Retail: Page 36

-

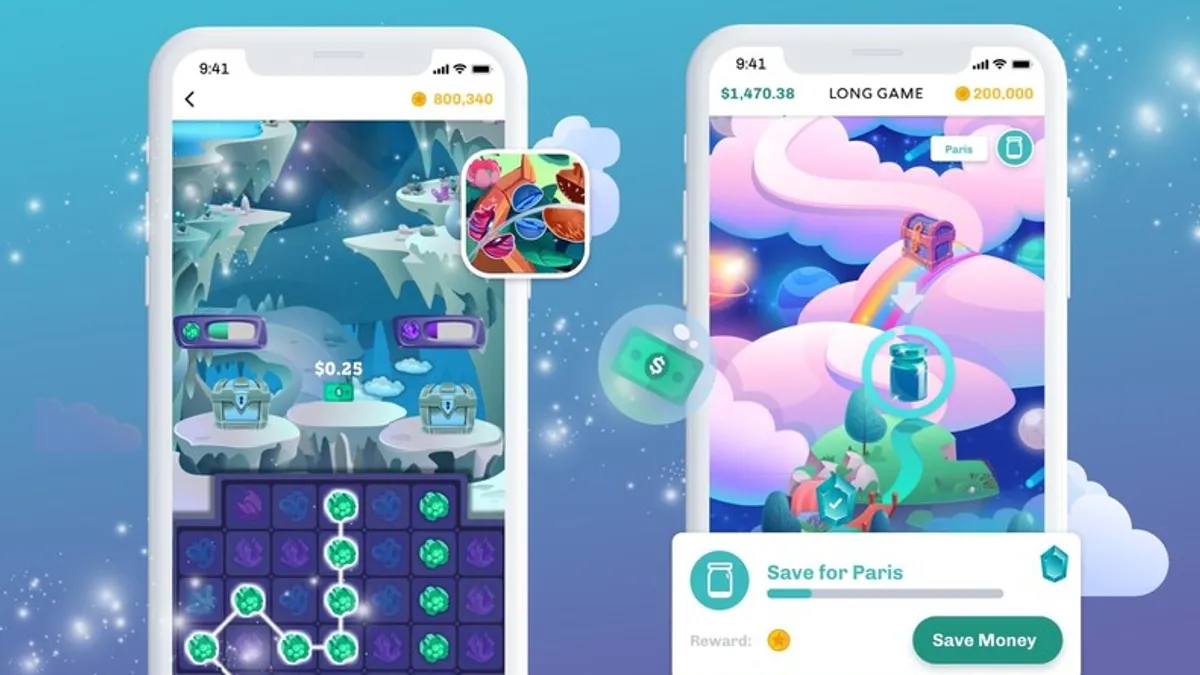

Truist buys gamified finance app Long Game

Long Game, which uses prize-linked games to encourage smart financial habits, aims to help banks and credit unions with client retention and account growth, particularly among Gen Z and millennial customers.

By Anna Hrushka • May 3, 2022 -

U.S. Bank rolls out Spanish-language voice assistant for mobile app

The Minneapolis lender cites a study indicating 25% of Hispanic Americans are "smartphone-only" internet users — double the proportion of White adults.

By Robin Bradley • May 2, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

First Century Bank scraps First Internet deal

The Federal Reserve signed off on the combination April 29, but the banks couldn't close the tie-up by an April 30 deadline because of statutory waiting periods, and could not agree on extension terms, First Internet said.

By Dan Ennis • May 2, 2022 -

KeyBank to cut overdraft charge to $20, eliminate NSF fees

The bank also will cut — from five to three — the maximum number of times per day a customer can be charged an overdraft fee. It is also instituting a $20 negative account balance threshold.

By Robin Bradley • April 29, 2022 -

Frost Bank: 'Build over buy' expansion plan is paying off

The San Antonio-based bank opened 25 branches in Houston over the past four years, and is in the midst of a similar expansion in Dallas, where next quarter it plans to open its third of 28 new locations.

By Anna Hrushka • April 29, 2022 -

Wisconsin credit union targets Illinois bank in 6th such tie-up of 2022

Financial terms of CoVantage Credit Union's proposed acquisition of LincolnWay Community Bank were not disclosed. The deal is expected to close in the fourth quarter.

By Robin Bradley • April 28, 2022 -

TD Bank targets South Florida tech talent pool

The Toronto-based lender on Tuesday announced the launch of a hub in Fort Lauderdale, adding it intends to hire 200 tech workers in the area over the next two years.

By Anna Hrushka • April 26, 2022 -

Wells Fargo starts layoffs in home lending unit

The bank did not put a number to the job cuts. Wells Fargo saw a 33% year-over-year decrease in mortgage origination volume. Interest rates accompanying 30-year fixed mortgages have climbed to a 12-year high.

