Retail: Page 44

-

State Street to vacate NYC offices amid shift to hybrid work

The bank's pivot comes as firms across the country are reevaluating office-return timelines or adopting permanent hybrid solutions.

By Anna Hrushka • Aug. 16, 2021 -

Memphis-based Orion Federal Credit Union to buy Financial Federal Bank

The deal, which would nearly double the $1 billion-asset Orion Federal’s size, is the seventh such deal involving a credit union purchasing a bank to be announced this year.

By Anna Hrushka • Aug. 12, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Capital One delays office return, requires vaccines for on-campus employees

CEO Richard Fairbank said the bank is allowing employees who are unvaccinated to work remotely throughout its reopening period, which it said will extend through at least the first quarter of 2022.

By Anna Hrushka • Aug. 12, 2021 -

Revolut readies for US growth with marketing push, product expansions

Since launching quietly stateside last year, the fintech has rolled out a small-business banking product, applied for a bank charter, and has begun offering remittances between the U.S. and Mexico.

By Anna Hrushka • Aug. 11, 2021 -

Citi requires vaccines for employees returning to offices

The bank is not extending the vaccine mandate to branch workers, according to the bank's head of HR, but will "strongly encourage them to get vaccinated and will require rapid testing and wearing of masks for all colleagues."

By Robin Bradley • Aug. 11, 2021 -

Wells Fargo names Steven Black chairman, replacing Charles Noski

Noski stepped into the role amid heightened political scrutiny last year, stemming from the bank’s handling of its 2016 fake accounts scandal.

By Anna Hrushka • Aug. 10, 2021 -

Brex withdraws ILC, deposit insurance applications

The San Francisco-based fintech, which filed the applications in February, said it will "modify and strengthen" its applications and plans to resubmit at a later date.

By Anna Hrushka • Aug. 9, 2021 -

Citizens Financial to buy valuation consulting firm

Citizens, which plans to grow its customer base by 1 million next year, said its acquisition of Willamette would place it among the top valuation services providers in the country.

By Anna Hrushka • Aug. 6, 2021 -

Overdraft alternatives

Digital-only credit union latest institution to scrap overdraft fees

Alliant’s move follows a similar one made by Ally Bank in June, and comes as a growing number of financial institutions are revamping their overdraft policies amid pushback from Democratic lawmakers.

By Anna Hrushka • Aug. 5, 2021 -

Chase study highlights growing popularity of digital banking

The COVID-19 pandemic has increased consumers' reliance on mobile banking tools to manage their savings.

By Robin Bradley • Aug. 5, 2021 -

Retrieved from Senate Banking Committee.

Retrieved from Senate Banking Committee. Overdraft alternatives

Overdraft alternativesOCC conducting review of overdraft policies, acting comptroller says

Acting Comptroller Michael Hsu's remarks come as more banks are revamping their overdraft policies and as Democrats are calling for legislation that would rein in the practice.

By Anna Hrushka • Aug. 4, 2021 -

Neobank Dave shifts to virtual-first model, implements national pay scale

"I think the silver lining of the pandemic is that it really forced companies to listen to what their team members want, maybe more so than they have in the past," said Dave executive Shannon Sullivan.

By Anna Hrushka • Aug. 3, 2021 -

Square buys BNPL player Afterpay for $29B

The acquisition of the Australian company is Square's biggest ever, and underscores CEO Jack Dorsey's ambitious plans to build his merchant and banking empire in new retail directions and across the globe.

By Lynne Marek • Aug. 2, 2021 -

Mastercard CFO: consumers 'ready and willing' to increase spending

"The U.S. has always been a laggard when it comes to contactless payments, but that’s changing," Sachin Mehra said after the company reported a successful quarter. "The aversion to cash is one component; it’s just a good user experience."

By Jane Thier • Aug. 2, 2021 -

Inside MoneyLion's quest to become a financial 'super app'

The neobank is diversifying its revenue sources and aiming to boost engagement frequency to transcend beyond finance to "life transactions."

By Suman Bhattacharyya • Aug. 2, 2021 -

NY regulator asks financial institutions to share diversity data

Superintendent Linda Lacewell cited the impacts of the COVID-19 pandemic, racial injustice and climate change as primary reasons entities should boost diversity.

By Anna Hrushka • July 30, 2021 -

Citizens Financial to acquire Investors Bancorp in $3.5B deal

The transaction, expected to close in the first or second quarter of 2022, will put Citizens' assets above $200 billion, and propel the bank to the top 10 in deposits among retail and commercial banks in the New York City market.

By Anna Hrushka • July 28, 2021 -

Sen. Cory Booker clarifies SAFE Banking Act support

"For me, a good bipartisan bill like the [SAFE] banking bill is a necessary sweetener to get people to move along on the equitable justice elements that are really critical," he said.

