Retail: Page 31

-

FDIC approves first new US mutual bank in 50 years

New Hampshire-based Walden Mutual aims to provide loans along the entire farm ecosystem to build a more inclusive, sustainable and local food system, the bank’s CEO said.

By Anna Hrushka • Oct. 6, 2022 -

M&T pledges to rectify People’s United account access issues

The bank’s pledge, in response to letters of concern from five senators and Connecticut’s attorney general, came during a week when M&T disclosed 325 layoffs in the Nutmeg State.

By Gabrielle Saulsbery • Oct. 3, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Banks turn to automation to realize efficiency gains

Automation will increasingly support customer experience improvements, product releases and other client-relations objectives, analysts said.

By Suman Bhattacharyya • Sept. 30, 2022 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB sues MoneyLion, alleging Military Lending Act violations

The fintech required customers to join a membership program to access its low-APR installment loan product, but wouldn’t let members cancel their memberships until their loans were paid, the bureau said.

By Anna Hrushka • Sept. 30, 2022 -

Lakeland Bank to pay $13M in DOJ redlining settlement

The settlement comes one day after Provident Bank said it would acquire Lakeland in a $1.3 billion all-stock transaction. Provident disclosed Tuesday it was aware of the pending settlement when agreeing to the deal.

By Gabrielle Saulsbery • Sept. 29, 2022 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB fines Regions $191M on overdraft practices

The bureau demanded Regions pay $141 million in redress to customers and a $50 million penalty over “authorized-positive” fees the bank charged related to the order in which it posted transactions.

By Dan Ennis • Sept. 28, 2022 -

JPMorgan’s UK retail bank hits 1M customers, aims to double staff by 2024

JPMorgan said it plans to introduce new features and enhancements to the current Chase U.K. account, including new savings options and lending products, such as a Chase credit card.

By Anna Hrushka • Sept. 28, 2022 -

NJ’s Provident, Lakeland to merge in $1.3B deal

The transaction, set to close in the second quarter of 2023, aims to give the Garden State a “super-community bank” at the $25 billion-asset level, filling a gap that opened when Citizens acquired Investors Bancorp.

By Dan Ennis • Sept. 27, 2022 -

PNC buys restaurant point-of-sale firm Linga

The Pittsburgh-based bank is boosting its payments footprint as banks from Banc of California to JPMorgan Chase are making similar large investments.

By Anna Hrushka • Sept. 27, 2022 -

Bank CEOs defend Zelle in Senate hearing

Sen. Elizabeth Warren, D-MA, called the peer-to-peer payments network “unsafe,” claiming Zelle users were defrauded out of $500 million last year.

By Anna Hrushka • Sept. 23, 2022 -

Citi proposes UK retail exit

The move wouldn’t materially affect the bank. Citi has one U.K. retail branch and intends to ask qualifying clients to use the bank’s private banking services.

By Gabrielle Saulsbery • Sept. 23, 2022 -

Republicans grill bank CEOs on handling of new merchant gun code

GOP lawmakers, during a wide-ranging hearing Wednesday, demanded the CEOs of the nation’s top banks share how they plan to respond to a new category code for gun and ammunition retailers.

By Anna Hrushka • Sept. 22, 2022 -

Chicago mayoral candidate proposes public bank

The bank would start with $500 million in assets, with half coming from the city’s “cash on hand.” The rest could come from federal stimulus funds, or the Illinois General Assembly could be asked to “match funds.”

By Gabrielle Saulsbery • Sept. 21, 2022 -

PNC gears up for Round 3 in USAA patent dispute

Lawyers for PNC asked a judge for a new trial in a $218 million case days after a jury found the bank should pay USAA another $4.3 million in a related matter.

By Dan Ennis • Sept. 21, 2022 -

Diversity, inflation, payments fraud to take center stage at hearings

Democratic lawmakers are expected to grill big-bank CEOs this week on reports of consumer abuses, while Republicans will likely target executives they say have caved to social pressures.

By Anna Hrushka • Sept. 20, 2022 -

Column

Goldman grows where it can — but may have just started its cull

The bank leans into an expansion in transaction banking and a new card partnership while cutting at least 25 bankers in Asia.

By Dan Ennis • Sept. 20, 2022 -

M&T-People’s United conversion issues draw AG scrutiny

Some customers have been unable to access online banking following M&T’s conversion of People’s United accounts over the Labor Day weekend, Connecticut's attorney general wrote last week in a letter.

By Anna Hrushka • Sept. 19, 2022 -

TD to expand in Charlotte area, with 15 new branches

At least 25% will be in majority-nonwhite or LMI areas, TD said, in perhaps an olive branch to community advocates concerned over the impact of the bank’s pending acquisition of First Horizon.

