Retail: Page 59

-

Wells Fargo, Citi, JPMorgan won't apply stimulus checks to negative balances

The Treasury Department is reviewing whether it has the legal authority to prevent banks from using customers' stimulus payments to collect on overdrafts, a source told The Washington Post.

By Dan Ennis • Updated April 21, 2020 -

Bank of America profits drop 45% as it builds reserves amid pandemic

The bank expects loan losses to increase dramatically this year as social distancing orders enacted in response to the pandemic continue to slow the economy.

By Anna Hrushka • April 15, 2020 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Citi's jump in Q1 fixed-income trading can't offset net income drop

The world's largest credit card issuer more than tripled its safeguard against defaults. In the last week of the quarter, card spending dropped as much as 30%, the bank's CFO said.

By Dan Ennis • April 15, 2020 -

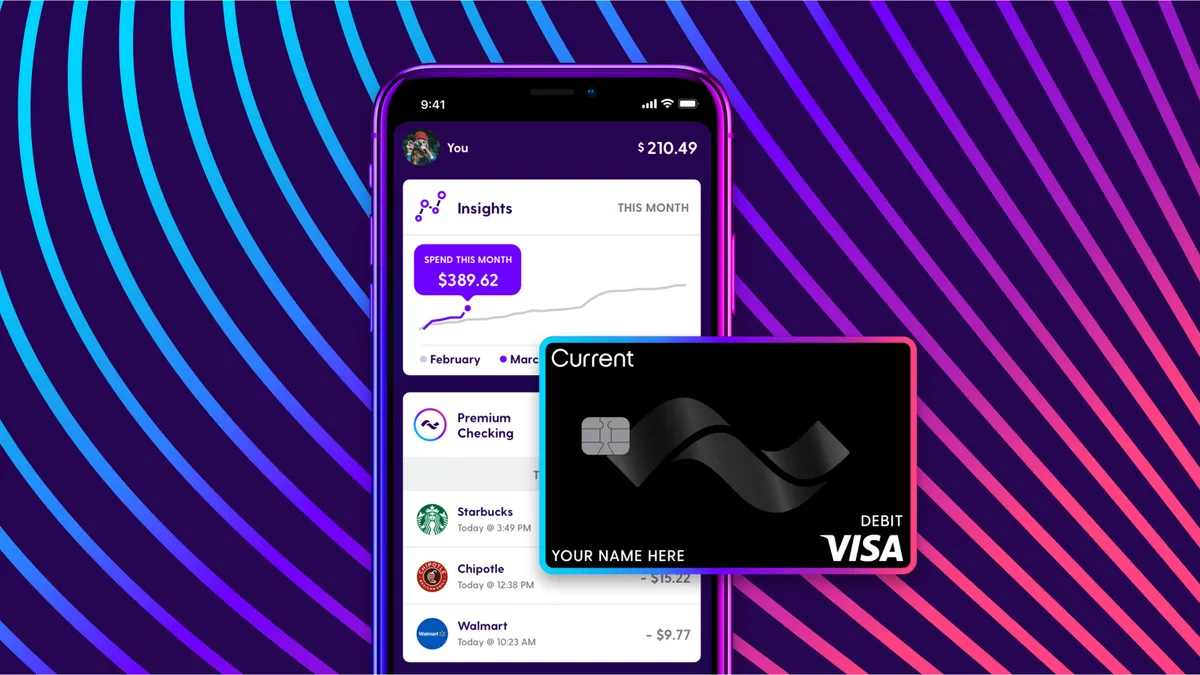

Digital bank Current flexes quick delivery of coronavirus relief checks

About 45% of the stimulus money that's been issued to Current's customers has already been spent — mostly on essential items, such as gas and groceries, said Adam Hadi, the company's vice president of marketing.

By Anna Hrushka • April 15, 2020 -

Banking trade groups seek pandemic-related exception to robocall law

Automated calls could help banks limit physical contact when warning consumers of scams or notifying them of branch closings, payment deferrals, fee waivers and forbearance on mortgage payments, the groups wrote.

By Kate Patrick • April 15, 2020 -

Wells Fargo's net income plummets 89% from a year ago

Much of the drop stems from $3.1 billion in reserves the bank set aside in case loans sour — a reflection of newly implemented accounting standards and of the tenuous position in which the coronavirus crisis has put clients.

