Payments: Page 3

-

BofA corporate client app surpasses $1 trillion in payments

Payments approved over the app are expected to rise 25% this year, echoing a similar increase last year over 2022.

By Lynne Marek • Dec. 11, 2024 -

FedNow racks up nearly $246M in annual expenses

The Federal Reserve projects the real-time payment system’s costs will climb slightly next year, from the $245.5 million it expects to spend this year.

By Lynne Marek • Dec. 4, 2024 -

Trendline

Fraud and AML in banking

The past year has been one of reckoning with regard to fraud — from TD’s $3 billion AML penalty to the continuing punitive phase connected to PPP misdeeds, crypto bankruptcies and pig butchering.

By Banking Dive staff -

Q&A

Worldpay exec talks digital wallet security

The head of fraud prevention for the processor said the company leverages data to block hackers and fraudsters seeking digital wallet information.

By Patrick Cooley • Dec. 3, 2024 -

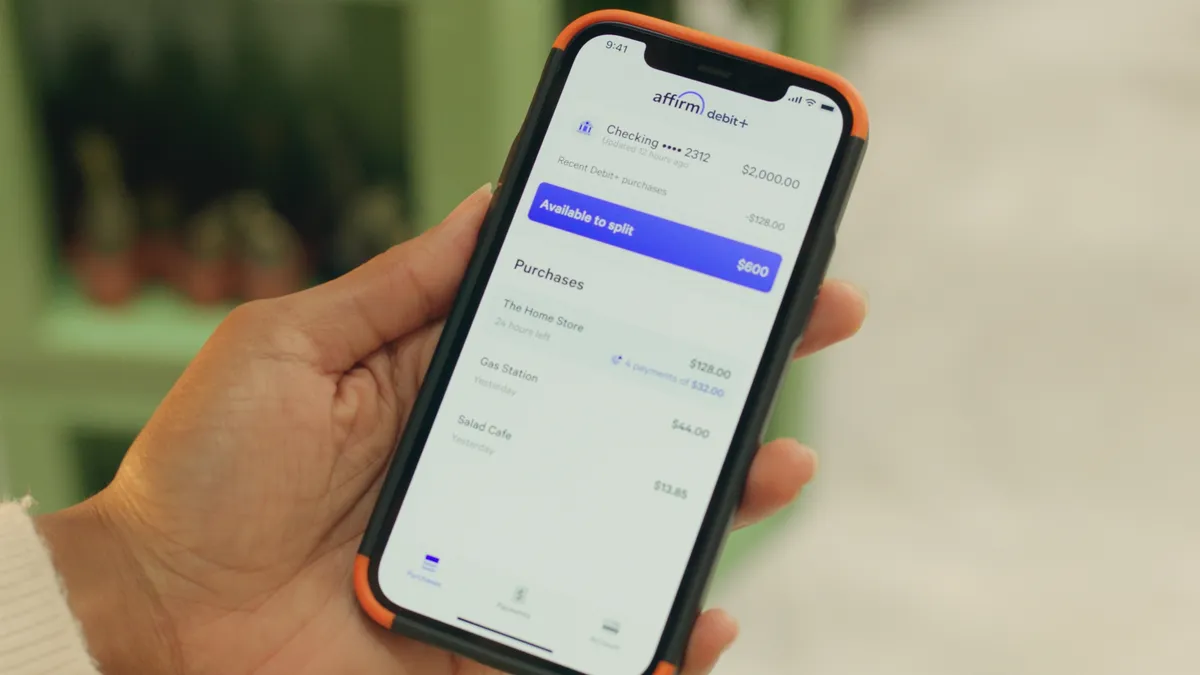

BNPL use may rise this year for holiday shopping

With credit card interest rates at a historic high, consumers are likely to gravitate to lower-cost alternatives, including potentially buy now, pay later options, industry consultants say.

By Patrick Cooley • Nov. 27, 2024 -

Retrieved from OCC.

Retrieved from OCC.

OCC admonishes Texas’ Clear Fork Bank for not correcting AML problems

The lender’s board was given one week to appoint a compliance committee to oversee the bank’s adherence to the OCC order’s provisions.

By Caitlin Mullen • Nov. 22, 2024 -

BNY nabs 5-year deal for Treasury’s Direct Express program

Comerica, Treasury’s previous partner on the program, reportedly drew flak for allowing a third-party vendor to work on dispute resolution from overseas.

By Dan Ennis • Nov. 22, 2024 -

CFPB tweaks big tech payments rule

In finalizing the new rule to oversee digital wallet providers Thursday, the Consumer Financial Protection Bureau said it made important changes to its initial proposal.

