Retail: Page 60

-

Goldman Sachs gives CEO a nearly 20% pay raise

The $4.5 million jump makes David Solomon the second-highest-paid CEO among Wall Street's big banks.

By Dan Ennis • March 23, 2020 -

Regulators ease loan modification rules amid coronavirus pandemic

Examiners will exercise judgment in reviewing loan modifications, including troubled debt restructurings, according to a joint statement by five agencies and an organization of state regulators.

By Anna Hrushka • March 23, 2020 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Wells Fargo asks Fed to lift asset cap

Adding deposits or loans may be one way the nation's fourth-largest bank could help businesses and customers hit hard by the coronavirus outbreak.

By Dan Ennis • March 23, 2020 -

Bank of America hires 2,000 amid outbreak, keeps all branches open

The nation's second-largest bank is offering eligible branch workers an extra $200 per biweekly pay period, but the company's lack of restrictions on branch access counters moves announced by JPMorgan Chase and others.

By Dan Ennis • March 20, 2020 -

Truist, PNC, Fifth Third, KeyBank lay out virus-influenced branch restrictions

Meanwhile, Citi and Wells Fargo suggest staggered log-in and meeting times so workers don't overtax remote access or teleconferencing systems.

By Dan Ennis • March 20, 2020 -

Coronavirus may force HSBC to delay restructuring

CEO Noel Quinn said the bank would proceed "wherever possible" with a plan to cut 35,000 jobs, adding that it would "need to consider what additional actions" to take against a post-coronavirus backdrop.

By Dan Ennis • Updated April 27, 2020 -

JPMorgan Chase temporarily closing 20% of US branches

The nation's largest bank is also offering a one-time, $1,000 bonus to tellers and other "front line employees" who can't work from home, the company announced Friday.

By Dan Ennis • Updated March 20, 2020 -

Wells Fargo cancels ex-CEO Sloan's $15M bonus

The bank considered the timing of Sloan's resignation, the company's performance and the status of its risk management objectives and outstanding regulatory matters in its decision, according to a proxy filing.

By Dan Ennis • March 18, 2020 -

Banks need to push digital offerings during COVID-19 pandemic, experts say

"As we saw in the last recession, if you take the pedal off, you can wake up in a couple of years and have a lot of fintechs nibbling away at your business," said John Stockamp, director in West Monroe's financial services practice.

By Anna Hrushka • March 18, 2020 -

HSBC makes Quinn’s CEO role permanent

The bank's failure to quickly revive growth in Asia led HSBC Chairman Mark Tucker to dismiss Quinn’s predecessor in August. Now the new CEO must right the ship amid a global pandemic and Brexit woes.

By Dan Ennis • March 18, 2020 -

Goldman Sachs waives March payments for Apple Card users

Apple and Goldman Sachs are continuing to allow payment deferrals in April, but Apple Card customers who took advantage of the March program must re-enroll, the tech giant said.

