Regulations & Policy: Page 52

-

Senators request Fed inspector general’s salary history

Sens. Rick Scott, R-FL, and Elizabeth Warren, D-MA, expressed concern, in a letter, that the structure of the official's compensation may create a conflict of interest.

By Anna Hrushka • July 25, 2023 -

6 ways FedNow may affect businesses’ cash flow

CFOs may need to lean on their banks for guidance to help them understand the implications of the new real-time payments system.

By Suman Bhattacharyya • July 24, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineArtificial intelligence

Banks’ focus on AI has shifted from a “cool-toys” mentality to one that sees the technology as a foundational pillar underlying finance and society itself.

By Banking Dive staff -

Fed fines UBS $268.5M over Credit Suisse’s Archegos ties

UBS “has already begun implementing its risk framework, including actions addressing these regulatory findings, across Credit Suisse,” the bank said in a statement Monday seen by Bloomberg.

By Dan Ennis • July 24, 2023 -

Banks’ restatements of uninsured deposits jump fourfold

Bank of America, for instance, reduced its reported uninsured deposits by $125.3 billion. The move comes as the comment period closes for the FDIC's special assessment fee.

By Rajashree Chakravarty • July 24, 2023 -

Senate bill would rein in SBA’s fintech lending plan

The legislation, which heads to the full Senate, is in response to the agency’s decision to end a 40-year moratorium on admitting new nonbank entrants to its 7(a) loan program.

By Anna Hrushka • July 21, 2023 -

Fed fines Deutsche Bank $186M over AML practices

Deutsche highlighted its “historic tardiness” in resolving 2015 and 2017 orders from the Fed, stemming from the bank’s relationship with the Estonia branch of Danske Bank.

By Rajashree Chakravarty • July 20, 2023 -

Blue Ridge Bank holding company’s CEO resigns

The president of the bank’s fintech division, Kirsten Muetzel, also is leaving the bank this month, according to her LinkedIn profile.

By Anna Hrushka • July 20, 2023 -

Photo by Tima Miroshnichenko from Pexels

Q&A

Q&AClair CEO welcomes on-demand pay regulation

Clair CEO Nico Simko weighed in on whether EWA is a payday loan and how the company offers fee-free wage access.

By James Pothen • July 20, 2023 -

Cannabis fintech Dama Financial looks to double sponsor bank network

Dama Financial’s network of sponsor banks holds the deposits for cannabis-related businesses which, due to conflicting state and federal laws, often operate outside of the banking sector.

By Anna Hrushka • July 19, 2023 -

Barr acknowledges AI’s promise but warns of bias risk

The red flag is one of five takeaways from a speech Tuesday in which the regulator also touched on the status of the multiagency CRA revamp.

By Dan Ennis • July 18, 2023 -

Retrieved from Consumer Financial Protection Bureau.

Retrieved from Consumer Financial Protection Bureau.

CFPB, European regulator open a dialogue on digital rules

Buy now, pay later platforms, artificial intelligence and other developments “if left unchecked, could increase consumers’ exposure to fraud and manipulation,” the regulators said Monday.

By Rajashree Chakravarty • July 18, 2023 -

Binance lays off at least 1,000: reports

The company told employees last month that it would stop offering certain benefits, according to The Wall Street Journal. CEO Changpeng Zhao said there could be additional layoffs every three to six months.

By Gabrielle Saulsbery • July 17, 2023 -

St. Louis Fed chief steps down

The reserve bank's president, James Bullard, will become dean of Purdue University’s business school next month. He will continue serving as an adviser at the St. Louis Fed until Aug. 14.

By Rajashree Chakravarty • July 14, 2023 -

Bank trade groups fire back over Barr recommendations

Five groups asked the Federal Reserve to extend the public comment period to 120 days for upcoming proposed changes to capital requirements.

By Anna Hrushka • July 14, 2023 -

Fed ends Capital One breach-related enforcement action

The OCC 10 months earlier freed the bank from a separate consent order tied to a former Amazon Web Services employee’s hack that exposed the data of 106 million customers.

By Dan Ennis • July 12, 2023 -

Merrill Lynch to pay $12M for filing too few SARs

The penalty was dwarfed by others which parent company Bank of America faced Tuesday. The bank reported suspicious activity on transactions of $25,000 or more but should have used a $5,000 threshold, the SEC said.

By Dan Ennis • July 12, 2023 -

Slow regulatory response led to SVB collapse: Fed’s Daly

“When the outcomes aren't what we want them to be, we all work collectively to make them better going forward,” San Francisco Fed President Mary Daly said.

By Rajashree Chakravarty • July 11, 2023 -

Bank of America fined $250M over fake accounts, junk fees

In charges that echo Wells Fargo’s 2016 fake-accounts scandal, regulators accused Bank of America employees of opening credit card accounts without customers’ consent to reach sales goals.

