Retail: Page 32

-

The image by Hobiecat93 is licensed under CC BY-SA 3.0

The image by Hobiecat93 is licensed under CC BY-SA 3.0

Citizens to buy college planning platform College Raptor

The deal will give Citizens, which already has several student lending products, greater access to the college student market, the bank’s executive vice president and head of student lending said.

By Anna Hrushka • Sept. 15, 2022 -

Column

How big of a deal is Q2’s deposit decline?

Deposits had seen an unsustainable 35% jump since 2020, and banks were pushing their capital limits. The real tell of consumer health from FDIC data may be a 25% spike in early delinquencies.

By Dan Ennis • Sept. 15, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

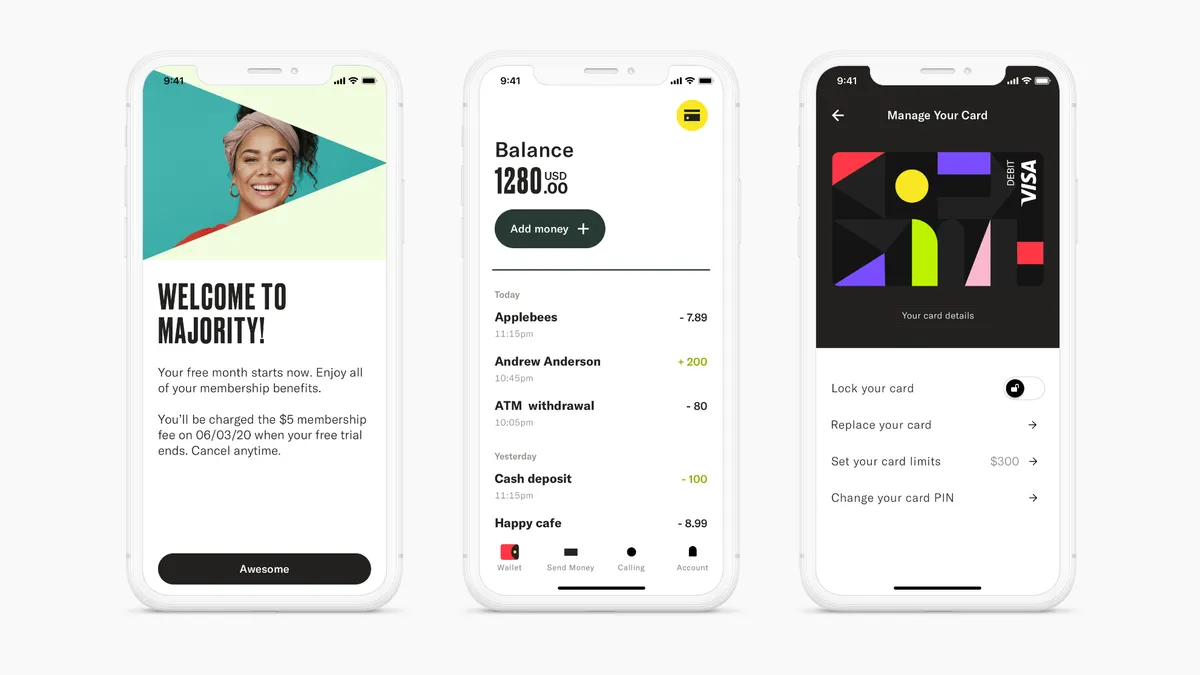

Majority raises $37M as neobank expands immigrant outreach

The neobank, which declined to share its current valuation or number of users, has raised $83.5 million to date.

By Anna Hrushka • Sept. 14, 2022 -

Wells Fargo agrees to third-party racial-equity audit

CEO Charlie Scharf called the move “a critical next step” toward closing the wealth gap, and added that diversity, equity and inclusion are “imperative” at the bank.

By Gabrielle Saulsbery • Sept. 14, 2022 -

BofA pledges $25M to support Black and Latino-led CDFIs

“This collaboration demonstrates that opportunities and impact are literally doubled when we work together,” said Marla Bilonick, chair of the National Alliance of Latino CDFI Executives.

By Gabrielle Saulsbery • Sept. 9, 2022 -

Truist taps insider as CFO as Bible retires

Mike Maguire, the Charlotte, North Carolina-based lender’s chief consumer finance and payments officer, will become CFO, effective Sept. 15. Current CFO Daryl Bible will stay on through a transition period.

By Gabrielle Saulsbery • Sept. 8, 2022 -

10 takeaways from Michael Barr’s first speech as Fed’s supervision czar

The regulator pushed a tiered set of capital requirements and stricter living wills for regional banks. He also clarified the central bank’s stance on climate risk.

By Dan Ennis • Sept. 8, 2022 -

Black woman, 71, sues Fifth Third over alleged refusal to cash check

The retiree alleges three White bank employees “insisted” the five-figure casino jackpot check was fraudulent. She later deposited it at JPMorgan Chase.

