Retail: Page 13

-

Could the factors that took down SVB combine for a rerun in 2024?

NYCB's surprise Q4 loss may stand as a warning — or an outlier — as regional banks fight for deposits, weather real estate woes and wait for interest rates to drop.

By Dan Ennis • Jan. 31, 2024 -

California banks merge in $233.6M deal

The tie-up between Southern California Bancorp and California BanCorp, set to close in the third quarter, will create a $4.6 billion-asset company in some of the state’s strongest areas for mid-market business banking.

By Ken McCarthy • Jan. 30, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Retrieved from OCC.

Retrieved from OCC.

‘Troubled’ Blue Ridge Bank enters consent order with OCC

The OCC alleged that Blue Ridge’s BSA/AML program experienced “systemic internal controls breakdowns,” among other issues, in its second regulatory action against the bank in 18 months.

By Gabrielle Saulsbery • Jan. 29, 2024 -

Goldman’s global banking and markets co-chief to leave bank

Jim Esposito — a 28-year veteran who had sought to become the bank's CEO or president, The Wall Street Journal noted — co-led a unit that brought in two-thirds of Goldman's revenue last year.

By Dan Ennis • Jan. 29, 2024 -

JPMorgan Chase shuffles C-suite execs

The nation's largest bank is giving a handful of top executives “broader experience” by reassigning them to roles in new businesses ahead of CEO Jamie Dimon’s eventual retirement, an analyst said.

By Gabrielle Saulsbery • Jan. 26, 2024 -

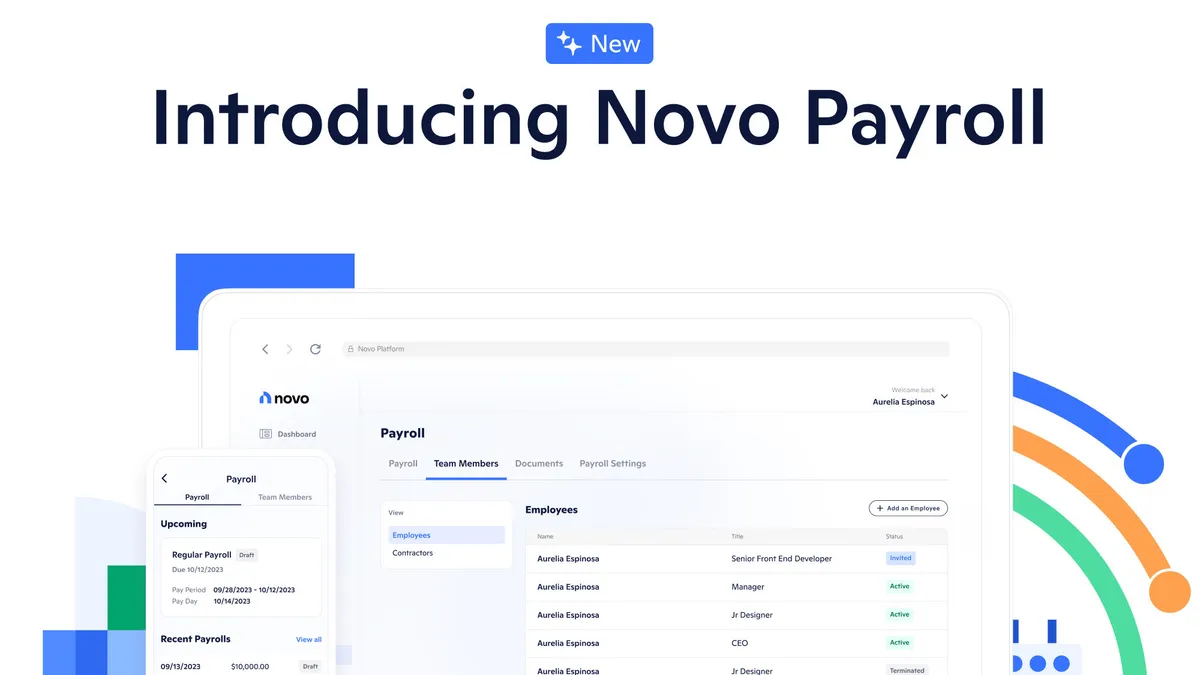

Novo rolls out an embedded payroll tool for small businesses

Powered by Check, the new tool, Novo Payroll, aims to help small businesses manage their finances from a single platform.

By Rajashree Chakravarty • Jan. 24, 2024 -

Comerica lays off 250, closes 26 branches

Dubbing the cuts “expense re-calibration efforts,” CFO Jim Herzog said the bank is now better positioned to enhance its funding base, revenue mix, capital efficiency and risk management framework.

By Gabrielle Saulsbery • Jan. 24, 2024 -

NBT CEO John Watt to step down in May

Scott Kingsley, the Norwich, New York-based bank's CFO, will assume the top role upon Watt’s retirement.

