Fintech: Page 17

The latest fintech news for banking professionals.

-

Q&A

‘We’re in the 1999 of the internet era’: a16z’s Julie Yoo on fintech’s potential

Yoo, who leads health tech investment at venture-capital firm Andreessen Horowitz, outlined her fintech investment thesis and why the healthcare industry is at an inflection point for adoption.

By Rebecca Pifer • Aug. 31, 2023 -

Column

Goldman, regional bank warnings show the Fed is now playing offense

The central bank has requested action from Citizens, Fifth Third and M&T regarding capital, liquidity, technology and compliance, according to Bloomberg. Goldman’s fintech partnerships are reportedly under scrutiny, too.

By Dan Ennis • Aug. 31, 2023 -

Explore the Trendline➔

Explore the Trendline➔

da-kuk via Getty Images

da-kuk via Getty Images Trendline

TrendlineArtificial intelligence

Banks are enthusiastic about AI’s promises. But can they get customers on board, and will regulators let the innovation happen?

By Banking Dive staff -

Q&A

Bluevine plans IPO while sticking to small business lending

The fintech, which hit 80% year-over-year revenue growth, is planning to go public within 18 to 24 months, Bluevine CEO Eyal Lifshitz said.

By Rajashree Chakravarty • Aug. 30, 2023 -

JPMorgan boosts its stake in Brazilian neobank C6 to 46%

C6 has seen its client base grow from 8 million to 25 million since June 2021, when JPMorgan bought its initial slice. C6’s credit portfolio has more than quadrupled in that time, the neobank said.

By Gabrielle Saulsbery • Aug. 30, 2023 -

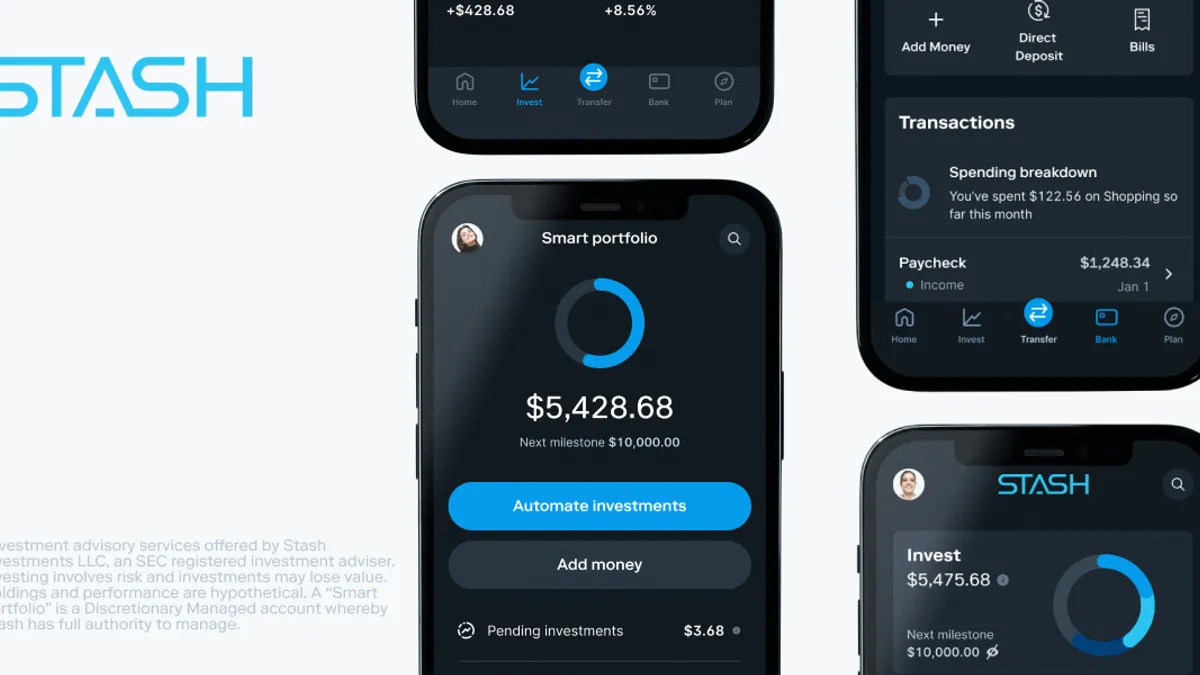

Stash appoints Dave veteran as CTO, eyeing new growth phase

Chien-Liang Chou spent nearly three years at Dave, overseeing the fintech’s effort to go public in 2022 as the team tripled.

By Suman Bhattacharyya • Aug. 30, 2023 -

Elavon, Ingenico team on new payments tool

U.S. Bank’s payments software unit is locking arms with the French hardware-maker to take on a raft of competitors targeting small businesses.

By Lynne Marek • Aug. 30, 2023 -

AI fintech Stampli opens Austin office

The California company extended its presence to a third U.S. city and aims to expand its employee headcount by 40%.

