Regulations & Policy: Page 18

-

Column

Dive Deposits: It was Citi’s week and, arguably, everybody won

The bank shook off fresh penalties by reporting skyrocketing revenue in its banking unit. It’s no wonder Citi granted $41 million to its banking chief. But a rival for that job may be glad he left.

By Dan Ennis • July 12, 2024 -

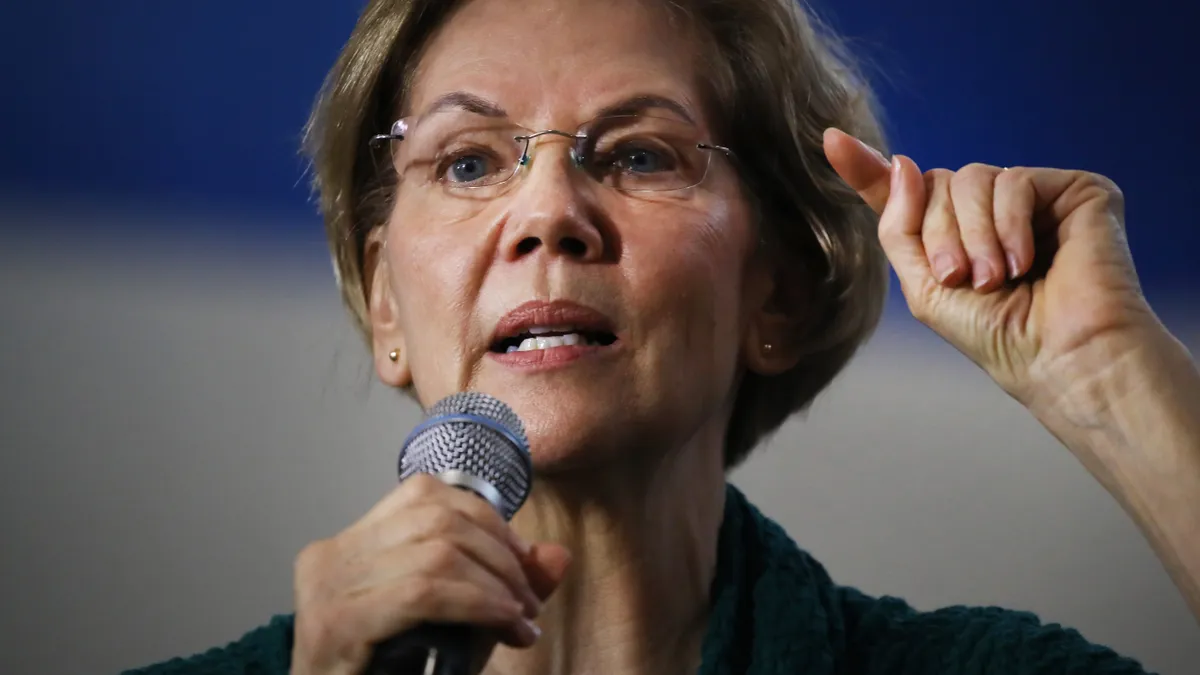

Senators press Jamie Dimon on alleged climate turnabout

The lawmakers, including Sen. Elizabeth Warren, D-MA, demanded answers from the JPMorgan Chase CEO on the bank's environmental "commitments" and "aspirations."

By Gabrielle Saulsbery • July 11, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Senators grill FDIC chair nominee Goldsmith Romero

The CFTC commissioner aiming to replace Martin Gruenberg pledged Thursday during a Senate committee hearing to bring accountability to an agency reeling from toxic-culture allegations.

By Caitlin Mullen • July 11, 2024 -

Citi to pay $135.6M in new penalties over 2020 orders

The bank has made insufficient progress toward resolving nagging data quality, risk management and internal control issues, the OCC and Federal Reserve said Wednesday.

By Dan Ennis • July 11, 2024 -

Bank-fintech guidance needs more clarity, FDIC’s McKernan says

“Rules of the road” for bank-fintech tie-ups could help banks that partner with fintechs better manage third-party risks, he said.

By Suman Bhattacharyya • July 10, 2024 -

Former FTX execs Wang, Singh to be sentenced this fall

Both cooperated with the prosecution and testified against their former colleague, Sam Bankman-Fried. This will "very likely" reflect in their sentences, one attorney told Banking Dive.

By Gabrielle Saulsbery • July 10, 2024 -

First Citizens’ poaching claims against HSBC largely dismissed

A judge allowed claims alleging theft of trade secrets and breach of contract to proceed. First Citizens claimed an SVB alum hatched a plan to persuade more than 40 employees to follow him to HSBC.

