Payments: Page 25

-

Walmart's trademark filing may offer clues to fintech startup

The litany of services "Hazel by Walmart" intends to provide ranges from credit and debit card payment processing services to financial portfolio analysis, credit repair and restoration and virtual currency transaction processing.

By Dan Ennis • April 8, 2021 -

Chance for early feedback spurs banks to join FedNow pilot program

More than 110 organizations are participating in the real-time payment effort, which is still slated for a 2023 debut.

By Anna Hrushka • April 6, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

COVID-19 pushed real-time payments to jump 41% in 2020, study finds

Real-time payments accounted for 9.8% of all electronic transactions in 2020, the report found. That figure is expected to reach 17.4% by 2025.

By Vaidik Trivedi • April 1, 2021 -

Retrieved from ILGA.gov on March 25, 2021

Retrieved from ILGA.gov on March 25, 2021

Illinois moves to create special charter for digital assets trust

"I had to get out of the bubble of the way I look at money in our country," said the bill's sponsor, state Rep. Margaret Croke, D-Chicago.

By Lynne Marek • March 26, 2021 -

Powell reiterates 'no-rush' stance on Fed's digital dollar

Powell insists on Congress's approval before proceeding with a CBDC, but researchers are hoping to unveil prototypes as early as July. Meanwhile, the Senate's new banking panel chair is calling for faster action.

By Dan Ennis • March 23, 2021 -

Visa's debit card business comes under DOJ scrutiny

Visa said in an SEC filing that it hasn't received a civil investigative demand from the agency but that the Justice Department sent a notice telling the company "to preserve relevant documents related to the investigation."

By Lynne Marek • Updated March 19, 2021 -

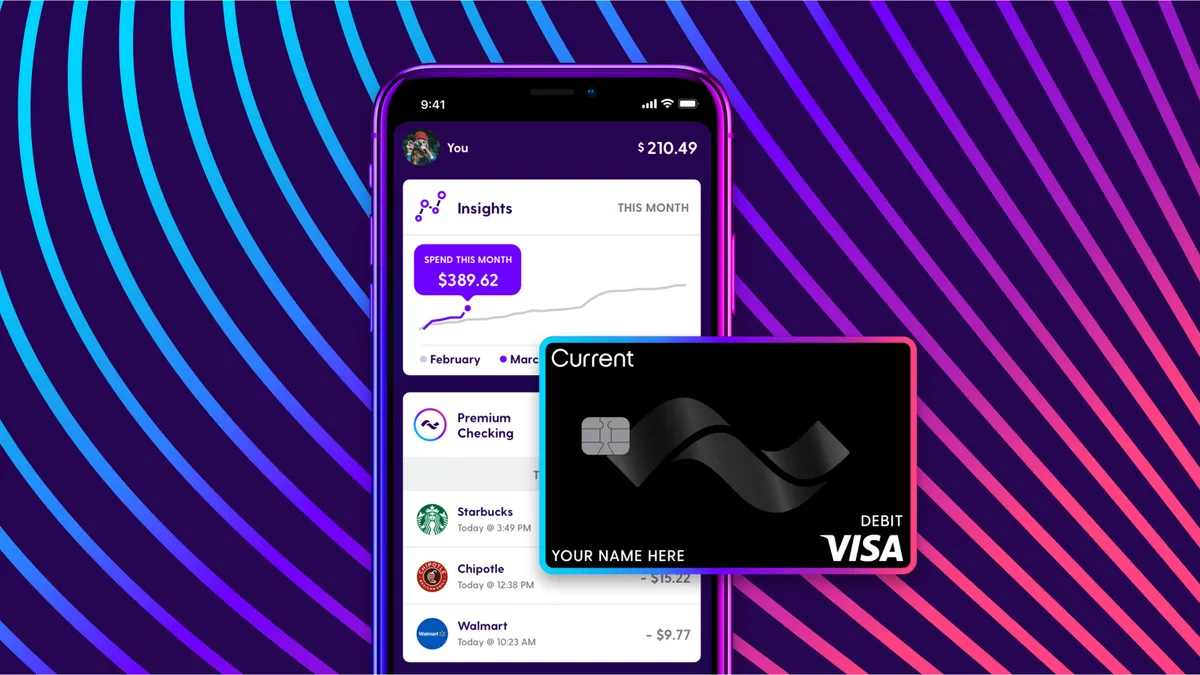

Early prep for stimulus payments pays off for digital banks, customers

"Digital banks are nimbly making strides, and incumbents are fully captivated," said Lane Martin, a partner at the consulting firm Capco.

By Anna Hrushka • March 16, 2021 -

Mastercard, Visa to postpone some fee increases next month

Bowing to pressure from the White House and congressional Democrats, the card networks won't increase expenses for merchants and consumers who are still coping with the pandemic.

By Lynne Marek • March 16, 2021 -

Wells Fargo, JPMorgan draw ire over stimulus payment release date

The banks are sticking with a March 17 disbursement date, even though the IRS has released at least some of the payments Friday. Fintechs Current and Chime are trumpeting their success at getting the money in users' hands.

