Fintech: Page 19

The latest fintech news for banking professionals.

-

Square tests credit card for merchants

The card aimed at providing more financial services to merchants comes amid a slew of competition to serve that clientele.

By Caitlin Mullen • June 28, 2023 -

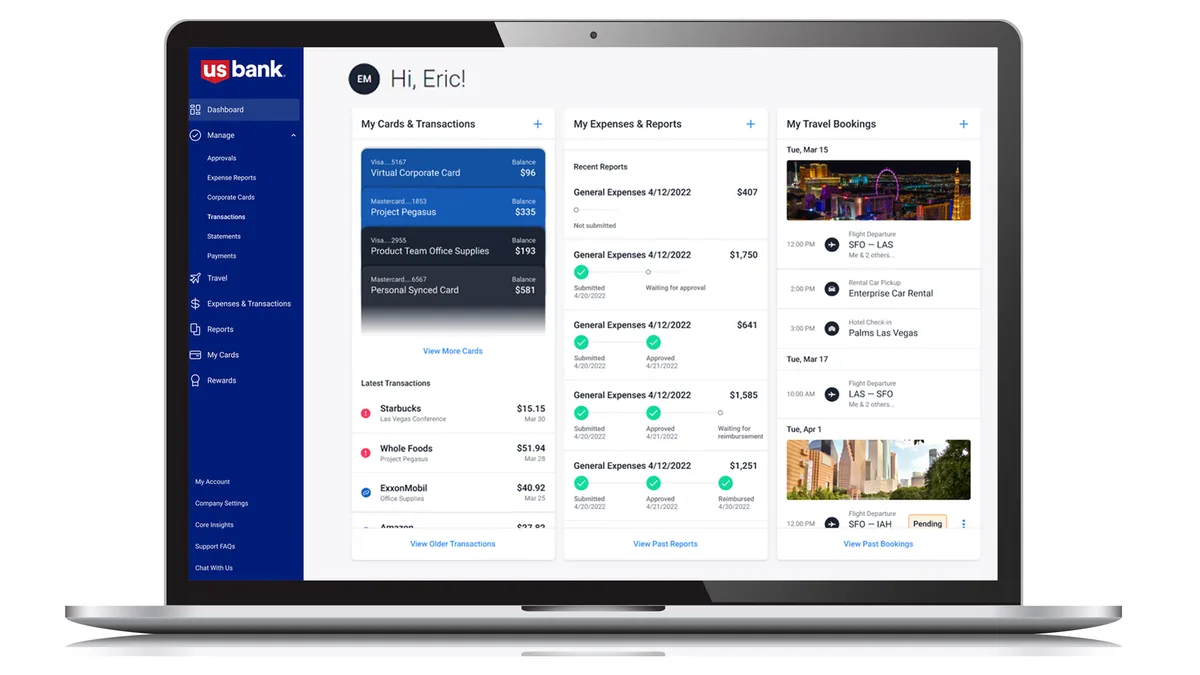

U.S. Bank’s fintech acquisition materializes in card launch

U.S. Bank and TravelBank, which it acquired in 2021, this week launched a commercial rewards card for the emerging middle market.

By Gabrielle Saulsbery • June 28, 2023 -

Explore the Trendline➔

Explore the Trendline➔

da-kuk via Getty Images

da-kuk via Getty Images Trendline

TrendlineArtificial intelligence

Banks are enthusiastic about AI’s promises. But can they get customers on board, and will regulators let the innovation happen?

By Banking Dive staff -

Robinhood cuts around 150 jobs

The cuts amount to 7% of the brokerage's workforce and follow two rounds of layoffs in 2022.

By Gabrielle Saulsbery • June 27, 2023 -

Fintech startup TreasurySpring raises $29M amid bank turmoil

The startup is among fintech companies looking to capitalize on the Silicon Valley Bank collapse and other recent bank failures.

By Alexei Alexis • June 26, 2023 -

Goldman underwhelmed by GreenSky bids: report

Apollo, Sixth Street and Synchrony are among bidders for all or part of the installment-lending platform, sources told CNBC. Goldman may take a writedown on the sale.

By Dan Ennis • June 23, 2023 -

Plaid launches anti-fraud network for banks, fintechs

The collaborative anti-fraud network is “designed to stop the chain reaction of fraud that occurs when identities are stolen and accounts are compromised,” the company said.

By Anna Hrushka • June 23, 2023 -

Robinhood to buy card startup X1 in $95M deal

The online brokerage said it will take on X1 employees, including co-founders Deepak Rao and Siddharth Batra, but did not specify how many.

