Risk

-

Climate alliance to cease operations, abandon membership model

The Net-Zero Banking Alliance becomes the second United Nations climate-aligned industry group to suspend operations in 2025.

By Lamar Johnson • Oct. 3, 2025 -

2026 banking conference roundup

Gatherings can be idea generators, or crucial chances to network — especially amid an environment where political change can yield previously unexpected possibilities and partnerships.

By Dan Ennis • Oct. 1, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Permission granted by Frost Bank

Permission granted by Frost Bank Trendline

TrendlineTop 5 stories from Banking Dive

Since the approval of Capital One’s acquisition of Discover, banks have increasingly waded into new deals. Beyond that, they’ve doubled down on strategy, from organic growth to branch placement to app design.

By Banking Dive staff -

NYDFS’ Adrienne Harris to step down

Kaitlin Asrow, who leads the regulator’s research and innovation division and previously was a senior fintech policy adviser at the San Francisco Fed, will serve as the state agency’s acting superintendent starting Oct. 18.

By Dan Ennis • Sept. 30, 2025 -

"Royal Bank of Canada's global headquarters at 200 Bay Street in Toronto, Canada" by Francisco Diez is licensed under CC BY 2.0

"Royal Bank of Canada's global headquarters at 200 Bay Street in Toronto, Canada" by Francisco Diez is licensed under CC BY 2.0

Ex-RBC employee accessed prime minister’s banking profile: police

Ibrahim El-Hakim faces fraud and identity theft charges after a bank camera caught him allegedly working to create banking profiles and obtain lines of credit in the name of public figures.

By Dan Ennis • Sept. 25, 2025 -

FinWise faces court action over data breach affecting 689K users

Plaintiffs argue the Utah bank and a fintech partner kept data unencrypted. A former employee accessed the data, but FinWise said it didn’t discover the breach until a year later.

By Dan Ennis • Sept. 24, 2025 -

Comerica names next risk chief

Kristina Janssens, a nine-year Flagstar veteran, had been Comerica’s chief compliance officer since 2023. Her predecessor in the risk role left for USAA in May.

By Dan Ennis • Sept. 22, 2025 -

NYDFS wants crypto-curious banks to use blockchain analytics tools

The tools can help when banks evaluate exposure to money laundering and sanctions activity or consider the risks associated with offering a particular crypto product, the regulator said.

By Caitlin Mullen • Sept. 18, 2025 -

Retrieved from Ally on July 23, 2025

Retrieved from Ally on July 23, 2025 Q&A

Q&AAlly CIO: Pace of tech change ‘weighs on me’

Sathish Muthukrishnan, the bank’s chief information, data and digital officer, shared what’s surprised him about the use of Ally’s AI platform and the challenges of keeping up with rapid tech evolution.

By Caitlin Mullen • Sept. 17, 2025 -

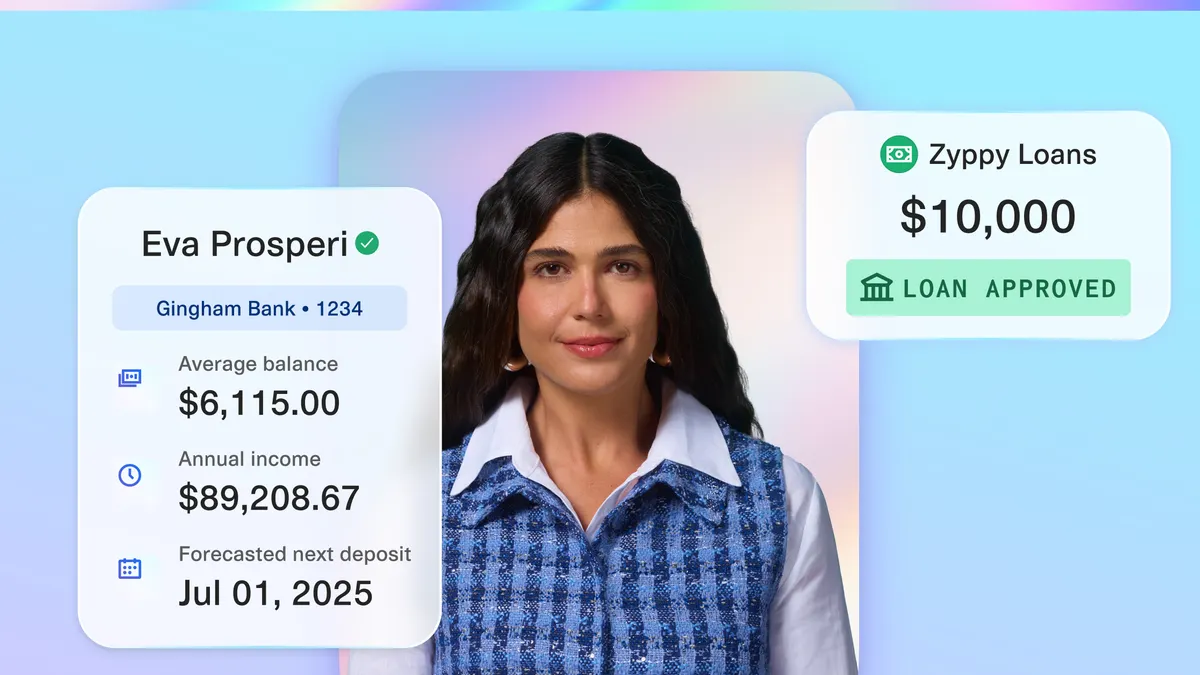

Sponsored by Plaid

Transforming the full lending lifecycle with cash flow insights

Unlock smarter, faster, more inclusive lending, powered by real-time cash flow insights.

