Payments: Page 19

-

Apple to launch high-yield savings account with Goldman Sachs

The move is the logical next step for the Apple-Goldman partnership, according to one consultant, who said the day-to-day banking product complements Apple’s Goldman-powered credit-card offering.

By Anna Hrushka • Oct. 14, 2022 -

Column

4 takeaways from Michael Barr’s DC Fintech Week speech

The Federal Reserve’s vice chair for supervision stressed caution with banks’ ties to crypto and spotlighted what sets stablecoins apart from other digital assets.

By Dan Ennis • Oct. 13, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Banks reimburse less than half of Zelle-related fraud claims, Warren says

The senator pushed to bolster a key CFPB rule after releasing a report tallying claims of fraud and scams on the P2P platform submitted by Truist, PNC, U.S. Bank and Bank of America.

By Dan Ennis • Oct. 4, 2022 -

PNC buys restaurant point-of-sale firm Linga

The Pittsburgh-based bank is boosting its payments footprint as banks from Banc of California to JPMorgan Chase are making similar large investments.

By Anna Hrushka • Sept. 27, 2022 -

Banc of California acquires Deepstack in payment processing play

The acquisition gives the bank access to predictable fee income and enables it to capture a larger share of revenue per transaction, Banc of California said.

By Anna Hrushka • Sept. 26, 2022 -

Varo’s tech unit looks to speed development, find efficiencies

The neobank aims to diversify its offerings in payments and lending, but there are unresolved questions about the company’s path to profitability.

By Suman Bhattacharyya • Sept. 26, 2022 -

Bank CEOs defend Zelle in Senate hearing

Sen. Elizabeth Warren, D-MA, called the peer-to-peer payments network “unsafe,” claiming Zelle users were defrauded out of $500 million last year.

By Anna Hrushka • Sept. 23, 2022 -

Kraken CEO Jesse Powell steps aside, as COO takes the reins

The crypto exchange’s top executive raised ire over a culture document that addressed preferred pronouns, diversity-focused hiring and abortion. He told Fortune he had “grown tired of long hours and day-to-day management tasks.”

By Gabrielle Saulsbery • Sept. 22, 2022 -

Republicans grill bank CEOs on handling of new merchant gun code

GOP lawmakers, during a wide-ranging hearing Wednesday, demanded the CEOs of the nation’s top banks share how they plan to respond to a new category code for gun and ammunition retailers.

By Anna Hrushka • Sept. 22, 2022 -

Zelle counters scam talk with growth rates

The instant payments brand is highlighting a double-digit growth rate for its peer-to-peer payments tool and downplaying scams on its system.

By Lynne Marek • Sept. 12, 2022 -

Wells Fargo to pay $145M to settle Labor probe into 401(k) plan

The plan paid between $1,033 and $1,090 per share for Wells Fargo preferred stock that had a set value of $1,000, the DOL found. The bank will pay $131.8 million to reimburse participants and a $13.2 million penalty.

By Dan Ennis • Sept. 12, 2022 -

JPMorgan Chase buys payments firm Renovite

Financial terms of the deal were not disclosed. The transaction builds on the bank's recent nonbank acquisitions, including stakes in Volkswagen’s payments business and Greek fintech Viva Wallet.

By Lynne Marek • Sept. 12, 2022 -

Citi wins appeal on $500M Revlon loan blunder

“Put simply, you don’t get to keep money sent to you by mistake unless you’re entitled to it anyway,” one judge wrote in his opinion.

By Anna Hrushka • Sept. 9, 2022 -

10 takeaways from Michael Barr’s first speech as Fed’s supervision czar

The regulator pushed a tiered set of capital requirements and stricter living wills for regional banks. He also clarified the central bank’s stance on climate risk.

By Dan Ennis • Sept. 8, 2022 -

Who’s afraid of FedNow? Not Visa

“The fact that there is a pipe, right, doesn't mean there's going to be traffic or volume on that pipe,” said the card network’s CFO, Vasant Prabhu. “If the pipe doesn't serve [specific] needs, the pipe will not be used.”

By Lynne Marek • Sept. 6, 2022 -

Retrieved from Federal Reserve Bank of Boston.

Retrieved from Federal Reserve Bank of Boston.

FedNow aims for September testing

Central bank officials put a finer point on the start date for the instant payments service, saying it would launch as early as May 2023 and no later than July.

By Lynne Marek • Aug. 30, 2022 -

JPMorgan Chase, State Street push back against CBDC

In comments to the Federal Reserve, trade groups and Wall Street banks stressed the risks of a digital dollar and largely rejected the idea that it would accomplish stated goals.

