Retail: Page 50

-

Digital bank Ando promises transparent green investments

Ando invests customers' dollars in sustainable infrastructure and regenerative agriculture, and says every $175 held in its account reduces carbon output equivalent to the work of one mature tree.

By Anna Hrushka • Feb. 10, 2021 -

Column

A cognitive dissonance in bonus pay

Bank of America walked back "cliff vesting" for its investment bankers but left it in place for others. Even if the bank keeps its bonus pool level, it's still far more lucrative than some in the U.K.

By Dan Ennis • Feb. 8, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

N26 doubles down on US in overseas growth plan

The German neobank looks to grow its U.S. employee base by 75% and is considering offering its stateside users subscription bundles, as it does in Europe.

By Suman Bhattacharyya • Feb. 4, 2021 -

Opinion

The way we look at brokered deposits for banks is broken

A bank that predominantly holds traditional core deposits is susceptible to a "bank run," whereas one funded primarily by brokered CD deposits is not. That's because these deposits have precise maturity dates.

By Charlie Knadler • Feb. 4, 2021 -

Navy Federal Credit Union continues branch expansion as banks scale back

"While the self-service capabilities ... work well to meet a lot of [military members'] fundamental needs, there's still ... a need for them to be able to walk into a branch and get some financial guidance," a credit union executive said.

By Anna Hrushka • Feb. 3, 2021 -

Gemini launches crypto-based savings product offering up to 7.4% yield

Gemini said it can pay such high rates because it lends to institutional borrowers through a partner, but that puts it largely outside the regulatory sphere — leaving customers assuming considerably more risk.

By Dan Ennis • Feb. 3, 2021 -

Neobank Dave taps former Apple Card exec to expand product suite

Chief Commercial Officer Jarad Fisher will be responsible for Dave's core business operations and performance, including Dave Banking, which rolled out to a waitlist of 2 million people last summer.

By Anna Hrushka • Feb. 2, 2021 -

Startup Paybby buys neobank Wicket to fast-track Black banking

Founder Hassan Miah said he plans to add overdraft protection, free retailer cash deposits, payments, transfers, check cashing, payday loan advances and consumer lending to the platform.

By Anna Hrushka • Feb. 1, 2021 -

(2020). "Holding Wells Fargo Accountable: CEO Perspectives on Next Steps for the Bank that Broke America’s Trust". Retrieved from https://www.youtube.com/watch?v=Sf5D9BprcXg&feature=youtu.be.

(2020). "Holding Wells Fargo Accountable: CEO Perspectives on Next Steps for the Bank that Broke America’s Trust". Retrieved from https://www.youtube.com/watch?v=Sf5D9BprcXg&feature=youtu.be.

Wells Fargo CEO Scharf sees 12% cut in compensation to $20.3M

Beyond financial performance, Wells' board weighed the bank's liquidity throughout the pandemic, its progress on enforcement actions and Scharf's introduction of new diversity goals.

By Dan Ennis • Feb. 1, 2021 -

Plaid launches tool to help banks, fintechs compete for direct deposits

The product, still in beta, is meant to combat the friction associated with manually changing the destination of a direct deposit, which can prevent customers from designating a new banking relationship as their primary one.

By Anna Hrushka • Jan. 29, 2021 -

Column

The game that matured Robinhood

In temporarily halting trades in GameStop stock and leaning into its investors for a $3.4 billion infusion, the company finds itself in the grown-up position of saying no to an upstart movement.

By Dan Ennis • Updated Feb. 1, 2021 -

JPMorgan acknowledges UK digital bank rollout plan

The bank has been testing its mobile checking account offering among a small group of people and plans to pilot it with some U.K.-based employees and their families and friends in the next few weeks, Bloomberg reported.

By Dan Ennis • Jan. 28, 2021 -

Black- and Latinx-focused digital bank Greenwood hits 500K signups in 100 days

"We see that there is definitely an appetite for what we're doing," said Ryan Glover, who founded the startup with civil rights leader Andrew Young and rapper Killer Mike. Glover said the platform could launch in May or June.

By Anna Hrushka • Jan. 26, 2021 -

Raisin patents 'savings-as-a-service' technology as it moves on US market

The 9-year-old fintech this month was awarded a patent for technology enabling banks to offer a "liquidity time deposit" CD product that allows the depositor to select and plan a distribution schedule.

By Suman Bhattacharyya • Jan. 25, 2021 -

Deep Dive

What’s in store for challenger banks in 2021?

As the challenger bank market continues to attract venture capital, new users and even celebrity endorsements, how will the momentum and hype surrounding this new way to bank continue into 2021?

By Anna Hrushka • Jan. 25, 2021 -

KeyBank aims to launch digital bank for doctors in March

"Think about a digital company that refinances student loans for doctors and dentists that are accredited, employed, have an average salary of about $200,000 per year," CEO Chris Gorman said. "These are great clients to get."

