Technology: Page 30

-

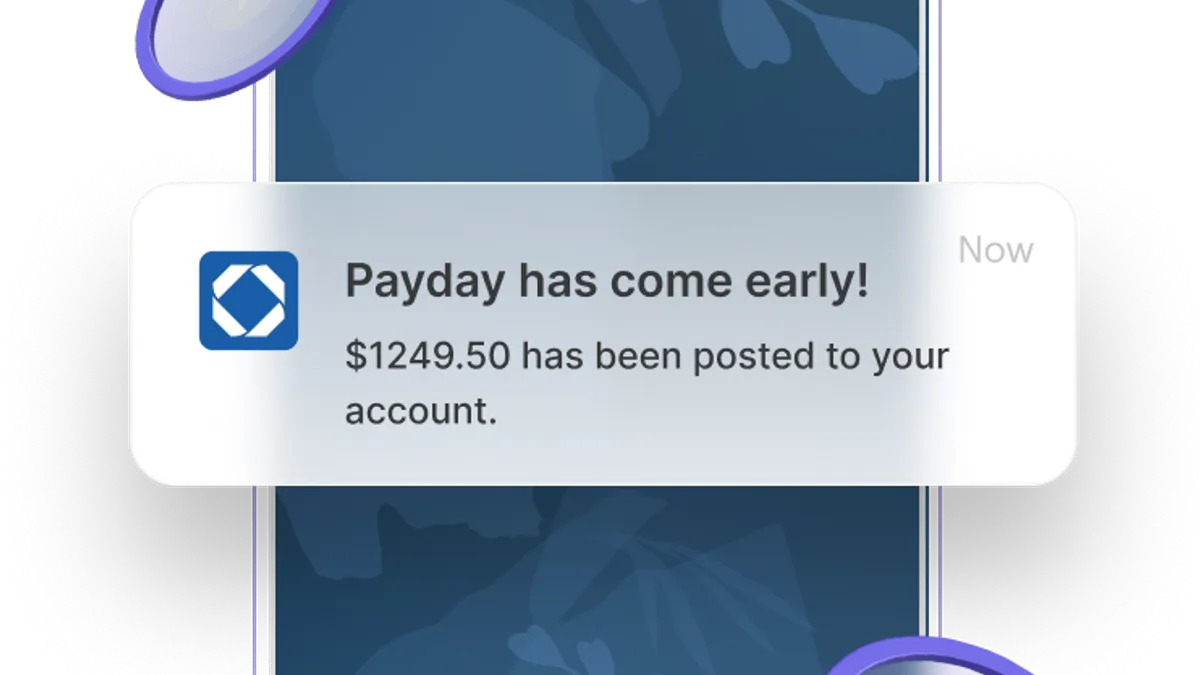

Marqeta launches demand deposit accounts in banking push

The company's suite of seven banking products includes early wage access, bill pay and instant funding. The latter two will be available in beta next year.

By Gabrielle Saulsbery • Oct. 25, 2022 -

Deep Dive

Banking-as-a-service grows as regulators play catch-up

The BaaS space is expected to reach $74.55 billion by 2030, and has emerged as an enticing revenue stream for community banks. Meanwhile, the OCC has hinted more regulation is forthcoming.

By Anna Hrushka • Oct. 25, 2022 -

Explore the Trendline➔

Explore the Trendline➔

da-kuk via Getty Images

da-kuk via Getty Images Trendline

TrendlineArtificial intelligence

Banks are enthusiastic about AI’s promises. But can they get customers on board, and will regulators let the innovation happen?

By Banking Dive staff -

Sponsored by Cisco - Meraki

Meeting your customers where they are—5 tips to keep banking secure from anywhere

Modern technology, including environmental sensors and cloud-managed smart cameras, provides innovative solutions and in fact has never been more important for banking institutions.

Oct. 24, 2022 -

Wells Fargo taps Google AI on virtual assistant launch

“This partnership will expand our customers’ digital financial support network by enabling meaningful money conversations,” the bank’s head of digital said.

By Gabrielle Saulsbery • Oct. 24, 2022 -

JPMorgan taps ex-Celsius exec for crypto legal post

The bank appears to be expanding its digital assets legal team despite CEO Jamie Dimon’s well-known skepticism. Aaron Iovine began the year at Cross River Bank before an eight-month stint at Celsius.

By Gabrielle Saulsbery • Oct. 19, 2022 -

Climate-conscious neobank Aspiration names new CEO

The leadership transition comes a year after the company announced plans to go public through a merger with special-purpose acquisition company InterPrivate III Financial Partners Inc.

By Anna Hrushka • Oct. 18, 2022 -

Fintechs clamor for FedNow access

The association representing Block, Stripe and others is asking the central bank to make access to the faster payments system more widely available.

By Lynne Marek • Oct. 18, 2022 -

Green Dot fires CEO, names replacement

The company terminated Dan Henry, its CEO since 2020, on Friday, it said. George Gresham, the firm’s chief financial and operating officer, is stepping into the top role.