By Gabrielle Saulsbery • Sept. 7, 2022 -

Citi joins Wells Fargo in cutting mortgage-lending staff

Citi’s layoffs will number fewer than 100, while Wells, in the past two weeks, notified 75 Iowa-based workers they would be let go.

By Dan Ennis • Sept. 6, 2022 -

Column

Need to fill a C-suite void? Target banks that are being acquired

First Republic and other banks looking to fill high-ranking roles hired executives from MUFG Union Bank, People’s United and other institutions at the non-surviving end of a merger.

By Dan Ennis • Sept. 1, 2022 -

Branch-closure freefall slows down: S&P Global

Net branch closures fell to 312 in the second quarter, compared with 950 in the first three months of 2022. If second-half closures continue at the first half’s pace, 19% fewer locations will shut down this year than in 2021.

By Anna Hrushka • Sept. 1, 2022 -

Average overdraft fee falls nearly $4, to lowest level since 2009

ATM fees, however, jumped to a three-year high of $4.66 per transaction, according to a Bankrate study, which also found users needed record or near-record-high balances to avoid monthly service charges.

By Gabrielle Saulsbery • Sept. 1, 2022 -

Hawaii’s Central Pacific Bank embraces BaaS to gather mainland deposits

“We could be business as usual, and continue focusing on traditional community banking in Hawaii,” the bank’s CFO said. “We chose to participate in the disruption.”

By Anna Hrushka • Aug. 31, 2022 -

BofA, BMO push to close racial property ownership gap

Bank of America launched a program offering a zero-down payment, zero-closing-cost mortgage solution to first-time homebuyers in nonwhite-majority areas, and another aimed at small businesses.

By Gabrielle Saulsbery • Aug. 31, 2022 -

U.S. Bank boosts minimum hourly wage to $20

This is the second bump for the bank’s pay floor this year. About 35,000 employees are also receiving a 3% boost in base pay — which won’t preclude them from another merit raise in 2023’s first quarter, the bank said.

By Gabrielle Saulsbery • Aug. 29, 2022 -

Deep Dive

How automation can help banks tame the home-lending ‘roller coaster’

The cyclical nature of the market doesn’t mean lenders should be forced to respond with mass hiring or firing as demand for mortgages ebbs and flows, analysts say.

By Anna Hrushka • Aug. 26, 2022 -

Citi to wind down its Russia retail presence

The bank expects to incur roughly $170 million in costs, mostly over the next 18 months, in a move expected to affect about 2,300 employees and 15 branches.

By Dan Ennis • Aug. 25, 2022 -

Japanese bank SMBC to launch US digital bank Jenius

Jenius will launch with personal loans in the coming months, and expand to savings and checking products within its first year, SMBC said.

By Anna Hrushka • Aug. 25, 2022 -

Truist acquires data governance platform from Zaloni

The platform’s founder and chief technology officer will be among 20 employees to transition to Truist as part of the deal, which highlights the bank’s continuing emphasis on nonbank and niche M&A.

By Anna Hrushka • Aug. 24, 2022 -

Column

Bank of America, RBC aim for ‘balance,’ whether leaning on data or emotion

Two banks’ messaging, on overdraft and office returns, could hardly be more different. One relies on statistics, another has no specifics. Yet they have one word in common.

By Dan Ennis • Aug. 23, 2022 -

FDIC orders FTX, 4 other crypto firms to halt ‘false and misleading’ claims

Brett Harrison, FTX’s president, responded on Twitter, saying the company “really didn’t mean to mislead anyone.” The FDIC cited a deleted tweet from Harrison in its letter to the company.

By Anna Hrushka • Aug. 22, 2022 -

USAA banking division job cuts number in ‘triple digits’: report

Layoffs appear aimed at restructuring the business. They affect IT, business continuation, client advising and human resources, the San Antonio Express-News reported.

By Anna Hrushka • Aug. 19, 2022 -

SEC, Fed fine EagleBank $22.9M, ban ex-CEO over insider lending

EagleBank had deficient internal controls between 2015 and 2018, allowing the bank to lend to entities its then-CEO owned or controlled, including certain family trusts, the Fed said.

By Anna Hrushka • Aug. 17, 2022 -

Nashville bank execs launch Sonata to serve fast-food industry

Dan Dellinger and Farzin Ferdowsi, with their third venture, aim to solve turnover and banking access issues in the quick-service space, and add telehealth and financial literacy to help franchisees retain talent.

By Anna Hrushka • Aug. 12, 2022 -

PNC eliminates NSF fees

The Pittsburgh lender in April 2021 began curtailing the penalty for customers of its Virtual Wallet tool and is now extending that policy across its user base.

By Dan Ennis • Aug. 12, 2022