Fintech: Page 21

The latest fintech news for banking professionals.

-

Q&A

How neobank Lili streamlines bookkeeping for SMBs

The fintech recently launched Lili Smart, accounting software that helps small-business owners manage their own bookkeeping by categorizing transactions in real time.

By Anna Hrushka • April 21, 2023 -

Open banking might affect deposit outflows, OCC’s Hsu says

“An open banking culture that ... puts trust above other objectives, including growth and profit, will succeed and thrive over time,” said Acting Comptroller Michael Hsu.

By Rajashree Chakravarty • April 20, 2023 -

Explore the Trendline➔

Explore the Trendline➔

da-kuk via Getty Images

da-kuk via Getty Images Trendline

TrendlineArtificial intelligence

Banks are enthusiastic about AI’s promises. But can they get customers on board, and will regulators let the innovation happen?

By Banking Dive staff -

MUFG hires SVB’s ex-corporate-banking chief, 4 other senior execs

In all, MUFG is adding 20 bankers to its technology, media and telecom unit, in perhaps its most significant U.S. move since it sold its West Coast branch footprint to U.S. Bank last year.

By Dan Ennis • April 20, 2023 -

Inclusive lending fintech Stratyfy raises $10M

The funding will go toward a product that helps lenders detect unfair bias, Stratyfy co-founder and CEO Laura Kornhauser said.

By Rajashree Chakravarty • April 19, 2023 -

Debt repayment fintech Clerkie raises $33M in Series A

“Our goal is to support struggling American families by giving them better tools to responsibly fulfill their debt obligations and ease their debt burden,” said founder Guy Assad.

By Gabrielle Saulsbery • April 19, 2023 -

Goldman confirms it’s exploring sale of fintech GreenSky

The comments lend more structure to CEO David Solomon’s assertion, at Goldman’s investor day in February, that the bank was “considering strategic alternatives” for its consumer business.

By Anna Hrushka • April 19, 2023 -

Goldman, Apple launch savings account with 4.15% APY

Work on the account was announced in October as part of a series of offerings, including a buy now, pay later platform, meant to generate a greater share of the tech company’s revenue from services.

By Rajashree Chakravarty • April 18, 2023 -

Retrieved from Moby on April 05, 2023

Retrieved from Moby on April 05, 2023

SF tech worker charged in murder of Cash App founder

San Francisco police arrested an IT worker in the murder of Bob Lee, who was knifed to death in the early morning hours of April 4. Police declined to discuss a motive at a Thursday press conference.

By Gabrielle Saulsbery • April 13, 2023 -

SBA to open flagship lending program to fintechs

A new rule, which takes effect May 11, ends a 40-year moratorium on admitting new nonbank lenders to the agency’s 7(a) loan program.

By Anna Hrushka • April 12, 2023 -

SoFi bolsters mortgage unit with Wyndham deal

The deal will broaden the neobank’s suite of mortgage products and lessen its reliance on third-party partners and processes, the fintech said.

By Rajashree Chakravarty • April 12, 2023 -

CFPB director wants some payments firms labeled systemically important

The bureau's chief, Rohit Chopra, urged users who maintain balances on their digital wallets and money-transfer apps to move that uninsured money to a bank account.

By Anna Hrushka • April 12, 2023 -

Judge grants Javice an exception on her JPMorgan mortgage

The fintech founder last week agreed not to contact employees of JPMorgan, the bank she is charged with defrauding. One catch: That bank holds her mortgage.

By Dan Ennis • April 11, 2023 -

Ledge seizes on SVB crisis with multi-bank offering

The Israeli finance tech startup decided to expedite the rollout of its new treasury management tool after the collapse of Silicon Valley Bank.

By Alexei Alexis • April 11, 2023 -

OCC to audit JPMorgan’s dealmaking: sources

The audit was scheduled before JPMorgan sued the founder of Frank, a fintech it bought. The Justice Department charged the fintech exec with fraud, a development that has raised questions around due diligence.

