Retail: Page 45

-

Return to the office

Wells Fargo lays out two-wave strategy for office return

Operations and call center workers will return to the office Sept. 7. Technology, corporate and back-office workers will return in October. And some New York- and North Carolina-based bankers will be invited back Aug. 2.

By Dan Ennis • Updated July 27, 2021 -

Sponsored by Statflo

The frictionless customer journey in banking starts with text messaging

Find out how to create the frictionless digital banking experience customers now expect.

July 19, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

SAFE Banking secondary to comprehensive pot reform, Senate Democrats say

The new bill, unveiled Wednesday, could become a setback for the future of the SAFE Banking Act, after lawmakers said the comprehensive reform would take priority over the more narrow banking bill.

By Anna Hrushka • July 16, 2021 -

Truist reports 73% Q2 profit amid loan-loss reserve release

"To thrive in today's world requires a deep commitment to continuously re-evaluating yesterday's activities and expenses associated with that, so that we can afford to invest in new activities for today's demands," CEO Kelly King said.

By Anna Hrushka • July 15, 2021 -

U.S. Bank sees Q2 profit nearly triple to just under $2B

The bank released fewer loan-loss reserves than in the first quarter, dropping net income in the shorter term. But the push and pull of loans and deposits appeared to reveal a recovering consumer base.

By Dan Ennis • July 15, 2021 -

Wells Fargo charges ahead to $6B Q2 profit

A $1.6 billion loan-loss reserve release — and an 8.3% drop in noninterest expenses, buoyed by a 5,000-person headcount cut — drove the bank's surge.

By Dan Ennis • July 14, 2021 -

Bank of America's Q2 profit soars as low interest rates dent revenue

A $2.2 billion loan-loss reserve release buoyed the nation's second-largest bank as it anticipates an economic rebound from the COVID-19 pandemic.

By Anna Hrushka • July 14, 2021 -

Citi's Q2 profit jumps more than fivefold, but revenue slumps

"While we have to be mindful of the unevenness in the recovery globally, we are optimistic about the momentum ahead," CEO Jane Fraser said Wednesday.

By Dan Ennis • July 14, 2021 -

Overdraft alternatives

Frost Bank gives direct deposit customers early paycheck access

The product follows an overdraft grace feature the bank rolled out in April that gives direct deposit enrollees protection when they overdraw their checking accounts on transactions up to $100.

By Anna Hrushka • July 13, 2021 -

JPMorgan's Q2 profit more than doubles amid slight drop in revenue

The bank said its reserves for credit losses remain at $22.6 billion, an amount CFO Jeremy Barnum said reflects the remaining uncertainty around the COVID-19 pandemic and the shape of the economic recovery.

By Anna Hrushka • July 13, 2021 -

Deep Dive // Overdraft alternatives

Rethinking overdraft

While many stakeholders would agree banks need to revamp the fee-based model, it remains to be seen whether change will come through legislation or the market.

By Anna Hrushka • July 12, 2021 -

U.S. Bank boosts unit to advise local governments on asset management

The deal to acquire PFM Asset Management for an undisclosed sum is at least the second move in the past seven months aimed at bolstering the Minneapolis-based bank's noninterest income.

By Dan Ennis • July 12, 2021 -

Retrieved from The White House/YouTube on January 29, 2021

Retrieved from The White House/YouTube on January 29, 2021

Biden executive orders target bank mergers, financial data sharing

One measure requires the Justice Department and bank regulators to update guidelines to boost merger scrutiny, while another encourages the CFPB to issue rules giving customers greater access to their financial data.

By Anna Hrushka • July 9, 2021 -

Szekely, Pedro. (2017). "Chicago Skyline" [Photograph]. Retrieved from Flickr.

Szekely, Pedro. (2017). "Chicago Skyline" [Photograph]. Retrieved from Flickr.

Billie Jean King-backed de novo to open this fall

Chicago-based First Women's Bank said it raised more than $30 million through its private placement offering with the support of an investor group including Bank of America, Fidelity Investments and the tennis legend.

By Anna Hrushka • July 8, 2021 -

Chime customers file hundreds of CFPB complaints over locked accounts: report

In an attempt to root out fraud related to government-backed pandemic aid, the fintech may have inadvertently closed hundreds of legitimate customer accounts, ProPublica reported Tuesday.

By Anna Hrushka • July 7, 2021 -

Chime, Current lead US banking app downloads in first half of 2021: report

The top 10 digital-first banking apps in the U.S. recorded 16.33 million installs during the first half of 2021, according to a report that indicated European neobanks are lagging their U.S.-based competitors in market share gains.

By Anna Hrushka • July 6, 2021 -

Fintech Karat aims to become influencers' bank, raises $26M

The company plans to move beyond credit cards and offer a suite of tools, including bank accounts and tax preparation services, for the creator economy.

