Technology: Page 24

-

CFTC sues Binance over compliance ‘evasion’

The crypto exchange said it would restrict U.S. customers from certain trading but communicated with users on an app set to automatically delete messages, the CFTC alleged.

By Gabrielle Saulsbery • March 28, 2023 -

Tech vendor risk raises vetting stakes in wake of SVB crisis

Deposits are safe, but tech startups may no longer have access to venture debt and the lines of credit that helped fuel innovation.

By Matt Ashare • March 27, 2023 -

Explore the Trendline➔

Explore the Trendline➔

da-kuk via Getty Images

da-kuk via Getty Images Trendline

TrendlineArtificial intelligence

Banks are enthusiastic about AI’s promises. But can they get customers on board, and will regulators let the innovation happen?

By Banking Dive staff -

Coinbase faces SEC enforcement action over staking services

“Coinbase runs a rigorous asset review process and has rejected more than 90% of assets that have applied to be listed on the platform,” CEO Brian Armstrong tweeted Wednesday.

By Gabrielle Saulsbery • March 24, 2023 -

JPMorgan to buy investment analytics fintech Aumni

The bank did not disclose the value of the deal, set to close by June. But Aumni was worth $232 million after its latest funding round in 2021, according to Pitchbook.

By Anna Hrushka • March 23, 2023 -

Apto Payments, Sardine team on anti-fraud tools

Apto Payments and Sardine are joining forces to offer commercial customers issuing cards better anti-fraud tools.

By Tatiana Walk-Morris • March 22, 2023 -

FTX debtors sue Bahamas arm over ownership claims

FTX Trading, FTX US and others claim that FTX Digital Markets was merely a “corporate shell.” FTX Digital Markets, meanwhile, claims to be the “constructive owner” of FTX’s assets.

By Gabrielle Saulsbery • March 21, 2023 -

A look at SVB’s new CEO, Tim Mayopoulos

The former Fannie Mae CEO on Tuesday urged clients who left SVB in the past week to return. The FDIC allegedly has targeted Mayopoulos since 2017 as someone who could steer a seized bank.

By Anna Hrushka • March 16, 2023 -

Fintechs offer expanded FDIC insurance in wake of SVB failure

“It is abundantly clear that $250K FDIC insurance is not enough for startups,” Immad Akhund, CEO of neobank Mercury, said after Silicon Valley Bank’s collapse.

By Rajashree Chakravarty • March 15, 2023 -

Deep Dive

‘Meme stock in reverse’: SVB collapse portends new era of viral bank runs

Silicon Valley Bank’s demise gave the banking sector a glimpse into how social media and digital banking can turn a financial institution from operational to insolvent in a matter of hours.

By Anna Hrushka • March 15, 2023 -

Anchorage Digital cuts 20% of staff

“The need for better crypto infrastructure is growing ever clearer,” the company told Bloomberg amid a seven-day span that has seen the closure of three banks heavily invested in the crypto sector.

