Payments: Page 9

-

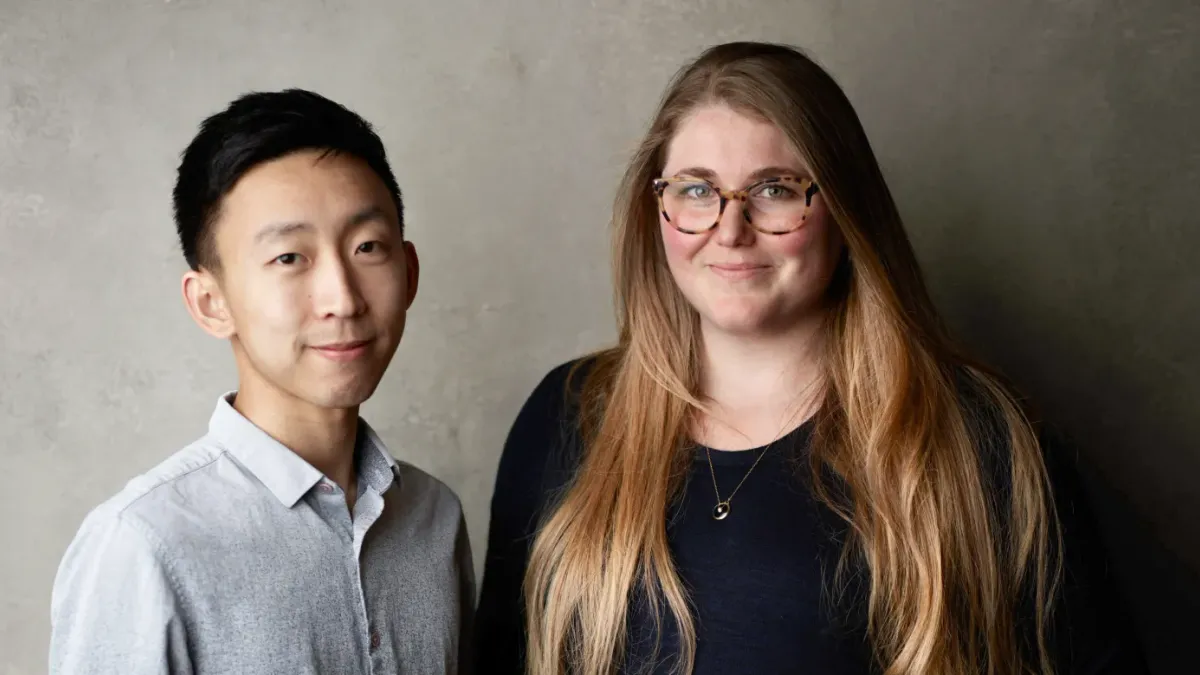

He could get 5 years. He could get 100. For how long will Sam Bankman-Fried go to prison?

Ryan Lee O'Neill, a New Jersey-based defense attorney, has represented countless defendants in the FTX founder's place. She has her own estimates.

By Gabrielle Saulsbery • March 20, 2024 -

Marqeta CFO touts EWA expansion

The card-issuing fintech has seen adoption of its debit card-linked EWA product increase as hourly workers at Walmart and Uber have been added, CFO Mike Milotich said.

By James Pothen • March 18, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

CFPB warns of ‘dangers’ on standards for open banking

“We know dangers exist when more powerful players weaponize industry standards,” the agency's director, Rohit Chopra, said in advance of finalizing an open banking rule later this year.

By Lynne Marek • March 15, 2024 -

Klarna’s IPO prospects grab spotlight

The BNPL provider’s CEO has suggested the company could IPO “quite soon,” but fintech investors expect the market will first want to see a stronger track record of profitability.

By Caitlin Mullen • March 13, 2024 -

Stripe reports payments volume increase

The digital payments company processed $1 trillion in total payments volume last year, according to its annual letter released Wednesday.

By James Pothen • March 13, 2024 -

Capital One angles to push Discover upmarket

With its acquisition of the card network, Capital One seeks to elevate Discover’s brand while also working to expand its acceptance abroad.

By Caitlin Mullen • March 7, 2024 -

Ansa cuts fees for merchants with white-labeled wallets

With an Ansa wallet, a merchant “doesn’t have to maintain ... what is at its core really tricky and regulated payments infrastructure,” co-founder Sophia Goldberg said.

