Regulations & Policy

-

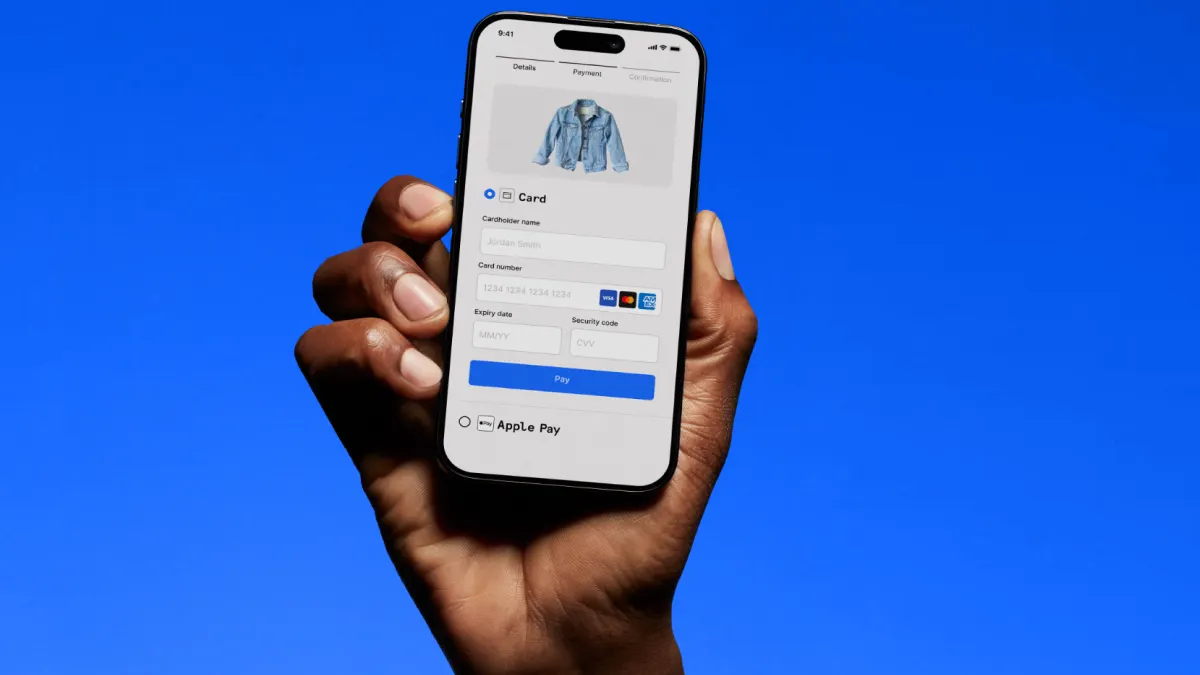

Photo by Bia Santana from Pexels.

Brazil’s Nubank applies for US banking charter

The move underscores the lengthy and sometimes unsuccessful paths challengers such as Bunq, Revolut and Monzo have faced in obtaining licenses.

By Dan Ennis • Oct. 3, 2025 -

Checkout.com seeks Georgia banking charter

If the company succeeds in its bid to be a merchant acquirer limited purpose bank, it would become the third firm – after Fiserv and Stripe – to do so.

By Gabrielle Saulsbery • Oct. 3, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Permission granted by Frost Bank

Permission granted by Frost Bank Trendline

TrendlineTop 5 stories from Banking Dive

Since the approval of Capital One’s acquisition of Discover, banks have increasingly waded into new deals. Beyond that, they’ve doubled down on strategy, from organic growth to branch placement to app design.

By Banking Dive staff -

Column

Dive Deposits: Regulator roulette extends into fall

The White House moved to take the “acting” tag off of Travis Hill’s title at the FDIC. Meanwhile, the withdrawal of Brian Quintenz’s bid to lead the CFTC keeps the agency’s only commissioner in place.

By Dan Ennis • Oct. 2, 2025 -

Government shutdown risks snarling Wealthfront’s IPO plan

Wednesday’s shutdown forced the SEC to furlough more than 90% of its workforce. It won’t be able to process initial public offerings during that time, according to an agency contingency plan.

By Daniel Muñoz • Oct. 1, 2025 -

Supreme Court says Trump can’t fire Cook for now

The court deferred the president’s request to overrule a stay – at least until justices hear oral arguments in the case in January.

By Dan Ennis • Oct. 1, 2025 -

Waters tells CFPB’s Vought not to use shutdown to furlough staff

“A shutdown does not apply to the CFPB,” the House Financial Services Committee’s ranking member told the bureau’s acting director Tuesday.

By Caitlin Mullen • Oct. 1, 2025 -

Fed grants Morgan Stanley lower stress capital buffer

The central bank dropped the investment bank’s stress capital buffer requirement from 5.1% to 4.3%, effective Wednesday.

