Fintech: Page 9

The latest fintech news for banking professionals.

-

N26 readies for a post-cap future

Germany's financial regulator will drop its limit on the fintech's growth June 1. N26's CEO said the cap has cost billions in lost valuation. But its compliance systems can handle an increased load.

By Dan Ennis • May 29, 2024 -

Klarna uses AI to save $10M on marketing annually while upping output

More than one-third of the Stockholm-based fintech’s marketing savings in Q1 are attributable to AI.

By Chris Kelly • May 29, 2024 -

Explore the Trendline➔

Explore the Trendline➔

da-kuk via Getty Images

da-kuk via Getty Images Trendline

TrendlineArtificial intelligence

Banks are enthusiastic about AI’s promises. But can they get customers on board, and will regulators let the innovation happen?

By Banking Dive staff -

Visa preps for US pay-by-bank services

The card network is focused on “stubborn categories” where large account-to-account payments have taken hold, such as in healthcare, education and rent, a Visa executive said.

By Lynne Marek • May 28, 2024 -

Paze targets nationwide coverage by year-end shopping season

The big bank-backed digital wallet is now accepted by about 80,000 “primarily small” merchants, according to James Anderson, managing director at Early Warning Services.

By James Pothen • May 28, 2024 -

Q&A

Compliance is an ‘opportunity to showcase integrity’: Maast CEO Jonathan O’Connor

O’Connor became Maast CEO, and chief-third party payments officer of its parent company Synovus Financial, earlier this year.

By Gabrielle Saulsbery • May 22, 2024 -

Varo Bank faces lawsuit over March data breach

The lawsuit accuses the online bank of failing to protect personal information stored within its network, including customer phone numbers and the last four digits of Social Security numbers.

By Rajashree Chakravarty • May 22, 2024 -

CFPB sues SoLo Funds, alleging it concealed costs from borrowers

The fintech's tip structure inflates the APR on loans, but most loans aren't funded unless a tip is included. And the option not to donate was hidden, the regulator argued.

By Dan Ennis • May 22, 2024 -

CFPB to treat BNPL loans like credit cards

“Whether a shopper swipes a credit card or uses Buy Now, Pay Later, they are entitled to important consumer protections under longstanding laws and regulations,” CFPB Director Rohit Chopra said.

