Regulations & Policy: Page 62

-

Powell hints at Fed's inflation moves, CBDC paper, ethics rules in hearing

The oft-delayed digital currency white paper is coming "within weeks," Powell said, but is "an exercise in asking questions and seeking input ... rather than taking a lot of positions."

By Dan Ennis • Jan. 12, 2022 -

Dimon: 'We're not going to pay you not to work in the office'

JPMorgan's CEO said the bank's policy toward COVID-19 vaccination would vary by locality. The bank hasn't threatened termination, as Citi has. But Dimon told CNBC, "To go to the office, you have to be vaxxed."

By Robin Bradley • Jan. 11, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Richard Clarida, Fed's outgoing vice chair, resigns

His last day is Friday, less than three weeks before his term was slated to end. An amended disclosure last week revealed Clarida sold a stock fund and re-bought it three days later, ahead of a Fed interest-rate move.

By Dan Ennis • Jan. 11, 2022 -

Column

Bank of America's bonus do-over

A purported 40% bump to the bank's bonus pool could set the tone among Wall Street rivals. It also may be a belated olive branch for last year, when bonuses stood pat despite a 20% revenue boost in 2020.

By Dan Ennis • Jan. 10, 2022 -

Citi sticks to vaccine mandate, could fire workers Jan. 31

Office-based employees who don't upload their COVID-19 inoculation card or request an exemption by Jan. 14 will be placed on unpaid leave the next day and terminated at month's end.

By Dan Ennis • Jan. 7, 2022 -

Nebraska agency denies GreenState Credit Union bank deal

The credit union, established under Iowa laws, does not meet the definition of a "financial institution" that can participate in cross-industry acquisitions or mergers in Nebraska, a hearing officer ruled.

By Dan Ennis • Jan. 7, 2022 -

Clarida stock-trading controversy deepens

An amended financial disclosure shows the Fed vice chair sold an exchange-traded fund Feb. 24, 2020, then re-bought it Feb. 27, calling into question a previous characterization of the move.

By Dan Ennis • Jan. 6, 2022 -

Chopra screen grab/Banking Dive, data from Screen grab

Chopra screen grab/Banking Dive, data from Screen grab

Credit bureaus increasingly fail on consumer complaint response, CFPB finds

Equifax, Experian and TransUnion reported relief in response to less than 2% of covered complaints filed in 2021, compared with 25% in 2019, the bureau reported Wednesday.

By Robin Bradley • Jan. 6, 2022 -

5 banking trends to watch in 2022

A reversal on in-office work from a hard-liner like Goldman Sachs may represent a pivot point in the acceptance of remote policies. But other narratives, such as small-scale niche M&A, mark a continuation from 2021.

By Dan Ennis , Anna Hrushka , Robin Bradley • Jan. 4, 2022 -

FDIC Chair Jelena McWilliams resigns

McWilliams' resignation comes after a power struggle emerged when Democratic FDIC board members Rohit Chopra and Martin Gruenberg published a review of bank merger policies without her approval.

By Anna Hrushka • Dec. 31, 2021 -

Green Dot, PayPal helped Secret Service recover more than $400M in stolen COVID-19 relief funds

Criminals have swindled nearly $100 billion through fraudulent applications since the start of the pandemic in the U.S., the agency said this week.

By Robin Bradley • Dec. 23, 2021 -

CFPB shuts down online lender LendUp

The fintech agreed to pay a $100,000 penalty as part of a settlement. It stopped originating loans this summer and expects to wind down operations early next year. A digital bank the parent company operates will not be affected.

By Robin Bradley • Dec. 22, 2021 -

Wells Fargo sets March 14 office-return date

The bank, which in December indefinitely postponed a formal return timeline, will adopt a "hybrid flexible model," which will send most employees to the office three days a week, an executive told Bloomberg.

By Dan Ennis • Updated Feb. 10, 2022 -

Column

Timing of Bank of America's stay-home call is either grinchy or genius

Giving New York City-area workers a remote option after the weekend keeps them on a shorter leash. By contrast, JPMorgan's announcement Friday, in theory, offered some a chance to flee town early.

By Dan Ennis • Dec. 21, 2021 -

Fed signs off on 3 mergers, but several still remain in limbo

First Citizens and CIT may find relief in their green light, but for other banks such as Old National, the wait is not over.

By Dan Ennis • Dec. 20, 2021 -

DOJ backs FDIC Democrats, requests public comments on bank merger review

A Friday statement from the Justice Department's Antitrust Division echoes comments by CFPB Director Rohit Chopra and other Democrats on the FDIC board, as federal regulators set banking M&A in their sights.

By Robin Bradley • Dec. 20, 2021 -

Banking group drops OCC suit after Figure updates charter application

"We still feel like the law would have come out on our side ... but we just don't want to continue to wait," the fintech's general counsel said of its decision to seek deposit insurance.

