Regulations & Policy: Page 78

-

Wells Fargo diversity pledge inquiry closes

The bank "responded to the inquiries with in-depth descriptions, materials, and data," a Labor Department spokesman said, according to The Wall Street Journal. "OFCCP was satisfied with the response."

By Dan Ennis • Updated March 8, 2021 -

Sen. Warren asks Fed to weigh Wells Fargo's mortgage missteps in asset cap evaluation

Of the 904 accounts for which forbearance was not requested, 344 told the bank they did not want the help, Warren indicated to the central bank.

By Dan Ennis • Oct. 5, 2020 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Varo turns focus to new products after national charter milestone

The launch of the Varo Bank app, which the company says is imminent, will free up resources and energy to "pivot on to the customer," Chief Risk Officer Philippa Girling said.

By Anna Hrushka • Oct. 2, 2020 -

As Goldman, JPMorgan resume cuts, Bank of America reiterates no-layoff vow

Brian Moynihan, the CEO of the nation's second-largest bank, touted the Charlotte, N.C.-based lender's progress on diversity Thursday in perhaps a direct counter to comments that put Wells Fargo chief Charlie Scharf in hot water.

By Dan Ennis • Updated Oct. 2, 2020 -

With stimulus in legislative limbo, market may see boost in small-dollar loans

Four regulators issued guidance on the products in May, but banks have been slow to roll out offerings. Higher demand may provide the catalyst they need.

By Suman Bhattacharyya • Oct. 1, 2020 -

Fed extends freeze on share buybacks, cap on dividends

The capital positions of large banks "have remained strong" while the restrictions have been in place, the central bank said. Those limits, imposed in June, were set to expire Wednesday if the Fed hadn't intervened.

By Anna Hrushka • Oct. 1, 2020 -

Treasury says it could start forgiving PPP loans this week

Meanwhile, 10 trade groups urged Senate and House leaders Tuesday to pass a measure reauthorizing the program — and banks gave the Fed insight into why the Main Street Lending Program is flailing.

By Dan Ennis • Sept. 30, 2020 -

OCC's Brooks defends special-purpose charters amid growing 'unbundling'

"Unbundling is not going away," the acting comptroller said Tuesday at a LendIt Fintech conference. "Customers want what they want. The question is, is our platform flexible enough to accommodate that? And I think it has to be."

By Anna Hrushka • Sept. 30, 2020 -

Citi fined for failing to fix 'ticking time bomb,' CFTC says

A bank employee warned Citi in 2014 of a flaw in its audio preservation system. Four years later, the system deleted millions of recordings, including some the CFTC subpoenaed — and the bank promised to preserve.

By Dan Ennis • Sept. 29, 2020 -

Column

With race, as with office returns, banks follow the herd or react to it

Citi's billion-dollar pledge and Deutsche's stay-home policy show when one bank misfires, another redirects the narrative.

By Dan Ennis • Sept. 25, 2020 -

Citi pledges more than $1B toward closing racial wealth gap

Much of the funding is aimed at boosting Black homeownership and entrepreneurship, but the bank also wants to root out biases in its software and eliminate out-of-network ATM fees for minority depository institution customers.

By Dan Ennis • Sept. 24, 2020 -

JPMorgan to pay more than $920M in record CFTC spoofing penalty

The punishment over metals market manipulation allegations that span eight years breaks down to a $436.4 million fine, $311.7 million in restitution and more than $172 million in disgorgement.

By Dan Ennis • Updated Sept. 29, 2020 -

Wells Fargo CEO Scharf comes under fire over diversity comments

The bank's pledge to double Black leadership created a domino effect in the industry, but the executive's assertion that the talent pool is "very limited" got under some people's skin. He has since apologized.

By Dan Ennis • Sept. 23, 2020 -

Fed pushes its own plan for CRA overhaul

The central bank would test banks' retail lending and community development separately and expand the activities for which banks could receive CRA credit.

By Dan Ennis • Sept. 22, 2020 -

3 more ex-Wells Fargo execs face OCC bans or fines

The regulator banned a former finance officer and fined him $925,000 for his role in the 2016 fake accounts scandal. Two other managers face personal cease-and-desist orders and penalties of $400,000 and $350,000.

By Dan Ennis • Sept. 22, 2020 -

Banks on pace to cut more than 80K jobs this year, highest since 2015

The actual number is likely higher, Bloomberg reported, because many banks reduce headcount without announcing they are doing so. But many that do are cutting costs, like Wells Fargo, or investing in technology, like Citi.

By Dan Ennis • Sept. 21, 2020 -

Column

4 Federal Reserve storylines to follow this month

The central bank published two scenarios Thursday under which it will test lenders' resilience. But dividend caps, share buybacks, the CRA and Main Street lending are also top of mind.

