Payments: Page 23

-

Citi settles with Revlon creditors over $500M piece of payments blunder

The legal action ends a two-year battle over $900 million the bank wired to creditors years ahead of schedule. But fallout from the error remains, in the form of regulatory legwork.

By Anna Hrushka • Dec. 19, 2022 -

Photo by Pavel Danilyuk on Pexels

Wise, VizyPay target US hiring

Some payments companies have plans for extensive hiring next year, despite the economic headwinds that led other players to contract this year.

By Lynne Marek • Dec. 19, 2022 -

Trendline

Fraud and AML in banking

The past year has been one of reckoning with regard to fraud — from TD’s $3 billion AML penalty to the continuing punitive phase connected to PPP misdeeds, crypto bankruptcies and pig butchering.

By Banking Dive staff -

Chime made two offers up to $2B to buy DailyPay: report

DailyPay, which was founded in 2015 by Jason Lee, may be content to wait for a better offer, or perhaps lean on its track record of successful fundraising going forward.

By Anna Hrushka • Dec. 16, 2022 -

CFPB to face reckoning in next Congress, Republicans warn Chopra

“Next month there will be a new majority in the House of Representatives. I think you'll wish you tried harder to play by the rules,” Rep. Patrick McHenry, R-NC, told the CFPB director.

By Anna Hrushka • Dec. 15, 2022 -

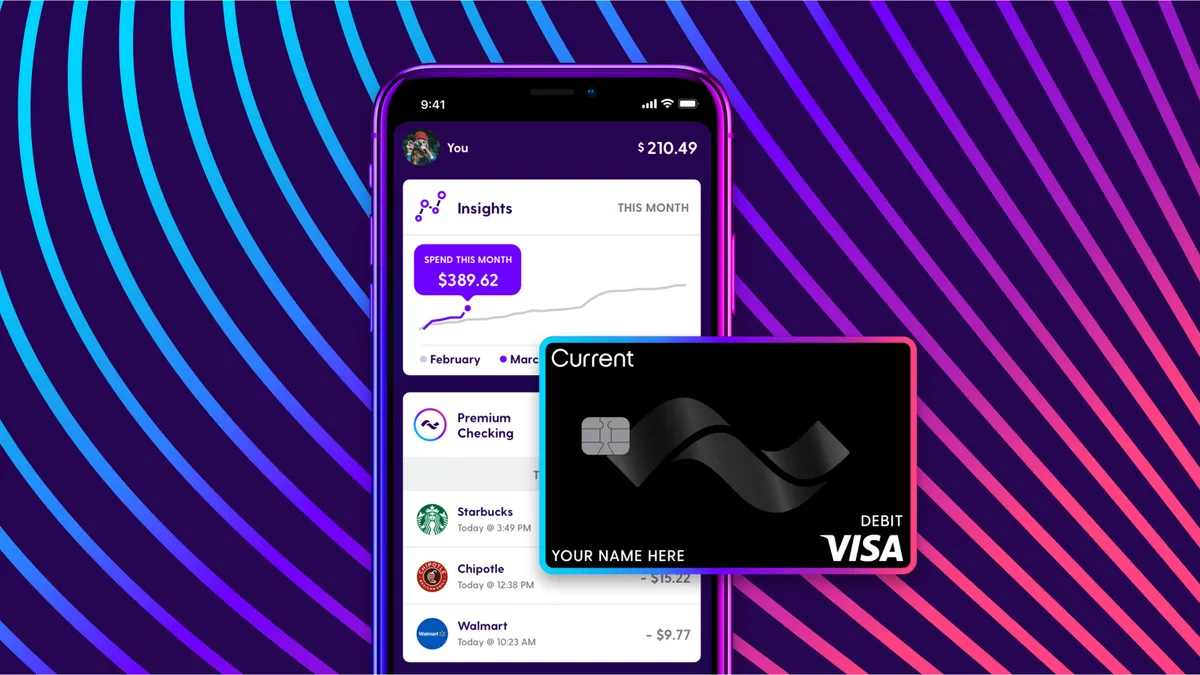

How Current pivoted to free

"We had a lever that other people didn't have, which was we can actually cut costs sufficiently that we don't need to fill that hole with a subscription fee,” said Trevor Marshall, the company's CTO.

By Suman Bhattacharyya • Dec. 14, 2022 -

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Discover pulls back on checking account over fraud concerns

The card company expects to resume taking applications early next year for the product, which offers cash-back and debit features, CEO Roger Hochschild said this week.

By Caitlin Mullen • Dec. 8, 2022 -

BlockFi files for bankruptcy amid FTX contagion

The crypto lender has initiated a cost-cutting plan that involves “major layoffs,” according to Decrypt. Monday’s announcement follows earlier rumors that the company had been mulling bankruptcy.

