Technology: Page 36

-

Huntington Bank partners with app to help neurodiverse people bank better

Magnusmode offers free step-by-step guides to everyday tasks such as using a phone to deposit a check, creating and tracking a budget and disputing a transaction.

By Gabrielle Saulsbery , Anna Hrushka • Dec. 16, 2022 -

8 takeaways from the House committee hearing on FTX

CEO John Ray didn't mince words when discussing FTX's business dealings under Sam Bankman-Fried, at one point calling it "old-fashioned embezzlement."

By Gabrielle Saulsbery • Dec. 14, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineArtificial intelligence

Banks’ focus on AI has shifted from a “cool-toys” mentality to one that sees the technology as a foundational pillar underlying finance and society itself.

By Banking Dive staff -

Goldman to cut 400 jobs, end Marcus consumer loans: reports

The staff cuts would come amid a reorganization that would split Marcus. It also follows reports that the bank is reinstating annual performance reviews, which may guide headcount-reduction decisions.

By Anna Hrushka • Dec. 13, 2022 -

CBA: Most consumers want more oversight for crypto, fintech firms

The trade group’s study saw an age gap. About 46% of baby boomers and 42% of Gen Xers sought higher regulatory standards for the companies, compared with 24% of millennials and 18% of Gen Zers.

By Gabrielle Saulsbery • Dec. 13, 2022 -

DOJ, SEC charge Sam Bankman-Fried with defrauding investors

The former FTX CEO, who was arrested Monday in the Bahamas, was supposed to appear in front of the House Financial Services Committee on Tuesday. FTX’s current CEO will testify instead.

By Gabrielle Saulsbery • Dec. 13, 2022 -

Bank of America wants a human bridge for its AI help

The bank aims to allow a human agent to pick up from where a customer leaves a chat with digital assistant Erica, but to let the chatbot finish the interaction, an executive said last week.

By Suman Bhattacharyya • Dec. 12, 2022 -

Q&A

Northern Trust predicts a ‘pause’ in the mainstreaming of crypto

The FTX crisis will prompt "reflection" regarding crypto, an executive said. But Northern Trust still predicts 5% and 10% of its assets under custody will be digital by 2030.

By Lynne Marek • Dec. 12, 2022 -

SEC wants public companies to disclose crypto risks

Meanwhile, former FTX CEO Sam Bankman-Fried said Friday he would testify Tuesday in front of the House Financial Services Committee.

By Gabrielle Saulsbery • Dec. 9, 2022 -

Lawmakers to subpoena Bankman-Fried if he doesn’t testify on FTX collapse

Sens. Elizabeth Warren, D-MA, and Tina Smith, D-MN, penned a letter to regulators concerning bank-crypto connections, as another FTX investigation begins.

By Gabrielle Saulsbery • Dec. 8, 2022 -

Nexo to exit US market after regulator talks hit dead end

The U.K. crypto lender was reportedly in talks with regulators for 18 months to comply with U.S. financial laws.

By Gabrielle Saulsbery • Dec. 6, 2022 -

International crypto exchanges Bybit, Swyftx see steep staff cuts

The Dubai- and Australia-based companies lack direct exposure to FTX but are feeling the effect of broader market challenges, slashing 30% and 40% of their workforces, respectively.

By Gabrielle Saulsbery • Dec. 6, 2022 -

Wells Fargo launches new commercial banking platform

Vantage replaces the bank’s two-decade-old Commercial Electronic Office Portal and aims to bring a "consumer-like experience" to Wells' commercial and corporate clients, an executive said.

By Anna Hrushka • Dec. 5, 2022 -

10 top reads from Banking Dive

If you're new, welcome. Here's a chance to catch up on some of our best work.

By Dan Ennis • Dec. 4, 2022 -

NYDFS proposes charging crypto businesses for supervision

The fees, up for two comment periods, would help the agency “continue adding top talent to its virtual currency regulatory team,” NYDFS said Thursday.

By Rajashree Chakravarty • Dec. 2, 2022 -

FTX ex-CEO says he ‘unknowingly commingled funds’

In his first public appearance since his former company's collapse, Sam Bankman-Fried said he doesn’t think he has criminal liability, but what happens with him is “not the important part.”

By Gabrielle Saulsbery • Dec. 1, 2022 -

Kraken cuts workforce by 1,100 people

Thousands of crypto jobs have vanished in 2022 as a result of the ongoing crypto winter, and the Kraken team is back to the size it was a year ago.