By Dan Ennis • Sept. 18, 2020 -

FinCEN overhaul to AML rules would bring clarity, experts say

However, not all institutions will favor the "one size fits all" solution, said regulatory, risk and compliance expert Julie Copeland.

By Anna Hrushka • Sept. 18, 2020 -

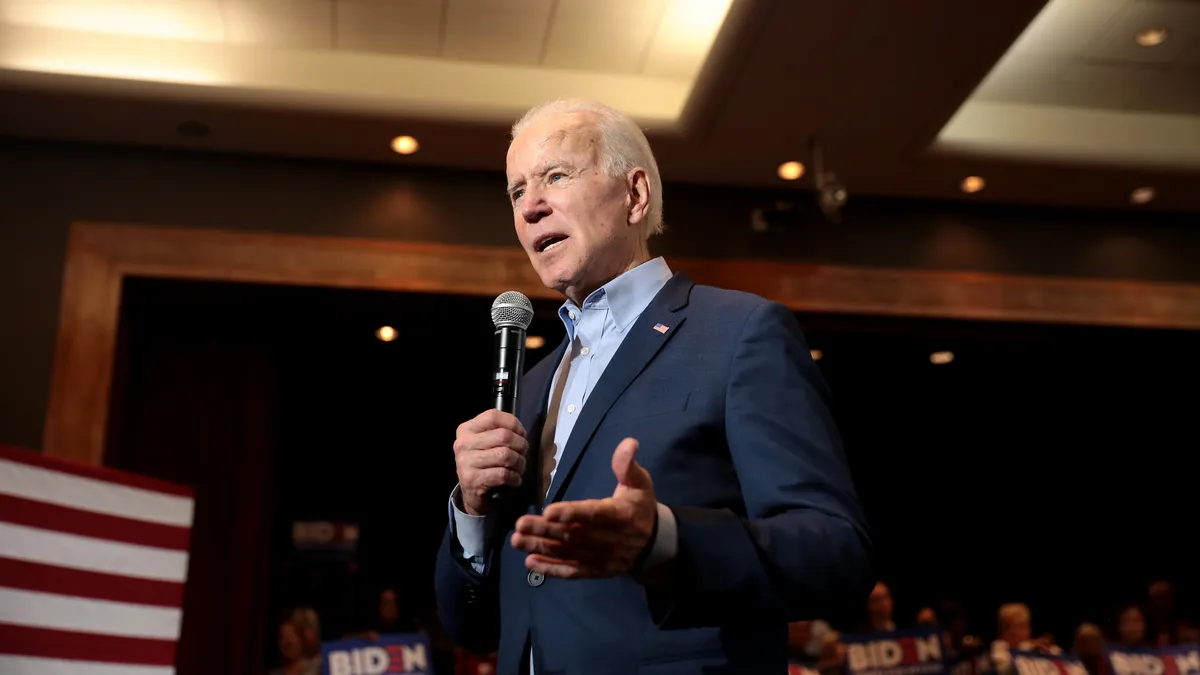

Biden tax plan could cost top 10 banks $7B per year, report finds

The plan would raise the corporate tax rate from 21% to 28%, partially rolling back changes enacted under the 2017 Tax Cuts and Jobs Act.

By Anna Hrushka • Sept. 17, 2020 -

JPMorgan, Goldman send staff home after employees test COVID-positive

Two days after JPMorgan communicated news of the case to workers, CEO Jamie Dimon said offices should "carefully open up and see if we can get the economy growing for the sake of everybody."

By Dan Ennis • Updated Sept. 18, 2020 -

Citi resumes job cuts, faces regulator reprimand over risk management

The prospect of the multiyear system revamp prompted CEO Michael Corbat to push up his plans to retire so his successor could see the effort through from the beginning.

By Dan Ennis • Sept. 15, 2020 -

Citi's Fraser paves the way, but more needs to be done, experts say

Banks need to do more than just hope that female leadership will create a "trickle-down" effect on organizational culture, one consultant said.

By Anna Hrushka • Sept. 14, 2020 -

Column

COVID relief programs can ill afford a third black eye

Lawmakers look to jump-start the Main Street Lending Program so it avoids the disappointments of PPP and EIDL.

By Dan Ennis • Sept. 14, 2020 -

Many banks not yet accepting PPP forgiveness applications

Lenders are awaiting more guidance from the federal government, as well as potential legislative action. Here is what some of the country's top banks are telling customers.

By Jennifer Goodman • Sept. 14, 2020 -

FinCEN business loan fraud reports jump 84% for 4th straight monthly record

Financial institutions filed 1,922 suspicious-activity reports in August, up from 1,044 in July and about 14 times the monthly average since the watchdog's database was established in 2014. July's total itself was more than double June's 489.

By Anna Hrushka • Updated Sept. 25, 2020