Payments: Page 26

-

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB, New York AG sue MoneyGram

Thursday's lawsuit accuses the remittance giant of repeatedly giving senders inaccurate information about when their transfers would be available to recipients abroad. MoneyGram denounced the suit as "frivolous."

By Jonathan Berr • April 22, 2022 -

Robinhood's acquisition of crypto firm puts UK, Europe in its sights

The purchase of Ziglu, which is in the good graces of the Financial Conduct Authority, marks the second attempt by the stock-trading app to broach the U.K. market. Terms of the deal were not disclosed Tuesday.

By Dan Ennis • April 19, 2022 -

Trendline

Fraud and AML in banking

The past year has been one of reckoning with regard to fraud — from TD’s $3 billion AML penalty to the continuing punitive phase connected to PPP misdeeds, crypto bankruptcies and pig butchering.

By Banking Dive staff -

AmEx takes on banks in bid for new generation of clients

With the launch of its new checking service, the payment network aims to expand its relationship with cardholders — and not miss out on attracting consumers drawn to debit cards.

By Caitlin Mullen • April 13, 2022 -

CBDC will take years, not months, to develop, Yellen says

Transactions need to be faster but responsible, and regulation should be "tech-neutral," the treasury secretary said in her first remarks on digital assets since a March executive order.

By Dan Ennis • April 8, 2022 -

Sen. Cruz seeks to restrict Fed role for CBDC

The Texas Republican's legislation, which follows a House bill introduced this year, would prevent the central bank from issuing a digital currency directly to consumers.

By Jonathan Berr • April 4, 2022 -

Citizens Bank offers on-demand pay product for corporate clients

The bank said the service can be up and running within 30 days. Citizens is working with an unnamed third-party vendor to provide the offering, an executive said.

By Anna Hrushka • April 1, 2022 -

House bill would put CBDC alternative in Treasury's hands

Legislation proposed Monday emphasizes privacy, financial inclusion and anti-money laundering protections, and would "preserve a role in our financial system for smaller anonymous cash-like transactions," backers said.

By Lynne Marek • March 29, 2022 -

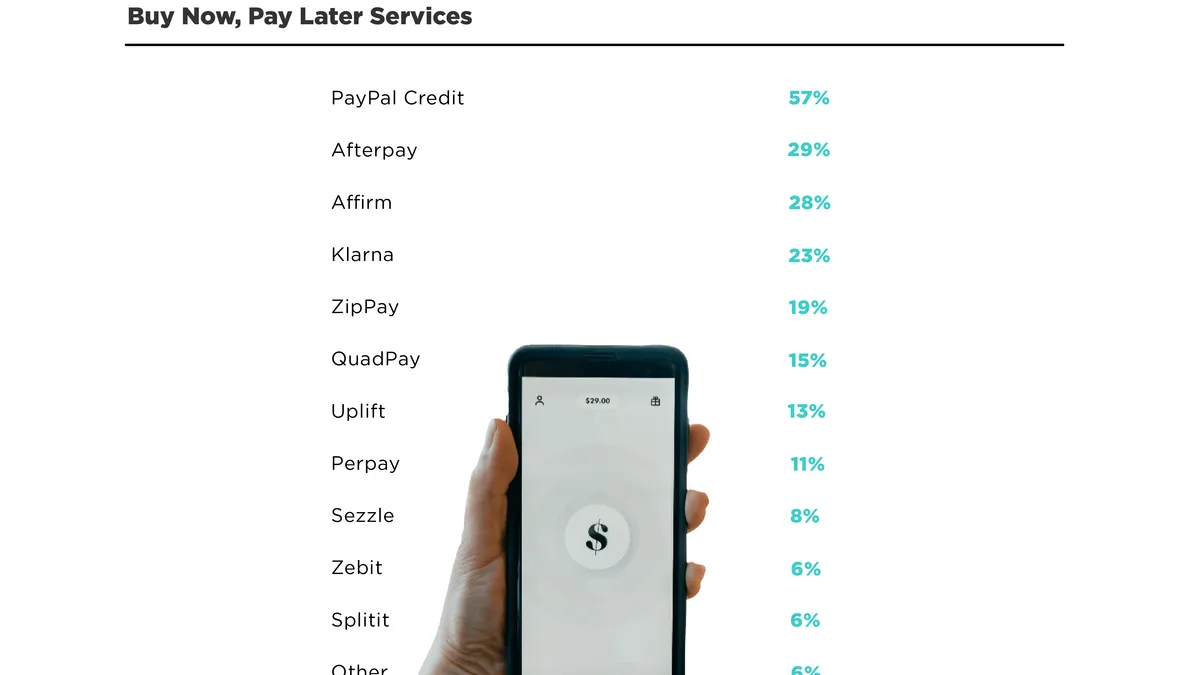

BNPL critics, backers join last-minute surge in feedback to CFPB

The Bank Policy Institute, the Consumer Bankers Association and a litany of state attorneys general and nonprofits submitted their views to the bureau just before the comment period's Friday deadline.

