Fintech: Page 14

The latest fintech news for banking professionals.

-

PayPal tackles chargeback fraud

PayPal is attacking illegitimate customer returns with new policies after a rise in e-commerce activity has fueled that type of fraud across the industry.

By Lynne Marek • Nov. 29, 2023 -

BNPL bolsters holiday weekend spending

The Black Friday through Cyber Monday shopping weekend was a boon for BNPL providers and payments companies such as Stripe and Square.

By Caitlin Mullen • Nov. 29, 2023 -

Explore the Trendline➔

Explore the Trendline➔

da-kuk via Getty Images

da-kuk via Getty Images Trendline

TrendlineArtificial intelligence

Banks are enthusiastic about AI’s promises. But can they get customers on board, and will regulators let the innovation happen?

By Banking Dive staff -

First OCC fintech chief had phony resume: reports

Prashant Bhardwaj alleged he held positions at Huntington and Fifth Third — and at Citi at a time when he would have been 13, according to a resume The Information obtained through FOIA.

By Gabrielle Saulsbery • Nov. 27, 2023 -

Want to avoid an HMBradley scenario? Diversify your bank network, Treasury Prime CEO says

A recent pivot by neobank HMBradley is a prime example of what can happen when a fintech relies on just one firm to handle its financial plumbing, Treasury Prime’s Chris Dean said.

By Anna Hrushka • Nov. 22, 2023 -

Plaid poaches Adyen executive for European expansion

Brian Dammeir sees opportunities for Plaid’s payments business to grow in Europe, particularly in account-to-account payments, he said in a Wednesday interview.

By James Pothen • Nov. 22, 2023 -

Blue Ridge Bank sheds fintech partners, explores capital raise

The Charlottesville, Virginia-based firm, whose fintech program came under OCC scrutiny last year, said it is in the process of offboarding about a dozen of its roughly 50 BaaS partners.

By Anna Hrushka • Nov. 22, 2023 -

Wise CFO credits customer growth for 280% profit jump

The fintech’s nearly quadruple jump in profits comes as its CFO is preparing to depart after an eight-year tenure.

By Grace Noto • Nov. 17, 2023 -

Neobank HMBradley to wind down retail operations in B2B pivot

After failing to hit growth targets, the fintech is shutting down its consumer operations and looking to sell its technology to banks.

By Anna Hrushka • Nov. 16, 2023 -

Refine Intelligence raises $13M with novel approach to AML

Wayne, New Jersey-based Valley Bank took a chance on Refine as its first customer. What it saw inspired an investment from Valley Ventures, the bank’s VC arm.

By Gabrielle Saulsbery • Nov. 15, 2023 -

Third-party guidance could have ‘chilling effect’ on BaaS, former FDIC chair warns

“I don’t think that the current set of regulators really want banking-as-a-service and third-party partnerships to blossom,” former FDIC Chair Jelena McWilliams said during an event in Washington, D.C. on Tuesday.

By Anna Hrushka • Nov. 15, 2023 -

DailyPay wage payments delayed due to Friday snafu

The early wage access company didn’t immediately make some payments to workers because of a snag related to the Veterans Day holiday.

By Lynne Marek • Nov. 14, 2023 -

BNPL companies face grim outlook, Moody’s says

Fierce competition, persistent losses and regulatory constraints are likely to push some players out of the buy now, pay later market, Moody’s predicted.

By Lynne Marek • Nov. 13, 2023 -

Revolut appoints interim CFO as it races to meet filing deadline

Revolut’s interim CFO and new U.K. CEO face an upward battle to win the fintech’s long-sought after U.K. banking license.