By Dan Ennis • April 7, 2023 -

Current’s ex-head of talent sues neobank in alleged discrimination

Isabelle Mitura, a tech recruiter, alleges Current’s head of people demeaned her in front of colleagues on multiple occasions, referring to her as "an old Asian woman with no kids.”

By Anna Hrushka • April 7, 2023 -

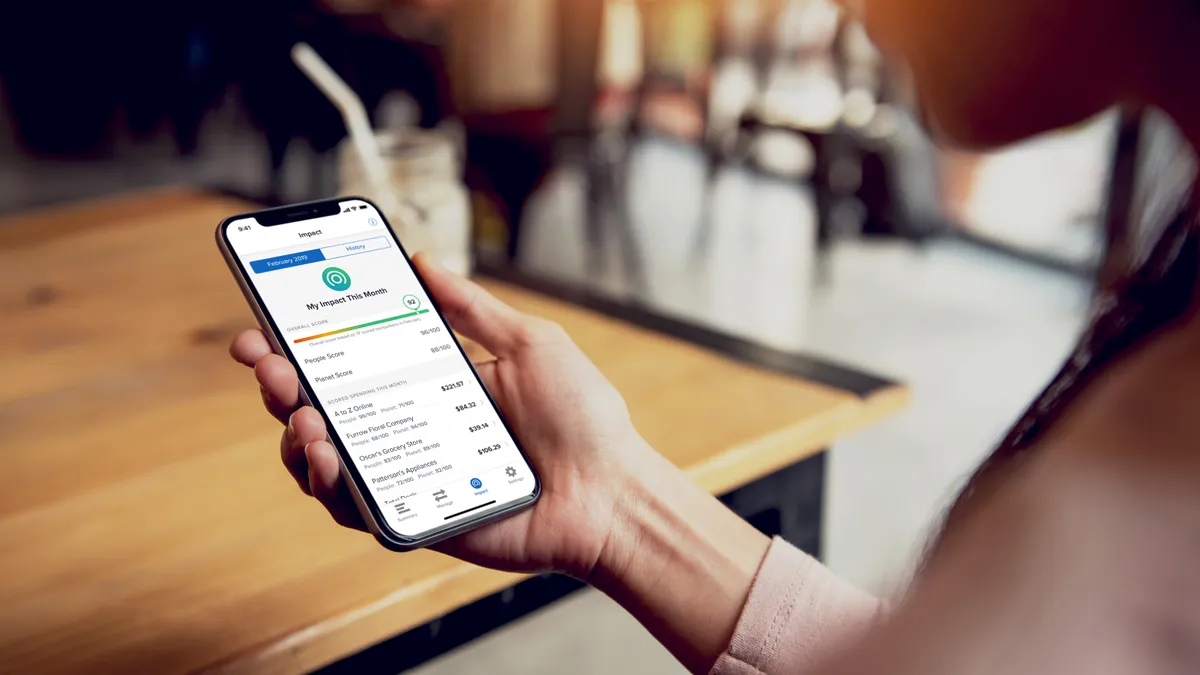

Neobank Aspiration to cut more than 180 jobs

The layoffs, part of a companywide restructuring, span multiple departments at the climate-conscious neobank and include the firm’s chief of staff and chief administrative officer.

By Anna Hrushka • April 6, 2023 -

Acorns targets next generation of customers in GoHenry deal

A longer-term investing horizon, coupled with calls for increasing financial literacy among teens, make the youth market an attractive target for the investing fintech.

