Fintech: Page 8

The latest fintech news for banking professionals.

-

SEC drops enforcement action against Paxos

The SEC dropping its enforcement action against Paxos a year after issuing the firm a Wells notice may have reignited the crypto regulation debate.

By Rajashree Chakravarty • July 17, 2024 -

6 ways the CFPB wants to keep its eyes on fintech middlemen

Clearer guidance around “rent-a-bank,” open banking and buy now, pay later will ensure more consumers benefit, Director Rohit Chopra said in remarks last week.

By Suman Bhattacharyya • July 17, 2024 -

Explore the Trendline➔

Explore the Trendline➔

da-kuk via Getty Images

da-kuk via Getty Images Trendline

TrendlineArtificial intelligence

Banks are enthusiastic about AI’s promises. But can they get customers on board, and will regulators let the innovation happen?

By Banking Dive staff -

Bain, Reverence to acquire Envestnet in $4.5B deal

The transaction, expected to close in the fourth quarter, will take the publicly traded wealth technology platform private.

By Rajashree Chakravarty • July 12, 2024 -

Bank-fintech guidance needs more clarity, FDIC’s McKernan says

“Rules of the road” for bank-fintech tie-ups could help banks that partner with fintechs better manage third-party risks, he said.

By Suman Bhattacharyya • July 10, 2024 -

MoneyLion doubles down on AI to bolster customer experience

The fintech aims to facilitate 25% of all financial product purchasing decisions through its platform within three years.

By Rajashree Chakravarty • July 10, 2024 -

Crypto theft doubles to $1.38B in 2024’s first half

The May theft of more than $300 million in Bitcoin from Japanese crypto exchange DMM Bitcoin is the largest digital currency heist so far this year.

By Alexei Alexis • July 8, 2024 -

Roger’s wide-scale marketing effort takes aim

Less than a year after launch, Citizens Bank of Edmond's military-focused neobank sees its account volume grow by 50% every month, Director Marcus Castilla said.

By Suman Bhattacharyya • July 3, 2024 -

Senators prod Synapse partners to return customer funds

“As those that made the current situation possible, you must accept the tremendous responsibility that comes with handling consumers’ money,” lawmakers scolded.

By Caitlin Mullen • July 2, 2024 -

FDIC orders Thread Bank to step up BaaS oversight

The Rogersville, Tennessee-based bank must implement a documented risk assessment of its fintech partners, the agency said. The bank’s board also must approve risk tolerance thresholds.

By Caitlin Mullen • July 1, 2024 -

Crypto firm Abra settles with 25 states for operating without a license

Abra agreed to repay customers some $82 million in crypto. CEO Bill Barhydt said all but $2 million, yet to be claimed, has been repaid.

By Gabrielle Saulsbery • June 27, 2024 -

Funding Circle sells its US unit, returns SBLC license

iBusiness Funding, a subsidiary of Ready Capital, agreed to acquire the fintech for roughly $42 million. In March, Funding Circle's CEO said it was exploring the sale of its U.S. unit.

