Payments: Page 2

-

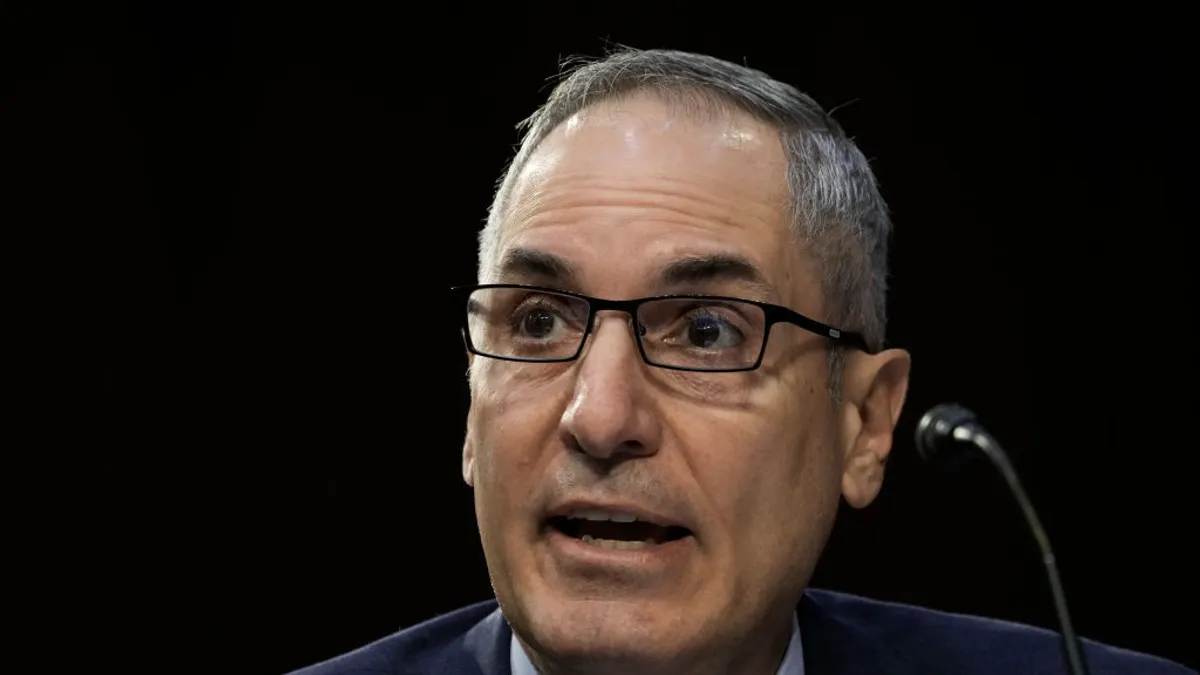

Waller sees stablecoins advancing in retail

Stablecoins are seeping into payments at stores, but there are plenty of hurdles before they become widely used, according to Federal Reserve Governor Christopher Waller.

By Lynne Marek • Feb. 18, 2025 -

Klarna, JPMorgan to offer BNPL to business clients

The collaboration will let the bank’s payments division offer the buy now, pay later company’s financing options to business customers.

By Patrick Cooley • Feb. 11, 2025 -

Trendline

Fraud and AML in banking

The past year has been one of reckoning with regard to fraud — from TD’s $3 billion AML penalty to the continuing punitive phase connected to PPP misdeeds, crypto bankruptcies and pig butchering.

By Banking Dive staff -

Senators reintroduce bill to bar CBDC

Republican senators revived a bill last week to block the Federal Reserve from creating a central bank digital currency.

By Lynne Marek • Feb. 10, 2025 -

CFPB fines Wise $2.5M over remittance violations

In one of the bureau's final actions under former Director Rohit Chopra's leadership, the CFPB said Wise misled customers in the U.S. about fees and failed to make other required disclosures.

By Rajashree Chakravarty • Feb. 5, 2025 -

Coinbase calls on regulators to clarify crypto-bank rules

Banks that pursued crypto “were almost universally met with resistance” from the FDIC, the agency’s acting chair, Travis Hill, said Wednesday.

By Gabrielle Saulsbery • Feb. 5, 2025 -

Trump media firm aims to launch fintech brand this year

The company wants to develop “American First” investment vehicles with funding of up to $250 million to be custodied by Charles Schwab, it said Wednesday.

By Dan Ennis • Jan. 29, 2025 -

U.S. Bank’s Kedia to become CEO in April

The super-regional lender’s president, Gunjan Kedia, will become the second woman leading a top-10 American bank when she replaces Andy Cecere on April 15.

