Technology: Page 29

-

Discover hires Wells Fargo exec as next CIO

Jason Strle, a six-year Wells vet who previously spent more than a decade at JPMorgan Chase, succeeds Amir Arooni at the card company.

By Matt Ashare • July 13, 2023 -

Fintechs, digital banks make gains in battle for checking accounts

Digital banks and fintechs made up nearly half (47%) of all new checking accounts opened so far in 2023, up from 36% in 2020, according to a survey by Cornerstone Advisors.

By Anna Hrushka • July 12, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineArtificial intelligence

Banks’ focus on AI has shifted from a “cool-toys” mentality to one that sees the technology as a foundational pillar underlying finance and society itself.

By Banking Dive staff -

Photo by Levi Meir Clancy on Unsplash

Twitter snags money transfer license in Arizona

That’s the fourth state in which the social media company has received a license, inching it closer to creating the payments tool and super-app envisioned by owner Elon Musk.

By James Pothen • July 12, 2023 -

Sponsored by EY Banking and Capital Markets

[PODCAST] Digital identity opportunities in the financial services industry

This podcast explores the policy and regulatory trends shaping digital identity, including age-gating and social media bans.

By Banking Dive's studioID • July 10, 2023 -

Sponsored by Delfi

Bank failures spur AI financial risk innovations

New AI solutions can leapfrog institutions beyond yesterday’s cutting edge, fundamentally transforming the competitive landscape.

July 10, 2023 -

Binance CEO deflects as compliance, legal execs leave

A source within the crypto exchange told Fortune the departures stemmed from Changpeng Zhao’s response to a DOJ investigation. However, Binance’s ex-chief strategy officer cited personal reasons in a tweet.

By Dan Ennis • July 7, 2023 -

Kraken ordered to hand over user info to IRS

The IRS requested the information earlier this year, but Kraken refused. The tax agency then asked a judge to enforce a summons issued to the exchange’s holding company.

By Gabrielle Saulsbery • July 6, 2023 -

Goldman in talks to transfer Apple card deal to Amex: reports

The move, if true, would mark a 180-degree turn after the bank and tech giant extended their partnership until 2029 in October.

By Gabrielle Saulsbery • July 5, 2023 -

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

FedNow battles conspiracy theories

The central bank has launched a marketing campaign aimed at debunking disinformation that derides the real-time payments system, set to roll out next month, as a government power grab.

