Payments: Page 6

-

JPMorgan threatens to sue CFPB over Zelle

The bank in May flagged government inquiries over its handling of disputes involving the P2P platform. But Friday, it said it would consider litigation if the agency were to issue an enforcement action on the matter.

By Dan Ennis • Aug. 5, 2024 -

Outdated tech could slow instant payment adoption: survey

Financial institutions expect business clients to be a driver of instant payment revenue, but adopting the technology comes with hurdles, the results of a recent survey showed.

By Tatiana Walk-Morris • Aug. 2, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Stripe buys software rival Lemon Squeezy

The San Francisco payments giant bought the 4-year-old Salt Lake City startup as it continues its global expansion.

By Patrick Cooley • July 30, 2024 -

Trump pledges to fire Gensler, support crypto

The Republican presidential nominee told Bitcoin 2024 attendees that, if elected, he will hire advisers who “want to see your industry thrive, not dive.”

By Gabrielle Saulsbery • July 29, 2024 -

Affirm says CFPB’s proposed BNPL rules will confuse customers

In commenting on the proposal, the BNPL provider said consumers would be better served by rules specific to BNPL transactions, as opposed to credit card regulations.

By Patrick Cooley • July 29, 2024 -

Sponsored by Giesecke+Devrient GmbH

The prestige and convenience of ceramic payment cards in redefining the banking customer experience

Discover how ceramic payment cards are creating an exclusive banking experience, becoming the top-of-wallet choice for consumers.

By Mikko Kähkönen. He is the Global Head of Payment Cards Portfolio at Giesecke+Devrient (G+D) • July 29, 2024 -

Zelle, big banks challenge senators on scam reimbursements

Forcing banks to reimburse authorized payments could encourage bad behavior and would not deter scammers, bank executives said in a Senate hearing.

By Patrick Cooley • July 26, 2024 -

Revolut faces more fraud claims than other UK banks: report

A spokesperson said the fintech investigates each fraud claim independently of other cases, and that it takes such claims “incredibly seriously.”

By Gabrielle Saulsbery • July 24, 2024 -

Column

Dive Deposits: Comerica’s loss may be BNY’s gain

The Treasury Department will not renew its Direct Express debit card contract with Comerica, the Dallas bank disclosed Friday. Rather, that partnership is going to BNY, sources told American Banker.

By Dan Ennis • July 23, 2024 -

BlockFi prepares to make customers whole

The crypto firm’s bankruptcy plan was approved in September. It announced Monday the sale of its FTX claims, part of its plan to pay customers back, at a “substantial premium to the[ir] face value.”

By Gabrielle Saulsbery • July 23, 2024 -

Truist execs pledge expense discipline

While the bank is “fully committed” to keeping expenses flat this year compared to last, Truist is spending to bolster its payments and middle market lending teams, CEO Bill Rogers said Monday.

By Caitlin Mullen • July 22, 2024 -

JPMorgan Chase invests in B2B payments startup Slope

The bank’s payments unit and Y Combinator were among investors providing $65 million in financing for the business-to-business upstart this month.

By Lynne Marek • July 22, 2024 -

Sponsored by Form3

Why orchestration is a key driver in payment modernization

Payment orchestration solutions give banks flexibility and control around what happens for each payment type they handle.

July 22, 2024 -

Capital One-Discover deal critics, supporters sound off

Executives with the two companies and a number of community groups spoke in favor of the $35.3 billion merger Friday, while a raft of critics urged regulators to block the deal.

By Caitlin Mullen • July 19, 2024 -

CFPB to apply lending laws to EWA

The federal agency weighed in Thursday with a proposed rule to oversee the burgeoning earned wage access industry.

By Lynne Marek • July 18, 2024 -

Opponents of Capital One-Discover merger to air grievances

Consumer advocates say the tie-up will stifle competition and give the combined company an easy avenue to raise fees on card payments.

By Patrick Cooley • July 18, 2024 -

Discover to sell student loan portfolio to Carlyle, KKR in $10.8B deal

The student loan sale is the latest loose end Discover seeks to tie up since Capital One announced its intent to purchase the card company.