By Rajashree Chakravarty • June 26, 2024 -

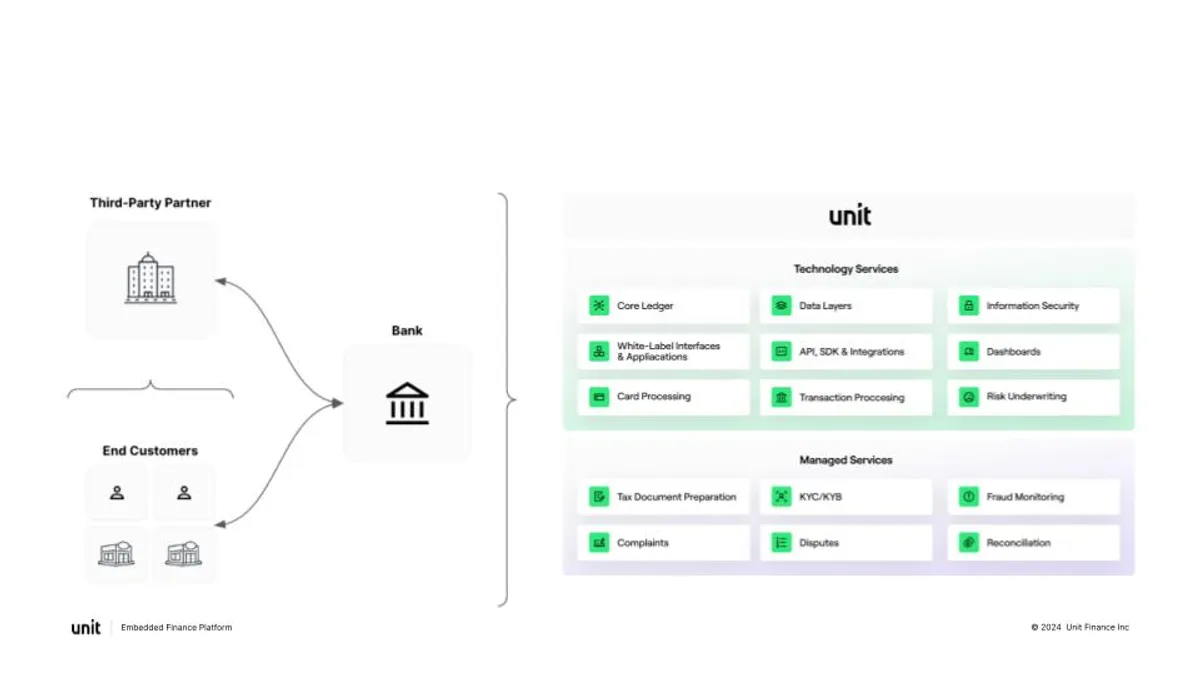

Unit Finance cuts 15% of staff

The embedded finance fintech “has always maintained a large balance sheet, and the changes we are making today will further solidify our strength,” founders Itai Damti and Doron Somech said.

By Gabrielle Saulsbery • June 18, 2024 -

JPMorgan, Greek fintech get a roadmap to bridge their dispute

A London judge detailed how Viva Wallet should be valued. Previous estimates — and the fine print in a deal that gave JPMorgan a minority stake in the fintech — have sparked lawsuits on both sides.

By Dan Ennis • June 17, 2024 -

Fed hits Synapse partner Evolve with enforcement action

An exam last year revealed Evolve Bank & Trust didn’t have an effective risk management framework in place for its fintech partnerships, the Fed said.

By Caitlin Mullen • June 14, 2024 -

Column

Dive Deposits: In HSBC’s eyes, Revolut can have Canary Wharf

The fintech signed a deal to occupy a high-rise alongside G-SIBs. But Revolut's coup — grabbing 40% more office space to match its 40% headcount bump — comes as the U.K.'s biggest bank is leaving the area.

By Dan Ennis • June 14, 2024 -

Terraform Labs, Do Kwon to settle with SEC for $4.47B

Meanwhile, Kwon remains in Montenegro as courts wrestle with whether or not to extradite him to his home country of South Korea or to the U.S. to face charges.

By Gabrielle Saulsbery • June 13, 2024 -

Brex moves to single-CEO model

Pedro Franceschi will become sole chief executive, while co-founder Henrique Dubugras will move to board chair as the company aims for a 2025 IPO.

By Dan Ennis • June 13, 2024 -

Synapse trustee McWilliams finds $85M gap in frozen funds

Partner banks of the bankrupt fintech middleman hold roughly $180 million in demand deposit and for-benefit-of accounts associated with end users. But those users are owed $265 million, a court filing shows.

By Dan Ennis • June 12, 2024 -

Apple unveils new iPhone touch and pay feature

The P2P ‘Tap to Cash’, which enables iPhone users to transfer money by holding their phones together, was unveiled along with a slate of other features Monday.

By Patrick Cooley • June 12, 2024 -

Ex-Bank of America lawyer builds female-focused investment app

A beta version of WealthMeUp, an application designed to help women navigate investment and address the disparity between how men and women look at the space, launched Tuesday.

By Rajashree Chakravarty • June 12, 2024 -

Robinhood leans further into crypto with $200M Bitstamp deal

Acquiring the crypto exchange would embed the brokerage deeper in digital assets and help it trade a greater variety of tokens in more markets globally.

By Dan Ennis • June 12, 2024 -

Rivals Adyen, Stripe partner with Capital One to combat fraud

The three companies announced last Wednesday that they are teaming up to launch a free service intended to combat fraud and reduce the amount of transactions that are improperly declined.

By Patrick Cooley • June 10, 2024 -

Yotta CEO: 85K customers lose access to funds due to Synapse-Evolve tussle

The fintech’s customers, who have a combined $112 million in savings, have been locked out of their accounts amid the Synapse-Evolve Bank & Trust dispute, Yotta CEO Adam Moelis told CNBC.

By Rajashree Chakravarty • June 5, 2024 -

SoFi hires JPMorgan, Citi alum as general counsel

Stephen Simcock, recent general counsel for consumer banking at JPMorgan, replaces Rob Lavet, who is retiring.

By Dan Ennis • June 5, 2024 -

Fintech Copper burned by Synapse collapse

The teen-focused fintech had to shut down its bank deposit accounts and debit cards mid-month — an earlier wind-down than expected due to turmoil experienced by its middleware provider, Synapse.

By Rajashree Chakravarty • May 29, 2024