By Dan Ennis • March 15, 2023 -

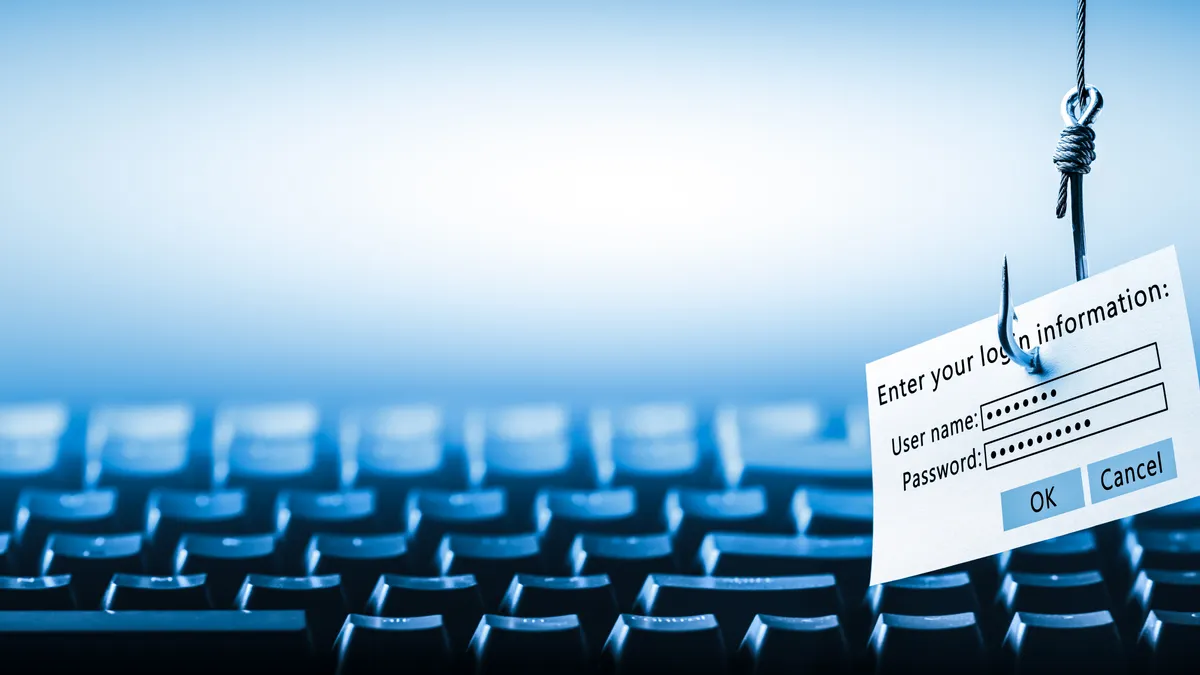

Bank failure panic fuels moment of opportunity for threat actors

As regulators step in to operate SVB and Signature, threat hunters and security executives warned organizations to look out for malicious activity.

By Matt Kapko • March 14, 2023 -

HSBC buys UK arm of SVB for symbolic £1

“Deposits will be protected, with no taxpayer support,” Jeremy Hunt, Britain’s finance minister, tweeted Monday.

By Rajashree Chakravarty • March 13, 2023 -

Signature Bank closed by NY regulator

Business clients pulled deposits Friday after the crumbling of fellow crypto-friendly Silicon Valley Bank. An auction for Signature's assets could begin Monday.

By Dan Ennis • March 13, 2023 -

Regulators take over Silicon Valley Bank

The California Department of Financial Protection and Innovation closed the embattled bank and appointed the FDIC as receiver, regulators said Friday.

By Anna Hrushka • March 10, 2023 -

Crypto bank Silvergate shuttering operations, liquidating

"Today we are seeing what can happen when a bank is overreliant on a risky, volatile sector like cryptocurrencies,” Sen. Sherrod Brown, D-OH, said in a statement.

By Gabrielle Saulsbery • March 9, 2023 -

Technology gap puts Black banks at risk: report

Black banks, which help expand credit to underserved areas, risk losing customers if they continue to fall behind their nonminority peers in terms of digital banking offerings, a researcher said.

By Anna Hrushka • March 9, 2023 -

Q&A

Grasshopper Bank leans on fintech partners to weather economic downturn

“We understand partnerships. And the one thing that I tell people is, once you refer to one of your fintech partners as a vendor, then you're in a bad place,” CEO Mike Butler said.

By Rajashree Chakravarty • March 8, 2023 -

HMBradley ends waitlist after landing new sponsor bank

The neobank tapped NYCB as its new sponsor bank after its former partner struggled to keep up with the rapid deposit growth.

By Anna Hrushka • March 8, 2023 -

WaFd fintech spinoff Archway launches after $15M funding round

“We’re trying to close that digital divide so the community and regional banks can really foster those relationships without making them sacrifice the technology side,” said Dustin Hubbard, Archway’s president.

By Gabrielle Saulsbery • March 8, 2023 -

Brex offers ChatGPT-style CFO tools

The announcement comes as interest in ChatGPT is rapidly gaining momentum, even as some worry about potential privacy and security risks.

By Alexei Alexis • March 7, 2023 -

Hsu: Crypto needs lead regulator, global framework of rules

The OCC's acting chief, during a speech Monday, likened FTX’s collapse to that of the Bank of Credit and Commerce International in 1991.

By Gabrielle Saulsbery • March 7, 2023 -

Kraken ‘on track’ to launch bank despite headwinds

"We're going to have those pens with the little ball chains ... and attach them to the desks of Wall Street banks everywhere. With our logo," Chief Legal Officer Marco Santori said on a podcast.

By Gabrielle Saulsbery • March 7, 2023 -

Banking technology provider Amount cuts 25% of staff

The Chicago-based fintech, which was valued at $1 billion in 2021, has initiated its second round of layoffs in less than a year.

By Anna Hrushka • March 6, 2023 -

Silvergate closes its crypto payments network

The abrupt closure follows an exodus of Silvergate partners and the bank's acknowledgment that it may be “less than well-capitalized.”

By Gabrielle Saulsbery • March 6, 2023 -

Sponsored by Encapture

Dodd-Frank 1071 is here: How financial institutions are preparing with automation

Just in time for the March 31 ruling, here’s what banks are doing about it.

By Will Robinson, CEO, Encapture • March 6, 2023