Risk: Page 28

-

BNY Mellon expects to lose $200M in Russia pullback

The custody bank Thursday said it would halt new banking business in Russia and suspend investment management purchases of Russian securities in a move that aligns it with the likes of Citi, Goldman Sachs and JPMorgan Chase.

By Dan Ennis • March 18, 2022 -

Citi, Deutsche join Goldman, JPMorgan in pullback from Russia

Germany's largest lender reversed course after taking heat for saying abandoning Russian clients would "go against our values."

By Dan Ennis • Updated March 14, 2022 -

Explore the Trendline➔

Explore the Trendline➔

da-kuk via Getty Images

da-kuk via Getty Images Trendline

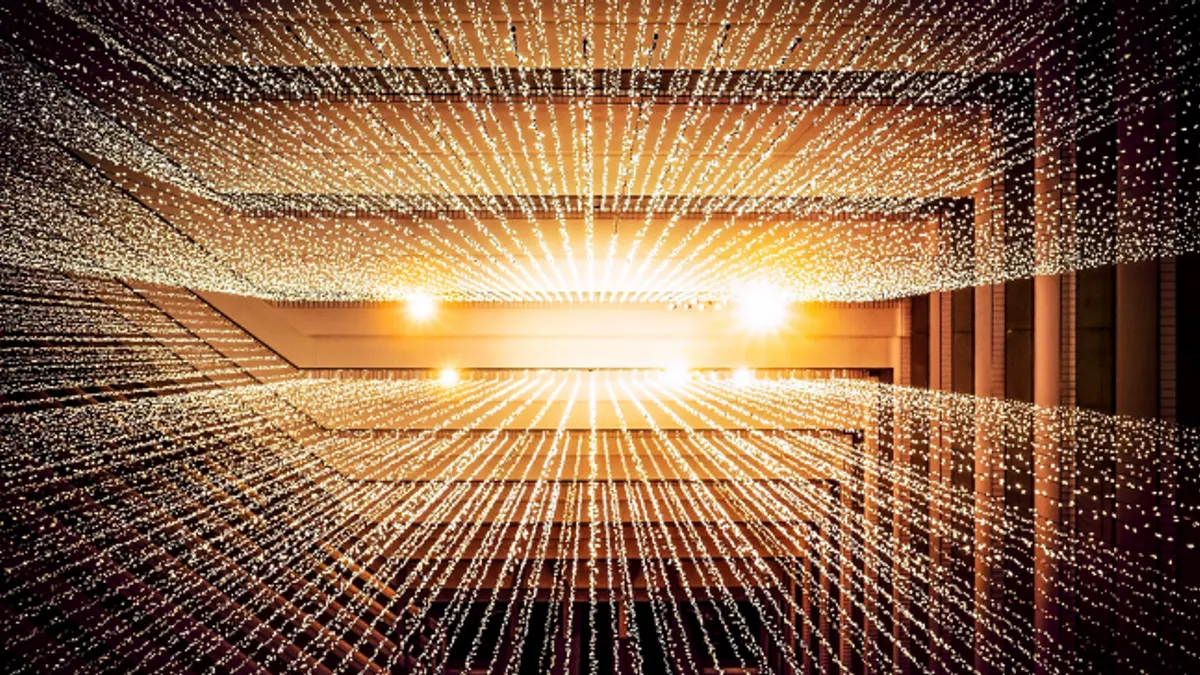

TrendlineArtificial intelligence

Banks are enthusiastic about AI’s promises. But can they get customers on board, and will regulators let the innovation happen?

By Banking Dive staff -

EU to restrict 7 Russian banks from SWIFT

The sanctions reportedly won't include Sberbank, which said Wednesday it would pull out of the European market. The Single Resolution Board is liquidating the lender's Austria-based unit while others have been sold.

By Dan Ennis • March 2, 2022 -

Citi has a $9.8B Russia headache

In the wake of Russia’s invasion of Ukraine, the bank warned investors of exposure that includes loans, securities, funding commitments and cash at the country's central bank.

By Dan Ennis • March 1, 2022 -

Crypto lender BlockFi to pay $100M to settle with SEC, states

The company agreed to stop selling its interest-bearing account in the U.S. and launch a new one tailored to the Securities Act of 1933. Half of the settlement money will go to the SEC. The other $50 million will be split among 32 states.

By Dan Ennis • Feb. 14, 2022 -

House lawmakers spar over stablecoin regulation

"Simply labeling something as stable or overly relying on a one-to-one ratio does not, in itself, mean it maintains a stable value," House Financial Services Committee Chair Maxine Waters, D-CA, said Tuesday.

By Jonathan Berr • Feb. 9, 2022 -

FinCEN proposal would let US banks share SARs with its foreign branches

The pilot program, however, requires banks to submit quarterly reports to the agency, which may reveal internal control deficiencies FinCEN could then share with the bank's regulators.

By Dan Ennis • Jan. 25, 2022 -

Wells Fargo's chief risk officer to retire in June

"Living through a pandemic teaches you things, and I've realized that now is the time to do some things I want and need to do outside of my career," Wells CRO Amanda Norton wrote in a memo Tuesday.

