Retail: Page 56

-

Q&A

Mastercard deal brings Finicity to global stage, CEO says

"The days of the walled garden approach to data sitting at a bank, only good for the bank and not so much good for the consumer, are over with the advent of open banking," Finicity CEO Steve Smith told Banking Dive.

By Anna Hrushka • July 17, 2020 -

Truist reports $958M Q2 profit as pandemic speeds cost savings timeline

CFO Daryl Bible said the bank can achieve 40% of its goal by the fourth quarter this year rather than 30%.

By Anna Hrushka • July 16, 2020 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Bank of America's Q2 profit falls 52% despite fixed-income trading swell

The bank set aside $5.1 billion during the quarter — less than half JPMorgan Chase's figure — sparking questions as to whether it reserved enough.

By Dan Ennis • July 16, 2020 -

BlackRock sale boosts PNC's Q2 profit to $3.7B

PNC's CEO said the company still plans to pursue "bank-like acquisitions" with the capital gained from the BlackRock sale, and is reevaluating its branch strategy in light of changing customer behavior.

By Anna Hrushka • July 15, 2020 -

Truist settles trademark suit with North Carolina credit union

The bank divulged in a May court document that it would cost $34 million — and take six to nine months and a shareholder vote — to change its name again.

By Dan Ennis • July 15, 2020 -

U.S. Bank sees 62% drop in net income despite loan, deposit growth

The second quarter marked the first full three-month span to show the pandemic's impact. But also, the bank, more than most, felt reverberations from the May 25 killing of George Floyd in its hometown, Minneapolis.

By Dan Ennis • July 15, 2020 -

JPMorgan profit drops 51% as bank braces for loan losses

Record trading revenue from the bank's investment arm, however, helped minimize balance sheet impact from COVID-19.

By Anna Hrushka • July 14, 2020 -

Citi profit falls 73% as bank sets aside $7.9B over loan concerns

A 68% jump in fixed-income trading balanced out a 24% drop in credit card spending for the world's largest card issuer.

By Dan Ennis • July 14, 2020 -

Wells Fargo CEO wants to slash $10B from bank's costs

Cutting consultancies could save the bank $1 billion to $1.5 billion per year. "The things that we rely on outside people to do is beyond anything that I've ever seen," CEO Charlie Scharf said.