By Dan Ennis • April 14, 2020 -

JPMorgan profits plunge as bank reserves funds for 'severe recession'

The bank attributed the massive earnings drop to a $6.8 billion addition to its credit reserves, a move it said it took in response to a potential economic downturn.

By Anna Hrushka • April 14, 2020 -

Upgrade accelerates launch of contactless card amid COVID-19 pandemic

"Going contactless in this environment, if there's ever been a time to do so, that's now," the challenger bank's co-founder and CEO, Renaud Laplanche, told Banking Dive.

By Anna Hrushka • April 9, 2020 -

TD Bank sees remote work in new light amid 9,500-employee transition

The Canadian lender is shifting 500 call center employees a day into a work-from-home capacity, offering them 10 extra personal days to help with day care, and the ability to change schedules and do split shifts.

By Dan Ennis • April 9, 2020 -

Personal finance startup SoFi to acquire payments platform Galileo for $1.2B

Because many of Galileo's clients are SoFi competitors, the deal could raise conflict-of-interest questions, one expert says.

By Anna Hrushka • April 8, 2020 -

Fifth Third hiring 950 employees amid higher loan, mortgage demand

The Cincinnati-based bank joins Bank of America in boosting its headcount during the coronavirus outbreak.

By Dan Ennis • April 7, 2020 -

Chime allows early stimulus access, expands overdraft program

CEO Chris Britt said most participants in the early-stimulus pilot did not access the full $1,200. Most used $150 to $300, on average, he said.

By Anna Hrushka • Updated April 13, 2020 -

Monzo, Starling furlough employees, lean on UK job retention plan

The challenger banks are taking advantage of the British government's coronavirus job retention scheme, which allows employers to claim 80% of a furloughed employee's monthly wage, up to £2,500 a month.

By Anna Hrushka • April 1, 2020 -

North Carolina de novo organizers buy bank in Tennessee

Community Bank of the Carolinas failed to raise enough money to open, but its investors found a path forward in Brighton Bank.