By James Pothen • May 21, 2024 -

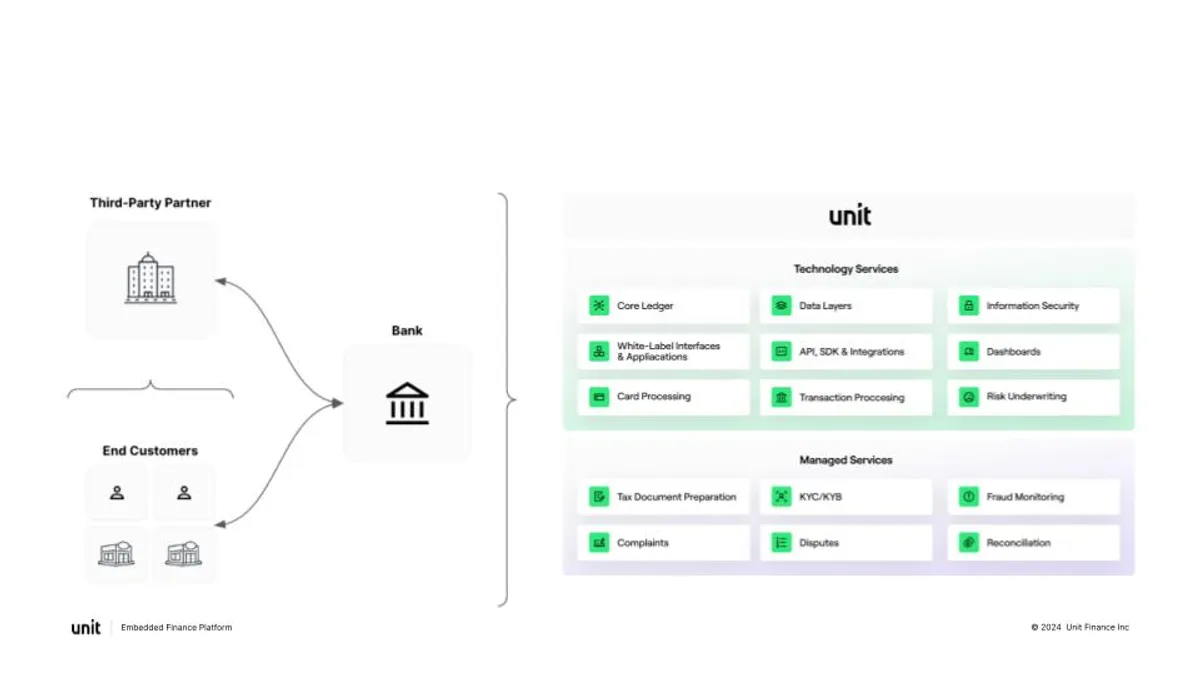

Elevated scrutiny begets clarity, better business: Unit Finance CEO

Regulatory scrutiny of third-party partnerships has had banks and fintechs on edge. But with scrutiny comes recognition that such tie-ups are important, Itai Damti explained.

By Gabrielle Saulsbery • May 15, 2024 -

Customer satisfaction with online-only banks dwindles, study finds

Though online-only direct bank customers have a higher satisfaction rate than traditional banks, that rate declined this year, particularly for those with checking accounts, J.D. Power reported.

By Rajashree Chakravarty • May 15, 2024 -

Brex CFO mulls long-term IPO scenario but keeps eye on costs

The prevailing attitude among companies seeking to go public is to achieve profitability beforehand, Ben Gammell said.

