Payments: Page 18

-

PayPal counts on its digital app for gains

The digital payments pioneer is scouting for new ways to increase customer use of its digital wallet, including plans to add a new Venmo teen account.

By Lynne Marek • Nov. 28, 2022 -

Regulatory challenges more prominent in eyes of fintech industry leaders this year

Private firms are adopting a more defensive posture, delaying new funding rounds, planning for modest growth and addressing regulatory risks, according to a report.

By Gabrielle Saulsbery • Nov. 23, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

JPMorgan’s crypto wallet trademark is approved

The green light comes more than two years after the bank submitted paperwork to the U.S. Patent and Trademark Office, and runs counter to CEO Jamie Dimon’s opinion on virtual currencies.

By Dan Ennis • Nov. 22, 2022 -

Column

Can Congress come together on crypto?

Perhaps even a divided Congress can make bipartisan headway in crafting a regulatory framework for crypto following FTX’s failure.

By Lynne Marek • Nov. 18, 2022 -

Visa names its next CEO

The card network’s president, Ryan McInerney, a former consumer-banking chief at JPMorgan Chase, will succeed Al Kelly on Feb. 1.

By Lynne Marek • Nov. 18, 2022 -

Tracker

Cryptexodus: A running list of crypto execs who’ve quit since May

The crypto market has been volatile since spring. While some executives have run for the hills, others have opted to transition to back-seat roles.

By Gabrielle Saulsbery • Nov. 14, 2022 -

Sam Bankman-Fried steps down as FTX CEO amid bankruptcy filing

FTX.com’s assets were frozen in the Bahamas, where the company is headquartered. Crypto lender BlockFi also paused withdrawals because of its exposure to FTX.

By Gabrielle Saulsbery • Nov. 11, 2022 -

Green Dot focuses on tech modernization amid leadership shakeup

The company named a CFO, COO and chief revenue officer, and said two BaaS partners recently extended their contracts.

By Suman Bhattacharyya • Nov. 11, 2022 -

Elon Musk wants to turn Twitter into ‘the people’s financial institution’

During a Thursday call with Twitter staff, Musk shared his plans to allow users to maintain a cash balance on the platform. He also hinted at the possibility of offering loans.

By Anna Hrushka • Nov. 11, 2022 -

Binance to acquire rival FTX amid ‘liquidity crunch’

FTX founder Sam Bankman-Fried announced the deal two days after Binance CEO Changpeng Zhao said he’d dump his holdings of FTX native coin FTT.

By Gabrielle Saulsbery • Nov. 8, 2022 -

A CBDC could make cross-border payments faster, safer: NY Fed

Researchers designed a prototype digital currency and blockchain and simulated foreign exchange spot transactions that cleared within 10 seconds but said the study doesn’t endorse a CBDC or assume the Fed will issue one.

