Retail: Page 54

-

Values-based Climate First Bank seeks Florida de novo charter

"I wanted to do something that would give back and not just make a bunch of people a bunch of money again, even though I have no opposition to that," said founder Ken LaRoe. "I just wanted there to be more meaning to life than that."

By Anna Hrushka • Oct. 9, 2020 -

JPMorgan Chase pledges $30B to fight racial wealth gap

The bank said it would spend $8 billion to originate 40,000 mortgages for Black and Latinx households over the next five years, and provide $14 billion in loans and investments to create 100,000 affordable rental units.

By Anna Hrushka • Oct. 8, 2020 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

How Bank of America's decentralized innovation approach conceives the future

The bank doesn't have a dedicated budget for its patent projects, but it relies on more than 5,600 inventors based in 42 states and 12 countries — and a philosophy that innovation is "part of everyone's job."

By Anna Hrushka • Oct. 7, 2020 -

E-commerce boom fuels Citizens Bank's point-of-sale lending activity

As fintechs expand their offerings, the Rhode Island-based lender is differentiating through big-ticket purchases and giving merchants flexibility with its products and pricing.

By Suman Bhattacharyya • Oct. 6, 2020 -

Sen. Warren asks Fed to weigh Wells Fargo's mortgage missteps in asset cap evaluation

Of the 904 accounts for which forbearance was not requested, 344 told the bank they did not want the help, Warren indicated to the central bank.

By Dan Ennis • Oct. 5, 2020 -

Bank of America invests in 7 minority-owned institutions

The investments, which are part of a $50 million commitment to MDIs and CDFIs, will go toward lending, housing, neighborhood revitalization and other banking services.

By Anna Hrushka • Oct. 5, 2020 -

Varo turns focus to new products after national charter milestone

The launch of the Varo Bank app, which the company says is imminent, will free up resources and energy to "pivot on to the customer," Chief Risk Officer Philippa Girling said.

By Anna Hrushka • Oct. 2, 2020 -

As Goldman, JPMorgan resume cuts, Bank of America reiterates no-layoff vow

Brian Moynihan, the CEO of the nation's second-largest bank, touted the Charlotte, N.C.-based lender's progress on diversity Thursday in perhaps a direct counter to comments that put Wells Fargo chief Charlie Scharf in hot water.

By Dan Ennis • Updated Oct. 2, 2020 -

Goldman leadership shuffle puts woman atop consumer division

Stephanie Cohen will co-lead a combined consumer and wealth management silo, the bank said Tuesday, following a restructuring CEO David Solomon set up in January. Leadership also changed at the bank's Marcus brand.

By Dan Ennis • Updated Sept. 30, 2020 -

Citi taps Morgan Stanley exec as new controller, accounting chief

The bank's latest executive hire comes as it tries to improve its risk management and controls, and follows reports that regulators have been pushing the bank for years to make such improvements.

By Anna Hrushka • Sept. 28, 2020 -

Commerzbank names next CEO, months after investor unrest

Germany's second-largest lender poached an executive from rival Deutsche with a reputation as a shrewd cost cutter, in an attempt to right a bank whose shares have lost half their value in the past 18 months.

By Dan Ennis • Sept. 28, 2020 -

How Citi's innovation lab is tackling COVID-19 challenges

The unit, for example, built a digital whiteboarding solution to help job candidates and managers interact through an on-screen notebook when interviews can't take place face to face.

By Anna Hrushka • Sept. 23, 2020 -

Pittsburgh becomes a battleground for national banking powerhouses

While JPMorgan and Bank of America expand their footprint into PNC's backyard, smaller banks say they maintain a customer relationship advantage. Though, with technology, that may wane, an analyst says.

By Ken McCarthy • Sept. 21, 2020 -

At $14.5B, Chime surpasses Robinhood as top-valued fintech

The challenger bank has more than tripled its transaction volume and revenue this year and is adding hundreds of thousands of accounts each month, CEO Chris Britt told CNBC.