By Anna Hrushka • Jan. 22, 2021 -

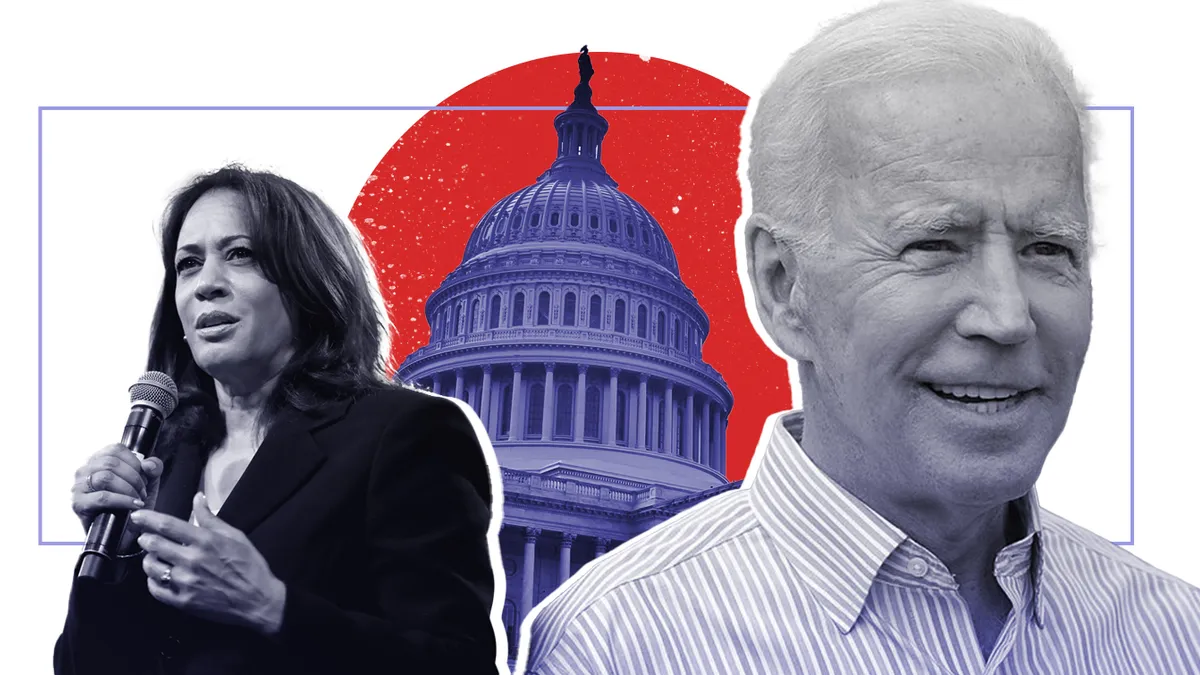

Alternative credit data, fair lending may take focus under Biden

Among his first actions as president, Joe Biden signed an executive order to extend the pause on student loan payments through Sept. 30.

By Anna Hrushka • Jan. 21, 2021 -

Truist reports Q4 profit, continues merger-related job cuts, branch closures

The bank eliminated 1,307 positions during the fourth quarter. It said it closed 149 branches in 2020 and plans to shutter more than 400 this year.

By Anna Hrushka • Jan. 21, 2021 -

Deep Dive

4 banking trends to watch in 2021

Banking Dive expects M&A to pivot toward niches, race to be a continuing focus of ESG, and crypto to have a make-or-break year in 2021.

By Dan Ennis , Anna Hrushka • Jan. 20, 2021 -

U.S. Bank hangs on to loan loss reserves, reports slight Q4 profit

The bank completed its branch consolidation project this month, closing nearly 25% of its brick-and-mortar locations, it said.

By Anna Hrushka • Jan. 20, 2021 -

Bank of America year-over-year profits drop nearly 22% in Q4

Net interest income and revenue, especially in consumer banking, saw double-digit percentage-point drops. But deposits jumped 23% and investment banking fees climbed 26%.

By Dan Ennis • Jan. 19, 2021 -

Plaid sees 'opportunity' after $5.3B Visa deal ends

The data aggregator's biggest priority now is getting 75% of its traffic dedicated to application programming interfaces by the end of 2021 — a prospect John Pitts, Plaid's head of policy, calls an "immense challenge."

By Anna Hrushka • Jan. 19, 2021 -

JPMorgan net income jumps 42% YoY over trading revenue, lower credit reserves

The bank said it plans to add an extra $900 million to its $11 billion technology budget in 2021 and to expand its branch presence to 48 states by midyear.

By Anna Hrushka • Jan. 15, 2021 -

Citi's net income jumps 44% in Q4 over previous quarter

The bank released $1.5 billion in credit loss reserves, after setting aside $436 million in the third quarter and $253 million a year ago.

By Suman Bhattacharyya • Jan. 15, 2021 -

PNC sees 6% jump in Q4 net income ahead of BBVA acquisition

Deposits at the Pittsburgh-based lender grew 25% year over year.

By Robert Freedman • Jan. 15, 2021