, Gathering Spot settle business dispute

“No one wins when the family feuds,” executives for Greenwood and The Gathering Spot said in a joint statement. “We apologize for distracting our communities over the last week as this became a topic of so much public discussion.”

By Anna Hrushka • July 26, 2023 -

Finance tech startup Bunker raises over $5M

The funds will be invested toward product development, growing the company’s team and accelerating its “go-to-market strategy,” according to Bunker CEO Shivom Sinha.

By Alexei Alexis • July 25, 2023 -

Gathering Spot founders sue neobank Greenwood

T’Keel Petersen and Ryan Wilson, who co-founded the club for Black professionals in 2016, claim the neobank owes them and other TGS shareholders roughly $5 million in earn-out payments.

By Anna Hrushka • July 24, 2023 -

Senate bill would rein in SBA’s fintech lending plan

The legislation, which heads to the full Senate, is in response to the agency’s decision to end a 40-year moratorium on admitting new nonbank entrants to its 7(a) loan program.

By Anna Hrushka • July 21, 2023 -

Blue Ridge Bank holding company’s CEO resigns

The president of the bank’s fintech division, Kirsten Muetzel, also is leaving the bank this month, according to her LinkedIn profile.

By Anna Hrushka • July 20, 2023 -

Photo by Tima Miroshnichenko from Pexels

Q&A

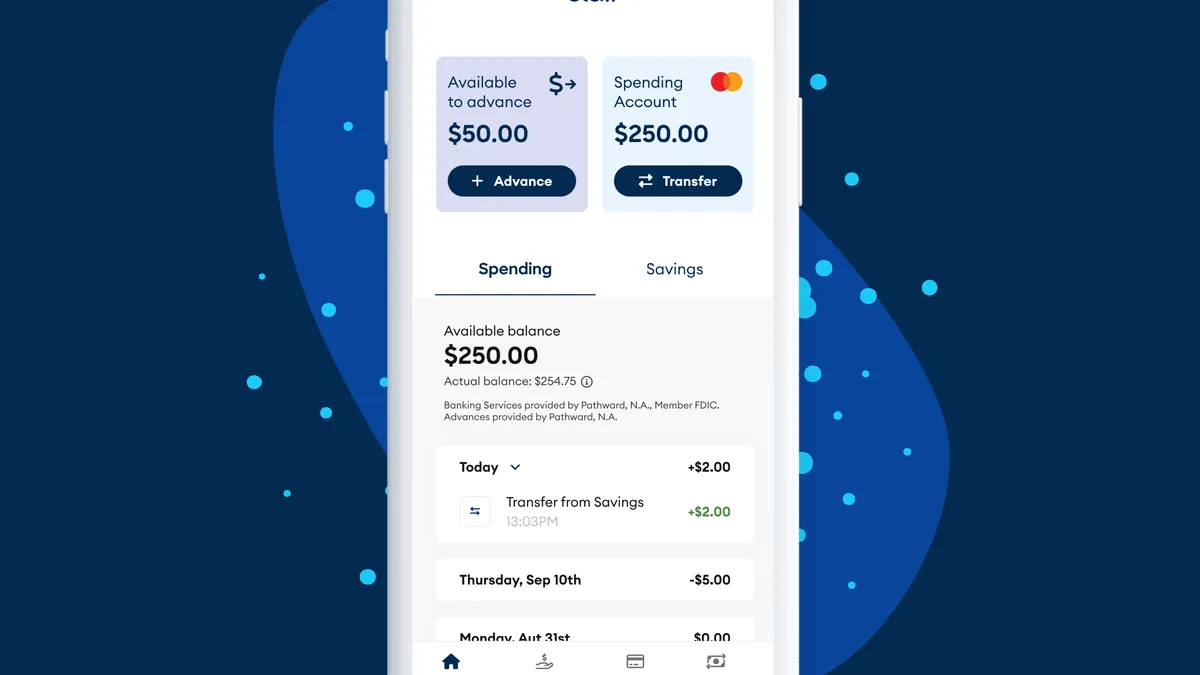

Q&AClair CEO welcomes on-demand pay regulation

Clair CEO Nico Simko weighed in on whether EWA is a payday loan and how the company offers fee-free wage access.

By James Pothen • July 20, 2023 -

Wells Fargo, Hello Alice team on $70M small-business fund

The fund is meant to increase banks' risk tolerance and help underserved small-business owners with credit enhancements and cash collateral deposits.

By Anna Hrushka • July 19, 2023 -

Cannabis fintech Dama Financial looks to double sponsor bank network

Dama Financial’s network of sponsor banks holds the deposits for cannabis-related businesses which, due to conflicting state and federal laws, often operate outside of the banking sector.

By Anna Hrushka • July 19, 2023 -

Fintech funding drops in Q2

While there was a drought of venture capital for payments startups and other fintechs in the first half of the year, industry reports spot potential for new flows in the second half.

By Lynne Marek • July 18, 2023 -

Second Frank exec can’t escape JPMorgan lawsuit, judge says

The startup's chief growth officer, Olivier Amar, pleaded not guilty Thursday to four fraud-related counts connected to what the acquiring bank said was a misrepresentation of Frank's customer base.

By Dan Ennis • July 17, 2023 -

Apple debuts recurring payments

The tech giant, now valued at $3 trillion, is continuing to expand its financial offerings after debuting a buy now, pay later feature and a savings account earlier this year.

By James Pothen • July 14, 2023 -

UK neobank Monzo eyeing Lunar acquisition: reports

The reported merger talks come as rising interest rates and a drop in venture funding have created a difficult environment for fintechs and neobanks.

By Anna Hrushka • July 12, 2023 -

Fintech Clair raises $175M, debuts tool for hourly employees

After seeing tenfold growth over the past year, Clair aims to use the funding to expand its team and accelerate the adoption of its solution among frontline workers.

By Rajashree Chakravarty • July 12, 2023 -

Fintechs, digital banks make gains in battle for checking accounts

Digital banks and fintechs made up nearly half (47%) of all new checking accounts opened so far in 2023, up from 36% in 2020, according to a survey by Cornerstone Advisors.

By Anna Hrushka • July 12, 2023