By Dan Ennis • April 25, 2022 -

Goldman Sachs expands Marcus checking account beta tests to all US-based employees

The bank is expected to release the product to the public this year. The fee-free accounts will include a physical debit card and offer a competitive interest rate, but a Goldman spokesperson did not detail the specific rate.

By Robin Bradley • April 22, 2022 -

Bank of America wants its cards made of 80% recycled plastic by 2023

The bank estimates it will produce 235 fewer tons of single-use plastics with the transition.

By Robin Bradley • April 21, 2022 -

Patterson, Richard. Retrieved from Flickr.

Patterson, Richard. Retrieved from Flickr.

Banks face 'tight deadline' under new cyber notification rule

The May 1 cutoff to comply with the rule comes as the Biden administration has warned U.S. businesses about the increasing risk of Russian cyberattacks.

By Anna Hrushka • April 21, 2022 -

:Weatherman1126. (2007). "Logo of The Goldman Sachs Group, Inc." [Image]. Retrieved from Wikipedia Commons.

:Weatherman1126. (2007). "Logo of The Goldman Sachs Group, Inc." [Image]. Retrieved from Wikipedia Commons.

Marcus brand, marketing exec leaves to join real estate investment startup

Dustin Cohn, who has taken at least partial credit in naming Goldman Sachs' consumer arm, said the departure — to become chief marketing officer at Cadre — was "completely amicable."

By Dan Ennis • April 20, 2022 -

CFPB focuses on rural banking access

Rural Americans visit bank branches nearly twice as often as urban and suburban customers, yet are more likely to be in a banking desert, generally have less internet access and submit fewer complaints on the agency's portal.

By Anna Hrushka • April 20, 2022 -

USAA revamps mobile app

With a new predictive search function, users can transact with fewer taps, said the company, which also reduced load times and added fingerprint, face and voice recognition log-in capabilities.

By Robin Bradley • April 19, 2022 -

Truist posts flat Q1 profit, completes transition to 'one brand'

The bank completed its largest merger-related conversion during the quarter, transitioning nearly 7 million customers to the Truist ecosystem and rebranding more than 6,000 branches and ATMs, CEO Bill Rogers said Tuesday.

By Anna Hrushka • April 19, 2022 -

Bank of America sees 12% Q1 profit dip

The bank, however, saw a 9.5% surge in equity trading revenue and set aside far less than its competitors — $30 million — to cover potential Russia exposure.

By Dan Ennis • April 18, 2022 -

Revolut, Cross River link up to offer US consumer loans

Customers who use the personal loan offering, which will be available in the coming months, won't be subject to late fees, origination fees or prepayment penalties, the neobank said.

By Anna Hrushka • April 18, 2022 -

Citi sets aside $1.9B to counter Russia exposure

The bank said it now risks a $3 billion loss at most over its Russia entanglements. Profit at the third-largest U.S.-based lender dropped by 46% in the first quarter, Citi said Thursday.

By Dan Ennis • April 14, 2022 -

Wells Fargo sees 21% Q1 profit drop amid weaker home lending

The home lending results came a day after the bank pledged $210 million in two programs aimed at narrowing a much-publicized mortgage refinancing gap along racial lines.

By Anna Hrushka • April 14, 2022 -

U.S. Bank profit dips 31% on buildup for credit losses

At the same time, the bank reported a 2.3% jump in revenue year over year, and 6.5% growth in loans and average total deposits.

By Robin Bradley • April 14, 2022 -

BBVA addition gives PNC earnings a dual picture

Profit either dropped 21% or jumped 9%, depending on the vantage point. The deal, as inflation swells and interest rates rise, came at the right time for the bank — at least for year-over-year optics.

By Dan Ennis • April 14, 2022 -

JPMorgan Chase sees 42% drop in Q1 profit

The bank reported a $902 million net build in credit reserves tied to potential Russia losses and trepidation over inflation. It also took $524 million in losses related to commodities trading and further Russia exposure.

By Dan Ennis • April 13, 2022 -

Fifth Third CEO Greg Carmichael to step down in July

Carmichael, who joined the bank in 2003 as executive vice president and chief information officer, will be replaced by Fifth Third President Tim Spence.

By Anna Hrushka • April 12, 2022 -

Bank deposits could decrease for the first time in 80 years

Businesses and consumers alike have been depositing at a greater clip since the COVID-19 pandemic began. And, according to a Barclays analysis, the banking industry has $8.5 trillion more in deposits than loans.

By Robin Bradley • April 12, 2022 -

Neobank Step to launch crypto, stock investing product for users under 18

The teen-focused challenger bank claims the new offering will make it the first financial app to enable customers under the age of 18 to buy, sell, hold and receive crypto.

By Anna Hrushka • April 12, 2022