By Caitlin Mullen • July 17, 2024 -

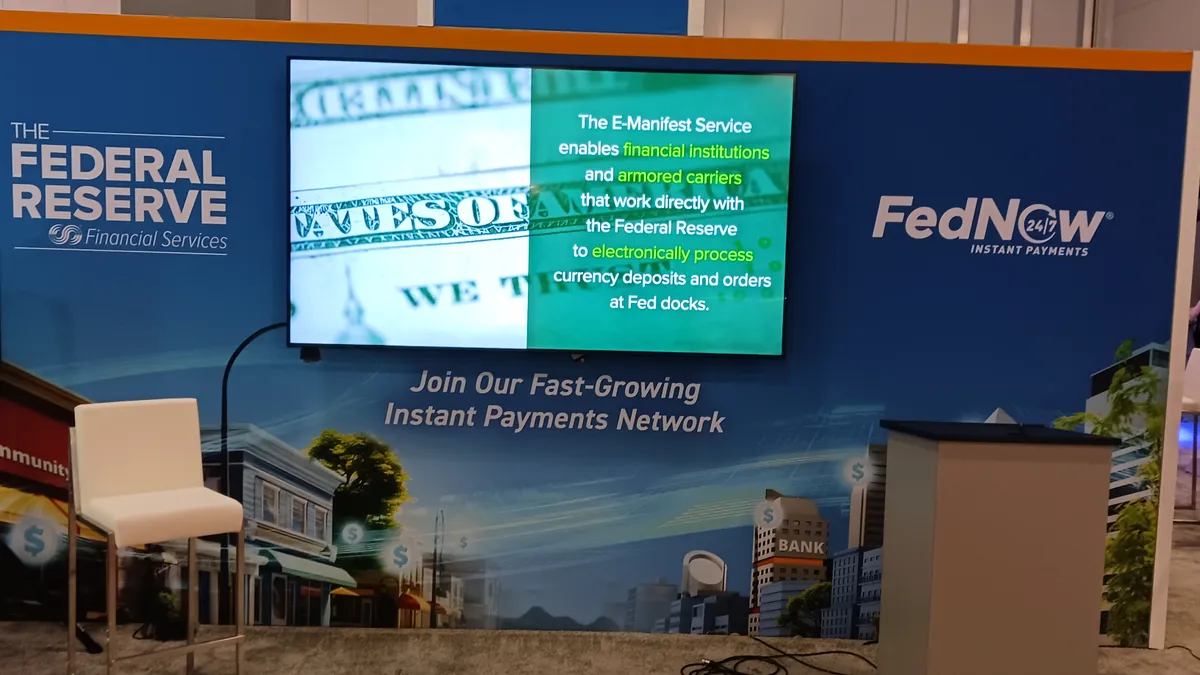

FedNow zooms past RTP participation in inaugural year

The Federal Reserve’s nascent instant payments system has collected hundreds of bank participants across the country in its first year of operations, although a few major banks are holdouts.

By Lynne Marek • July 17, 2024 -

Banks should proactively tackle instant payments fraud: BNY

Use of data-sharing protocols among banks could warn customers before they send money, said Carl Slabicki, a BNY executive.

By Suman Bhattacharyya • July 12, 2024 -

Lawmakers egg on US payments system expansion

A bipartisan group is nudging the Federal Reserve to explain why it can’t speed up a plan to extend the operational availability of the U.S. payments system.

By Lynne Marek • July 8, 2024 -

Discover to settle card misclassification class actions for $1.2B

The card company has warned it could face further financial toll related to the issue, in which it overcharged merchants for years.

By Caitlin Mullen • July 8, 2024 -

Silvergate pays $63M to settle with SEC, Fed, California regulator

The company and two of its executives settled allegations against them. Silvergate’s former CFO, however, did not, and eyes a civil trial.

By Gabrielle Saulsbery • July 2, 2024 -

Sponsored by Federal Reserve Financial Services

Here’s how the FedNow® Service answers the need for fast, safe and reliable instant payments

A new survey released by the Federal Reserve shows that among all the choices, faster and instant payments are growing in demand.

July 1, 2024 -

VersaBank’s cross-border acquisition of Minnesota lender gets final nod

Canada’s Office of the Superintendent of Financial Institutions approved the transaction this week, after the Fed and OCC green-lighted the tie-up.

By Dan Ennis • June 28, 2024 -

Chuck morphs into a new Alloy Labs-backed effort

Community banks partnered with Alloy Labs and Payrailz a few years ago on a project called Chuck, in a bid to rival Zelle, but that effort has been subsumed by a stealthy successor.

By Lynne Marek • June 27, 2024