By Dan Ennis • July 10, 2024 -

Warren presses Fed’s Powell on bank exec compensation

The central bank chair engaged in a heated back-and-forth with the senator, and also weighed in on CRE, Chevron deference and liquidity in hearings this week.

By Caitlin Mullen • July 10, 2024 -

FDIC downgrades Forbright Bank’s CRA score

The demerit stems from a relationship the bank had with a third party that ended more than two years ago, a source familiar with the evaluation said.

By Gabrielle Saulsbery • July 9, 2024 -

Fifth Third fined $20M over fake accounts, auto repossessions

The Cincinnati bank must compensate roughly 35,000 harmed consumers. The CFPB settlement resolves a March 2020 lawsuit that asserted the bank created fake accounts and used an aggressive “cross-sell” strategy.

By Rajashree Chakravarty • July 9, 2024 -

Powell: Capital requirements changes should face public comment

The Federal Reserve chair told senators Tuesday it’s his preference to seek public comment on a revised capital requirements proposal, and the Fed is working to get the FDIC and OCC on board.

By Caitlin Mullen • July 9, 2024 -

Warren blasts Powell’s ‘cozy relationship’ with bank execs

Since Powell assumed his role in February 2018, the Federal Reserve chair has had private conversations with JPMorgan CEO Jamie Dimon at least 19 times, according to the senator.

By Rajashree Chakravarty • July 8, 2024 -

TD names Citi vet next compliance chief

Erin Morrow replaces Monica Kowal, who left the bank July 2. Two of the three highest-ranking TD execs assigned to fix compliance management framework deficiencies have left in recent days.

By Dan Ennis • July 8, 2024 -

Discover to settle card misclassification class actions for $1.2B

The card company has warned it could face further financial toll related to the issue, in which it overcharged merchants for years.

By Caitlin Mullen • July 8, 2024 -

Potential BofA blind spot prompts court to revive $10B lawsuit

A U.S. appeals court nullified a ruling by a judge whose wife owned, then divested, Bank of America shares while he presided over an antitrust case in which BofA was a defendant.

By Rajashree Chakravarty • July 3, 2024 -

Silvergate pays $63M to settle with SEC, Fed, California regulator

The company and two of its executives settled allegations against them. Silvergate’s former CFO, however, did not, and eyes a civil trial.

By Gabrielle Saulsbery • July 2, 2024 -

SEC sues Consensys over failure to register as a broker

The crypto firm collected more than $250 million in fees as an unregistered broker, the SEC said. The company sued the SEC in April over the agency’s regulation of the Ethereum blockchain.

By Rajashree Chakravarty • July 2, 2024 -

Supreme Court ends Chevron deference

The decision is likely to influence how banking regulators make their rules, and the amount of legal challenges that follow those rules, attorneys said.

By Gabrielle Saulsbery • July 1, 2024 -

Biggest US banks boost dividends, launch stock buybacks

JPMorgan and Morgan Stanley flag repurchase programs worth $30 billion and $20 billion, while Goldman Sachs bemoans an uptick in the bank’s stress capital buffer.

By Dan Ennis • July 1, 2024 -

Citi urges court to dismiss ex-employee’s retaliation lawsuit

Kathleen Martin sued the bank, claiming she was fired for refusing to misreport data to the OCC. Citi claims she was fired for lacking “the requisite leadership and engagement skills” her role demands.

By Rajashree Chakravarty • July 1, 2024 -

FDIC orders Thread Bank to step up BaaS oversight

The Rogersville, Tennessee-based bank must implement a documented risk assessment of its fintech partners, the agency said. The bank’s board also must approve risk tolerance thresholds.

By Caitlin Mullen • July 1, 2024 -

VersaBank’s cross-border acquisition of Minnesota lender gets final nod

Canada’s Office of the Superintendent of Financial Institutions approved the transaction this week, after the Fed and OCC green-lighted the tie-up.

By Dan Ennis • June 28, 2024 -

Coinbase sues SEC, FDIC to see probe-related documents

The crypto firm wants to know how the SEC, for one, first began deciding which tokens would and would not be considered securities.

By Gabrielle Saulsbery • June 28, 2024 -

Biggest banks would see $685B in losses in Fed stress test

All 31 banks passed, prompting trade and lobbying groups to push back on Basel — and JPMorgan to say the Fed's buffer calculations were wrong.

By Dan Ennis • June 27, 2024 -

Crypto firm Abra settles with 25 states for operating without a license

Abra agreed to repay customers some $82 million in crypto. CEO Bill Barhydt said all but $2 million, yet to be claimed, has been repaid.

By Gabrielle Saulsbery • June 27, 2024