Technology: Page 50

-

Q&A

LendingClub, Radius execs talk regulation, tech integration ahead of merger

In a wide-ranging interview, executives said they don’t foresee any pushback from regulators or any significant post-merger complications associated with integrating the two companies’ platforms or IT.

By Anna Hrushka • Feb. 24, 2020 -

JPMorgan Chase reportedly launching UK digital bank

JPMorgan would have its fair share of digital bank competitors in the U.K., including Monzo, Starling, Revolut, as well as fellow U.S. bank Goldman Sachs's Marcus.

By Anna Hrushka • Feb. 24, 2020 -

Explore the Trendline➔

Explore the Trendline➔

da-kuk via Getty Images

da-kuk via Getty Images Trendline

TrendlineArtificial intelligence

Banks are enthusiastic about AI’s promises. But can they get customers on board, and will regulators let the innovation happen?

By Banking Dive staff -

LendingClub's Radius deal paves the way for more fintech purchases, experts say

Industry experts say the deal could be a tipping point, ushering in more fintech-bank purchases. But it won't come without its complexities.

By Anna Hrushka • Feb. 21, 2020 -

JPMorgan Chase invests $75M to prepare youth for money-making careers

"[B]usinesses, government and communities must work together to prepare young people for the future of work," a company spokesperson said.

By Sheryl Estrada • Feb. 18, 2020 -

JPMorgan gives fintechs July deadline to sign new data access agreements

The move shows the nation's largest bank is following through on its plan to tighten security around customer data.

By Anna Hrushka • Feb. 14, 2020 -

Amazon, Google, Microsoft reportedly compete for Deutsche Bank's tech overhaul

The project comes amid a massive restructuring for the German lender. At least two of the banks' potential partners have worked to make inroads in banking.

By Dan Ennis • Feb. 11, 2020 -

Report: JPMorgan to merge blockchain unit Quorum with ConsenSys

JPMorgan Chase uses Quorum to power its blockchain-based Interbank Information Network, which aims to speed up cross-border transactions.

By Anna Hrushka • Feb. 11, 2020 -

4 Chinese military members charged in Equifax hack

The attackers exploited a vulnerability in software used by the credit bureau's online dispute portal and routed traffic through 34 servers in nearly 20 countries to mask their true location, the Justice Department said Monday.

By Dan Ennis • Feb. 10, 2020 -

Central banks most trusted digital currency source, survey finds

Tech companies rank lowest in trust, according to the report, which comes as Federal Reserve Gov. Lael Brainard indicates the U.S. central bank is deepening its exploration of a digital dollar.

By Dan Ennis • Feb. 10, 2020 -

'Stickiness' of Bask Bank's airline perk may help it spread, analyst says

Customers were finding interest rates uninteresting. So the Dallas bank sought a way to help them save for tomorrow, yet live for today.

