Technology: Page 39

-

Retrieved from Senate Banking Committee.

Retrieved from Senate Banking Committee.

OCC wants more data on banks’ crypto-related activities

Banks are already required to seek the OCC’s non-objection before engaging in crypto activity. But further enhancements may be needed “to track the risk of cross-contagion,” Acting Comptroller Michael Hsu said.

By Anna Hrushka • Oct. 11, 2022 -

Celsius co-founder Leon follows Mashinsky out

The crypto lending firm’s chief strategy officer, Shlomi Daniel Leon, has left the company, shortly after fellow co-founder Alex Mashinsky, joining a growing list of recently departed crypto executives.

By Gabrielle Saulsbery • Oct. 5, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineArtificial intelligence

Banks’ focus on AI has shifted from a “cool-toys” mentality to one that sees the technology as a foundational pillar underlying finance and society itself.

By Banking Dive staff -

Inside Stash’s crypto-winter gamble

The investment app expands access to digital assets, spotlighting a long-term view of the currencies, in the platform's first offering on a new core system.

By Suman Bhattacharyya • Oct. 5, 2022 -

Crypto bank Anchorage pushes into Asia

Anchorage Digital, valued over $3 billion, established six partnerships across Asia, including in Singapore and Thailand.

By Gabrielle Saulsbery • Oct. 5, 2022 -

FSOC wants legislation to fill crypto sector oversight gaps

The panel wants regulators to work in tandem to issue rules that would help prevent regulatory arbitrage in the sector.

By Anna Hrushka • Oct. 4, 2022 -

(2024). [Photo]. Retrieved from Federal Reserve.

(2024). [Photo]. Retrieved from Federal Reserve. Column

Column3 times Michelle Bowman stood out as the Fed’s anti-Barr

The central bank governors diverged on stress tests, mergers and digital assets in recent speeches but appear to agree on capital requirements.

By Dan Ennis • Oct. 3, 2022 -

M&T pledges to rectify People’s United account access issues

The bank’s pledge, in response to letters of concern from five senators and Connecticut’s attorney general, came during a week when M&T disclosed 325 layoffs in the Nutmeg State.

By Gabrielle Saulsbery • Oct. 3, 2022 -

How JPMorgan Chase allots its $14B IT budget

Between hybrid cloud infrastructure, data security and supporting roughly 6,000 apps, JPMorgan Chase’s technology portfolio is massive. “Sometimes people get stuck on the number,” said Lori Beer, the bank’s global CIO.

By Matt Ashare • Oct. 3, 2022 -

Shutterstock/Viktoriia Hnatiuk

Sponsored by Backbase

Sponsored by BackbaseImproving the odds of success for your bank’s digital transformation

Banks know that they have to change for the digital engagement age, but often lack the knowledge to find the best approach. Discover how you can boost your bank’s chances for success with a few simple steps.

Oct. 3, 2022 -

Banks turn to automation to realize efficiency gains

Automation will increasingly support customer experience improvements, product releases and other client-relations objectives, analysts said.

By Suman Bhattacharyya • Sept. 30, 2022 -

(2024). [Photo]. Retrieved from Federal Reserve.

(2024). [Photo]. Retrieved from Federal Reserve.

Digital banks, credit unions should factor into merger reviews: Fed’s Bowman

Potential combinations should hinge on risk analysis, not deposit market share, in an update to 1995 guidelines, the central bank governor said Wednesday.

By Dan Ennis • Sept. 29, 2022 -

Celsius CEO, FTX US president resign

Mashinsky’s departure comes amid bankruptcy proceedings his company initiated in July. Harrison’s resignation comes one day after FTX US won the bid to buy Voyager Digital’s assets for $1.4 billion.

By Gabrielle Saulsbery • Sept. 28, 2022 -

FTX wins bid to buy Voyager’s assets for $1.42B

The deal comes two months after the crypto brokerage accused FTX’s billionaire owner of trying to subvert its bankruptcy process by offering early liquidity to Voyager customers.

By Gabrielle Saulsbery • Sept. 27, 2022 -

PNC buys restaurant point-of-sale firm Linga

The Pittsburgh-based bank is boosting its payments footprint as banks from Banc of California to JPMorgan Chase are making similar large investments.