By Kate Patrick Macri • Updated April 2, 2020 -

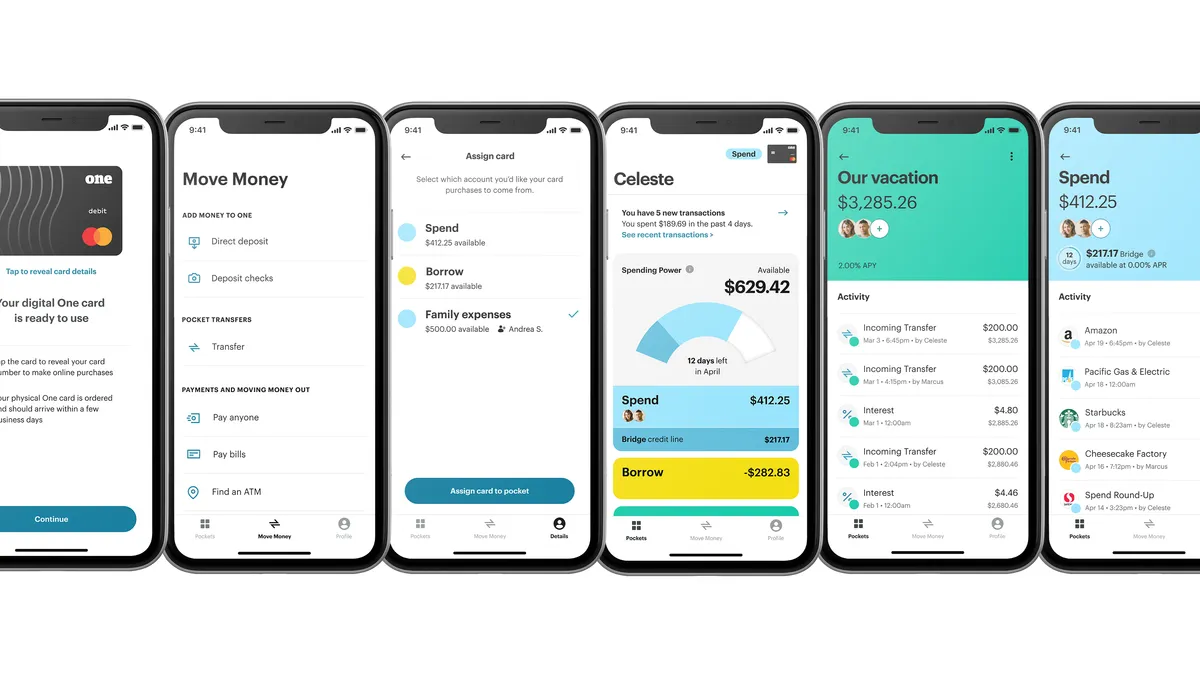

Former PayPal, Intuit CEO launches digital bank targeting middle-class families

Bill Harris said the San Francisco-based startup will serve a demographic that hasn't had its needs adequately met by traditional banks or the current fintech offerings that are available in the market.

By Anna Hrushka • March 17, 2020 -

The novel coronavirus impact on the banking industry

The banking industry is central to the global economy's stability. Follow Banking Dive's coverage of the pandemic here.

Updated March 18, 2020 -

Major US banks halt share buybacks in response to coronavirus pandemic

The forum called the COVID-19 pandemic “an unprecedented challenge for the world and the global economy,” and said the U.S.’s largest banks have an “unquestioned ability and commitment” to support the nation.

By Anna Hrushka • March 16, 2020 -

FDIC to issue proposed rulemaking on ILCs at next board meeting

While the FDIC has not approved an ILC applicant in more than a decade, Square Capital and Japanese e-commerce company Rakuten have pending applications with the FDIC.

By Anna Hrushka • March 13, 2020 -

Aion CEO: Global uncertainty works in favor of subscription-based digital bank

The subscription model creates a relationship that helps build a sense of stability for consumers looking for a banking partner.

By Robert Freedman • March 13, 2020 -

Fed injects $1.5T into Wall Street as regulators, lawmakers respond to coronavirus

Some analysts welcomed the move, but said a fiscal stimulus from Congress is also needed.