By Caitlin Mullen • Oct. 1, 2025 -

2026 banking conference roundup

Gatherings can be idea generators, or crucial chances to network — especially amid an environment where political change can yield previously unexpected possibilities and partnerships.

By Dan Ennis • Oct. 1, 2025 -

Fed’s Barr floats alternative to stress test changes

The central bank governor expressed “deep concerns,” suggesting decoupling stress tests from regulatory capital requirements.

By Daniel Muñoz • Sept. 30, 2025 -

NYDFS’ Adrienne Harris to step down

Kaitlin Asrow, who leads the regulator’s research and innovation division and previously was a senior fintech policy adviser at the San Francisco Fed, will serve as the state agency’s acting superintendent starting Oct. 18.

By Dan Ennis • Sept. 30, 2025 -

CFPB ends WaFd mortgage consent orders early

The Seattle-based lender paid penalties of $200,000 and $34,000 in connection with enforcement actions it received in 2013 and 2020.

By Dan Ennis • Sept. 29, 2025 -

CFPB ends U.S. Bank, Apple consent orders early

The bureau contends the bank and tech giant have paid their penalties in separate cases related to unemployment benefits restrictions and the launch of the Apple Card, respectively.

By Dan Ennis • Sept. 23, 2025 -

Payment players offer fraud fixes to Fed, OCC, FDIC

EWS, Nacha and the Financial Technology Association told regulators that collaboration, information-sharing and more consumer education are needed to tackle payments fraud.

By Caitlin Mullen • Sept. 23, 2025 -

Fed’s Miran calls for slashing main interest rate to avert job loss

Federal Reserve Gov. Stephen Miran brushed aside concerns that he has weakened the central bank’s independence by not resigning as the top White House economic adviser.

By Jim Tyson • Sept. 22, 2025 -

OCC bans five from TD, Wells, PNC

Five former bank employees have been penalized in cases that involve alleged PPP fraud, misappropriation and theft.

By Gabrielle Saulsbery • Sept. 22, 2025 -

Senate report on SVB rips KPMG, reveals CFO role

The Senate subcommittee’s report stems from a 28-month investigation that reviewed nearly 100 hours of briefings and interviews with auditors and regulators.

By Maura Webber Sadovi • Sept. 22, 2025 -

BofA unit to pay $5.56M to settle market manipulation case

The resolution with the Justice Department includes disgorgement and victim compensation, and doesn’t include a determination of liability.

By Gabrielle Saulsbery • Sept. 19, 2025 -

Trump takes Cook firing to Supreme Court

Chief Justice John Roberts asked the Fed governor for a response by Sept. 25. The U.S. solicitor general, meanwhile, argued lower courts have “interfere[d]” with President Trump’s right to remove Cook.

By Dan Ennis • Sept. 18, 2025 -

Fed bans ex-First Horizon, M&T bankers

One former banker allegedly obtained customer data and gave it to a third-party impersonator who initiated fraudulent wire transfers. Another allegedly used customer data to run up $25,000 in debit charges.

By Dan Ennis • Sept. 18, 2025 -

NYDFS wants crypto-curious banks to use blockchain analytics tools

The tools can help when banks evaluate exposure to money laundering and sanctions activity or consider the risks associated with offering a particular crypto product, the regulator said.

By Caitlin Mullen • Sept. 18, 2025 -

Tether eyes US return in December, names Trump ally Hines to top post

The stablecoin firm stopped serving American customers directly in 2021. The company’s reemergence comes amid fresh legislation and intense competition from Circle and other issuers.

By Dan Ennis • Sept. 17, 2025 -

Wells Fargo execs settle suit over diverse hiring practices

The bank and shareholders expect to file a motion for preliminary approval of the settlement by Oct. 13, according to court documents.

By Caitlin Mullen • Sept. 17, 2025 -

Senators press Fed, OCC, FDIC to defend CRA final rule

Seven Democratic senators urged financial regulators to withdraw their planned rescission of an update to the decades-old anti-redlining rule.

By Gabrielle Saulsbery • Sept. 16, 2025 -

Senate confirms White House adviser Miran to Fed post

Lawmakers voted 48-47 to allow Trump ally Stephen Miran to serve as a governor at the central bank for a term that ends in January. He was sworn in Tuesday and is attending an interest rate-setting meeting.

By Dan Ennis • Sept. 16, 2025 -

Appeals court keeps Fed’s Cook in place

A three-judge panel voted 2-1 to reject President Donald Trump’s request to uphold his firing of the central bank governor. The majority opinion focused on due process and not mortgage fraud allegations.

By Dan Ennis • Sept. 16, 2025