By Jonathan Berr • March 29, 2022 -

Cannabis firm's CFO works to bring industry's financing out of the 'gray'

Item 9 Labs' net revenues more than doubled last fiscal year. But pot's federal status can still make financial partners skittish, CFO Bobby Mikkelsen finds.

By Maura Webber Sadovi • March 29, 2022 -

Fed's Powell lists his 4 qualifications for a US CBDC

A digital dollar must ensure user privacy, be "identity verifiable," be "intermediated" and be widely accepted as a means of payment, the central bank chief said at an event hosted by the Bank for International Settlements.

By Dan Ennis • March 24, 2022 -

White House lays out digital-asset priorities

An executive order issued Wednesday details six priorities in "harnessing the potential benefits" of the emerging technologies.

By Lynne Marek • March 9, 2022 -

US extends sanctions to Russia's 2 largest banks

Russia's access to the SWIFT financial messaging service remains intact for now, a move that sparked criticism from both Democrats and Republicans. But President Joe Biden said he wouldn't eliminate that option.

By Dan Ennis • Feb. 25, 2022 -

Washington policymakers spout off on CBDCs

A Friday speech by Fed Gov. Lael Brainard and a Feb. 7 report from the Congressional Research Service underscore the U.S. government's rising interest in a digital dollar.

By Lynne Marek • Feb. 22, 2022 -

Coinbase muscles in on popular remittance corridor

The company is partnering with Remitly to let users in Mexico cash out crypto transfers in pesos — a service that will be free through March.

By Robin Bradley • Feb. 16, 2022 -

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Discover backs card-free payments

Atlanta-based fintech Buy It Mobility is partnering with the card network to enable consumers to make direct payments from their checking accounts to merchant apps.

By Caitlin Mullen • Feb. 16, 2022 -

Jack Henry to unbundle services, put them on the public cloud

The company's broadest strategic update in 20 years aims to help its customers adapt to disruption-by-fintech as consumers change their banking behaviors.

By Lynne Marek • Feb. 11, 2022 -

House lawmakers spar over stablecoin regulation

"Simply labeling something as stable or overly relying on a one-to-one ratio does not, in itself, mean it maintains a stable value," House Financial Services Committee Chair Maxine Waters, D-CA, said Tuesday.

By Jonathan Berr • Feb. 9, 2022 -

Senators probe allegations of JPMorgan 'robo-signing' in debt collection

A CFPB consent order barring the bank from that practice expired in 2020, but a ProPublica report alleges JPMorgan has resumed an "affidavit-signing assembly line."

By Robin Bradley • Feb. 8, 2022 -

Revolut to offer 30-minute, fee-free remittances from US to Mexico

Remittances sent from the U.S. to Mexico increased by 37.7% between November 2020 and 2021, according to research published by BBVA.

By Robin Bradley • Jan. 31, 2022 -

Diem to end crypto project, sell its assets to Silvergate Bank for $182M

The California bank said Monday it intends to launch a stablecoin this year using the assets it acquired in the deal.

By Dan Ennis • Updated Feb. 1, 2022 -

Walmart fintech buys earned wage access firm Even in 'super app' pursuit

Former Goldman Sachs exec Omer Ismail will serve as CEO of the combined business, which includes One Finance, a digital financial services company the retailer also bought Wednesday.

By Lynne Marek • Jan. 27, 2022 -

JPMorgan buys 49% stake in Greek fintech Viva Wallet

The U.S.'s largest bank is continuing an acquisition spree it accelerated in 2021, when it made more than 30 deals — many either banking-adjacent or outside banking entirely.

By Dan Ennis • Jan. 25, 2022 -

Retrieved from Ono Kosuki from Pexels.

Retrieved from Ono Kosuki from Pexels.

ATMs may have peaked in 2019, research finds

A Euromonitor International executive predicts the once-revolutionary dispensers may be gone within 25 years — a consequence of reduced demand and higher costs for servicing the machines.

By Lynne Marek • Jan. 10, 2022 -

Santander finds itself in a Citi moment with $175M error

In looking to claw back duplicate payments, Santander may find varying levels of cooperation from other banks. The incident may also prompt regulators to examine the lender's risk management framework and history.

By Dan Ennis • Jan. 5, 2022 -

BNPL growth prompts change from credit bureaus

Paying in installments has become wildly popular, but many of these plans aren't reflected on consumers' credit reports. Credit agencies say adaptations are coming.

By Caitlin Mullen • Dec. 24, 2021