Technology

-

Synchrony buys financing software provider

Versatile Credit’s consumer financing platform can lead to more sales for merchants and increase access to credit for consumers, the issuer said.

By Caitlin Mullen • Oct. 3, 2025 -

Government shutdown risks snarling Wealthfront’s IPO plan

Wednesday’s shutdown forced the SEC to furlough more than 90% of its workforce. It won’t be able to process initial public offerings during that time, according to an agency contingency plan.

By Daniel Muñoz • Oct. 1, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

2026 banking conference roundup

Gatherings can be idea generators, or crucial chances to network — especially amid an environment where political change can yield previously unexpected possibilities and partnerships.

By Dan Ennis • Oct. 1, 2025 -

NYDFS’ Adrienne Harris to step down

Kaitlin Asrow, who leads the regulator’s research and innovation division and previously was a senior fintech policy adviser at the San Francisco Fed, will serve as the state agency’s acting superintendent starting Oct. 18.

By Dan Ennis • Sept. 30, 2025 -

TD wants to get ‘back to winning’

The Canadian lender’s executives detailed plans to slash costs by $1.8 billion a year and deepen customer relationships to make the bank more efficient while revving up revenue growth.

By Caitlin Mullen • Sept. 30, 2025 -

"Royal Bank of Canada's global headquarters at 200 Bay Street in Toronto, Canada" by Francisco Diez is licensed under CC BY 2.0

"Royal Bank of Canada's global headquarters at 200 Bay Street in Toronto, Canada" by Francisco Diez is licensed under CC BY 2.0

Ex-RBC employee accessed prime minister’s banking profile: police

Ibrahim El-Hakim faces fraud and identity theft charges after a bank camera caught him allegedly working to create banking profiles and obtain lines of credit in the name of public figures.

By Dan Ennis • Sept. 25, 2025 -

FTX sues crypto miner Genesis Digital Assets for $1.15B

Former FTX CEO Sam Bankman-Fried invested over $1 billion in a crypto mining company despite shoddy paperwork and “red flags,” according to the firm in charge of recovering funds for FTX creditors.

By Gabrielle Saulsbery • Sept. 25, 2025 -

Financial firms fuel a surge in AI research, adoption

Teams at JPMorgan Chase, Capital One, RBC, Wells Fargo and TD are blazing a trail for the technology’s deployment in high-stakes, regulated environments, according to Evident Insights.

By Matt Ashare • Sept. 25, 2025 -

Citi deploys agentic tools to in-house AI platform

The bank began initial rollout of agentic capabilities to 5,000 of its workers this month, according to a Monday announcement.

By Roberto Torres • Sept. 23, 2025 -

Sponsored by EnterpriseDB

Why a cloud-native approach is a strategic key to AI in a world of data sovereignty

Just look at the AI leaders in BFSI.

Sept. 22, 2025 -

NYDFS wants crypto-curious banks to use blockchain analytics tools

The tools can help when banks evaluate exposure to money laundering and sanctions activity or consider the risks associated with offering a particular crypto product, the regulator said.

By Caitlin Mullen • Sept. 18, 2025 -

Old IT systems weigh down bank modernization

Banks are struggling to differentiate their digital products due to outdated tech, clearing the way for customer churn.

By Makenzie Holland • Sept. 18, 2025 -

3 major banks turn to predictive insights to boost trust

Bank of America, U.S. Bank and Wells Fargo allow users to analyze estimated spending, scheduled transactions and deposit data.

By Kristen Doerer • Sept. 18, 2025 -

Tether eyes US return in December, names Trump ally Hines to top post

The stablecoin firm stopped serving American customers directly in 2021. The company’s reemergence comes amid fresh legislation and intense competition from Circle and other issuers.

By Dan Ennis • Sept. 17, 2025 -

Ex-Voyager CEO must pay $750K to customers

The Commodity Futures Trading Commission sued Stephen Ehrlich in 2023 seeking relief for customers caught up in Voyager Digital’s bankruptcy.

By Gabrielle Saulsbery • Sept. 17, 2025 -

Retrieved from Ally on July 23, 2025

Retrieved from Ally on July 23, 2025 Q&A

Q&AAlly CIO: Pace of tech change ‘weighs on me’

Sathish Muthukrishnan, the bank’s chief information, data and digital officer, shared what’s surprised him about the use of Ally’s AI platform and the challenges of keeping up with rapid tech evolution.

By Caitlin Mullen • Sept. 17, 2025 -

Sponsored by Automation Anywhere

Transforming customer onboarding: Leveraging agentic process automation for competitive advantage

The mounting pressure: Industry-wide challenges in customer onboarding.