By Rajashree Chakravarty • Jan. 23, 2024 -

Fifth Third aims to open 31 branches this year in a bet on Southeast

The bank wants to establish about a 50/50 balance between Southeast and Midwest markets, CEO Tim Spence said. Fifth Third plans to boost its Southeast headcount in commercial banking by up to 15%, Bloomberg reported.

By Gabrielle Saulsbery • Jan. 22, 2024 -

JPMorgan’s Dimon, after 4% raise, got $36M in 2023

A breakdown of the CEO’s salary shows $1.5 million in base salary and $34.5 million in performance-based variable incentive compensation — $5 million of which will be in cash and the rest in stock.

By Rajashree Chakravarty • Jan. 19, 2024 -

First Republic ‘fraudulently’ recruited brokers before collapse, plaintiffs say

Alexander Kadish and Nicholas Davey had profitable careers at Morgan Stanley before First Republic execs lured them to work for the bank with omissions and false representations, they allege.

By Gabrielle Saulsbery • Jan. 19, 2024 -

Citizens trimmed 650 jobs in Q4

Among bright spots in the quarter, the lender launched its private bank, which it expects to break even in the second half of this year.

By Dan Ennis • Jan. 18, 2024 -

Varo rolls out free tax prep and filing tool with Column Tax

All Varo Bank customers can access the tax filing service, which uses pre-filled data based on user information and helps to file taxes in less than 15 minutes, the lender said.

By Rajashree Chakravarty • Jan. 17, 2024 -

FirstSun, HomeStreet to merge

FirstSun will function as the acquirer in the all-stock deal, which upon completion, will create a $17 billion-asset bank.

By Gabrielle Saulsbery • Jan. 17, 2024 -

CFPB proposal would cut overdraft fees as low as $3

Overdraft fees would be reclassified as extensions of credit, forcing banks to disclose an APR. Banks would also choose whether to charge customers a "break-even" fee or an amount set by the CFPB.

By Dan Ennis • Jan. 17, 2024 -

JPMorgan Securities to pay SEC $18M

A Securities and Exchange Commission investigation found that the firm kept clients from reaching out to the SEC to report potential violations.

By Gabrielle Saulsbery • Jan. 16, 2024 -

Top 6 banks dole out $9.4B toward FDIC special fee in Q4

JPMorgan Chase paid the largest share, at $2.9 billion, to replenish the agency’s deposit insurance fund following last year's bank failures. The bank reported $49.6 billion in annual net income.

By Anna Hrushka • Jan. 16, 2024 -

Citi to cut 20K jobs in ‘medium term’

The bank said it expects to incur as much as $1 billion in severance and restructuring costs this year as part of the cuts.

By Anna Hrushka • Jan. 12, 2024 -

Citi flags $3.8B hit on charges, reserves

In an SEC filing on Wednesday, Citi said fourth-quarter profit will be impacted by charges and reserves related to international exposures, its restructuring plan and the FDIC’s special assessment.

By Anna Hrushka • Jan. 11, 2024 -

TD execs knew in November 2022 about DOJ’s probe into AML: report

Regulatory scrutiny of TD's AML practices has long been rumored as the catalyst for the May 2023 collapse of the bank's proposed $13.4 billion acquisition of First Horizon.

By Dan Ennis • Jan. 11, 2024 -

Deep Dive

Barr hints at looming changes for emergency fund, capital requirements

A post-SVB lending facility may end in March as scheduled, the Fed supervisory czar indicated. Meanwhile, the public looks to get a louder say on the impact of new capital rules.

By Dan Ennis • Jan. 10, 2024 -

Ex-Wells, JPMorgan exec tapped to lead mortgage firm Mr. Cooper

Michael Weinbach, a 25-year veteran of the financial services industry, will be responsible for leading Mr. Cooper’s operations, including originations, servicing and technology, the firm said.

By Anna Hrushka • Jan. 10, 2024 -

The image by Gareth Milner is licensed under CC BY-SA 2.0

The image by Gareth Milner is licensed under CC BY-SA 2.0

Barclays slashes 5,000 jobs in cost-cutting effort

The London-based bank said it cut 5,000 roles from its global workforce of 84,000 last year in a bid to "simplify and reshape the business.”

By Anna Hrushka • Jan. 9, 2024 -

Truist to close 72 locations by March

Truist CEO Bill Rogers announced plans to consolidate the bank’s branch network in September, part of a $750 million cost-cutting effort. The 72 branches make up about 3.5% of the bank's footprint.

By Anna Hrushka • Jan. 4, 2024 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

Bank groups flag concerns with CFPB’s open banking proposal

The Bank Policy Institute and The Clearing House want the consumer watchdog to take a tougher stance on screen scraping, and allow banks to charge fees to cover the cost of enabling data sharing.

By Anna Hrushka • Jan. 3, 2024