By Lynne Marek • Nov. 21, 2024 -

Deep Dive

PayPal CEO pushes beyond payments

After a year as CEO of the digital payments pioneer, Alex Chriss is spearheading an expanded role in commerce for the company.

By Lynne Marek • Nov. 20, 2024 -

18 AGs sue SEC over crypto actions

A group of attorneys general led by Kentucky’s Russell Coleman allege the agency and its commissioners “sought to unilaterally wrest regulatory authority away from the States” through crypto enforcement.

By Gabrielle Saulsbery • Nov. 15, 2024 -

Block recalibrates crypto approach

The payments firm is winding down its bitcoin-focused TBD business and investing in its self-custody wallet and bitcoin mining businesses.

By Gabrielle Saulsbery • Nov. 13, 2024 -

Underbanked US population grows to 14.2%, FDIC finds

Separately, the unbanked proportion of U.S. households dropped to 4.2% last year, the regulator said in its biennial survey. But racial disparity persists: 32.3% of unbanked households are Black and 33.4% are Hispanic, the FDIC found.

By Caitlin Mullen • Nov. 13, 2024 -

Fed’s Waller: Payments industry needs public-private balance

The Federal Reserve must consider when to make up for private sector shortcomings in payments, while keeping its role limited, board governor Christopher Waller said Tuesday.

By Tatiana Walk-Morris • Nov. 13, 2024 -

Klarna files for IPO

The buy now, pay later company announced Tuesday it had filed confidentially with the Securities and Exchange Commission for an initial public offering.

By Patrick Cooley • Nov. 13, 2024 -

Comerica sues CFPB over ‘costly’ prepaid card probe

The agency “failed to acknowledge” that Comerica “generally acted with the oversight … or approval of the federal government” in handling a Treasury Department program, the bank said.

By Caitlin Mullen • Nov. 12, 2024 -

FTX suing Binance, founder for $1.76B

The FTX estate is looking to recoup funds it alleged were “fraudulently” transferred to Binance in 2021.

By Gabrielle Saulsbery • Nov. 11, 2024 -

Paze gets new leader amid slow start

Early Warning Services, the bank-owned company that operates Paze, tapped a new leader last month for the digital wallet operation after slow progress in launching the new service.

By Patrick Cooley • Nov. 7, 2024 -

Cross River drops lawsuit against Fiserv subsidiary

The Fort Lee, New Jersey-based lender dismissed its lawsuit against First Data Merchant Services, which was filed in October 2023, without disclosing a reason.

By Rajashree Chakravarty • Nov. 6, 2024 -

Fed aims to make instant payments the norm

“It's going to be up to us to move instant payments from being novel to being normal,” Federal Reserve Financial Services’ chief payments executive told attendees at an industry conference last week.

By Lynne Marek and Patrick Cooley • Nov. 5, 2024 -

Stablecoins face obstacles to widespread adoption

The digital currencies could simplify cross-border payments, but consumers are wary of using them, payments and fintech executives say.

By Patrick Cooley • Nov. 4, 2024 -

AI increases fraud risk, fintechs say

Financial firms monitor for fraud by looking for unusual activity, but an artificial intelligence model can be trained to transact like a real person.

By Patrick Cooley • Oct. 31, 2024 -

BofA discloses Zelle probe, says it may result in litigation

The bank also said it’s in contact with regulators over its Bank Secrecy Act/anti-money laundering and sanctions compliance programs, and a regulatory order could stem from those discussions.

By Caitlin Mullen • Oct. 30, 2024 -

How open banking will shape the future of payments

The Consumer Financial Protection Bureau released its open banking final rule last week, leading the payments and financial services industries to begin preparing for a new era in data sharing.

By Patrick Cooley • Oct. 29, 2024 -

Pay-by-bank to be used for bills, Plaid CEO predicts

Plaid CEO Zach Perret expects consumers to use pay-by-bank services for mortgage and utility payments, but is skeptical they will be used to pay at restaurants or for groceries any time soon, he said.

By Patrick Cooley • Oct. 28, 2024 -

Industry balks at FDX standard-setting monopoly

Regulators and industry participants worry that FDX will have an unfair monopoly and will advantage its own members if no other organization applies.

By Patrick Cooley • Oct. 24, 2024 -

Goldman, Apple to pay CFPB $89.8M over Apple Card issues

The bank and tech firm failed to address disputed transactions from their joint Apple Card program, the bureau alleged, and misled cardholders about interest-bearing products.

By Gabrielle Saulsbery • Oct. 23, 2024