By Dan Ennis • March 31, 2020 -

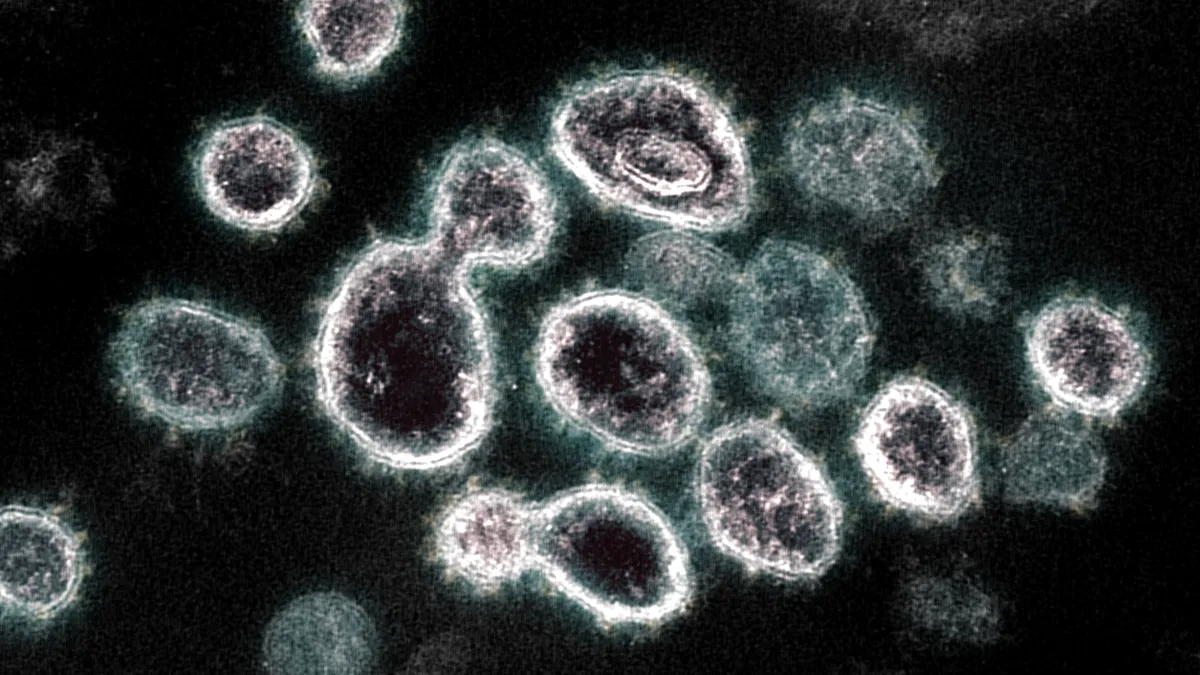

National Institute of Allergy and Infectious Diseases. (2020). "Novel Coronavirus SARS-CoV-2" [Image]. Retrieved from https://www.flickr.com/photos/nihgov/49565662436/in/album-72157713108522106/.

National Institute of Allergy and Infectious Diseases. (2020). "Novel Coronavirus SARS-CoV-2" [Image]. Retrieved from https://www.flickr.com/photos/nihgov/49565662436/in/album-72157713108522106/.

Standard Chartered pledges $1B toward pandemic relief, freezes hiring

The bank's backing will come in the form of loans to drug companies, health care providers and non-medical firms that have volunteered to make ventilators, face masks, sanitizers and protective equipment.

By Dan Ennis • March 31, 2020 -

BofA CEO: Capital levels allow us to focus on operations amid crisis

"It’s much different than walking down 6th Avenue in 2007-08 and being worried about risk," said Brian Moynihan. "Now it’s much more about how do we operationalize and help the economy get back on its feet?"

By Anna Hrushka • March 30, 2020 -

Robinhood accused of using $75 credits to hush class-action suit

A federal judge won't block Robinhood from reaching out to users because the plaintiff "failed to establish a clear record of abusive communications by Defendants," according to court documents released Tuesday.

By Dan Ennis • Updated April 1, 2020 -

Morgan Stanley pledges no job cuts in 2020 — and several banks follow

Citi, Wells Fargo and Bank of America all vowed to maintain staffing levels throughout the coronavirus crisis, while European lenders such as HSBC and Deutsche Bank, which were planning layoffs, put them on hold.

By Dan Ennis • March 27, 2020 -

Regulators urge banks to offer responsible small-dollar loans

Five agencies promise future guidance on the lending vehicle, which some trade groups advocated long before the coronavirus pandemic sent the economy into a spiral.

By Anna Hrushka • March 27, 2020 -

DC's first de novo in more than a decade set to open April 13

Founders Bank raised $30 million to receive final approval from federal and district regulators, but Washington has proved a tough market for new banks over the past year.

By Dan Ennis • March 26, 2020 -

Green Dot hires former Netspend chief as CEO

The prepaid card provider renewed its most valuable partnership last year but lost hundreds of thousands of customers — and about 60% of its stock price.

By Dan Ennis • March 26, 2020 -

British challenger bank Revolut launches in US

The fintech, launched in 2015, could face unique challenges as it expands to a new market at a time of economic uncertainty amid the coronavirus pandemic.

By Anna Hrushka • March 25, 2020 -

National Institute of Allergy and Infectious Diseases. (2020). "Novel Coronavirus SARS-CoV-2" [Image]. Retrieved from https://www.flickr.com/photos/nihgov/49565892277/in/album-72157713108522106/.

National Institute of Allergy and Infectious Diseases. (2020). "Novel Coronavirus SARS-CoV-2" [Image]. Retrieved from https://www.flickr.com/photos/nihgov/49565892277/in/album-72157713108522106/.

Santander chair, CEO give half of their pay to bank's virus-related medical fund

The bank's canceled dividends free up $97 billion to lend to coronavirus-affected businesses. "We need maximum flexibility so that we can do even more for the communities in the months ahead," Chairman Ana Botín said.

By Dan Ennis • Updated April 3, 2020 -

JPMorgan freezes hiring as coronavirus impact felt industrywide

Managers have been told to pull non-immediate job postings, and the company has delayed bringing new recruits into the bank until April 20, Bloomberg reported. Units such as home lending are exempt from the freeze.

By Dan Ennis • March 24, 2020 -

Citi, Wells, U.S. Bank boost compensation for front-line employees

Both Capital One and U.S. Bank have opted for pay raises, with the former offering an additional $10 an hour to branch workers. U.S. Bank, meanwhile, is giving an extra 20% to branch, call center and field office staff.

By Dan Ennis • Updated March 27, 2020