By Gabrielle Saulsbery • March 6, 2024 -

i2c pursues bank clients abroad

The issuing-processing fintech sees a bigger opportunity in regions outside the U.S. to sell its core banking services, founder and CEO Amir Wain said.

By Caitlin Mullen • March 6, 2024 -

Gemini to return more than $1.1B to Earn customers

The crypto exchange and New York's Department of Financial Services reached an agreement Wednesday that included a $37 million penalty for compliance failures.

By Gabrielle Saulsbery • Feb. 29, 2024 -

Capital One sets out to tackle Discover compliance issues

The bank projects it will spend $2.8 billion in integration costs, CFO Andrew Young said Tuesday. That's on top of the $500 million Discover is planning to spend on compliance this year.

By Caitlin Mullen • Feb. 28, 2024 -

Warren calls out OCC over merger policy ahead of Capital One-Discover

The senator urged regulators to block the deal and took the OCC to task for its approval record. Meanwhile, JPMorgan CEO Jamie Dimon advocated for Capital One to get a fair shake.

By Dan Ennis • Feb. 27, 2024 -

Column

Fed official makes a case for the dollar’s hegemony

Can the dollar’s reign as the world’s reserve currency persist? This Fed official makes a strong case, but digital doubts may remain.

By Lynne Marek • Feb. 27, 2024 -

Q&A

Capital One-Discover deal may spur payments M&A

The blockbuster deal is set “to trigger a bunch of rethinking across the industry,” said Erin McCune, a partner at consulting firm Bain & Co.

By Caitlin Mullen • Feb. 27, 2024 -

Kraken wants SEC suit dismissed

The playbook for Kraken's motion to dismiss looks a lot like those of Binance and Coinbase.

By Gabrielle Saulsbery • Feb. 23, 2024 -

Capital One-Discover deal carries $1.38B termination fee

The fee would apply if Discover chooses another buyer or if either board has a change of heart but not if regulators block the deal.

By Dan Ennis • Feb. 23, 2024 -

Mastercard to be dinged by Capital One-Discover deal

While both Mastercard and Visa will be impacted by Discover’s plan to be acquired by card issuer Capital One, the former is likely to bear the brunt of the blow.

By Lynne Marek • Feb. 22, 2024 -

Capital One-Discover deal may spark antitrust concern

While the $35.3 billion acquisition is expected to prompt antitrust concerns related to consumer card lending, regulators may see competition benefits in the card network arena.

By Caitlin Mullen • Feb. 21, 2024 -

Cross-border payments remain focus for Fed

Tools that “automate processes, reduce costs and promote effective safeguards across jurisdictions” may help improve cross-border payments, a Federal Reserve official said last week.

By Lynne Marek • Feb. 20, 2024 -

Warren probes Zelle scam policy

Three senators, including Elizabeth Warren, asked Zelle owner Early Warning Services to provide detailed information about its fraud reimbursement policy.

By James Pothen • Feb. 20, 2024 -

PayPal invests in AI startup Rasa

The investment is the first that the digital payments pioneer is making from its new artificial intelligence venture fund.

By Tatiana Walk-Morris • Feb. 20, 2024 -

Capital One to acquire Discover in $35.3B deal

The transaction would give a big boost to a bank well-known for its credit card component, yet lend regulatory gravitas and investment dollars to a struggling card network.

By Dan Ennis • Feb. 20, 2024 -

SoLo Funds nears 2M users

The peer-to-peer lending platform has faced some regulatory backlash, but a study from London's Centre for Economics and Business Research shows it's cheaper than many other subprime options.

By Gabrielle Saulsbery • Feb. 14, 2024 -

Q&A

Adyen eyes growth in North America

Davi Strazza, North America president at Adyen, pointed to the Dutch processor’s single technology platform as setting it apart in a crowded field of payments players.

By Caitlin Mullen • Feb. 14, 2024 -

NY AG expands suit against DCG

Attorney General Letitia James initially alleged that Digital Currency Group and others defrauded investors of $1 billion. Now, after hearing from more investors, that number is up to $3 billion.

By Gabrielle Saulsbery • Feb. 12, 2024 -

Bill Holdings, Bank of America revamp contract

The provider of bill-pay software services was expecting to extend its services to more of the bank's clients. Now the bank is changing its plans.

By Lynne Marek • Feb. 12, 2024