By Ron Wade • Sept. 15, 2025 -

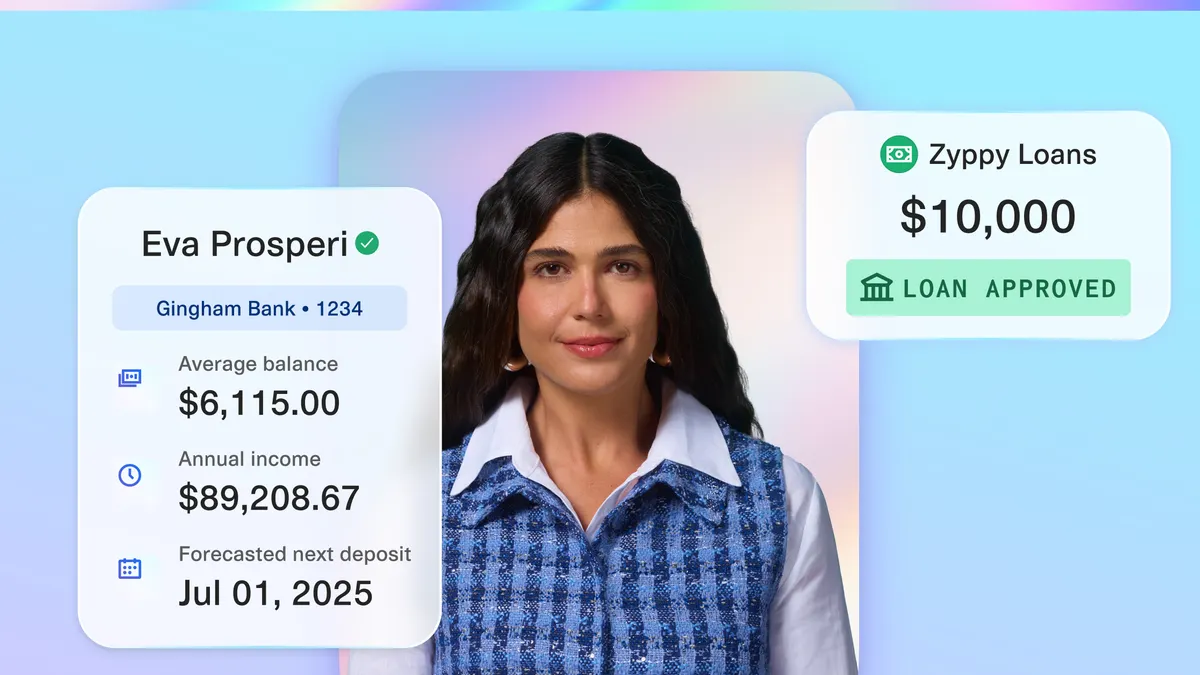

Sponsored by Plaid

Transforming the full lending lifecycle with cash flow insights

Unlock smarter, faster, more inclusive lending, powered by real-time cash flow insights.

By Michelle Young, Allison Milton • Sept. 15, 2025 -

Citi snags AI head from IBM

Shobhit Varshney will help scale AI capabilities at the financial services company, Citi COO Anand Selvakesari said in an internal memo Tuesday.

By Roberto Torres • Sept. 12, 2025 -

FINRA charges former Synapse execs

Former Synapse Brokerage CEO Jeffrey Stanley allegedly “failed to reasonably supervise” his company’s cash management program. Former Compliance Chief Mark Paverman is also accused of lying to FINRA.

By Gabrielle Saulsbery • Sept. 10, 2025 -

Javice, in sentencing memo, calls JPMorgan a ‘unique’ victim

Comparing the bank’s annual revenue against the median U.S. household income of $80,610, the Frank co-founder’s lawyer said the bank’s alleged $200 million loss equates proportionately to $58.

By Gabrielle Saulsbery • Sept. 10, 2025 -

Banks seek to reconcile AI governance gaps

Financial sector IT leaders struggle to reduce adoption risks and strengthen governance, according to a FICO and Corinium Global Intelligence study.

By Matt Ashare • Sept. 8, 2025 -

Central Florida de novo targets early 2026 opening

The group behind prospective lender Portrait Bank has submitted regulatory applications and increased its capital target based on strong response, said Erik Weiner, who will serve as CEO and president.

By Caitlin Mullen • Sept. 5, 2025 -

Figure eyes $4.13B valuation in IPO

The blockchain startup and certain investors aim to sell more than 26 million shares at $18 to $20 each. The company outlined go-public plans during the same week as crypto exchange Gemini and BNPL provider Klarna.

By Dan Ennis • Sept. 3, 2025 -

U.S. Bank revives bitcoin custody

The Minneapolis-based lender paused its bitcoin custody offering in 2022, but “enhanced regulatory clarity” has brought the service back to life, an executive said.

By Gabrielle Saulsbery • Sept. 3, 2025