By Anna Hrushka • Sept. 27, 2022 -

Varo’s tech unit looks to speed development, find efficiencies

The neobank aims to diversify its offerings in payments and lending, but there are unresolved questions about the company’s path to profitability.

By Suman Bhattacharyya • Sept. 26, 2022 -

Kraken CEO Jesse Powell steps aside, as COO takes the reins

The crypto exchange’s top executive raised ire over a culture document that addressed preferred pronouns, diversity-focused hiring and abortion. He told Fortune he had “grown tired of long hours and day-to-day management tasks.”

By Gabrielle Saulsbery • Sept. 22, 2022 -

Morgan Stanley fined $35M by SEC over improper data disposal

The bank hired a company with no data-destruction experience to decommission hard drives and servers, which were sold to a third party and auctioned with some unencrypted customer data intact, the regulator found.

By Gabrielle Saulsbery • Sept. 20, 2022 -

OCC frees Capital One from consent order tied to 2019 breach

The Office of the Comptroller of the Currency determined the bank had reached a level of “safety and soundness” no longer requiring extra oversight regarding a leak of 106 million customers’ data.

By Gabrielle Saulsbery • Sept. 19, 2022 -

Biden administration releases digital asset regulation framework

The Biden administration wants the SEC and the CFTC to “aggressively pursue investigations and enforcement actions against unlawful practices in the digital assets space.”

By Anna Hrushka • Sept. 16, 2022 -

The image by Hobiecat93 is licensed under CC BY-SA 3.0

The image by Hobiecat93 is licensed under CC BY-SA 3.0

Citizens to buy college planning platform College Raptor

The deal will give Citizens, which already has several student lending products, greater access to the college student market, the bank’s executive vice president and head of student lending said.

By Anna Hrushka • Sept. 15, 2022 -

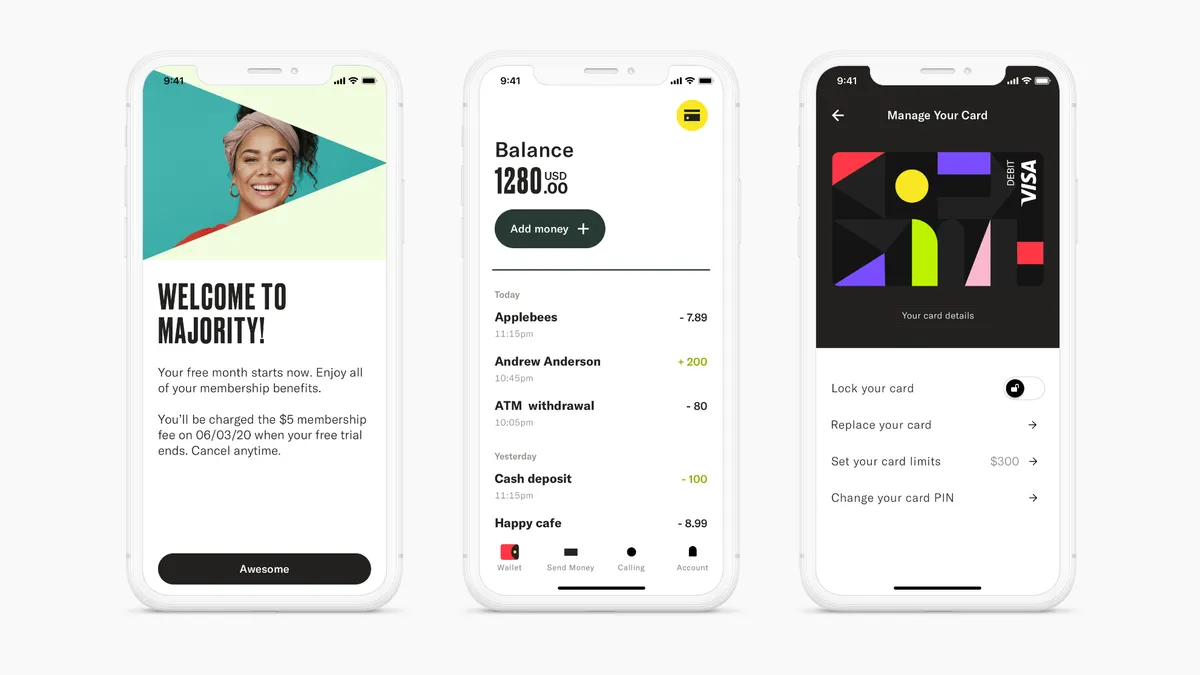

Majority raises $37M as neobank expands immigrant outreach

The neobank, which declined to share its current valuation or number of users, has raised $83.5 million to date.

