Technology: Page 13

-

FTX founder Sam Bankman-Fried gets 25 years in prison

The former crypto exchange CEO was convicted in November 2023 on seven counts of fraud and conspiracy.

By Gabrielle Saulsbery • March 28, 2024 -

SEC can continue its case against Coinbase

The agency “sufficiently pleaded that Coinbase operates as an exchange, as a broker, and as a clearing agency under the federal securities laws,” U.S. District Judge Katherine Polk Failla ruled.

By Gabrielle Saulsbery • March 27, 2024 -

Explore the Trendline➔

Explore the Trendline➔

da-kuk via Getty Images

da-kuk via Getty Images Trendline

TrendlineArtificial intelligence

Banks are enthusiastic about AI’s promises. But can they get customers on board, and will regulators let the innovation happen?

By Banking Dive staff -

SEC asks judge to green-light $2B penalty for Ripple

The crypto firm hasn’t accepted responsibility for the portion of XRP sales a judge ruled illegal in July, the SEC said. In a social post, Ripple’s CEO said the company would “expose the SEC for what they are” in a filing next month.

By Dan Ennis • March 26, 2024 -

Robinhood co-founder steps down

Baiju Bhatt, who co-founded the fintech 11 years ago and was most recently chief creative officer, is moving on to “focus on his next enterprise.”

By Gabrielle Saulsbery • March 25, 2024 -

Banks balance cloud, cyber priorities with AI eagerness

More than two-thirds of financial firms have made meaningful progress on core modernization, according to Broadridge data.

By Matt Ashare • March 25, 2024 -

Bakkt names Andy Main as new CEO in leadership shuffle

The switch comes after the New York Stock Exchange threatened to delist the crypto platform over its share price. Bakkt’s next chief executive will detail his vision for the company March 25 in an earnings call.

By Rajashree Chakravarty • March 20, 2024 -

He could get 5 years. He could get 100. For how long will Sam Bankman-Fried go to prison?

Ryan Lee O'Neill, a New Jersey-based defense attorney, has represented countless defendants in the FTX founder's place. She has her own estimates.

By Gabrielle Saulsbery • March 20, 2024 -

Robinhood goes live in the UK

The company indefinitely postponed its U.K. launch in 2020 over technical issues but rolled out a waitlist in November. It did, however, pause margin investing for U.K. users.

By Gabrielle Saulsbery • March 20, 2024 -

FTC fines fintechs Biz2Credit, Womply $59M over PPP actions

The agency claimed Biz2Credit misrepresented the timeline for application processing, and Womply had inadequate customer service in the COVID-era crunch for small-business loans.

By Dan Ennis • March 19, 2024 -

SEC busts company behind $300M crypto Ponzi scheme targeting Latinos

Under the leadership of Gary Gensler, the SEC has intensified efforts to protect investors involved in what he calls the “Wild West” of crypto assets.

By Jim Tyson • March 15, 2024 -

Morgan Stanley names firmwide AI chief

Jeff McMillan, a 15-year veteran of the bank, led the creation of Morgan Stanley’s generative AI-powered chatbot last year as chief analytics and data officer.