By Grace Noto • May 14, 2024 -

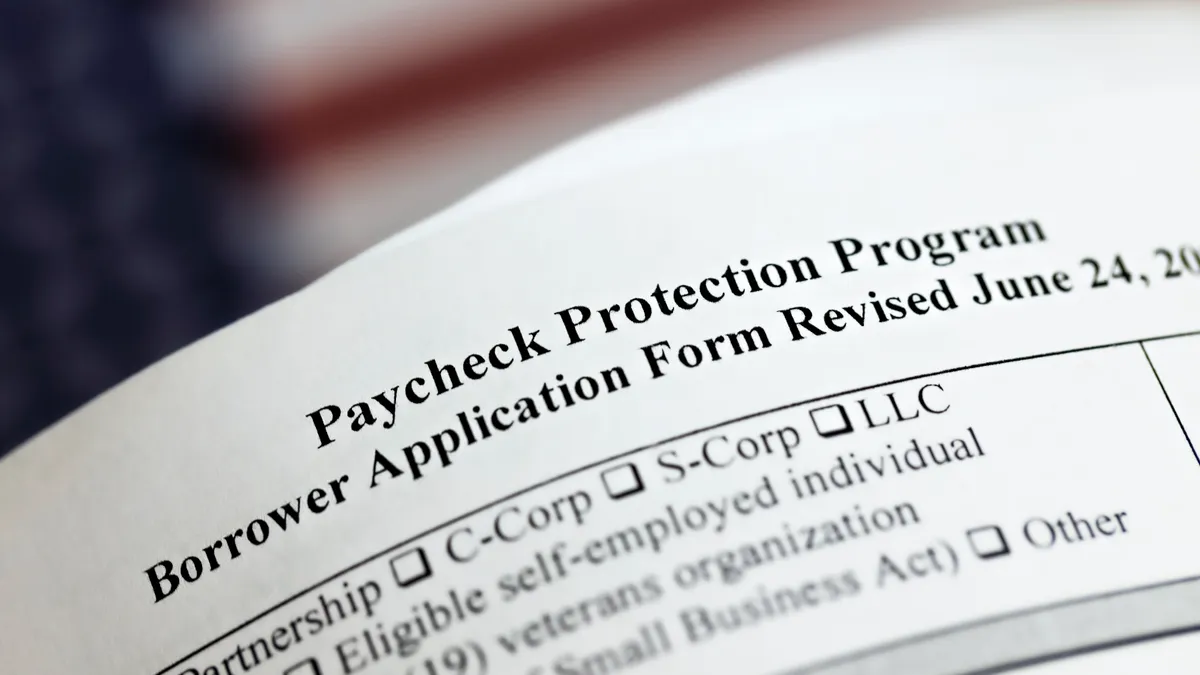

Kabbage to pay $120M in PPP fraud settlements with DOJ

The second-largest PPP lender in the nation by application volume “knowingly submitted thousands of false claims” and employed lax fraud controls, the Justice Department said.

By Caitlin Mullen • May 14, 2024 -

TabaPay calls off deal with Synapse

TabaPay sent Synapse a termination notice of the transaction Thursday, “based on failure to meet the purchase agreement closing conditions,” a TabaPay spokesperson said.

By Rajashree Chakravarty • May 10, 2024 -

Upstart subpoenaed by SEC over AI, loans

“We are cooperating with the SEC and are unable to predict the outcome of this matter,” the fintech lender said in a filing Tuesday.

By Rajashree Chakravarty • May 9, 2024 -

Aspiration spins off consumer financial brand

The standalone company, helmed by Tim Newell, will continue to operate under the Aspiration brand name and focus on offering climate-friendly products.

By Rajashree Chakravarty • May 8, 2024 -

Fifth Third launches ‘reimagined’ eBus with SpringFour

The eBus will travel to underserved communities across the bank’s footprint and give consumers access to around 24,000 nonprofit resources through its collaboration with the social impact fintech.

By Rajashree Chakravarty • May 8, 2024 -

Third-party risk guide ‘a welcome sign,’ analysts say

The guide from the Fed, OCC and FDIC aims to help bankers “get in the same mindset as the examination team” when assessing and managing third-party relationship risks, said the ICBA’s Michael Emancipator.

By Caitlin Mullen • May 7, 2024 -

Robinhood may face SEC lawsuit over crypto unit

In a blog post, the company cited its "good-faith attempts" with the agency. At least one analyst said Robinhood has no incentive to sue because the SEC chair's term is up in two years.

By Dan Ennis • May 7, 2024 -

Lawmakers push to revoke Funding Circle’s SBLC license

Rep. Roger Williams and Sen. Joni Ernst wrote to SBA Administrator Isabel Guzman to raise concerns over the agency granting the London-based fintech its first SBLC license.

By Rajashree Chakravarty • May 1, 2024 -

Stripe unbundles services as industry shifts

The company’s move to decouple embedded financial services from payment processing means it’s ready to pursue larger customers, analysts said.

By James Pothen • May 1, 2024 -

Green Dot CHRO eyes ‘engagement,’ tech hires amid BaaS buildout

The company has brought aboard a new chief product officer, tech chief and general manager for BaaS over the past six months.

By Suman Bhattacharyya • April 26, 2024 -

Synapse signs deal with TabaPay, files for bankruptcy

TabaPay has set a purchase price of $9.7 million to acquire Synapse's assets — a deal that is pending court approval.

By Rajashree Chakravarty • April 24, 2024 -

Temenos hires VMware exec as CEO

Jean-Pierre Brulard will take the reins from Andreas Andreades, who will retire after serving as interim CEO since Max Chuard's departure in January 2023.

By Dan Ennis • April 24, 2024 -

First Internet Bank CEO talks M&A, BaaS work

After its acquisition of First Century Bank fell through in 2022, First Internet built its own banking-as-a-service team, CEO David Becker said. It now counts startup Ramp as a client.

By Caitlin Mullen • April 24, 2024 -

Figure hires Brex, SoFi vet to succeed Cagney as CEO

Michael Tannenbaum served as Brex's chief operating officer until January. He cut his teeth as chief revenue officer at SoFi when Mike Cagney was still CEO.

By Dan Ennis • April 24, 2024