By Anna Hrushka • July 2, 2021 -

Column // Return to the office

Banks prepare for 2021's second act with office-return, banker-pay pledges

Like any good drama, last week provided a recap of several long-running narratives in banking before the industry launches into 2021's latter half.

By Dan Ennis • July 2, 2021 -

Wealth management fintech gets boost from Florida community bank

A $2.5 million investment from Coral Gables-based Amerant Bank accounted for half of a Series A funding round for Marstone, whose CEO says the pandemic has accelerated every institution's digital roadmap.

By Anna Hrushka • June 30, 2021 -

JPMorgan Chase eyes 3rd fintech acquisition in the past year

The latest tie-up follows a busy year of deal activity for the U.S.'s largest bank, which is also eyeing growth opportunities in the U.K. and Brazil.

By Anna Hrushka • June 29, 2021 -

Overdraft alternatives

TD Bank introduces no overdraft-fee account, revises overdraft policy

The account comes with a $4.95 monthly fee. The bank, effective in August, will increase its overdraft threshold to $10 and reduce the number of times a customer can be charged an overdraft fee from five per day to three.

By Anna Hrushka • June 28, 2021 -

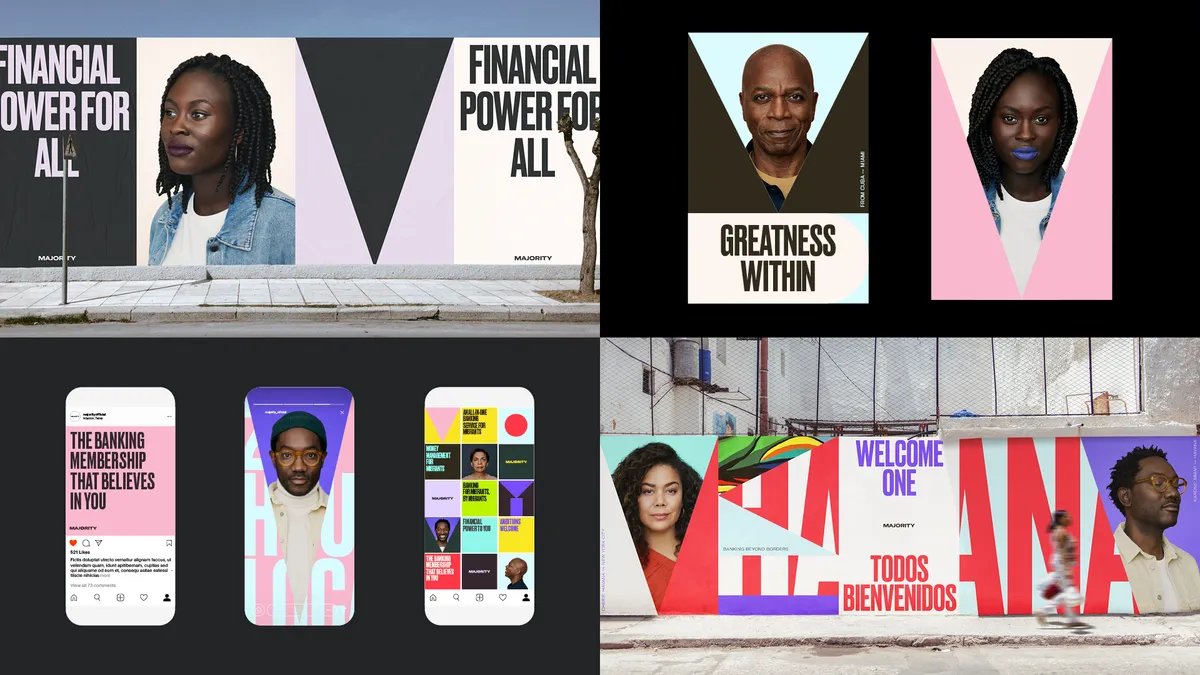

Neobanks expand, add products for US immigrant market

Majority secured $19 million in seed funding to help it expand nationally. Remitly's Passbook debuted a series of new features. And Fair officially launched.

By Anna Hrushka • June 25, 2021 -

Overdraft alternatives

Timing is right for overdraft legislation, lawmaker says

Rep. Carolyn Maloney, D-NY, who has introduced the Overdraft Protection Act every Congress since 2009, said the COVID-19 pandemic has highlighted the need for more transparency in banks' overdraft practices.

By Anna Hrushka • June 24, 2021 -

HSBC to sell French retail banking operations to Cerberus-backed entity

Europe's largest lender expects to take a $3 billion hit as part of the deal, which is set to close during the first half of 2023.

By Dan Ennis • June 21, 2021 -

Verizon targets Gen Z market with new digital banking app

For a $5.99 monthly fee, Family Money lets parents monitor and cap their children's spending, block certain spending categories and set up allowances.

By Anna Hrushka • June 18, 2021