By Gabrielle Saulsbery • March 15, 2024 -

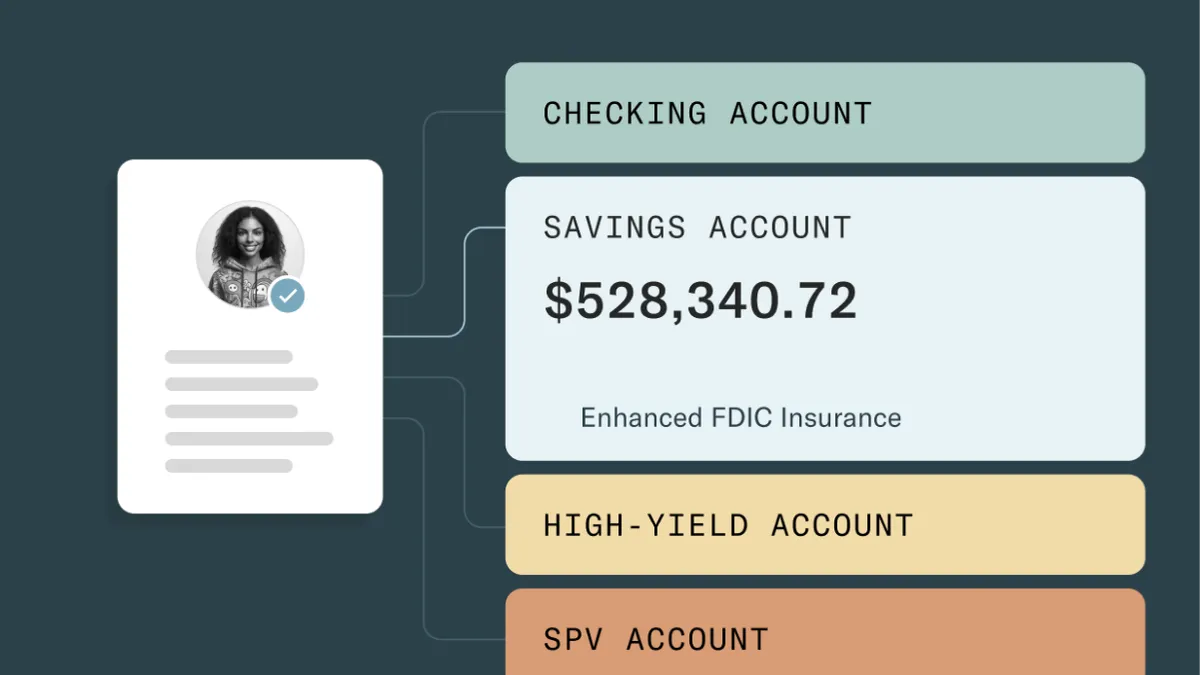

A year later: SVB’s impact on fintech

Fintechs like Mercury and MoneyLion showed their resilience, offering innovative products and assisting their customers through difficult times.

By Rajashree Chakravarty • March 13, 2024 -

FDIC vice chair wants regulators to hurry up on addressing tokenization

Tokenization could be a "major leap" for the monetary system. Travis Hill doesn't want the U.S. to be left out.

By Gabrielle Saulsbery • March 12, 2024 -

JPMorgan to launch biometric checkout next year

The bank’s payments unit plans to engage in more pilots this year before rolling out the checkout service broadly next year, said Prashant Sharma, JPMorgan’s executive director of biometrics and identity solutions.

By Caitlin Mullen • March 11, 2024 -

Q&A

How banks, fintechs can navigate regulatory challenges in BaaS space

Banks have a responsibility to treat their customers fairly because they deal with people’s money, said the CEO of Synctera, a partner of Lineage Bank, which was recently hit with an FDIC consent order over BaaS.

By Rajashree Chakravarty • March 6, 2024 -

JPMorgan Chase’s Neovest buys LayerOne Financial

The deal allows Neovest’s 500-plus clients, many of them hedge funds, to monitor portfolios, conduct risk assessments and perform compliance checks, among other things.

By Gabrielle Saulsbery • March 5, 2024 -

Metropolitan Commercial Bank exits BaaS

“The decision to terminate these financial service partnerships will reduce the Company’s exposure to the heightened, and evolving, regulatory standards related to these activities,” the bank said in its 10-K filing last week.

By Gabrielle Saulsbery • March 4, 2024 -

Coinbase users see $0 balance in technical glitch

“We are aware that some users may see a zero balance across their Coinbase accounts and may experience errors in buying or selling,” the crypto exchange wrote on its website. “Your assets are safe."

By Rajashree Chakravarty • Feb. 29, 2024 -

Smaller credit unions face hurdles despite NCUA’s fintech rule

The financial innovation rule may open the door to more partnerships, but larger institutions still have advantages on tech, budget and risk management, experts say.

By Ken McCarthy • Feb. 28, 2024 -

Green Dot faces Fed’s proposed consent order

The digital bank set aside $20 million to cover a potential penalty stemming from compliance risk management issues predating the company’s current management.

By Gabrielle Saulsbery • Feb. 28, 2024 -

Treasury Prime has laid off half its staff

The banking-as-a-service platform is shedding its fintech-bank liaison duties — and about 40 to 50 employees — to focus exclusively on providing software to banks.

By Gabrielle Saulsbery • Feb. 28, 2024 -

Kraken wants SEC suit dismissed

The playbook for Kraken's motion to dismiss looks a lot like those of Binance and Coinbase.

By Gabrielle Saulsbery • Feb. 23, 2024 -

AI could spark change in the SMB lending space: white paper

Financial institutions, including fintechs, can leverage artificial intelligence technology like machine learning to automate lending decisions, a white paper commissioned by Uplinq said.

By Rajashree Chakravarty • Feb. 21, 2024 -

PayPal invests in AI startup Rasa

The investment is the first that the digital payments pioneer is making from its new artificial intelligence venture fund.

By Tatiana Walk-Morris • Feb. 20, 2024 -

Capital One to acquire Discover in $35.3B deal

The transaction would give a big boost to a bank well-known for its credit card component, yet lend regulatory gravitas and investment dollars to a struggling card network.

By Dan Ennis • Feb. 20, 2024