By Gabrielle Saulsbery • Sept. 16, 2022 -

Bank of America to offer paid sabbaticals starting next year

Employees who have served 15 years at the bank can take four weeks, with an extra week for 20-year vets, and a sixth for those with 30.

By Dan Ennis • Sept. 15, 2022 -

The image by Hobiecat93 is licensed under CC BY-SA 3.0

The image by Hobiecat93 is licensed under CC BY-SA 3.0

Citizens to buy college planning platform College Raptor

The deal will give Citizens, which already has several student lending products, greater access to the college student market, the bank’s executive vice president and head of student lending said.

By Anna Hrushka • Sept. 15, 2022 -

Column

How big of a deal is Q2’s deposit decline?

Deposits had seen an unsustainable 35% jump since 2020, and banks were pushing their capital limits. The real tell of consumer health from FDIC data may be a 25% spike in early delinquencies.

By Dan Ennis • Sept. 15, 2022 -

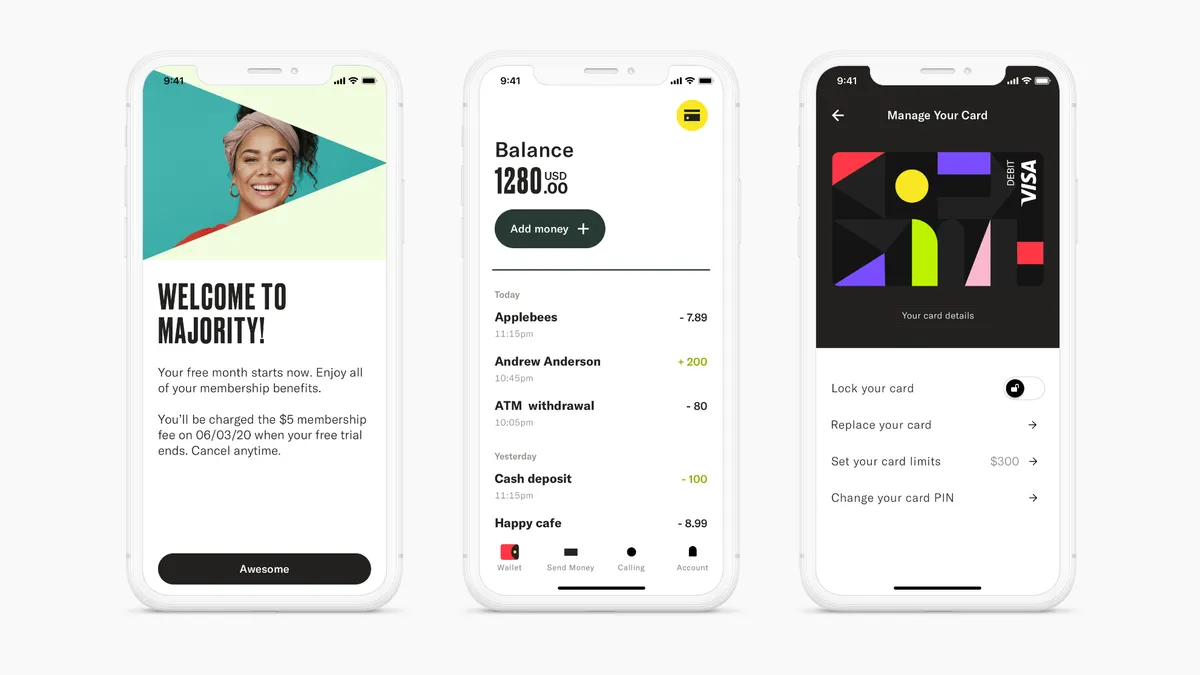

Majority raises $37M as neobank expands immigrant outreach

The neobank, which declined to share its current valuation or number of users, has raised $83.5 million to date.

By Anna Hrushka • Sept. 14, 2022 -

Wells Fargo agrees to third-party racial-equity audit

CEO Charlie Scharf called the move “a critical next step” toward closing the wealth gap, and added that diversity, equity and inclusion are “imperative” at the bank.

By Gabrielle Saulsbery • Sept. 14, 2022 -

BofA pledges $25M to support Black and Latino-led CDFIs

“This collaboration demonstrates that opportunities and impact are literally doubled when we work together,” said Marla Bilonick, chair of the National Alliance of Latino CDFI Executives.

By Gabrielle Saulsbery • Sept. 9, 2022 -

Truist taps insider as CFO as Bible retires

Mike Maguire, the Charlotte, North Carolina-based lender’s chief consumer finance and payments officer, will become CFO, effective Sept. 15. Current CFO Daryl Bible will stay on through a transition period.

By Gabrielle Saulsbery • Sept. 8, 2022