By Anna Hrushka • Updated Jan. 14, 2022 -

JPMorgan to pay $200M in SEC, CFTC fines over record-keeping failures

The bank in June ordered staff to save relevant texts from as early as 2018 made on personal devices and on messaging platforms until the company's legal department said otherwise, Bloomberg reported.

By Anna Hrushka • Dec. 17, 2021 -

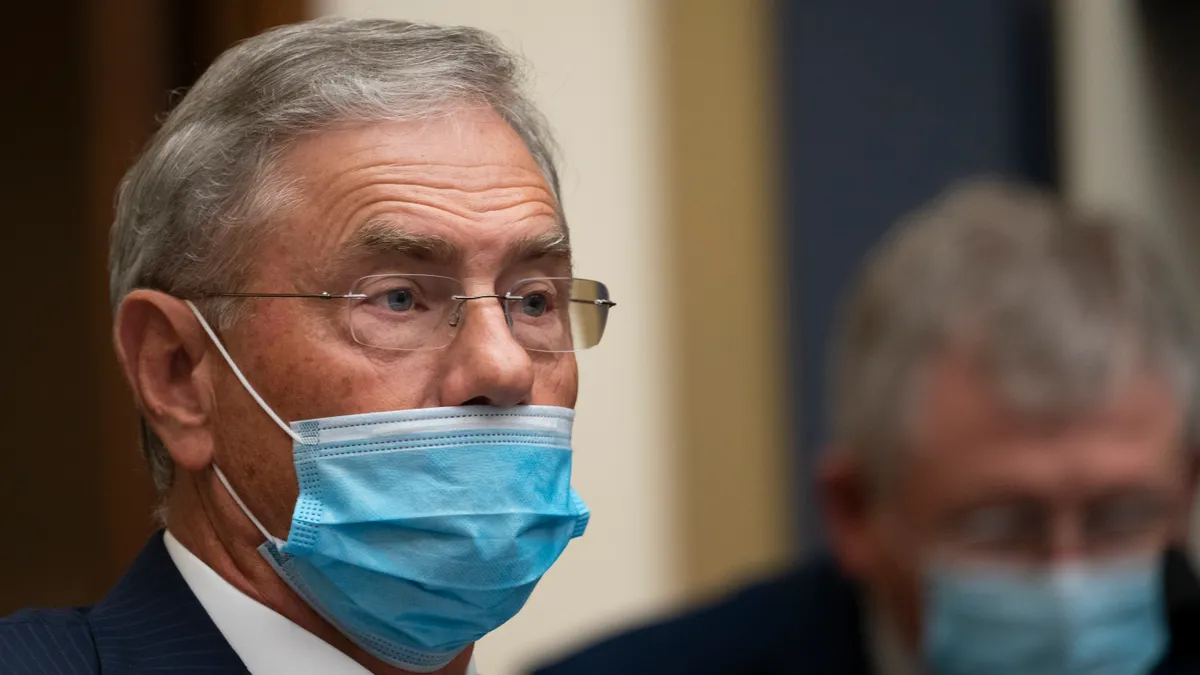

Lawmaker tells CFPB chief to stay in his own lane

Rep. Blaine Luetkemeyer, R-MO, introduced a bill to strip Rohit Chopra of his FDIC board voting rights. The bill also would cap FDIC board members' tenure at 12 years. Martin Gruenberg has served on the board for 16.

By Robin Bradley • Dec. 16, 2021 -

JPMorgan locked down its No. 2. Now how will it keep its rank and file?

The bank this week gave its co-president a stock award worth roughly $25 million. It's also considering a 40% bump in the bonus pool for investment bankers in underwriting and M&A advisory roles.

By Dan Ennis • Dec. 16, 2021 -

FDIC board power struggle continues after meeting

CFPB Director Rohit Chopra, in a statement Tuesday, said he received a last-minute revision to a request for information "with a series of strings attached," which he deemed unacceptable.

By Robin Bradley • Dec. 15, 2021 -

JPMorgan Chase reaches its virtual tipping point

The bank told unvaccinated Manhattan-based employees to work remotely for now, and pushed its annual healthcare conference online after two biotech giants backed out.

By Dan Ennis • Dec. 15, 2021 -

Crypto custody firm Anchorage Digital raises $350M in $3B valuation

The company's latest raise comes as the firm is ramping up its strategy to partner with financial institutions that want to provide their clients with custody services for their digital assets.

By Anna Hrushka • Dec. 15, 2021 -

Morgan Stanley CEO Gorman: ‘I was wrong’ on office-return stance

The executive said Monday he anticipates COVID-19 variants could disrupt work life "through most of next year." Meanwhile, several banks are urging U.K. employees to work from home as the country reports its first omicron death.

By Dan Ennis • Dec. 14, 2021 -

JPMorgan's reported $200M fine, Credit Suisse crackdown spotlight mobile comms

The U.S.'s largest bank could settle by the end of the year a probe by the SEC and CFTC over lax communications monitoring, according to Bloomberg. Meanwhile, the Swiss lender tightened its own policy on monitoring comms.

By Dan Ennis • Dec. 13, 2021