By Lynne Marek • June 28, 2023 -

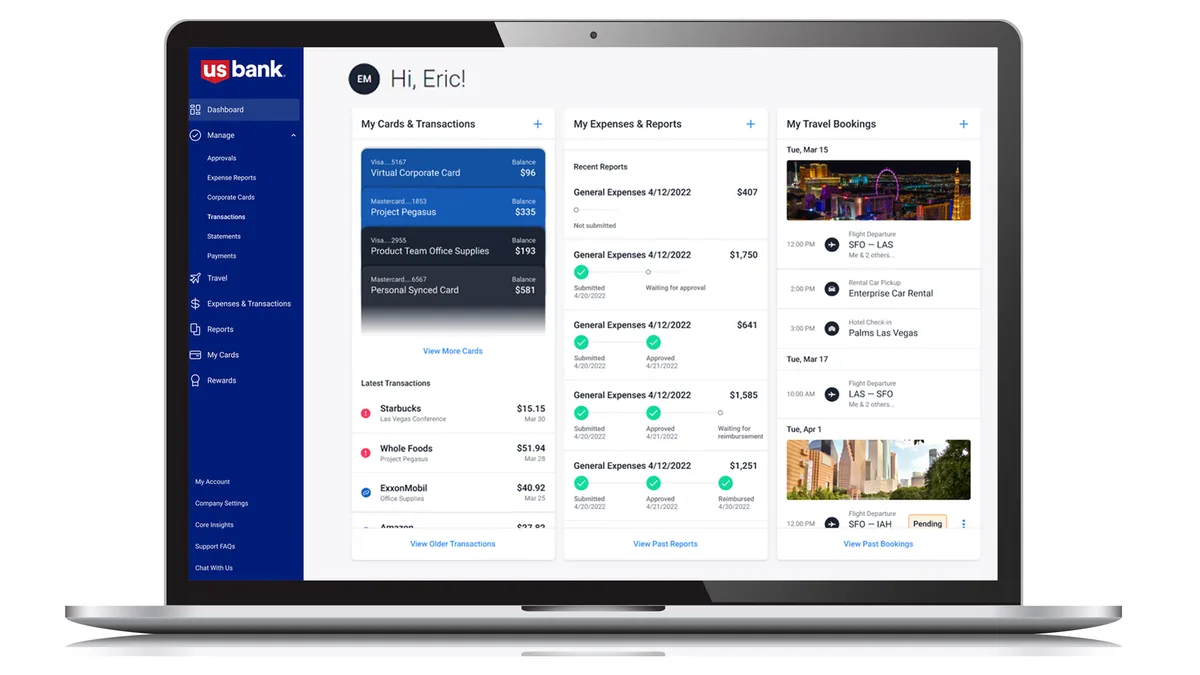

U.S. Bank’s fintech acquisition materializes in card launch

U.S. Bank and TravelBank, which it acquired in 2021, this week launched a commercial rewards card for the emerging middle market.

By Gabrielle Saulsbery • June 28, 2023 -

Fintech startup TreasurySpring raises $29M amid bank turmoil

The startup is among fintech companies looking to capitalize on the Silicon Valley Bank collapse and other recent bank failures.

By Alexei Alexis • June 26, 2023 -

Sponsored by Argyle

Using income and employment data to personalize financial experiences and meet evolving expectations

Whether it’s to attract direct deposits, or to upsell credit products in the future, creating long lasting relationships with customers is one of the ultimate goals for any bank.

June 26, 2023 -

Sponsored by Blend

Diving into composable banking? Focus on origination.

Leading financial institutions are moving towards composable banking solutions. What are the benefits of this next-gen model and where should you get started?

June 26, 2023 -

JPMorgan to pay $4M to SEC over 47M lost records

An outside vendor mistakenly deleted emails and instant messages from early 2018 but failed to apply a setting that would have preserved the records for the three years the SEC requires, the regulator said.

By Dan Ennis • June 22, 2023 -

JPMorgan names head to new data and analytics business

Company vet Teresa Heitsenrether will lead the charge in implementing artificial intelligence, something CEO Jamie Dimon recently called “critical to our company’s future success.”

By Gabrielle Saulsbery • June 22, 2023 -

Citizens partners with Wisetack on BNPL loans for SMBs

Citizens will focus on home improvement projects through Wisetack’s platform that connects in-person providers with buy now, pay later lenders.

By Rajashree Chakravarty • June 21, 2023 -

Deutsche Bank applies for crypto custody license

BlackRock and a Charles Schwab-backed platform have entered or clearly made plans to broach the cryptosphere in the past week, which could bode well for crypto-native companies.

By Gabrielle Saulsbery • June 21, 2023 -

Binance.US avoids asset freeze via SEC deal

Customers of the U.S. affiliate of Binance, the world’s largest crypto exchange, can continue to withdraw their assets after the exchange struck a deal with the regulator Saturday.

By Gabrielle Saulsbery • June 20, 2023 -

Sponsored by Argyle

Maximizing the benefits of digital income verification for underwriting and risk management

Interest rates aren’t showing signs of slowing down anytime soon, especially as the U.S. economy continues to be resilient.

June 20, 2023 -

Customers Bank hires 30 Signature bankers, acquires $631M portfolio

The new team is expected to be onboarded in the next few weeks. The Pennsylvania bank bought the portfolio at approximately 85% of book value, it said.

By Dan Ennis • June 16, 2023 -

Binance.US laid off employees following SEC enforcement

About 50 employees were affected, according to Reuters. A former Binance.US employee confirmed the reduction to Banking Dive.

By Gabrielle Saulsbery • June 16, 2023 -

Jack Henry to eliminate screen scraping by end of summer

The fintech, which has API integrations with data exchange platforms Finicity, Akoya, Plaid, Envestnet | Yodlee and Intuit, started phasing out the practice five years ago.

By Anna Hrushka • June 14, 2023 -

Retrieved from Consumer Financial Protection Bureau.

Retrieved from Consumer Financial Protection Bureau.

CFPB to hover as open banking evolves

The agency is on track to issue a proposal in October, and seek public comment, the agency’s director, Rohit Chopra, told a House committee.

By Lynne Marek , Dan Ennis • June 14, 2023 -

Bittrex to open for customer withdrawals

The U.S. arm of Bittrex Global filed for bankruptcy last month following regulatory enforcement.

By Gabrielle Saulsbery • June 14, 2023 -

Sponsored by Vericast

Maximizing acquisition strategies with smarter data: How to take control and drive growth through data-driven insights

Building the right consumer data partnership is a critical aspect of successful acquisition marketing strategies.

June 12, 2023