By Anna Hrushka • Oct. 17, 2022 -

Fed’s Waller expresses skepticism on CBDC

Launching a digital currency could introduce costs and risks that could harm the U.S. dollar's standing internationally, Waller said. The dollar’s primacy, he added, has little to do with technology.

By Gabrielle Saulsbery • Oct. 17, 2022 -

Warren roasts Wells Fargo’s ‘severely bad performance’ on Zelle fraud

Four of the seven banks that own Zelle reported specific data to the senator, but she focused on Wells CEO Charlie Scharf specifically in a letter Thursday.

By Gabrielle Saulsbery • Oct. 14, 2022 -

Apple to launch high-yield savings account with Goldman Sachs

The move is the logical next step for the Apple-Goldman partnership, according to one consultant, who said the day-to-day banking product complements Apple’s Goldman-powered credit-card offering.

By Anna Hrushka • Oct. 14, 2022 -

Custodia Bank accuses Fed of favoritism toward BNY Mellon

The Wyoming-based bank said the Fed’s warning last week on crypto is counter to allowing BNY Mellon to hold and transfer digital assets.

By Anna Hrushka • Oct. 13, 2022 -

Column

4 takeaways from Michael Barr’s DC Fintech Week speech

The Federal Reserve’s vice chair for supervision stressed caution with banks’ ties to crypto and spotlighted what sets stablecoins apart from other digital assets.

By Dan Ennis • Oct. 13, 2022 -

Gen Z neobank Step launches crypto investing, rewards

The fintech, which claims to have more than 3 million customer accounts, said it is partnering with digital assets infrastructure and regulatory platform Zero Hash to offer transaction and custody services.

By Anna Hrushka • Oct. 12, 2022 -

Crypto exchange Bittrex to pay $29M to settle AML, sanctions charges

The exchange failed to file any suspicious activity reports for more than three years and allowed customers in Syria, Sudan, Iran, Cuba and the Crimea to make tens of thousands of transactions, two Treasury offices said Tuesday.

By Dan Ennis • Oct. 12, 2022 -

BNY Mellon set to take clients’ crypto

The move comes more than a year and a half after the bank laid out its intention to hold, transfer and issue digital assets. It received NYDFS approval within the past month.

By Dan Ennis • Oct. 11, 2022 -

Retrieved from Senate Banking Committee.

Retrieved from Senate Banking Committee.

OCC wants more data on banks’ crypto-related activities

Banks are already required to seek the OCC’s non-objection before engaging in crypto activity. But further enhancements may be needed “to track the risk of cross-contagion,” Acting Comptroller Michael Hsu said.

By Anna Hrushka • Oct. 11, 2022 -

Celsius co-founder Leon follows Mashinsky out

The crypto lending firm’s chief strategy officer, Shlomi Daniel Leon, has left the company, shortly after fellow co-founder Alex Mashinsky, joining a growing list of recently departed crypto executives.

By Gabrielle Saulsbery • Oct. 5, 2022 -

Inside Stash’s crypto-winter gamble

The investment app expands access to digital assets, spotlighting a long-term view of the currencies, in the platform's first offering on a new core system.

By Suman Bhattacharyya • Oct. 5, 2022 -

Crypto bank Anchorage pushes into Asia

Anchorage Digital, valued over $3 billion, established six partnerships across Asia, including in Singapore and Thailand.

By Gabrielle Saulsbery • Oct. 5, 2022 -

FSOC wants legislation to fill crypto sector oversight gaps

The panel wants regulators to work in tandem to issue rules that would help prevent regulatory arbitrage in the sector.

By Anna Hrushka • Oct. 4, 2022 -

(2024). [Photo]. Retrieved from Federal Reserve.

(2024). [Photo]. Retrieved from Federal Reserve. Column

Column3 times Michelle Bowman stood out as the Fed’s anti-Barr

The central bank governors diverged on stress tests, mergers and digital assets in recent speeches but appear to agree on capital requirements.

By Dan Ennis • Oct. 3, 2022 -

M&T pledges to rectify People’s United account access issues

The bank’s pledge, in response to letters of concern from five senators and Connecticut’s attorney general, came during a week when M&T disclosed 325 layoffs in the Nutmeg State.

By Gabrielle Saulsbery • Oct. 3, 2022 -

How JPMorgan Chase allots its $14B IT budget

Between hybrid cloud infrastructure, data security and supporting roughly 6,000 apps, JPMorgan Chase’s technology portfolio is massive. “Sometimes people get stuck on the number,” said Lori Beer, the bank’s global CIO.

By Matt Ashare • Oct. 3, 2022 -

Shutterstock/Viktoriia Hnatiuk

Sponsored by Backbase

Sponsored by BackbaseImproving the odds of success for your bank’s digital transformation

Banks know that they have to change for the digital engagement age, but often lack the knowledge to find the best approach. Discover how you can boost your bank’s chances for success with a few simple steps.

Oct. 3, 2022