Regulations & Policy: Page 82

-

Main Street Lending Program doesn't live up to its name, community banker says

Businesses with up to 15,000 employees or $5 billion in revenue are eligible to participate in the program. But certain requirements, while well-intentioned, are neither attractive nor attainable for most of her clients, one banker says.

By Anna Hrushka • June 23, 2020 -

Fed's 3 pandemic recovery scenarios could determine bank dividends

Alongside its annual stress test, the central bank will measure banks' resilience to a V-shaped, U-shaped and W-shaped economic bounce-back.

By Dan Ennis • June 23, 2020 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Alabama Extension. (2020). "The image" [Photograph]. Retrieved from Flickr.

Alabama Extension. (2020). "The image" [Photograph]. Retrieved from Flickr.

SBA follows through on promise to disclose PPP loan recipients

The move comes days after President Donald Trump signed into law a five-week extension of the deadline to file new applications for the program.

By Dan Ennis • Updated July 7, 2020 -

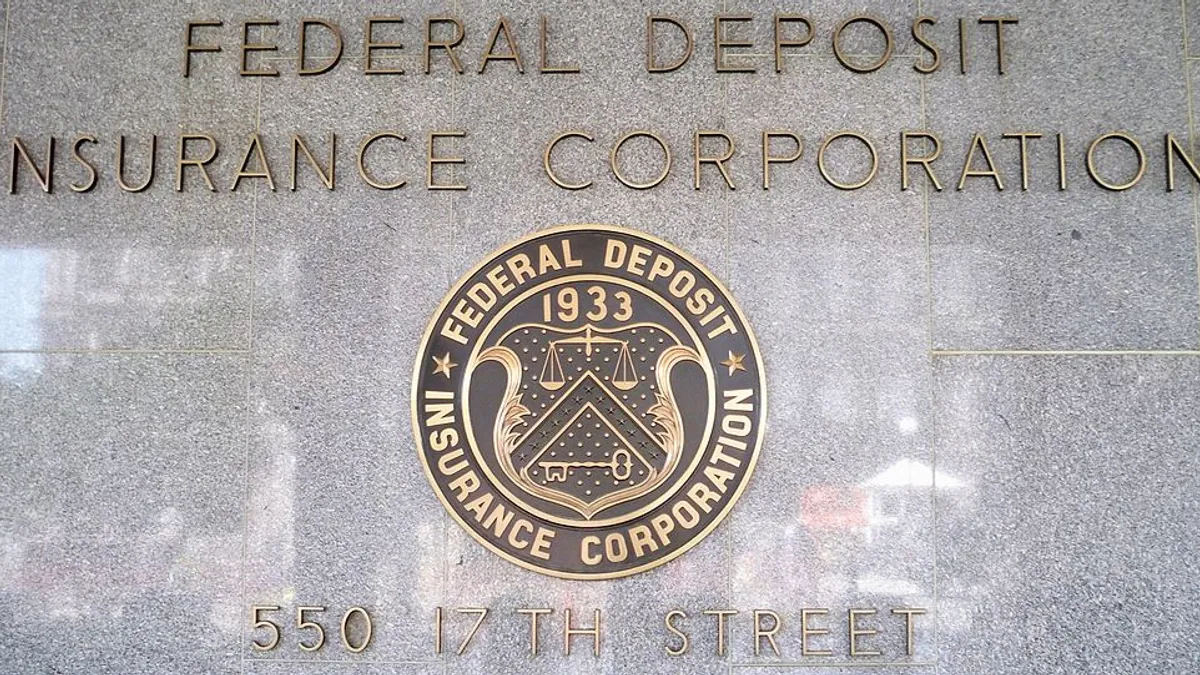

Bank earnings drop 70% in Q1, FDIC report finds

Banks set aside $52.7 billion during the quarter — a 280% increase from the previous year — to prepare for potential loan losses and the implementation of CECL standards.

By Anna Hrushka • June 17, 2020 -

PPP forgiveness process constrains lenders, small businesses, bankers say

In a letter Friday, 47 senators bemoaned the 11-page document as unwieldy as banks repurpose staff for the next stage of coronavirus relief.

By Anna Hrushka • June 15, 2020 -

California 'mini-CFPB' clears latest hurdle

The state Assembly and Senate on Monday passed the California Consumer Financial Protection Law, which restructures the Department of Business Oversight and expands its purview to include fintechs, payday lenders and debt collectors.

By Dan Ennis • Updated Sept. 1, 2020 -

Senate fails to overturn OCC's rewrite of CRA

The largely party-line vote was expected. Ninety days remain on the public comment period for the Federal Reserve's answer to revamp the 1977 anti-redlining rule.

By Dan Ennis • Updated Oct. 21, 2020 -

Fed opens Main Street Lending Program to small, midsize businesses

The Boston Fed, which is administering the program, posted registration documents on its website and is encouraging financial institutions to begin lending "immediately."