By Grace Noto • Nov. 10, 2023 -

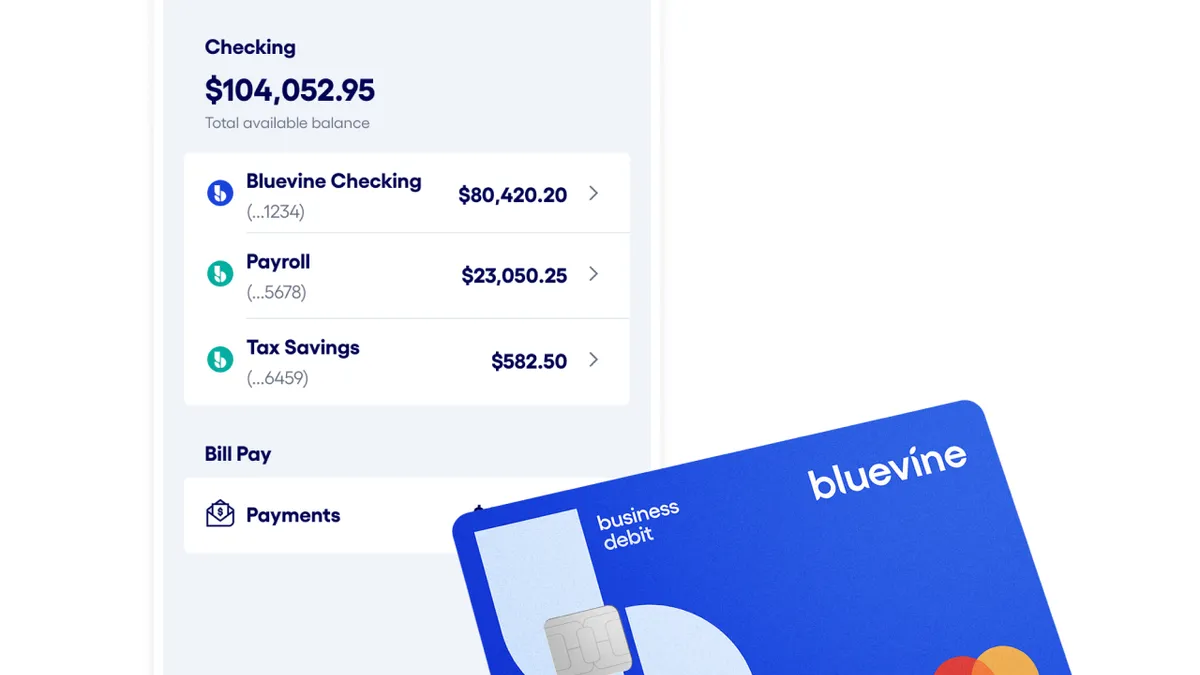

Bluevine rolls out high-yield interest rate for SMBs

The offering pairs a high return with cash flow flexibility, two features in strong demand among small-business owners, Charles Amadon, the fintech’s senior vice president and general manager of banking said.

By Anna Hrushka • Nov. 8, 2023 -

Oportun to cut 185 jobs, end Sezzle partnership

The installment lender is also discontinuing its investment and retirement products and “exploring strategic options” related to its credit-card portfolio, CEO Raul Vazquez said Monday.

By Dan Ennis • Nov. 8, 2023 -

CFPB proposes new oversight for payment tech firms

Google, Apple and 15 other big non-bank technology companies that provide digital wallets or payments apps would be subject to increased regulation if a new Consumer Financial Protection Bureau rule is approved.

By Lynne Marek , James Pothen • Nov. 7, 2023 -

Regions Bank partners with credit-building fintech

Through a new partnership with Self Financial, Regions customers can have their rent, cell phone and utility payments reported to the three major credit bureaus.

By Anna Hrushka • Nov. 7, 2023 -

What execs are saying about bank-fintech partnerships

Bank-fintech partnerships, including banking-as-a-service models, have faced increased scrutiny this year. But executives are optimistic, some deeming these tie-ups “critical.”

By Gabrielle Saulsbery , Anna Hrushka • Nov. 3, 2023 -

Breaking down buy now, pay later

After its pandemic-era growth spurt, buy now, pay later has gone mainstream in consumer payments. But changing economic conditions are forcing the installment trend to evolve.

By Caitlin Mullen • Nov. 3, 2023 -

Trust in banks remains steady, while fintechs have ground to cover: survey

The percentage of U.S. adults who say they trust banks and credit unions has held steady even in the wake of the collapse of Silicon Valley Bank and other regional lenders.

By Anna Hrushka • Nov. 2, 2023 -

Funding Circle gets long-awaited shot at SBA lending

Funding Circle joins Arkansas Capital Corp. and Alaska Growth Capital BIDCO as the first nondepository institutions to be granted new Small Business Lending Company licenses in 40 years.

By Anna Hrushka • Nov. 1, 2023 -

What makes a neobank? A primer can explain.

Read on to learn more about the birth of neobanks, an apt moniker, and what makes a neobank apply for a charter to become a traditional bank.

By Rajashree Chakravarty • Nov. 1, 2023 -

Charlie, a neobank for retirees, raises fresh capital to fight fraud

After closing a $23 million Series A round, the fintech plans to launch a set of anti-fraud tools designed specifically for the 62+ population.

By Anna Hrushka • Oct. 31, 2023 -

What bank, fintech execs are saying about AI

Ahead of the Biden administration’s landmark executive order unveiled on Monday, banks and fintech executives discussed AI use cases and implications at Money20/20 last week.

By Anna Hrushka , Gabrielle Saulsbery • Oct. 30, 2023 -

A look at Week 4 of the Sam Bankman-Fried trial

Bankman-Fried admitted that FTX didn't turn out how he expected: "A lot of people got hurt," he said. But he said he didn't defraud anyone.

By Gabrielle Saulsbery • Oct. 27, 2023