By Dan Ennis • Updated Aug. 6, 2020 -

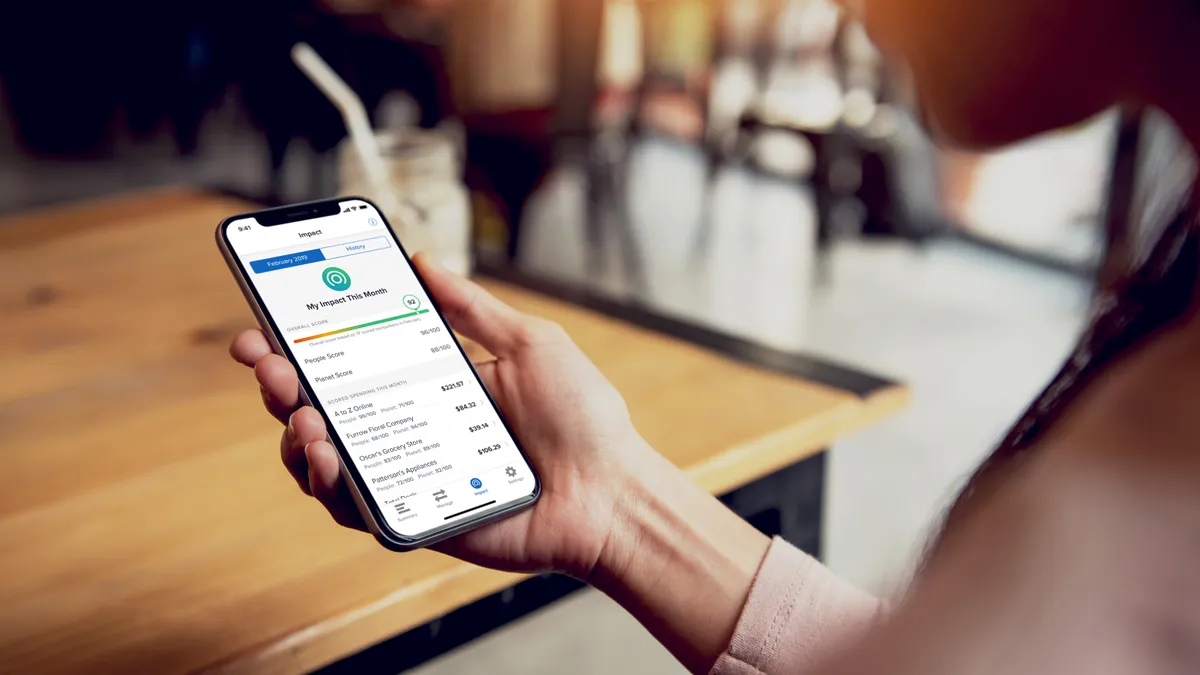

Aspiration CEO banks on customers' social conscience

The bank allows debit card customers to round up purchases to the nearest dollar in an initiative that plants trees. But are consumers less apt to be green amid COVID? Not in the least, CEO Andrei Cherny says.

By Anna Hrushka • July 14, 2020 -

Don't use coronavirus as excuse to close branches, OCC says

Some industry observers have questioned the future of bank branches in light of the pandemic, as customers grow accustomed to digital channels and banks rethink the viability of brick and mortar amid a recession.

By Anna Hrushka • July 13, 2020 -

JPMorgan, Bank of America, Wells Fargo, Goldman Sachs back launch of climate finance center

Banks are increasingly seeing the value — not just in optics but in revenue — of environmentally responsible investment.

By Dan Ennis • July 10, 2020 -

SoFi files for national bank charter with OCC

A national charter would let SoFi operate under a unified set of national regulations instead of the "patchwork of varying requirements" it follows to comply with regulations across 50 states, the company said.

By Anna Hrushka • July 10, 2020 -

Wells Fargo donates $400M in PPP fees to help Black-owned businesses

A June report from the National Bureau of Economic Research found COVID-related conditions eliminated 41% of Black small-business owners between February and April.

By Dan Ennis • July 9, 2020 -

Q&A

KeyBank's digital strategy: Let the client choose

The Cleveland-based bank has spent the past decade strategizing how it can digitize its products to provide remote self-service capabilities for its clients while maintaining in-person options.

By Anna Hrushka • July 7, 2020 -

Column

German banks are having a moment right now

The proposed resignations of Commerzbank's CEO and board chairman come little more than a week after the collapse of the country's biggest challenger bank and amid restructuring by its largest lender.

By Dan Ennis • Updated Aug. 4, 2020 -

Investment company Edward Jones files for ILC charter

"Given market conditions, we believe the need for enhancements to our financial services is more important than ever to our clients as they look to reach their financial goals," Edward Jones Principal Ken Cella said.

By Anna Hrushka • July 6, 2020 -

Citi survey asks workers if they'd like to return Oct. 5

The bank would cap office presence at 30%, a source told Bloomberg. The questionnaire also asks employees to give a general reason why they're staying home, so the bank can offer potential solutions.

By Dan Ennis • Updated Sept. 10, 2020 -

BBVA brings 'banker bar' to new branches in Texas expansion

The bank seeks to do away with the traditional teller role, replacing it with an employee who can onboard customers to digital channels and originate accounts.

By Anna Hrushka • July 1, 2020 -

(2020). "Holding Wells Fargo Accountable: CEO Perspectives on Next Steps for the Bank that Broke America’s Trust". Retrieved from https://www.youtube.com/watch?v=Sf5D9BprcXg&feature=youtu.be.

(2020). "Holding Wells Fargo Accountable: CEO Perspectives on Next Steps for the Bank that Broke America’s Trust". Retrieved from https://www.youtube.com/watch?v=Sf5D9BprcXg&feature=youtu.be.

Wells Fargo cuts dividend to level it will reveal July 14

Most other big banks will keep their third-quarter shareholder payouts consistent with second-quarter figures, including Goldman Sachs, which the Fed says must maintain a 6.7% stress capital buffer.