By Robin Bradley • Updated Jan. 19, 2022 -

Santander finds itself in a Citi moment with $175M error

In looking to claw back duplicate payments, Santander may find varying levels of cooperation from other banks. The incident may also prompt regulators to examine the lender's risk management framework and history.

By Dan Ennis • Jan. 5, 2022 -

Morgan Stanley, Capital One's old errors cause new headaches

The banks, collectively, agreed to pay $250 million to settle class-action lawsuits connected to data breaches for which the Office of the Comptroller of the Currency levied penalties in 2020.

By Dan Ennis • Jan. 4, 2022 -

Retrieved from Senate Banking Committee.

Retrieved from Senate Banking Committee.

OCC lays out climate-risk framework, seeks feedback

Many of the agency's "draft principles" are of the 10,000-foot variety, but it still marks a first among federal banking regulators. The OCC said it plans to follow up with more specific guidance next year.

By Dan Ennis • Dec. 17, 2021 -

Crypto execs tout financial inclusion during digital-asset hearing

Circle, for example, aims to funnel "billions of dollars" of USDC dollar-denominated reserves into minority depository institutions to aid underserved communities, CEO Jeremy Allaire told lawmakers Wednesday.

By Anna Hrushka • Dec. 9, 2021 -

Crypto, cybersecurity and climate in focus in OCC risk report

"The OCC is approaching crypto-related activities in the federal banking system very carefully with a high degree of caution and expects its supervised institutions to do the same," the agency said in its report.

By Anna Hrushka • Dec. 7, 2021 -

Senate banking panel chair seeks stablecoin issuer feedback

The complexity of stablecoins makes it difficult for investors and consumers to fully understand their potential risks, Sen. Sherrod Brown, D-OH, said in letters to eight issuers and exchanges, including Coinbase and Tether.

By Anna Hrushka • Nov. 29, 2021 -

Fintechs Blueacorn, Womply added to House panel's PPP probe

A subcommittee focused on COVID-19's impact seeks documents and information on the companies' fraud prevention measures. The panel made similar requests of Kabbage, BlueVine and others in May.

By Dan Ennis • Nov. 24, 2021 -

Bank regulators to roll out crypto guidance in 2022

A two-page report doesn't provide many details regarding how banks should navigate digital assets, but regulators said the industry should expect further guidance throughout the next year.

By Anna Hrushka • Nov. 23, 2021 -

U.S. Bank pledges net-zero emissions by 2050, in a first among regionals

The bank also aims to put $50 billion by 2030 toward financing customers and projects that have a positive environmental impact. It said it is establishing a framework to more clearly track that figure.

By Dan Ennis • Nov. 11, 2021 -

Retrieved from Senate Banking Committee.

Retrieved from Senate Banking Committee.

Bank boards should press execs on climate risk, OCC says

Acting Comptroller Michael Hsu suggested five lines of questioning directors should pursue to boost banks' preparedness.

By Dan Ennis • Nov. 9, 2021 -

Regulators to issue policy on crypto, stablecoins, FDIC chair says

Jelena McWilliams shared details about the interagency "crypto sprint" involving the FDIC, the OCC and the Fed, and said the agencies plan to issue a series of policy statements in the coming months.

By Anna Hrushka • Oct. 26, 2021 -

Sponsored by MX

Reducing fraud with account verification

How fintechs and financial institutions can ensure NACHA requirements with modern financial connectivity solutions.

Oct. 25, 2021 -

SC National Guard. (2018). "180925-Z-XH297-1108" [Photograph]. Retrieved from Flickr.

SC National Guard. (2018). "180925-Z-XH297-1108" [Photograph]. Retrieved from Flickr.

New York Fed researchers design climate stress test for banks

The paper defines what it calls CRISK — the expected capital shortfall of a financial institution in a climate stress scenario — a measure that rose significantly in 2020.

By Robin Bradley • Sept. 27, 2021 -

Coinbase scraps crypto lending product under fire from SEC

The company is also discontinuing its waitlist for Lend, a product that would have let users earn 4% interest by lending their holdings of a stablecoin to other customers.

By Dan Ennis • Sept. 21, 2021 -

JPMorgan Chase glitch let customers see other users' data

The breach, which lasted from May 24 to July 14, appears to have limited reach — seven customers in Montana, for example — although no details were available regarding potential impact in other states, or elsewhere.

By Dan Ennis • Aug. 23, 2021 -

Column

Stablecoin meeting's focus finally comes to light

Tether and Diem were reportedly the focus of last week's "act-quickly" directive. The Justice Department is allegedly probing whether executives behind Tether hid from banks that transactions were linked to cryptocurrency.

By Dan Ennis • July 28, 2021 -

Sen. Cory Booker clarifies SAFE Banking Act support

"For me, a good bipartisan bill like the [SAFE] banking bill is a necessary sweetener to get people to move along on the equitable justice elements that are really critical," he said.

By Anna Hrushka • July 27, 2021