By James Pothen • Aug. 29, 2023 -

Massachusetts’ top court rules against Robinhood

The Supreme Judiciary Court’s 5-0 ruling upholds the state’s fiduciary rule, holding broker-dealers like Robinhood to fiduciary duties of care and loyalty, similar to investment advisers.

By Gabrielle Saulsbery • Aug. 28, 2023 -

PayNearMe strikes partnership with Dollar General

The deal increases PayNearMe's retailer footprint by one-third, bringing the ability to pay bills in cash to millions more Americans.

By Gabrielle Saulsbery • Aug. 23, 2023 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB sues Curo Group subsidiary over consumer loan practices

The fintech lender’s subsidiary, Heights Finance, reaped hundreds of millions of dollars in loan costs and fees through “illegal loan-churning practices," the agency said.

By Rajashree Chakravarty • Aug. 23, 2023 -

Pinwheel partners with Plaid for direct deposit switching services

Pinwheel said San Francisco-based Plaid would refer its customers requiring direct deposit switching to the New York-based startup.

By Rajashree Chakravarty • Aug. 18, 2023 -

Jack Henry & Associates trims workforce

The bank payment and technology services provider has offered an early retirement program that it expects to pare 160 employees.

By Lynne Marek • Aug. 17, 2023 -

Rightfoot raises $15M to help banks convert customers

Banks experience a 40% dropoff when they require customers to share bank account information online, according to Rightfoot, provider of no-login, consumer permissioned financial data product Connect Magic.

By Gabrielle Saulsbery • Aug. 16, 2023 -

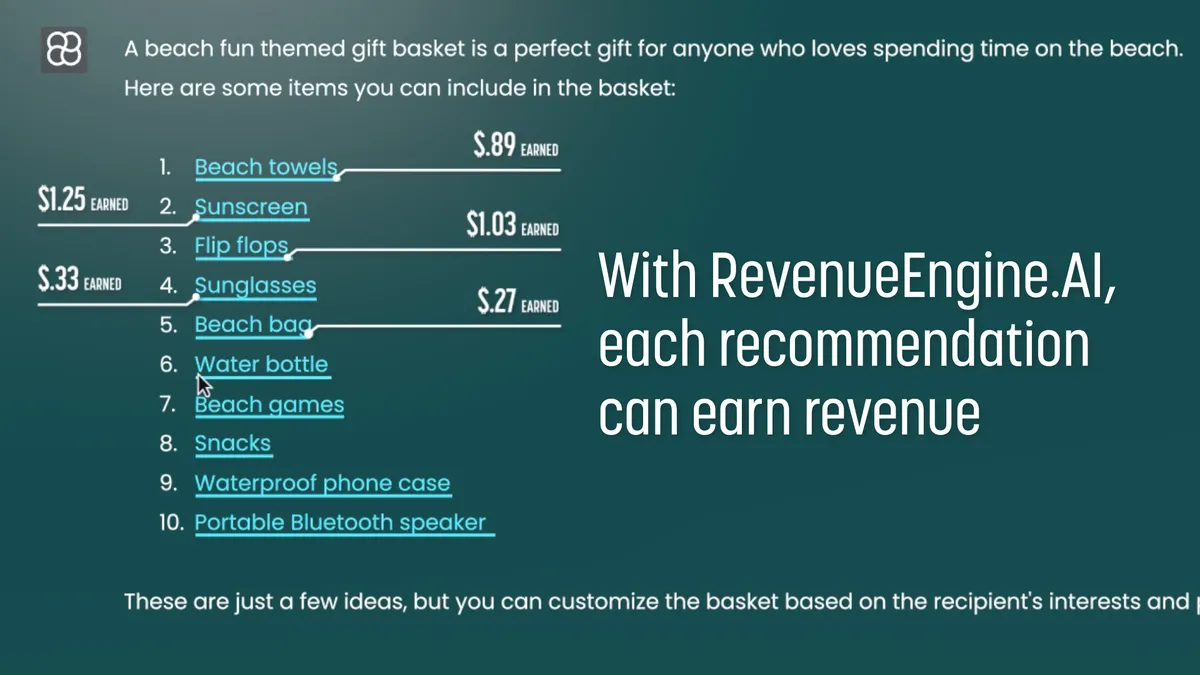

Wildfire’s AI-powered tool helps banks monetize e-commerce transactions

Wildfire’s RevenueEngine works with banks directly to power their rewards and loyalty programs to help drive consumer retention and new user acquisition, CEO Jordan Glazier said.

By Rajashree Chakravarty • Aug. 16, 2023 -

Zelle parent hires new CEO

Early Warning Services gets a new executive in the midst of rolling out a bank-backed digital wallet, while also coming under scrutiny from lawmakers and regulators.

By James Pothen • Aug. 15, 2023 -

PayPal names Intuit exec as CEO

The digital payments pioneer tapped Intuit’s Alex Chriss to lead the company, starting next month, as Dan Schulman heads for an exit.