By Anna Hrushka • July 27, 2021 -

M&T Bank to cut more than 700 jobs following People’s United takeover

The Buffalo, New York-based bank anticipates it will save about $330 million in annual expenses that would otherwise be duplicated as a result of its $7.6 billion acquisition of People's United.

By Anna Hrushka • July 26, 2021 -

Opinion

A new leaf for the bank branch

A café might be a reason to visit a bank branch. But a customer journey map would let banks see how customers interact with digital channels outside the branch and inform digital-first branch remodeling.

By Mohamed Abdelsadek • July 26, 2021 -

Plaid taps former bank execs to help reach data-sharing goal

The company's mission to forge stronger relationships with banks and increase its API traffic comes amid a sometimes less-than-amicable interplay between data aggregators and financial institutions.

By Anna Hrushka • July 23, 2021 -

Neobank HMBradley shifts to invite-only, seeks more partner banks

The fintech has accepted more than $400 million in deposits since its 2019 launch and has seen a 300% increase in deposits since January, leading its partner to pump the brakes, its CEO said.

By Anna Hrushka • July 22, 2021 -

Column // Return to the office

Bank of America, Deutsche and the case of the summer sequel

Commitments to de-emphasize overdraft fees, boost junior banker pay and refresh banks' card suites are hardly new. This week offers deeper tread on well-worn narratives.

By Dan Ennis • July 21, 2021 -

OCC to rescind Trump-era revamp to anti-redlining rule

"While the OCC deserves credit for taking action to modernize the CRA through adoption of the 2020 rule, upon review I believe it was a false start," Acting Comptroller Michael Hsu said in a statement.

By Anna Hrushka • July 20, 2021 -

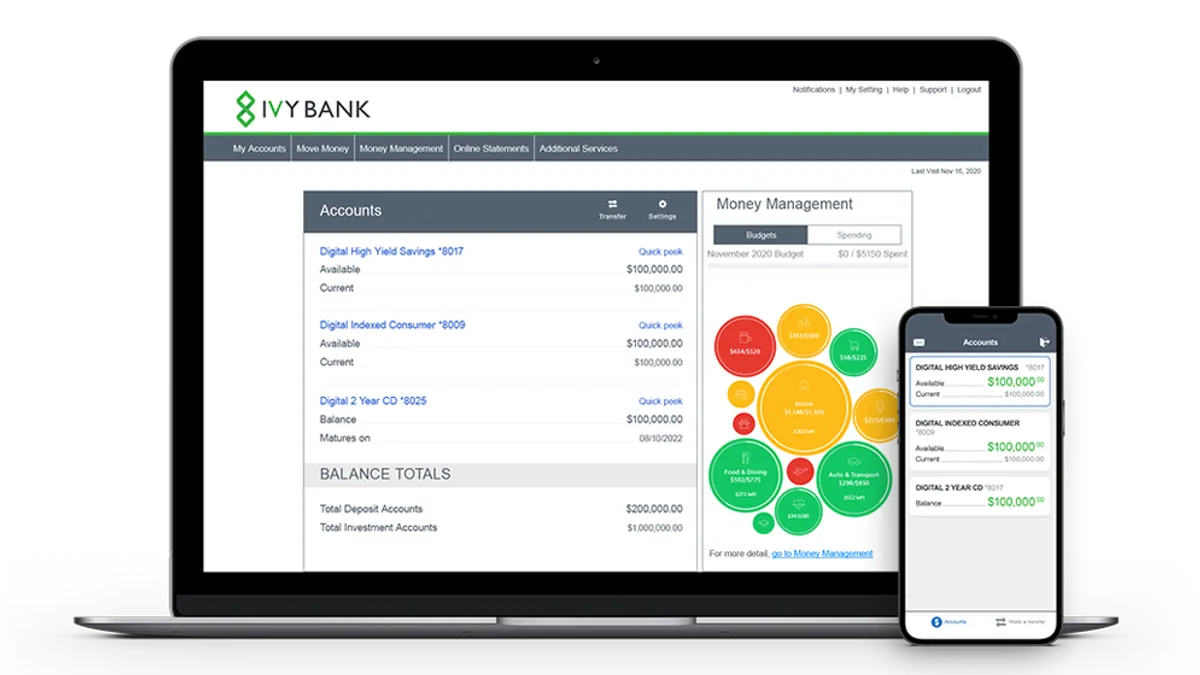

Cambridge Savings Bank launches digital bank to expand national reach

The Massachusetts-based bank said its "Ivy Bank" platform has been in the works for the past two years and will aim to compete with other digital-only banks in the marketplace.

By Anna Hrushka • July 19, 2021