By Rajashree Chakravarty • Nov. 8, 2022 -

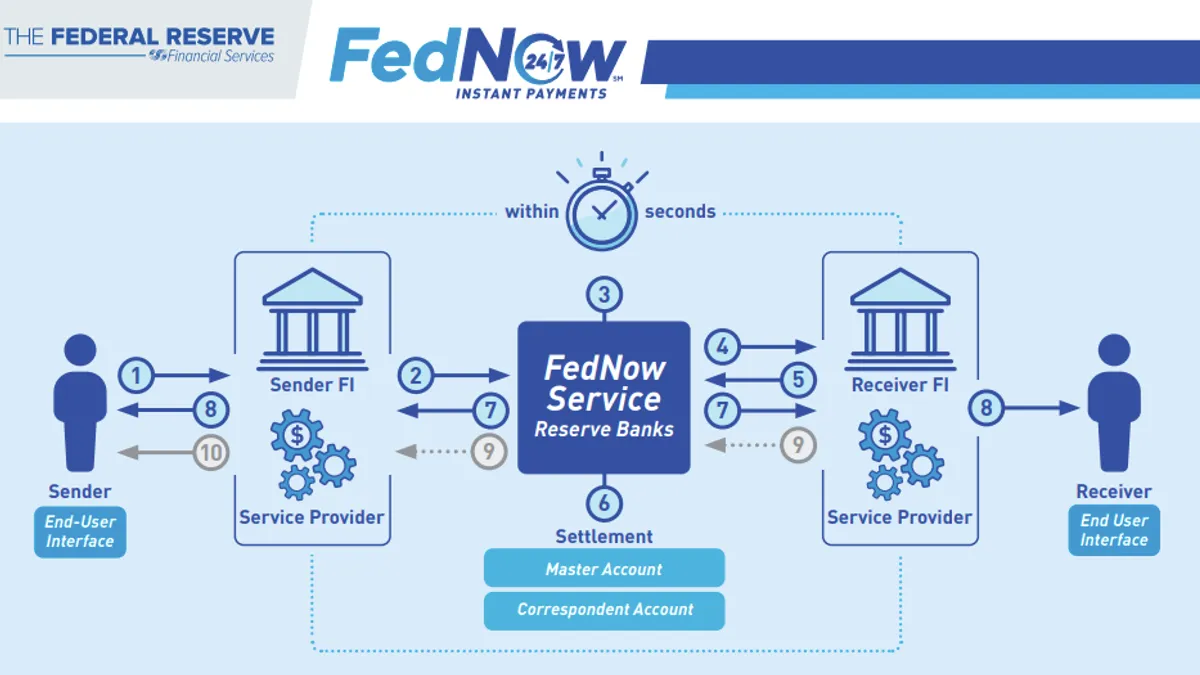

FedNow gives fee holiday in 2023

The Fed reiterated the fees the banks will ultimately charge — namely, customer credit transfer and customer credit transfer return fees of $0.045 per-item and a participation fee of $25 per routing transit number per month.

By Lynne Marek • Nov. 7, 2022 -

Goldman launches digital asset classification system

Datonomy is intended to help institutional investors make sense of the new asset class.

By Gabrielle Saulsbery • Nov. 4, 2022 -

CFPB investigating U.S. Bank over pandemic-era unemployment payments

The bank is the latest lender to face regulatory scrutiny over its administration of the payments. Bank of America was handed a $225 million fine in July after regulators said its efforts to tamp down fraud went too far.

By Anna Hrushka • Nov. 3, 2022 -

Safe Harbor to buy cannabis banking, payments fintech

The deal will add 300 accounts to Safe Harbor’s portfolio and expand the firm’s operations to more than 30 states.

By Anna Hrushka • Nov. 2, 2022 -

Here’s what Brett Harrison expects in the crypto market

The "decade of free money" is ending, but the future is bright, said the former president of FTX US.

By Gabrielle Saulsbery • Oct. 27, 2022 -

CFPB aims to give ‘open banking’ rule teeth in 2024

The bureau's chief, Rohit Chopra, laid out a timeline on a rule change meant to make it easier for consumers to break up with their banks.

By Gabrielle Saulsbery • Oct. 26, 2022 -

FedNow will be a ‘public utility model,’ Waller says

The central bank governor equated the nascent system with an interstate highway on which private companies will provide "on-ramps" and "off-ramps."

By Lynne Marek • Oct. 26, 2022 -

Marqeta launches demand deposit accounts in banking push

The company's suite of seven banking products includes early wage access, bill pay and instant funding. The latter two will be available in beta next year.

By Gabrielle Saulsbery • Oct. 25, 2022 -

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services. Opinion

OpinionFedNow may stumble without nonbanks, cross-border payments

“In addition to cross-border payments, the benefits of FedNow must be widely available to Americans through competitive, diverse providers — including nonbanks,” writes a U.S.-based Wise executive.

By Rina Wulfing • Oct. 19, 2022 -

Texas securities regulators investigate FTX, Sam Bankman-Fried

FTX shouldn't be allowed to buy Voyager's digital assets while the regulator is looking into whether the company is illegally offering interest-bearing accounts, an enforcement official asserted.

By Gabrielle Saulsbery • Oct. 18, 2022 -

Fintechs clamor for FedNow access

The association representing Block, Stripe and others is asking the central bank to make access to the faster payments system more widely available.

By Lynne Marek • Oct. 18, 2022 -

Green Dot fires CEO, names replacement

The company terminated Dan Henry, its CEO since 2020, on Friday, it said. George Gresham, the firm’s chief financial and operating officer, is stepping into the top role.

By Anna Hrushka • Oct. 17, 2022 -

Fed’s Waller expresses skepticism on CBDC

Launching a digital currency could introduce costs and risks that could harm the U.S. dollar's standing internationally, Waller said. The dollar’s primacy, he added, has little to do with technology.

By Gabrielle Saulsbery • Oct. 17, 2022 -

Warren roasts Wells Fargo’s ‘severely bad performance’ on Zelle fraud

Four of the seven banks that own Zelle reported specific data to the senator, but she focused on Wells CEO Charlie Scharf specifically in a letter Thursday.

By Gabrielle Saulsbery • Oct. 14, 2022