By Lynne Marek • Aug. 14, 2023 -

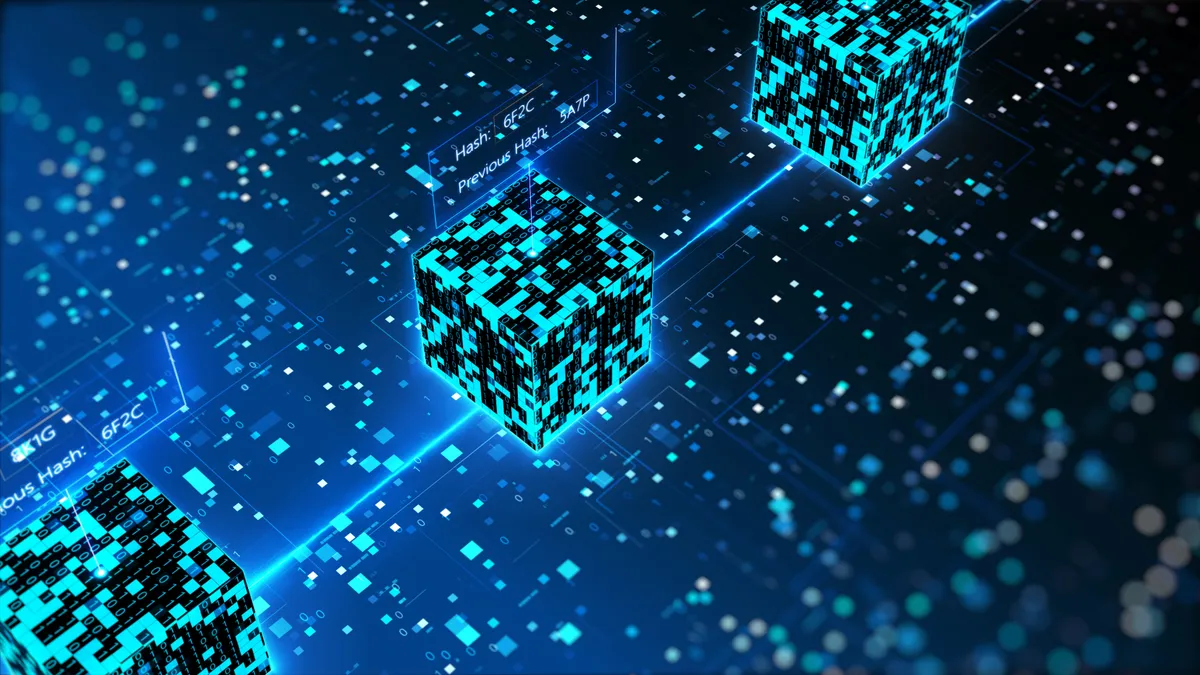

New Fed unit to supervise crypto, nonbank partnerships

The central bank clarified that any state bank it supervises must get the regulator’s green light before issuing, holding or transacting in dollar tokens, such as stablecoins, to facilitate payments.

By Anna Hrushka • Aug. 9, 2023 -

MoneyLion faces suit over stock, earn-out payments

The founders of Malka Media Group, a creator network MoneyLion acquired in 2021, claim the neobank is withholding millions of dollars and using “delay tactics to drag out the resolution process.”

By Anna Hrushka • Aug. 9, 2023 -

PayPal launches stablecoin

PayPal is planting a flag in the stablecoin space despite the slow uptake of digital assets in consumer payments and the lingering crypto chill.

By Caitlin Mullen • Aug. 8, 2023 -

Revolut halts US crypto trading

U.S. customers will no longer be able to buy tokens on the neobank’s platform as of Sept. 2, and crypto access for those users will be disabled a month later, the neobank said.

By Anna Hrushka • Aug. 4, 2023 -

Figure withdraws bank charter application

The blockchain startup applied for a charter in 2020, then included plans to seek deposit insurance after the Conference of State Bank Supervisors sued.

By Gabrielle Saulsbery • Aug. 2, 2023 -

Bunq CEO: US regulators ‘tough but fair’ amid license wait

“At Bunq we’d rather do things right than rush things,” said Ali Niknam, who founded the Dutch fintech in 2012. “And the only way for us to be able to do that is by having our own bank.”

By Anna Hrushka • Aug. 2, 2023 -

Shopify taps Ramp to save on corporate expenses

E-commerce company Shopify is adopting more artificial intelligence by automating its corporate expenses through Ramp.

By James Pothen • Aug. 1, 2023 -

How banks could fit into Elon Musk’s plans for an ‘everything app’

The billionaire’s intent to bring the social media platform into the banking and payments landscape presents both opportunities and risks for traditional banks, experts said.

By Anna Hrushka • July 31, 2023 -

Upgrade acquires BNPL firm Uplift for $100M

The deal, Upgrade’s first acquisition, more than doubles the neobank’s customer base by adding 3.3 million users to its existing 2.5 million, CEO Renaud Laplanche said.

By Anna Hrushka • July 27, 2023