By Gabrielle Saulsbery • Nov. 30, 2022 -

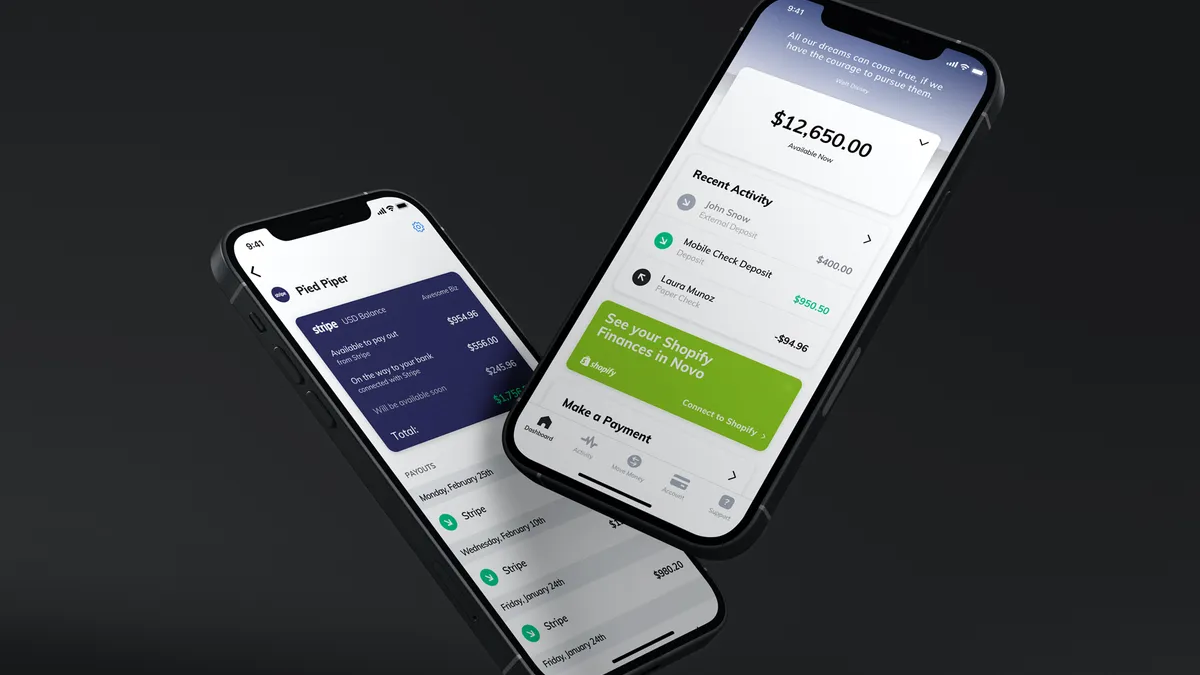

Novo grows customizable small-business banking platform, eyes lending

The fintech, which raised $35 million from GGV Capital last week, announced a new partnership Wednesday with LegalZoom to provide entity formation services to Novo customers.

By Anna Hrushka • Nov. 30, 2022 -

BlockFi sues Bankman-Fried’s holding company

The lawsuit, to recover shares in Robinhood, came the same day BlockFi filed for Chapter 11 bankruptcy protection, in part because of its exposure to FTX, which Bankman-Fried founded.

By Gabrielle Saulsbery • Nov. 29, 2022 -

Kraken settles with Treasury Department for $362K

The platform avoided the maximum penalty of $272 million because it self-reported, the Office of Foreign Assets Control said.

By Gabrielle Saulsbery • Nov. 29, 2022 -

BlockFi files for bankruptcy amid FTX contagion

The crypto lender has initiated a cost-cutting plan that involves “major layoffs,” according to Decrypt. Monday’s announcement follows earlier rumors that the company had been mulling bankruptcy.

By Gabrielle Saulsbery • Nov. 28, 2022 -

State regulators probe Genesis for securities violations

Regulators are investigating whether the company influenced residents to invest in crypto securities through its platform without having the right registrations, an Alabama official said.

By Gabrielle Saulsbery • Nov. 28, 2022 -

Sponsored by ServiceNow

Why banks need hyperautomation now more than ever

Worries about recession, the need to drive cost down and a desire to accelerate risk initiatives has many banks thinking hard about how to seize the benefits of hyperautomation quickly and efficiently.

Nov. 28, 2022 -

Regulatory challenges more prominent in eyes of fintech industry leaders this year

Private firms are adopting a more defensive posture, delaying new funding rounds, planning for modest growth and addressing regulatory risks, according to a report.

By Gabrielle Saulsbery • Nov. 23, 2022 -

Q&A

Payitoff CEO, spouse became ‘walking testimonial’ for student debt management

“If I'm in a bank, I would want to learn everything I could from these fintechs, whether it's partnering with them, buying them ... because everything's on discount,” CEO Bobby Matson said.

By Rajashree Chakravarty • Nov. 23, 2022 -

JPMorgan’s crypto wallet trademark is approved

The green light comes more than two years after the bank submitted paperwork to the U.S. Patent and Trademark Office, and runs counter to CEO Jamie Dimon’s opinion on virtual currencies.

By Dan Ennis • Nov. 22, 2022