By Anna Hrushka • July 11, 2023 -

9 takeaways from Barr’s capital requirements recommendations

Banks with assets of $100 billion or more would have to account for unrealized losses and gains in available-for-sale securities when calculating regulatory capital, the Fed official said Monday.

By Dan Ennis • July 10, 2023 -

SVB Financial sues FDIC to recover $1.9B

The money seized by the FDIC during Silicon Valley Bank’s failure should be generating more than $100 million in annual interest at the current rate, the filing claimed.

By Rajashree Chakravarty • July 10, 2023 -

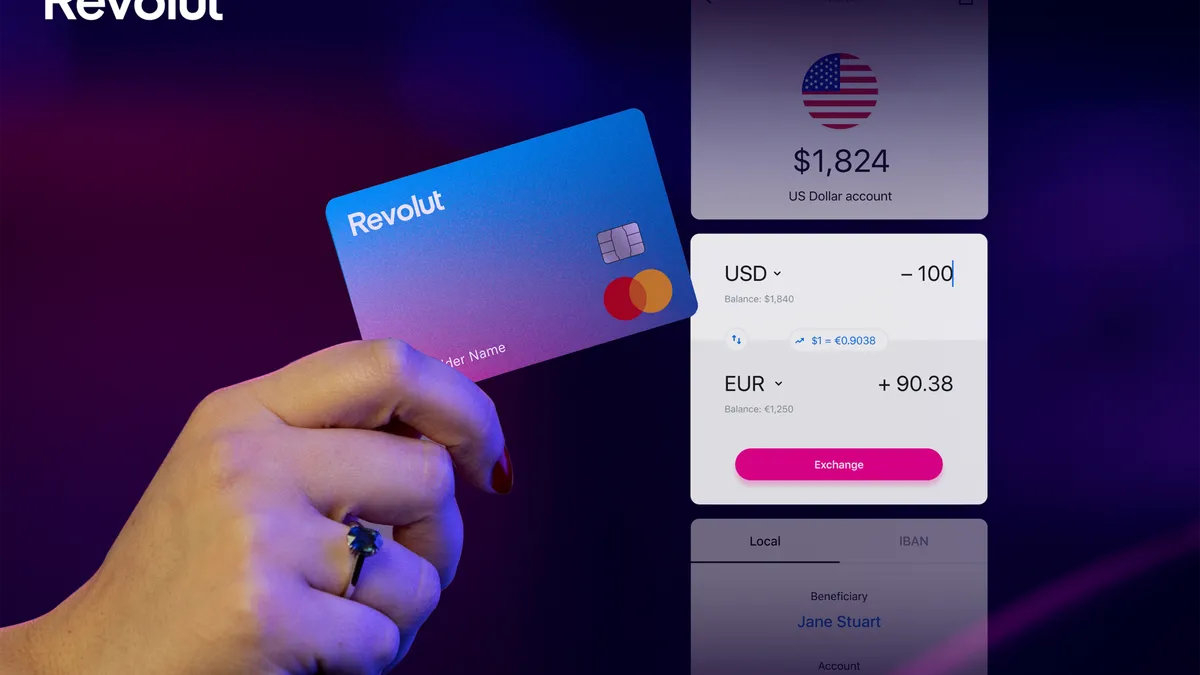

Criminals stole $20M from Revolut via payment loophole: report

Differences in the firm’s U.S. and European systems meant the neobank would use its own money to erroneously refund certain declined payments, the Financial Times reported.

By Anna Hrushka • July 10, 2023 -

Sponsored by EY Banking and Capital Markets

[PODCAST] Digital identity opportunities in the financial services industry

This podcast explores the policy and regulatory trends shaping digital identity, including age-gating and social media bans.

By Banking Dive's studioID • July 10, 2023 -

Philadelphia Fed restricts Quontic’s capital distribution

Quontic’s holding company must submit a capital plan and detail its cash flow projections for the remainder of 2023. The company may not pay dividends or engage in share repurchases without the regulator’s sign-off.

By Anna Hrushka • July 7, 2023 -

Barclays boosts parental leave for US employees

The bank, as of July 1, is giving all new U.S.-based parents 16 weeks of leave and allows birth mothers an additional six to eight weeks of leave to recover. That matches a policy Morgan Stanley launched in 2021.

By Dan Ennis • July 7, 2023 -

Goldman should disclose profit from SVB bond sale: Warren

In a letter addressed to Goldman CEO David Solomon, Sen. Elizabeth Warren, D-MA, accused the firm of profiting “at nearly every stage of Silicon Valley Bank’s collapse.”

By Anna Hrushka • July 6, 2023