By Anna Hrushka • March 13, 2020 -

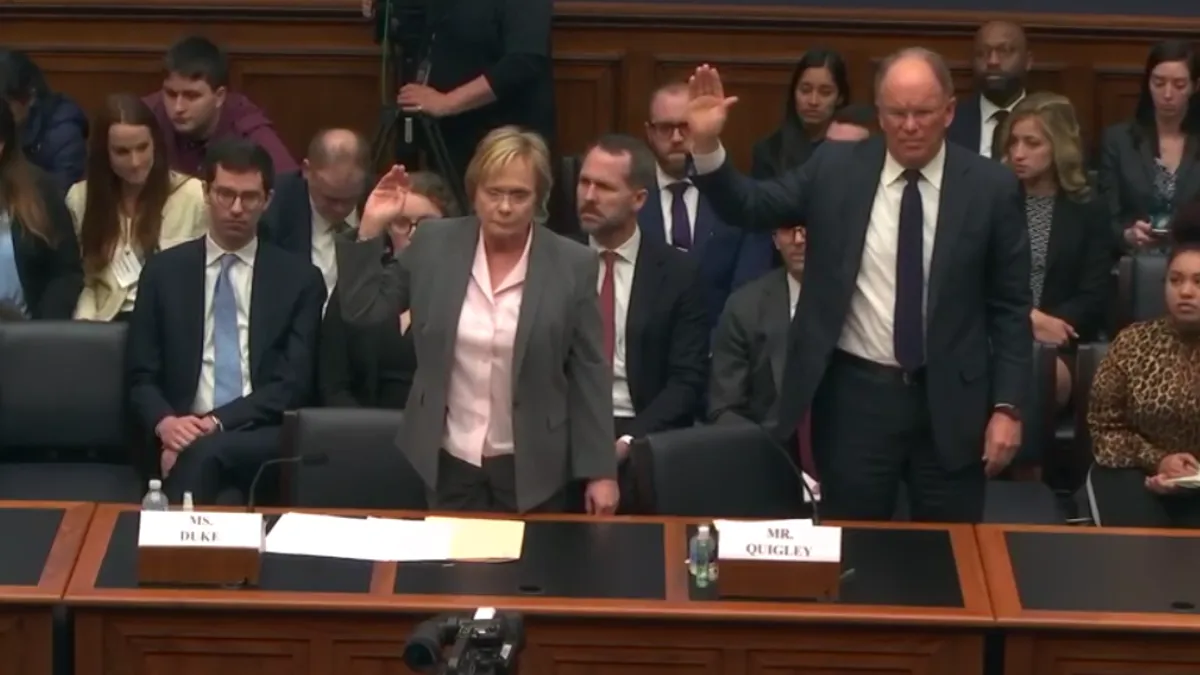

(2020). "Holding Wells Fargo Accountable: Examining the Role of the Board of Directors in the Bank’s Egregious Pattern of Consumer Abuses". Retrieved from https://www.youtube.com/watch?v=oeESjOWe_xQ&feature=youtu.be.

(2020). "Holding Wells Fargo Accountable: Examining the Role of the Board of Directors in the Bank’s Egregious Pattern of Consumer Abuses". Retrieved from https://www.youtube.com/watch?v=oeESjOWe_xQ&feature=youtu.be.

Former Wells Fargo board members defend scandal response in House hearing

Betsy Duke and James Quigley said they were shocked and troubled when they first learned of the bank’s misconduct, but both told the panel they had done all they could to steer the bank in the right direction.

By Anna Hrushka • March 11, 2020 -

Wells Fargo's long, winding path to recovery

March 11, 2020 -

(2020). "Holding Wells Fargo Accountable: CEO Perspectives on Next Steps." [Video]. Retrieved from https://financialservices.house.gov/videos/?VideoID=Sf5D9BprcXg.

(2020). "Holding Wells Fargo Accountable: CEO Perspectives on Next Steps." [Video]. Retrieved from https://financialservices.house.gov/videos/?VideoID=Sf5D9BprcXg.

Maxine Waters calls for DOJ probe into former Wells Fargo CEO's 'false statements'

Tim Sloan, who led the scandal-plagued bank from October 2016 to March 2019, resigned shortly after testifying at a House hearing over the bank’s widespread consumer abuses.

By Anna Hrushka • March 11, 2020 -

Report: Banks risk 5% loss in revenue to fintechs if they don't change

Banks' use of hidden fees that leverage consumers' money mismanagement is hurting them on trust, but they have an opportunity to change that, an Accenture report finds.

By Robert Freedman • March 11, 2020 -

(2020). "Holding Wells Fargo Accountable: CEO Perspectives on Next Steps for the Bank that Broke America’s Trust". Retrieved from https://www.youtube.com/watch?v=Sf5D9BprcXg&feature=youtu.be.

(2020). "Holding Wells Fargo Accountable: CEO Perspectives on Next Steps for the Bank that Broke America’s Trust". Retrieved from https://www.youtube.com/watch?v=Sf5D9BprcXg&feature=youtu.be.

Wells Fargo CEO: 'Broken' culture led to consumer abuse scandals

Scharf told lawmakers Wells Fargo’s structure was "problematic," and company leadership failed its stakeholders. "Our culture was broken, and we did not have the appropriate controls in place across the company," he said.

By Anna Hrushka • March 10, 2020 -

Credit Sesame launches digital bank to capitalize on expense management

Sesame Cash — the company's new digital banking service — aims to compete with both traditional banks as well as other digital platforms.

By Kate Patrick Macri • March 10, 2020 -

Fifth Third charged with opening fake accounts

The alleged practice by the large Midwestern bank resembles the incentive scheme that recently cost Wells Fargo a $3 billion fine.

By Robert Freedman • March 10, 2020 -

Robinhood trading app experiences 3rd outage in 8 days as stocks plunge

It’s been a rough week for Robinhood and its users as the platform’s recent outages coincide with historic trading days.

By Anna Hrushka • Updated March 27, 2020