By Dan Ennis • Sept. 21, 2020 -

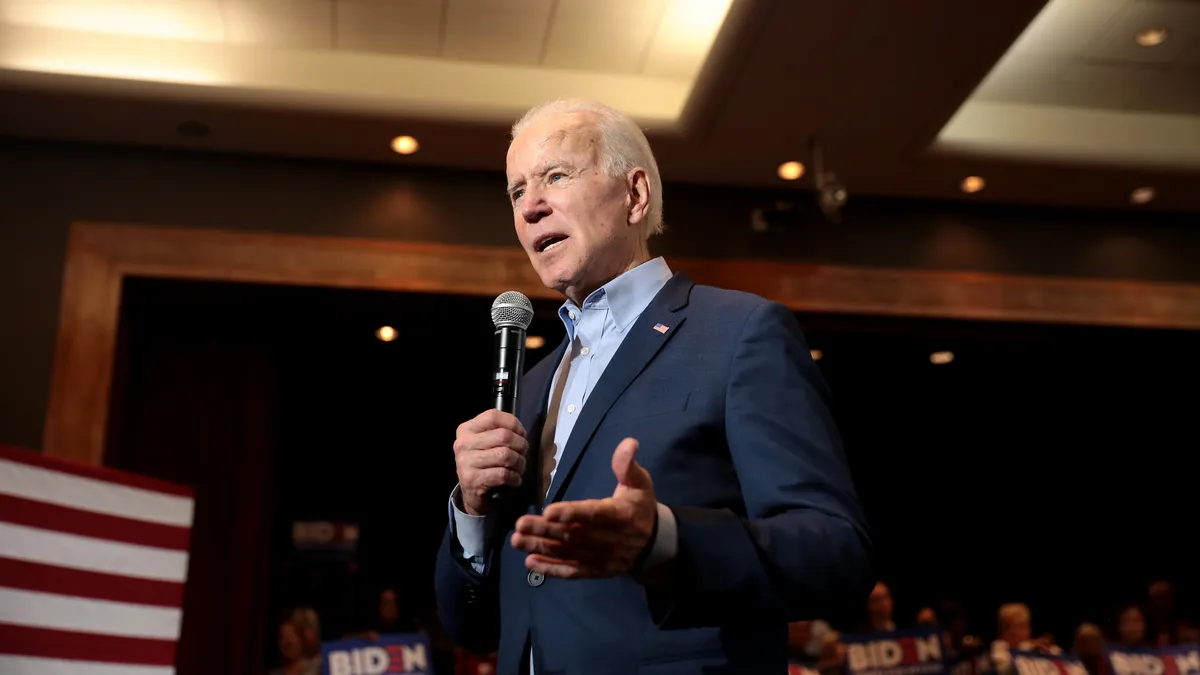

Biden tax plan could cost top 10 banks $7B per year, report finds

The plan would raise the corporate tax rate from 21% to 28%, partially rolling back changes enacted under the 2017 Tax Cuts and Jobs Act.

By Anna Hrushka • Sept. 17, 2020 -

Deutsche extends remote option until July 2021 for NY-area employees

The bank laid out a tiered approach in calling its U.S. investment bankers back to the office. Risk takers "involved in committing the firm's capital" will likely return full time "Client-facing" staff can work remotely one day a week.

By Dan Ennis • Updated June 3, 2021 -

PNC looks to shutter 280 branches by the end of next year

The bank is on track to double the number of closures it expected this year, thanks to the pandemic. But the Pittsburgh-based lender has been in the "consolidation business" for some time, executives have said.

By Dan Ennis • Sept. 16, 2020 -

Neobank Unifimoney partners with DriveWealth to offer investing services

The San Francisco-based startup, which describes itself as a neobank for affluent millennials, is the latest fintech to use automation to help customers save and invest money.

By Anna Hrushka • Sept. 16, 2020 -

Citi's Fraser paves the way, but more needs to be done, experts say

Banks need to do more than just hope that female leadership will create a "trickle-down" effect on organizational culture, one consultant said.

By Anna Hrushka • Sept. 14, 2020 -

Citi taps Jane Fraser to be CEO when Corbat retires in February

Fraser will become the first woman to lead a major U.S. bank. Before stepping into Citi's No. 2 role last October, she served as CEO of the bank's Latin American operations.

By Anna Hrushka • Sept. 10, 2020 -

Fintech Jiko gains national charter by buying Minnesota community bank

"Without a license, we would be just another fintech amongst many others," founder and former Goldman Sachs trader Stephane Lintner said. "We decided to buy a bank because it felt better for us, given what we wanted to do."

By Anna Hrushka • Sept. 4, 2020 -

Stash sees sign-ups, deposits swell as customers shift into 'save' mode

The personal-finance fintech looks to build a digital community around its investing roots, arranging weekly fractional-share giveaways.

By Suman Bhattacharyya • Sept. 4, 2020 -

Wells Fargo fast-tracks launch of no-overdraft-fee bank account

The account could be an attempt to show the public the bank is implementing positive change in a practice often criticized by lawmakers and consumer groups.

By Anna Hrushka • Sept. 2, 2020 -

Inside Northern Trust's $2.5B tech investment

"We see a huge amount of fairly inefficient [processes], especially when you compare it to our personal lives where we are logging into apps and moving money instantaneously," said one exec. "We get about 20,000 faxes a month on trade instructions."

By Suman Bhattacharyya • Sept. 2, 2020 -

How MoCaFi brings banking to Black and Brown communities

"I had my 'George Floyd' moment," CEO Wole Coaxum said of Michael Brown's death in 2014. "I was one of the most senior African Americans at JPMorgan and felt that I wanted to be a part of a national conversation to address the lack of access to financial services products."

By Anna Hrushka • Sept. 1, 2020