Regulations & Policy: Page 77

-

Fed lowers Main Street loan threshold to $100K

With the chance of a PPP revival waning, the central bank played with the margins in Main Street — waiving the 1% fee it collects from borrowers on loans of less than $250,000, but allowing banks to charge 2% origination fees.

By Dan Ennis • Nov. 2, 2020 -

American Express pledges $1B toward racial, gender equality

Much of that will come in an effort to double — to $750 million annually by 2024 — the credit-card network’s spending on diverse and minority-owned suppliers in the U.S.

By Dan Ennis • Oct. 30, 2020 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

NY regulator lays out climate risk expectations for banks

The Department of Financial Services wants banks to integrate climate-related financial risks into their business strategies, risk management processes and governance frameworks, but stopped short of demanding climate stress tests.

By Dan Ennis • Oct. 30, 2020 -

SoFi gets OCC's preliminary approval for bank charter, launches credit card

The card will offer up to 2% cash back when rewards are redeemed to pay down student loans or personal loans financed through the company. SoFi's charter application still needs sign-off from the FDIC and Federal Reserve.

By Anna Hrushka • Oct. 29, 2020 -

Visa's Plaid deal faces antitrust scrutiny from Justice Department

The DOJ may be concerned Visa's purchase of Plaid would result in a "killer acquisition" — when a legacy company purchases a smaller, innovative player to preempt future competition, a Bloomberg Law analyst said.

By Anna Hrushka • Oct. 28, 2020 -

OCC clarifies 'true lender' status on bank-fintech loans

A final rule the regulator issued Tuesday puts the onus on banks to ensure a loan complies with consumer protection laws.

By Dan Ennis • Oct. 28, 2020 -

:Weatherman1126. (2007). "Logo of The Goldman Sachs Group, Inc." [Image]. Retrieved from Wikipedia Commons.

:Weatherman1126. (2007). "Logo of The Goldman Sachs Group, Inc." [Image]. Retrieved from Wikipedia Commons.

Ex-Goldman lawyer sues bank in alleged sexual misconduct cover-up

Whistle-blower Marla Crawford claims her boss retroactively added negative comments to her performance review in retaliation for her complaint over an inappropriate relationship, leading Crawford's bonus to be slashed by $30,000.

By Dan Ennis • Oct. 27, 2020 -

Fed, FinCEN want to make banks report international transfers of as little as $250

Friday's proposal to lower the threshold from $3,000 is meant to catch bad actors using low-dollar cross-border transactions to facilitate terrorist financing and other illicit activity.

By Anna Hrushka • Oct. 26, 2020 -

Kansas regulators close Almena State Bank in year's 4th bank failure

Almena is the second U.S. bank to shutter within a week. The bank's two branches opened Monday under the banner of Equity Bank, which is purchasing roughly all of Almena's $65.8 million in assets and its deposits.

By Dan Ennis • Oct. 26, 2020 -

Fintechs hopeful as CFPB seeks to modify data access rule

Section 1033 of the Dodd-Frank Act won't prevent banks from overstepping their authority and blocking consumers from sharing their data with certain companies, fintechs argue.

By Anna Hrushka • Oct. 23, 2020 -

Goldman claws back $174M from current, former execs in 1MDB case

The move comes as the Justice Department on Thursday handed down a $2.9 billion settlement in which a Malaysian unit of the bank pleaded guilty to conspiracy to violate anti-bribery laws.

By Dan Ennis • Oct. 22, 2020 -

Senate bill would expand Civil Rights Act to bar discrimination at banks

Senators cited a June article in The New York Times recounting Black people's experiences being turned away or accused of fraud while trying to make simple transactions, such as to cash a check or withdraw funds.