By Michelle Young, Allison Milton • Sept. 15, 2025 -

Zions CEO eyes acquisition opportunities

The $89 billion-asset regional is “a really good partner” for small banks that “are going to be looking for a home,” its CEO said this week.

By Caitlin Mullen • Sept. 12, 2025 -

Merger with Synovus isn’t ‘Truist 2.0,’ Pinnacle CEO says

The CEOs of Pinnacle and Synovus sought to assure investors that they learned from other recent mergers of equals and sorted out a number of decisions early on.

By Caitlin Mullen • Sept. 11, 2025 -

Deutsche Bank doubles down on net-zero commitment

In an updated transition plan, the German lender said it will uphold its climate targets as they are “part of a prudent risk management practice as well as a business opportunity.”

By Zoya Mirza • Sept. 5, 2025 -

Morgan Stanley wants Fed to lower its stress capital buffer

The request comes a year after Goldman Sachs successfully petitioned the central bank to reduce its stress capital buffer.

By Caitlin Mullen • Sept. 2, 2025 -

Celtic Bank ‘fueled’ Ponzi scheme, lawsuit alleges

A group of investors is accusing the Utah-based lender of conspiracy to defraud and racketeering in connection with what the Justice Department has labeled a $200 million water vending machine scheme.

By Caitlin Mullen • Aug. 28, 2025 -

CFPB proposes trimming its nonbank purview

A rule proposed Tuesday would restrict the bureau’s ability to supervise nonbanks. The agency aims to adopt a binding, standardized definition of “risks to consumers” that would make enforcement consistent, it said.

By Caitlin Mullen • Aug. 26, 2025 -

Q&A

Debanking debate damages regulator, bank confidence, professor warns

To confront the debanking issue, the dean of the law college at the University of Wyoming suggests reforms that tackle regulatory discretion and secrecy.

By Caitlin Mullen • Aug. 25, 2025 -

JPMorgan to pay $330M to settle 1MDB claims

Swiss authorities, in a connected case, fined the bank $3.7 million after the lender was found guilty of failing to prevent aggravated money laundering.

By Dan Ennis • Aug. 22, 2025 -

Customers CEO talks lessons learned from Fed enforcement action

After investing to strengthen its risk management practices, the Pennsylvania bank now seeks to jump on the favorable atmosphere for digital-asset activities.

By Caitlin Mullen • Aug. 21, 2025 -

GOP lawmaker seeks probe into StanChart sanctions case

Rep. Elise Stefanik, R-NY, urged U.S. Attorney General Pam Bondi to launch an investigation into Standard Chartered Bank’s “illicit payments” and related “inaction” from New York’s attorney general.

By Caitlin Mullen • Aug. 18, 2025 -

Column

Dive Deposits: Goldman’s CEO, chief economist and even Steve Mnuchin face Trump barbs

The president blasted David Solomon (and his erstwhile DJ side gig) in a social post Tuesday, suggesting he fire a top analyst at the bank. Trump also teased legal action against Fed Chair Jerome Powell.

By Dan Ennis • Aug. 13, 2025 -

PNC picks next risk chief from within

Amy Wierenga will succeed Kieran Fallon next month as the Pittsburgh-based lender’s chief risk officer, and Fallon will return to the bank’s legal department.

By Caitlin Mullen • Aug. 12, 2025 -

CFPB moves to hold Synapse accountable for missing customer funds

The CFPB alleged the now-bankrupt Synapse failed to maintain adequate records of consumers’ funds and match them with its partner banks, leading to an unrecovered loss of $60 million to $90 million.

By Rajashree Chakravarty • Aug. 11, 2025 -

Warren urges Fed to activate countercyclical capital buffer

The Fed has never activated the framework, which would force banks to add a capital cushion. Sen. Elizabeth Warren thinks it’s time to do so – and is asking why the central bank has not voted on the measure in five years.

By Gabrielle Saulsbery • Aug. 11, 2025 -

Paxos to pay $48.5M over AML, due-diligence failures

Some of the charges stem from the stablecoin issuer’s relationship with Binance. The agreement includes a $22 million investment in Paxos’ compliance program and a $26.5 million payment to New York’s Department of Financial Services.

By Gabrielle Saulsbery • Aug. 7, 2025 -

Florida’s BayFirst sheds 51 jobs, shutters SBA loan platform

The bank’s COO called out older, smaller loans as a trouble spot. BayFirst counted $1.5 million in first-half losses and expects to take a third-quarter restructuring charge. It’s also suspending dividend payouts.

By Dan Ennis • Aug. 6, 2025