By Dan Ennis • March 15, 2021 -

Stripe's new $95B valuation makes it Silicon Valley's most valuable startup

The payments processing company's new valuation is based on raising $600 million in new capital that it plans to use for further expansion in Europe.

By Lynne Marek • March 15, 2021 -

JPMorgan to pull Chase Pay from merchant apps, sites March 31

The bank announced in 2019 it would shut down the platform's stand-alone app. Merchant acceptance — about 1% in 2019 — has paled in comparison to competitor Apple Pay's 40%.

By Robert Freedman • March 10, 2021 -

Plaid payroll product streamlines income verification

Plaid Income is the second product the company has launched since the termination of a proposed $5.3 billion tie-up with Visa, signaling the scrapped deal is not slowing the expansion of the fintech's suite.

By Anna Hrushka • March 8, 2021 -

Column

Square becomes more reflective of Jack Dorsey the person with Tidal buy

The CEO's investment in the music streaming service may not be an obvious fit in payments, but jibes with Dorsey's decentralization philosophy as he becomes more famous than his (other) company.

By Dan Ennis • March 5, 2021 -

Inside Marqeta's plans to grow its 'card-as-a-service' offering

The card issuer and processor is differentiating through a flexible, API-based platform that helps clients launch card offerings in months instead of years.

By Suman Bhattacharyya • March 3, 2021 -

Column

Goldman crypto trading desk relaunch portends softer industry stance on Bitcoin

The bank follows BNY Mellon and JPMorgan in greater crypto acceptance, in a reversal from a May report in which Goldman called Bitcoin an "unsuitable investment." Citi this week said the currency is at a "tipping point."

By Dan Ennis • March 3, 2021 -

Square launches long-awaited industrial bank

The FDIC gave the fintech conditional approval for an ILC charter nearly a year ago. Now the company can originate small-business loans rather than doing so through its previous partner, Celtic Bank.

By Dan Ennis • March 2, 2021 -

Deep Dive

Can banks win in the booming buy-now-pay-later space?

While BNPL represents a relatively small niche of the payments ecosystem, banks should take note of what the growth of that silo says about the next generation of consumers, one consultant said.

By Anna Hrushka • March 2, 2021 -

Fed says 'operational error' caused payment system outage

"An automated data center maintenance process ... was inadvertently triggered during business hours," a Fed spokeswoman specified Thursday. "This was human error," she told The Wall Street Journal.

By Anna Hrushka • Updated Feb. 26, 2021 -

Valadi, Sam. (2012). "Empire State - New York City" [Photograph]. Retrieved from Flickr.

Valadi, Sam. (2012). "Empire State - New York City" [Photograph]. Retrieved from Flickr.

Tether, crypto exchange Bitfinex to pay $18.5M to settle NY probe

Tether will give officials quarterly reports on its reserves and end trading with the state's residents in an agreement that ends a two-year investigation into allegations it hid the loss of $850 million in client and corporate money.

By Dan Ennis • Feb. 24, 2021 -

Valadi, Sam. (2012). "Empire State - New York City" [Photograph]. Retrieved from Flickr.

Valadi, Sam. (2012). "Empire State - New York City" [Photograph]. Retrieved from Flickr.

BNY Mellon commits to holding, transferring and issuing crypto

The New York-based bank said Thursday it is developing a client-facing prototype for a multi-asset digital custody and administration platform set to roll out this year.

By Dan Ennis • Feb. 11, 2021 -

Aggregator MX to expand reach of 'money experiences' as it angles toward IPO

The company has quadrupled its value in the past year in a field that, amid the Visa-Plaid deal's disintegration, has room for "co-opetition," one analyst said, as some banks use multiple data aggregators.

By Suman Bhattacharyya • Jan. 20, 2021 -

Plaid sees 'opportunity' after $5.3B Visa deal ends

The data aggregator's biggest priority now is getting 75% of its traffic dedicated to application programming interfaces by the end of 2021 — a prospect John Pitts, Plaid's head of policy, calls an "immense challenge."

By Anna Hrushka • Jan. 19, 2021 -

Visa terminates $5.3B acquisition of Plaid after DOJ antitrust suit

The abandonment of the deal won't keep Visa from pursuing partnerships with Plaid or other fintechs, CEO Al Kelly said Tuesday during a call with analysts.

By Anna Hrushka • Jan. 13, 2021 -

Banks can use stablecoins, blockchains for payments, OCC says

The move follows a letter the agency issued in July clarifying national banks are allowed to provide cryptocurrency custody services, and hold unique cryptographic "keys" associated with cryptocurrency on behalf of customers.

By Anna Hrushka • Jan. 5, 2021 -

SEC sues Ripple, top execs over sale of XRP cryptocurrency

Ripple executives accused the regulator of "picking virtual currency winners and losers." XRP lost 60% of its value in the week after the suit, which one Twitter user called a "kill shot."

By Anna Hrushka • Updated March 5, 2021