By Dan Ennis • Updated June 15, 2020 -

Banks' video hiring may be here to stay, but interviewing is changing

Preparation is crucial to avoiding awkward communication when screens replace candidates' in-room presence, executives say.

By Ken McCarthy • June 5, 2020 -

Big banks took $11.7B in overdraft fees last year, nonprofit says

About 9% of account holders paid 84% of the $35 fees, according to data from the Center for Responsible Lending, which wants regulators to bar banks from charging for negative balances during the pandemic.

By Dan Ennis • June 4, 2020 -

Trump signs revised PPP rules into law

The Senate passed a bill Wednesday that reduces to 60% the proportion of loans that must be put toward payroll and gives small businesses 24 weeks to use the funds.

By Dan Ennis • Updated June 5, 2020 -

COVID-19 lockdowns threaten banking system's stability, OCC says

"Requiring businesses to remain closed decreases businesses' ability to service their debt, thus increasing default risk in the banking system," the regulator's acting chief said.

By Anna Hrushka • June 2, 2020 -

Morgan Stanley, TD Bank take opposite tacks on post-COVID office return

The investment bank wants to begin sending its traders back to its New York headquarters in mid- to late June. Meanwhile, all six of Canada's biggest banks pledged to keep their employees out of downtown Toronto until September.

By Dan Ennis • Updated July 30, 2020 -

Alabama Extension. (2020). "The image" [Photograph]. Retrieved from Flickr.

Alabama Extension. (2020). "The image" [Photograph]. Retrieved from Flickr.

House passes bill to ease PPP payroll rule, triple spending period

The legislation, which also extends the time recipients have to repay the loan from two to five years, heads to the Senate, which reconvenes Monday.

By Anna Hrushka • May 28, 2020 -

Banks face logistical, security challenges with branch reopenings

The right date to allow lobby foot traffic — and the proliferation of face masks — present just two tests in post-pandemic banking.

By Anna Hrushka • May 28, 2020 -

Column

HSBC, Deutsche take divergent paths in resuming overhauls

Britain's leading lender stresses urgency in demanding more radical restructuring, while Germany's largest bank courts employee buy-in.

By Dan Ennis • May 27, 2020 -

Pandemic not discouraging Provident Bank's acquisition plan

"When we announced the deal, the market was getting hammered," Provident Bank CEO Chris Martin told Banking Dive. "We're going to be better together than separate, so why not continue?"

By Anna Hrushka • May 27, 2020 -

Community groups plan to sue OCC over CRA revamp

The agency says its changes are aimed at "strengthening and modernizing" the anti-redlining law, but community groups say the overhaul will allow banks to lend less to lower-income areas.

By Anna Hrushka • May 26, 2020 -

Survey: 3 in 4 PPP borrowers confused by loan's terms

The uncertainty leaves some recipients reluctant to use the funds, even though new guidance doesn't expand the eight-week window. Waning interest in the program is spurring some banks to stop taking new applications.

By Dan Ennis • May 26, 2020 -

OCC defends timing, lack of regulatory support for CRA revamp

The absence of lock-step with the Federal Reserve and the FDIC — and the rule's quick turnaround — led one advocate to call it an "administrative fiasco."

By Anna Hrushka • May 21, 2020 -

Expect more PPP fraud cases as DOJ moves past 'low-hanging fruit'

The speed with which the SBA and Treasury Department set up the program, and the volume of loans funneled through it, means more cases are likely to emerge, an attorney says.

By Anna Hrushka • May 20, 2020 -

OCC releases CRA overhaul as Otting prepares to step down

The 372-page rule adds new data collection requirements and tweaks the asset thresholds for participating banks, but neither the FDIC nor the Fed joined the OCC on the new low-income lending guidelines.

By Dan Ennis • May 20, 2020 -

2018 asset cap has cost Wells Fargo $220B in market value

The bank's biggest competitors have seen a swell in deposits during the pandemic, as customers flee smaller banks for more security. But Wells Fargo's deposit bump was much smaller in the first quarter, by comparison.

By Dan Ennis • May 19, 2020 -

Alabama Extension. (2020). "The image" [Photograph]. Retrieved from Flickr.

Alabama Extension. (2020). "The image" [Photograph]. Retrieved from Flickr.

PPP is failing Black, Latino-owned businesses, survey shows

A partnership specializing in getting loans to nonwhite businesses has launched, but some companies are exhausted by the constant tweaks to the program. And Congress is planning more.

By Dan Ennis • May 18, 2020 -

Regulators temporarily ease bank leverage ratio requirements

The FDIC and OCC estimate the interim rule, which will be in effect through March 2021, would relax bank capital requirements by as much as $55 billion.

By Anna Hrushka • May 18, 2020