By Caitlin Mullen • Jan. 28, 2025 -

Fintechs may gain at banks’ expense in Trump era

The Trump administration may usher in policies that buttress the aspirations of new entrant payments players and increase competition for banks.

By Lynne Marek • Jan. 28, 2025 -

X teams with Visa on new digital payments tool

Billionaire Elon Musk’s social media site has forged an alliance with the card network giant to launch a new digital payments tool this year.

By Lynne Marek • Jan. 28, 2025 -

Judge deals SEC, Kraken partial wins in ongoing case

Kraken and the Securities and Exchange Commission both secured partial victories in a ruling about what defenses Kraken can use in the ongoing case between the two.

By Gabrielle Saulsbery • Jan. 27, 2025 -

Ally to sell credit card business to CardWorks

Plans for the sale were hinted at earlier this year, a month after the CEO said the business wasn’t within Ally’s core focus.

By Gabrielle Saulsbery • Jan. 22, 2025 -

Stripe pushes out 300 employees

Despite the 3.5% cut to the payments services company’s headcount, it still plans to increase its workforce to 10,000 by the end of the year, up from 8,200 now.

By Patrick Cooley • Jan. 22, 2025 -

Silvergate ex-CFO seeks dismissal of SEC charges

Antonio Martino filed for dismissal Tuesday, seven months after the SEC fined Silvergate and banned two of its executives from C-suite positions for five years.

By Gabrielle Saulsbery • Jan. 16, 2025 -

Block agrees to pay $255M to regulators for Cash App deficiencies

The Consumer Financial Protection Bureau said the payments provider “employed weak security protocols for Cash App and put its users at risk.”

By Lynne Marek • Jan. 16, 2025 -

Judge stays Coinbase, SEC case

Judge Katherine Polk Failla granted Coinbase an interlocutory appeal, leading to a stay, so another court can decide one of the most pressing questions in crypto.

By Gabrielle Saulsbery • Jan. 8, 2025 -

CFPB picks FDX to set open banking standards

The nonprofit will craft standards for consumer data sharing between financial institutions for the next five years.

By Patrick Cooley • Jan. 8, 2025 -

Kansas bank challenges $20M FDIC penalty

CBW Bank, charged with failing to maintain adequate anti-money laundering controls, has filed a lawsuit challenging the agency’s action, calling the penalty “unreasonable and unprecedented for a bank of this size.”

By Caitlin Mullen • Jan. 3, 2025 -

Merchants, banks spar over Fed’s debit card fee proposal

Major trade groups for merchants and banks engaged in another round of fighting last week over whether the Federal Reserve should finalize a lower debit card interchange fee rate.

By Lynne Marek • Jan. 3, 2025 -

Walmart forced delivery workers to pay ‘junk fees,’ CFPB alleges

A Consumer Financial Protection Bureau lawsuit alleges the retailer and fintech Branch Messenger illegally opened accounts for drivers, and deposited their pay into accounts without their consent.

By Peyton Bigora • Jan. 2, 2025 -

CFPB sues JPMorgan, Bank of America, Wells Fargo over Zelle

Zelle operator Early Warning Services rushed the platform to market to compete with the likes of Venmo and CashApp but without effective safeguards, the agency said.

By Caitlin Mullen • Dec. 20, 2024 -

What role do stablecoins play in the payments industry?

With the discussion of stablecoins intensifying after the election of Donald Trump, here’s a primer explaining what this cryptocurrency is and what its practical uses may be.

By Patrick Cooley • Dec. 17, 2024 -

U.S. Bank CEO talks payments split, a rising DOGE

Dividing its payments unit into two segments under different leaders points to the significance of the business at the bank, said Andy Cecere, the lender’s chief executive.

By Caitlin Mullen • Dec. 13, 2024 -

FDIC letters give credence to ‘Choke Point 2.0’ claims: Coinbase CLO

The agency asked nearly two dozen banks to pause crypto-related activity in 2022, according to letters unveiled via Coinbase’s FOIA requests.

By Gabrielle Saulsbery • Dec. 11, 2024 -

BofA corporate client app surpasses $1 trillion in payments

Payments approved over the app are expected to rise 25% this year, echoing a similar increase last year over 2022.

By Lynne Marek • Dec. 11, 2024 -

FedNow racks up nearly $246M in annual expenses

The Federal Reserve projects the real-time payment system’s costs will climb slightly next year, from the $245.5 million it expects to spend this year.

By Lynne Marek • Dec. 4, 2024