By Dan Ennis • June 30, 2020 -

Bank profitability at risk as pandemic slows economy, OCC says

Financial institutions are beginning to see the adverse credit effects of the economic shock brought on by the pandemic, according to the regulator's semiannual report.

By Anna Hrushka • June 30, 2020 -

Inside Ally Financial's technology strategy

The company needs to operate at a speed it hasn't before, Ally's technology chief said. In the next three to five years, digital capabilities will "stop being exotic," PwC has said.

By Naomi Eide • June 30, 2020 -

JPMorgan cites 'technical issue' over incorrect customer balances

The bank's customers took to Twitter to report money unexpectedly missing or appearing in their accounts using the #ChaseBank hashtag.

By Anna Hrushka • June 29, 2020 -

Ally, CardWorks terminate $2.7B merger over pandemic concerns

The deal fell through less than a year after Ally dropped a three-year partnership with TD Bank and refocused on point-of-sale loans. The coronavirus has scuttled, delayed and disrupted several proposed tie-ups.

By Dan Ennis • June 25, 2020 -

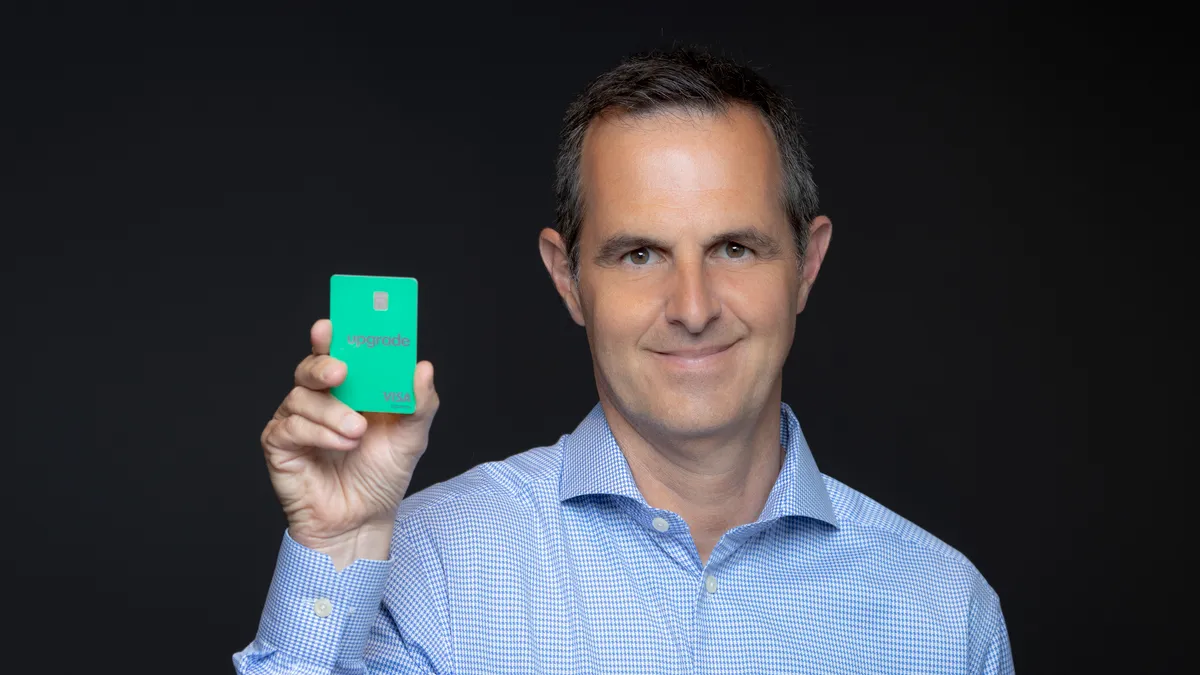

How Upgrade plans to use its latest $40M investment

Upgrade's latest funding round boosts the startup's valuation to $1 billion, giving it "unicorn" status alongside other neobanks such as Chime, Dave, Monzo, Revolut, N26 and NuBank.

By Anna Hrushka • June 25, 2020