By Gabrielle Saulsbery • Nov. 28, 2022 -

Banks discuss refund rule for Zelle customer fraud: report

Under measures being discussed, banks would share liability inside Zelle’s system and guarantee to reimburse one another, sources told The Wall Street Journal.

By Anna Hrushka • Nov. 28, 2022 -

PayPal counts on its digital app for gains

The digital payments pioneer is scouting for new ways to increase customer use of its digital wallet, including plans to add a new Venmo teen account.

By Lynne Marek • Nov. 28, 2022 -

Regulatory challenges more prominent in eyes of fintech industry leaders this year

Private firms are adopting a more defensive posture, delaying new funding rounds, planning for modest growth and addressing regulatory risks, according to a report.

By Gabrielle Saulsbery • Nov. 23, 2022 -

JPMorgan’s crypto wallet trademark is approved

The green light comes more than two years after the bank submitted paperwork to the U.S. Patent and Trademark Office, and runs counter to CEO Jamie Dimon’s opinion on virtual currencies.

By Dan Ennis • Nov. 22, 2022 -

Column

Can Congress come together on crypto?

Perhaps even a divided Congress can make bipartisan headway in crafting a regulatory framework for crypto following FTX’s failure.

By Lynne Marek • Nov. 18, 2022 -

Visa names its next CEO

The card network’s president, Ryan McInerney, a former consumer-banking chief at JPMorgan Chase, will succeed Al Kelly on Feb. 1.

By Lynne Marek • Nov. 18, 2022 -

Tracker

Cryptexodus: A running list of crypto execs who’ve quit since May

The crypto market has been volatile since spring. While some executives have run for the hills, others have opted to transition to back-seat roles.

By Gabrielle Saulsbery • Nov. 14, 2022 -

Sam Bankman-Fried steps down as FTX CEO amid bankruptcy filing

FTX.com’s assets were frozen in the Bahamas, where the company is headquartered. Crypto lender BlockFi also paused withdrawals because of its exposure to FTX.

By Gabrielle Saulsbery • Nov. 11, 2022 -

Green Dot focuses on tech modernization amid leadership shakeup

The company named a CFO, COO and chief revenue officer, and said two BaaS partners recently extended their contracts.

By Suman Bhattacharyya • Nov. 11, 2022 -

Elon Musk wants to turn Twitter into ‘the people’s financial institution’

During a Thursday call with Twitter staff, Musk shared his plans to allow users to maintain a cash balance on the platform. He also hinted at the possibility of offering loans.

By Anna Hrushka • Nov. 11, 2022 -

Binance to acquire rival FTX amid ‘liquidity crunch’

FTX founder Sam Bankman-Fried announced the deal two days after Binance CEO Changpeng Zhao said he’d dump his holdings of FTX native coin FTT.

By Gabrielle Saulsbery • Nov. 8, 2022 -

A CBDC could make cross-border payments faster, safer: NY Fed

Researchers designed a prototype digital currency and blockchain and simulated foreign exchange spot transactions that cleared within 10 seconds but said the study doesn’t endorse a CBDC or assume the Fed will issue one.

By Rajashree Chakravarty • Nov. 8, 2022 -

FedNow gives fee holiday in 2023

The Fed reiterated the fees the banks will ultimately charge — namely, customer credit transfer and customer credit transfer return fees of $0.045 per-item and a participation fee of $25 per routing transit number per month.

By Lynne Marek • Nov. 7, 2022 -

Goldman launches digital asset classification system

Datonomy is intended to help institutional investors make sense of the new asset class.

By Gabrielle Saulsbery • Nov. 4, 2022 -

CFPB investigating U.S. Bank over pandemic-era unemployment payments

The bank is the latest lender to face regulatory scrutiny over its administration of the payments. Bank of America was handed a $225 million fine in July after regulators said its efforts to tamp down fraud went too far.

By Anna Hrushka • Nov. 3, 2022 -

Safe Harbor to buy cannabis banking, payments fintech

The deal will add 300 accounts to Safe Harbor’s portfolio and expand the firm’s operations to more than 30 states.

By Anna Hrushka • Nov. 2, 2022 -

Here’s what Brett Harrison expects in the crypto market

The "decade of free money" is ending, but the future is bright, said the former president of FTX US.

By Gabrielle Saulsbery • Oct. 27, 2022 -

CFPB aims to give ‘open banking’ rule teeth in 2024

The bureau's chief, Rohit Chopra, laid out a timeline on a rule change meant to make it easier for consumers to break up with their banks.

By Gabrielle Saulsbery • Oct. 26, 2022