By Lynne Marek • Aug. 29, 2022 -

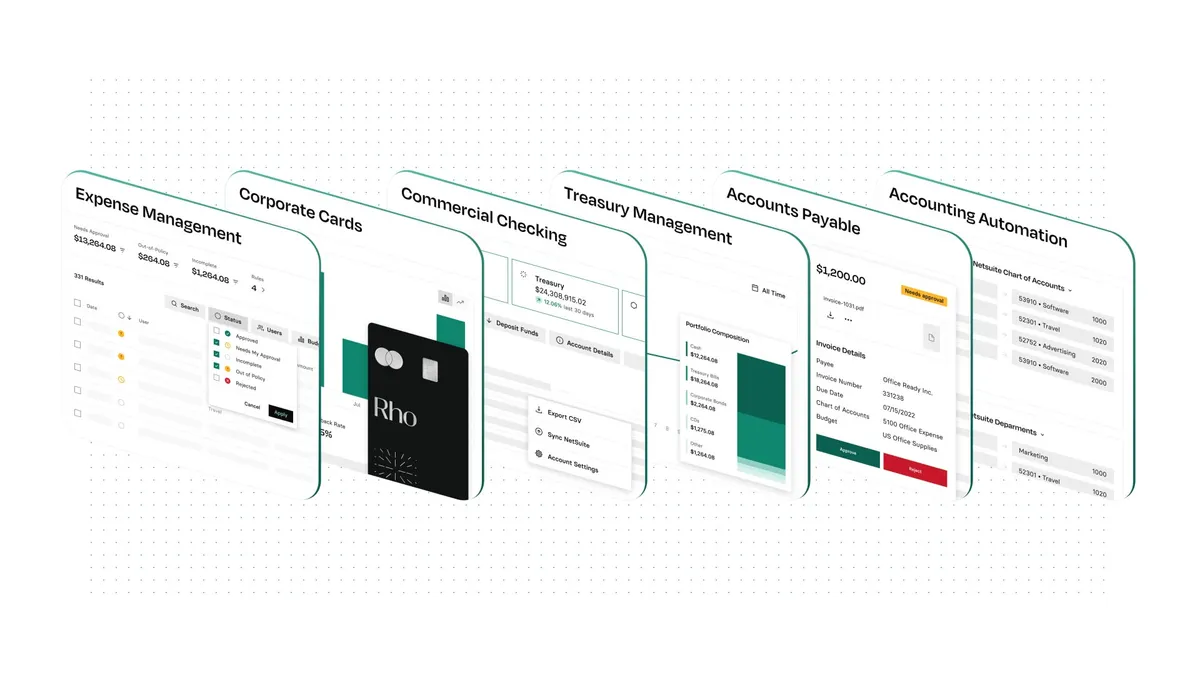

Rho woos bigger clients as fintechs vie to fill Brex’s small-biz void

The business banking startup added an automated expense-management tool for its middle-market clients. But the company won't be tempted to aim small to snatch a share of Brex's core audience.

By Suman Bhattacharyya • Aug. 23, 2022 -

(2024). [Photo]. Retrieved from Federal Reserve.

(2024). [Photo]. Retrieved from Federal Reserve.

FedNow to launch by mid-2023, Bowman says

The Fed’s request for input on a potential central bank digital currency has generated some 2,000 responses so far. The central bank plans to publish a summary of the comments, the Fed governor said.

By Lynne Marek • Aug. 22, 2022 -

Sponsored by Modern Treasury

Commercial banks and embedded finance: Growth engine or existential threat? It’s a matter of timing

The opportunities to unlock new revenue growth are unparalleled. But for banks that fail to see it, or aren’t prepared, embedded payments could prove an existential threat.

By Dimitri Dadiomov, CEO and Co-Founder of Modern Treasury • Aug. 22, 2022 -

Marqeta executive exodus follows IPO

Of 10 top executives leading the company at its IPO last year, only three remain, including CEO Jason Gardner, who said he plans to exit that role and become executive chairman.

By Jonathan Berr , Lynne Marek • Aug. 17, 2022 -

Fed master account guidance includes tiered review framework

Firms that lack deposit insurance or traditional regulatory frameworks would undergo the highest level of scrutiny, while companies with federal deposit insurance would be subject to a “streamlined” process.

By Anna Hrushka • Aug. 16, 2022 -

U.S. Bank builds out its real-time payments capabilities for auto dealers

The Minneapolis lender is issuing instant loan funds using the RTP Network — a move that follows U.S. Bank’s partnership with Lithia Motors to provide instant payments for car sellers using the same network.

By Tatiana Walk-Morris • Aug. 12, 2022 -

Green Dot is locked in Uber contract dispute, loses other clients

“I don't want to be out there opening up our [bank] charter for every Joe fintech that wants to do something in payments,” Green Dot CEO Dan Henry said last week on a call with analysts.

By Lynne Marek • Aug. 11, 2022 -

Column

Goldman, Citi, Jefferies reveal ‘August surprises’ to stave off September ones

Warnings of a CFPB probe into Goldman's credit-card business, Citi's rising Russia exposure and Jefferies' $80 million WhatsApp set-aside give investors time to settle in to bad news.

By Dan Ennis • Aug. 5, 2022