By Anna Hrushka • April 5, 2023 -

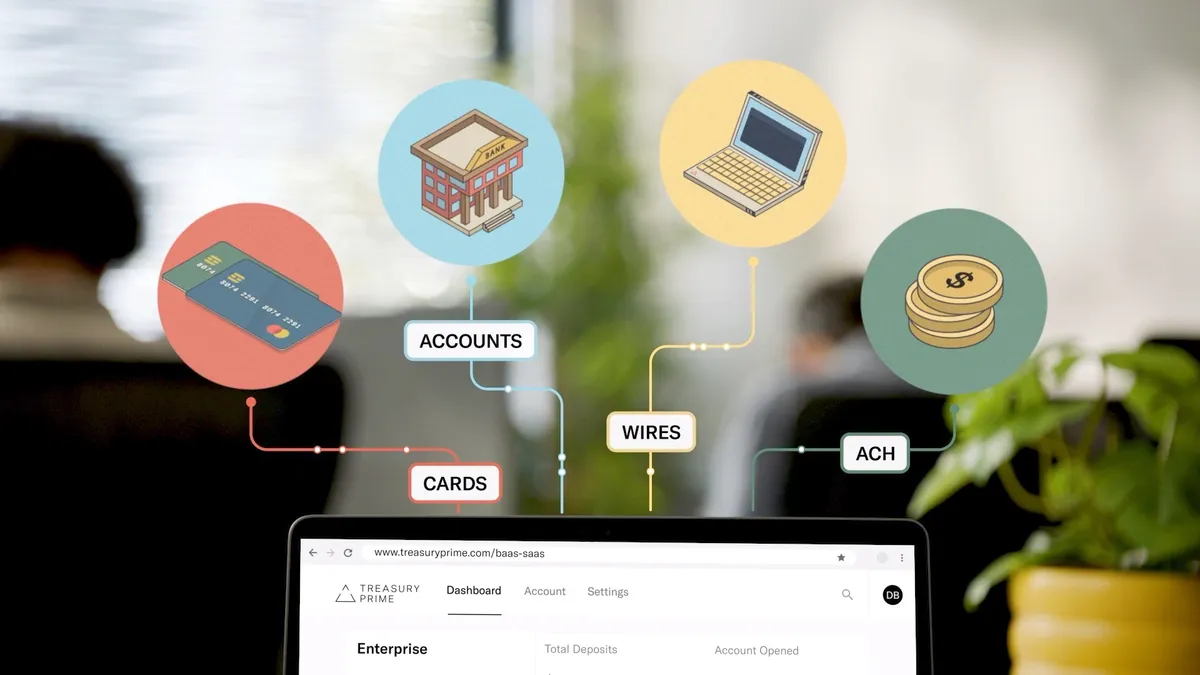

Treasury Prime launches instant cross-bank transfer product

The fintech says the platform offers a seamless movement of money within a network of more than 15 financial institutions using a single API.

By Rajashree Chakravarty • April 5, 2023 -

Retrieved from Moby on April 05, 2023

Retrieved from Moby on April 05, 2023

Cash App founder stabbed dead, police say

No arrests have been made in the Tuesday morning death of Bob Lee, the chief product officer at crypto firm MobileCoin, police said.

By Gabrielle Saulsbery • April 5, 2023 -

Dutch neobank Bunq applies for US bank license

Bunq CEO Ali Niknam said the neobank is expanding to the U.S. to serve European expatriates “with strong ties to both sides of the Atlantic.”

By Anna Hrushka • April 4, 2023 -

Deep Dive

EWS readies Paze to help banks take on digital wallet market

Even with the backing of the nation’s largest banks, the platform, set for a June launch, will face adoption and security hurdles, industry experts say.

By Anna Hrushka • April 3, 2023 -

SavvyMoney helps consumers bolster credit scores, banks bolster loan portfolio

The integrated credit solution has 1,055 banking partners, and that number "grows daily," its CEO said.

By Gabrielle Saulsbery • March 29, 2023 -

BM Technologies taps Raymond James vet as co-CEO

The fintech appointed Raj Singh, previously an adviser to the company, to strengthen its management team and position itself for the “next phase of growth,” BM Technologies said Monday.

By Rajashree Chakravarty • March 29, 2023 -

Greenlight’s new B2B offering brings kid-focused banking to traditional firms

Over half a dozen firms, including Morgan Stanley, WaFd Bank and Community Financial Credit Union have partnered with the neobank to offer its services to their customers.

By Anna Hrushka • March 29, 2023 -

FDIC orders neobank Utoppia to stop making claims of deposit insurance

As of January, the fintech’s website claimed Utoppia was “insured by the FDIC,” according to the regulator. The FDIC also said Utoppia’s CFO made false claims of deposit insurance on LinkedIn.

By Anna Hrushka • March 28, 2023