By Anna Hrushka • Feb. 7, 2020 -

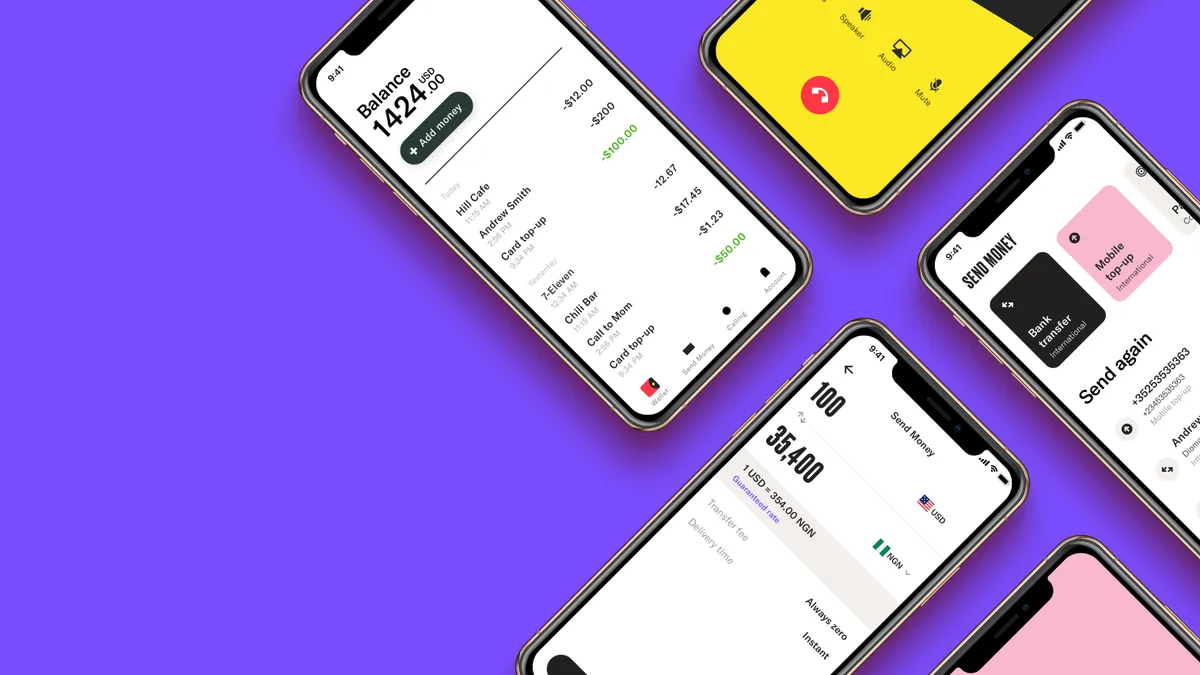

Competition intensifies in immigrant banking market

As the digital bank Majority expands nationwide, the remittance company Remitly launches Passbook, a bank aimed at first-generation Americans.

By Anna Hrushka • Feb. 4, 2020 -

Texas Capital Bank launches digital bank with American Airlines perks

In the current low-rate environment, the Dallas-based bank says it aims to attract customers that want more than a traditional savings account that only returns "pennies on the dollar."

By Anna Hrushka • Feb. 3, 2020 -

Expensify amps up charitable giving with 'Karma Points'

A San Francisco company's corporate card gives a slice of its swipe fees to organizations fighting homelessness, hunger and climate change, depending on the cardholder's spending.

By Kate Patrick Macri • Jan. 31, 2020 -

Truist seeks more time to reach $1.6B post-merger net savings goal

The nation's sixth-largest bank reported a 7% decrease in net income in its first earnings call after the merger of BB&T and SunTrust.

By Anna Hrushka • Jan. 31, 2020 -

JPMorgan Chase plans to cut hundreds of jobs in consumer division

Reductions at the nation's largest bank could indicate last year's trend is spilling over into 2020, as financial institutions pare their workforce to adapt to digital banking and global uncertainty.

By Anna Hrushka • Jan. 29, 2020 -

Zelle reports adding 100 financial institutions last quarter

Year-over-year payment values on the P2P platform increased by 57%, while transaction volume jumped 72%, network operator Early Warning Systems reported Tuesday.

By Anna Hrushka • Jan. 28, 2020 -

Opinion

Industry-led groups are only the 1st step to open banking

U.S. policymakers must make financial data sharing more fair and transparent if they want Americans to have the same access to fintech tools as other people, a Financial Data and Technology Association executive writes.

By Steve Boms • Jan. 27, 2020 -

Q&A

N26 gains 250K US customers in 5 months

The Berlin-based startup also reported it surpassed 5 million customers globally, a 43% jump from the 3.5 million users it reported last summer.

By Anna Hrushka • Jan. 27, 2020 -

Morgan Stanley muscles in on traditional bank accounts with CashPlus

The shift in strategy comes after the investment bank announced it's cutting 1,500 jobs and reducing bonuses.

By Dan Ennis • Jan. 24, 2020 -

The Clearing House quadruples single real-time payment limit to $100K

The move is meant to boost the network's attractiveness in comparison to those with a $25,000 ceiling operated by ACH or the Federal Reserve.

By Dan Ennis • Jan. 23, 2020 -

Vodafone quits Facebook's Libra, doubles down on M-Pesa

The British telecommunications conglomerate wants to expand the mobile payments app beyond its mostly African base to better serve the underbanked.

By Dan Ennis • Jan. 22, 2020 -

Trust should be the foundation in democratization of data, CEO says

"People are driving their financial lives with the equivalent of a semi truck at 80 mph all across this country," said Ryan Caldwell, CEO of MX. "[Banks] have the ability to put data collection around that vehicle and guide people to safety."

By Kate Patrick Macri • Jan. 21, 2020 -

Opinion

Mobile wallets let local markets leapfrog card payments

Fintech innovations have enabled many countries to skip over certain payment methods in their financial evolution, writes Steve Villegas, a vice president at PPRO.

By Steve Villegas • Jan. 21, 2020 -

Visa's Plaid deal pushes open banking, third-party security to forefront

The $5.3 billion acquisition may spur more fintech-on-fintech M&A, but the crux may lie in the card network's desire to stay relevant, analysts say.

By Anna Hrushka • Jan. 17, 2020 -

Ex-CFTC chairman 'Crypto Dad' launches digital dollar think tank

Converting to electronic currency could bolster anti-money laundering and protect the dollar's dominance from foreign and corporate digital efforts. But it may prove a death knell for financial privacy.

By Dan Ennis • Jan. 17, 2020