By Anna Hrushka • Sept. 14, 2022 -

Gensler: Securities laws cover ‘vast majority’ of crypto tokens

The SEC chief signaled he would cooperate with the CFTC to the extent that “it needs greater authorities with which to oversee and regulate crypto non-security tokens.”

By Maura Webber Sadovi • Sept. 8, 2022 -

10 takeaways from Michael Barr’s first speech as Fed’s supervision czar

The regulator pushed a tiered set of capital requirements and stricter living wills for regional banks. He also clarified the central bank’s stance on climate risk.

By Dan Ennis • Sept. 8, 2022 -

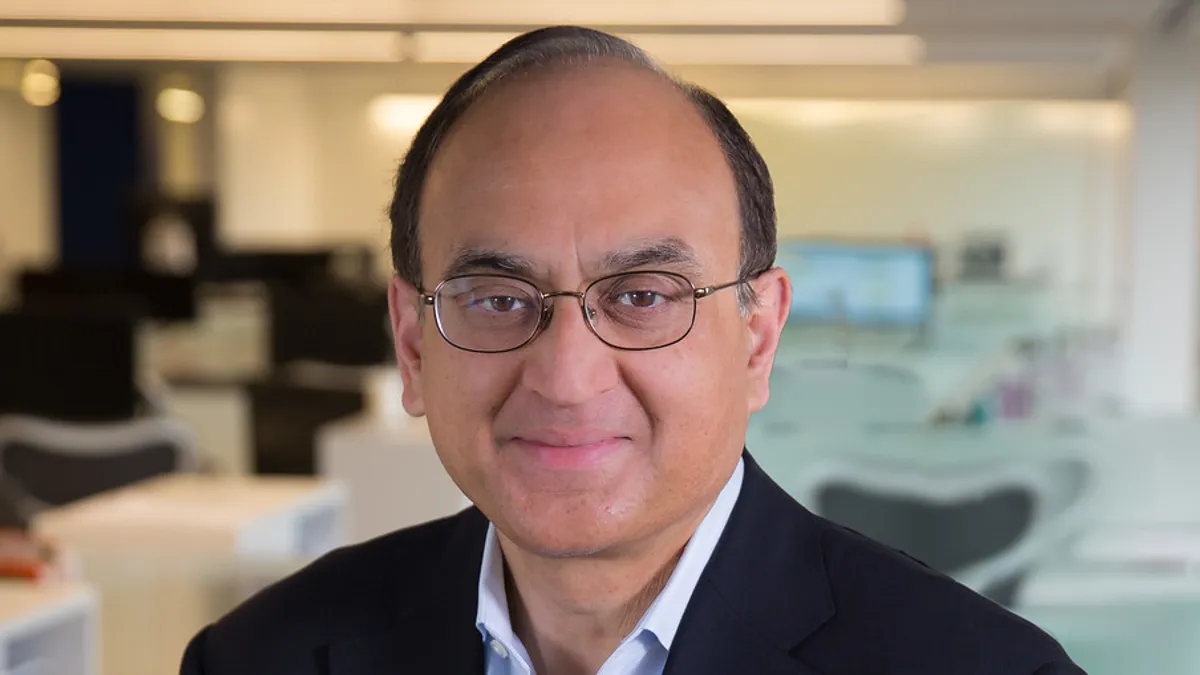

Who’s afraid of FedNow? Not Visa

“The fact that there is a pipe, right, doesn't mean there's going to be traffic or volume on that pipe,” said the card network’s CFO, Vasant Prabhu. “If the pipe doesn't serve [specific] needs, the pipe will not be used.”

By Lynne Marek • Sept. 6, 2022 -

Branch-closure freefall slows down: S&P Global

Net branch closures fell to 312 in the second quarter, compared with 950 in the first three months of 2022. If second-half closures continue at the first half’s pace, 19% fewer locations will shut down this year than in 2021.

By Anna Hrushka • Sept. 1, 2022