By Anna Hrushka • Oct. 22, 2020 -

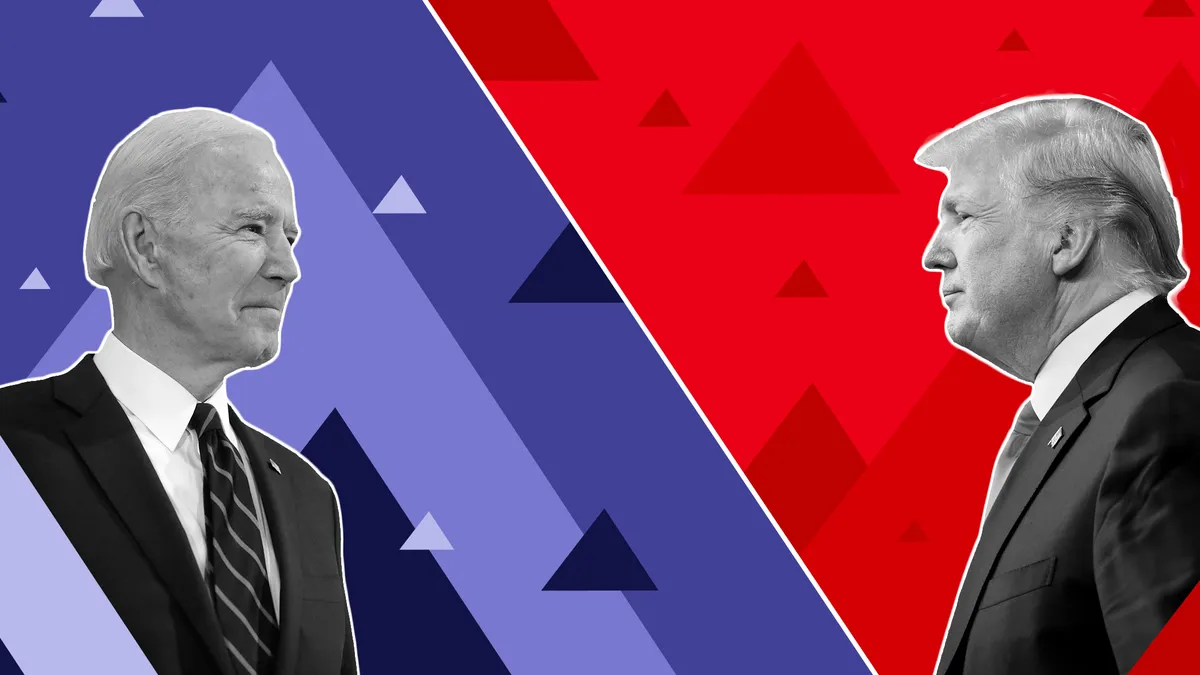

Photography by Gage Skidmore / Photo Illustration by Kendall Davis / Industry Dive

Deep Dive

Deep DiveElection 2020: What should the banking industry expect from Biden or Trump?

Banking Dive spoke to several academics, consultants and legal experts about what may change or stay the same in the banking sector under a new Biden administration or a second Trump term.

By Anna Hrushka • Oct. 22, 2020 -

Regulators finalize rule requiring big banks to keep year's worth of liquidity

Most of the nation's 20 largest banks already meet the rule's demands, regulators said. However, at least one bank — unidentified — needs to come up by 8%.

By Anna Hrushka • Oct. 21, 2020 -

Synchrony lets all US workers stay remote permanently

The credit card provider wants to cut up to $250 million in expenses next year. But the new policy contributed to an $89 million restructuring charge the company took in the third quarter, according to earnings reported Tuesday.

By Dan Ennis • Oct. 21, 2020 -

Fed chair remains cautious on regulator's digital dollar efforts

The central bank's chief, Jerome Powell, told a panel Monday he'd rather the U.S. "get it right" than be first — and that such a currency should aim to complement rather than replace the dollar.

By Dan Ennis • Oct. 20, 2020 -

Retrieved from Unsplash.

Retrieved from Unsplash.

Regulators close Florida's First City Bank, 2020's 3rd bank failure

The bank's chairman and CEO in January attributed its struggles to the 2008 financial crisis and the Deepwater Horizon oil spill.

By Anna Hrushka • Oct. 19, 2020 -

House panel blasts banks over gap in PPP loan processing times

JPMorgan's larger borrowers waited an average of 3.7 days from application to funding, while others waited 14. But U.S. Bank applicants, regardless of size, saw little to no difference, a report found.

By Dan Ennis • Oct. 19, 2020 -

Varo Bank launches small-dollar loan product

Varo's new product follows Bank of America's rollout this month of Balance Assist, and comes as regulators have encouraged banks to issue small-dollar loans amid the ongoing coronavirus pandemic.

By Anna Hrushka • Oct. 16, 2020 -

OCC fines USAA $85M over compliance, IT failures

"[W]e did not sufficiently invest in the capabilities and expertise necessary to meet regulatory requirements and evolving business needs," USAA CEO Wayne Peacock said.

By Anna Hrushka • Oct. 15, 2020 -

PNC sees bump in Q3 revenue as bank reaches 'stable reserve levels'

After padding its loan-loss reserves over the past two quarters, the Pittsburgh-based lender set aside $2.4 billion less than it did in the previous three months.

By Anna Hrushka • Oct. 14, 2020 -

Simplified PPP forgiveness doesn't go far enough, bank trade groups say

The Independent Community Bankers of America, Bank Policy Institute and Consumer Bankers Association welcomed the two-page form covering loans of $50,000 or less, but continue to push for congressional action.

By Anna Hrushka • Oct. 12, 2020 -

New bank CEOs come of age amid coronavirus trial by fire

Net interest margin is so 2019. Bankers taking top roles during the pandemic have found branch cleanliness and small-business lending just as crucial.

By Ken McCarthy • Oct. 12, 2020 -

Morgan Stanley fined $60M for data center oversight failures

The bank hired a third-party vendor to wipe data from servers and other hardware, but some customer information remained on the equipment after it was sold to a recycler.

By Dan Ennis • Oct. 9, 2020 -

Citi fined $400M over risk management, data governance issues

The OCC demands approval of any "significant new" acquisition the bank wants to make and reserves the right to make changes to senior management and Citi's board if the regulator deems the bank is moving too slowly.

By Dan Ennis • Oct. 8, 2020