By Lynne Marek • June 23, 2023 -

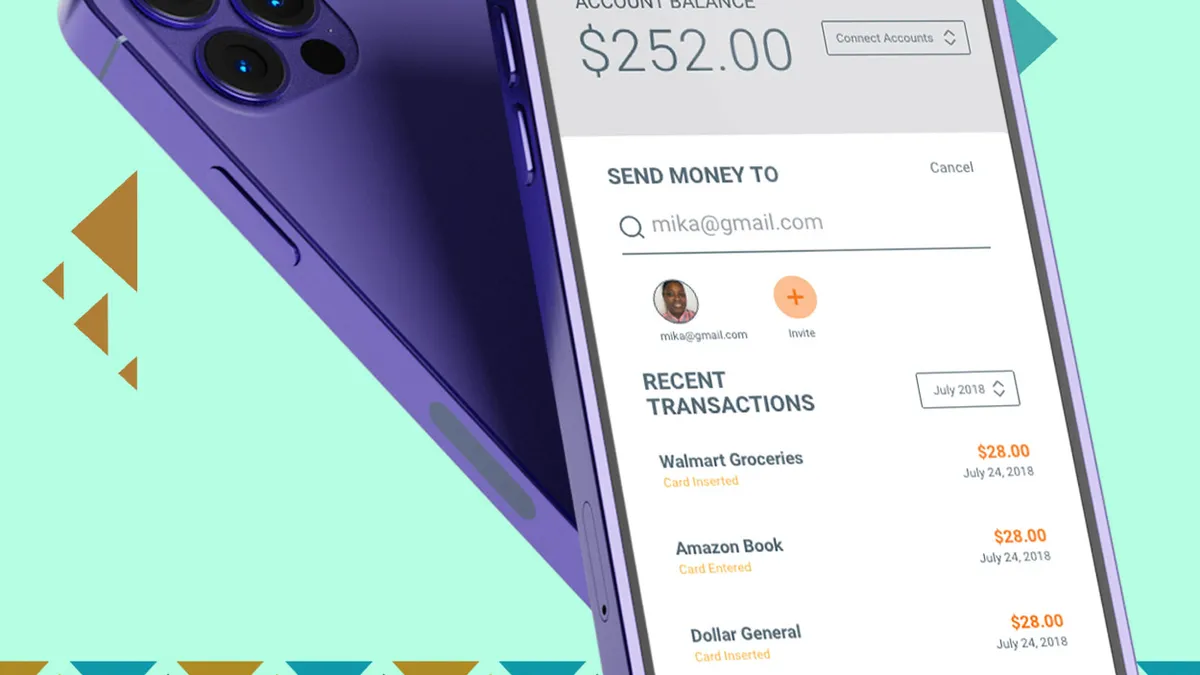

US servicemembers ensnared by digital payment app scams

Servicemember complaints about digital payment apps surged last year, according to a CFPB report, which also highlighted military families’ susceptibility to payments fraud.

By Lynne Marek • June 22, 2023 -

Q&A

Majority leans into subscriptions as consolidation hits fintech sector

Majority raised $9.75 million in new funding this month, some of which it plans to put toward a meet-up space it recently opened at the U.S.-Mexico border in Laredo, Texas.

By Anna Hrushka • June 21, 2023 -

Citizens partners with Wisetack on BNPL loans for SMBs

Citizens will focus on home improvement projects through Wisetack’s platform that connects in-person providers with buy now, pay later lenders.

By Rajashree Chakravarty • June 21, 2023 -

Shopify taps Adyen in bid for bigger clients

Canadian e-commerce company Shopify is upgrading its integration with Dutch fintech Adyen in an effort to serve larger merchants in North America and on the international stage.

By Caitlin Mullen • June 21, 2023 -

Fed publishes master account list

The move follows calls from Republicans for the Fed to shed light on the process by which it grants accounts, and comes as an increasing number of uninsured firms are vying for access to the central bank’s system.

By Anna Hrushka • June 20, 2023 -

Walmart-backed ONE offers 5% savings rate

As the fintech looks to grow in a competitive field, it plans to leverage Walmart’s distribution channels, and is rapidly expanding its presence in Walmart stores, a source said.

By Anna Hrushka • June 14, 2023 -

BNY Mellon, MoCaFi link up to bring digital payments to unbanked

The bank's treasury services clients will now be able to disburse payments to those without bank accounts through MoCaFi.

By Gabrielle Saulsbery • June 14, 2023 -

Visa launches fintech accelerator in Africa

The program is part of Visa’s effort to invest $1 billion in the continent’s digital transformation over five years.

By James Pothen • June 14, 2023 -

Jack Henry to eliminate screen scraping by end of summer

The fintech, which has API integrations with data exchange platforms Finicity, Akoya, Plaid, Envestnet | Yodlee and Intuit, started phasing out the practice five years ago.

By Anna Hrushka • June 14, 2023 -

Starling CEO Anne Boden’s exit followed investor clash: report

Jupiter Asset Management sold its stake in the neobank, dropping Starling’s valuation by more than £1 billion. The effect on the value of Boden’s — and Starling employees’ — holdings became a concern.

By Rajashree Chakravarty • June 14, 2023 -

Banks too slow to address P2P payment scams, CFPB’s Chopra says

“They have been very slow to take action,” the bureau’s director said Tuesday, when asked if banks were creating frameworks to combat fraud and scams conducted on peer-to-peer payment platforms.

By Anna Hrushka • June 13, 2023 -

FIS acquires Bond: reports

FIS has acquired Bond, according to two news outlet reports, including one backed by an internal company memo.

By Lynne Marek • June 12, 2023 -

Fed, FDIC, OCC update guidance on third-party risk management

Regulators described the new guidance as “principles-based,” which can be adjusted to the unique circumstances of each third-party relationship.

By Anna Hrushka • June 7, 2023 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB slaps warning on P2P

The federal agency told consumers that money sitting in uninsured accounts, such as some offered by PayPal, Venmo and Cash App, could be at risk.

By Lynne Marek • June 2, 2023 -

Fintech lenders drive consumer loan growth: J.D. Power study

Fintechs are gaining momentum in the lending space as they deliver a quick, frictionless approach to lending, the study found.

By Rajashree Chakravarty • May 31, 2023 -

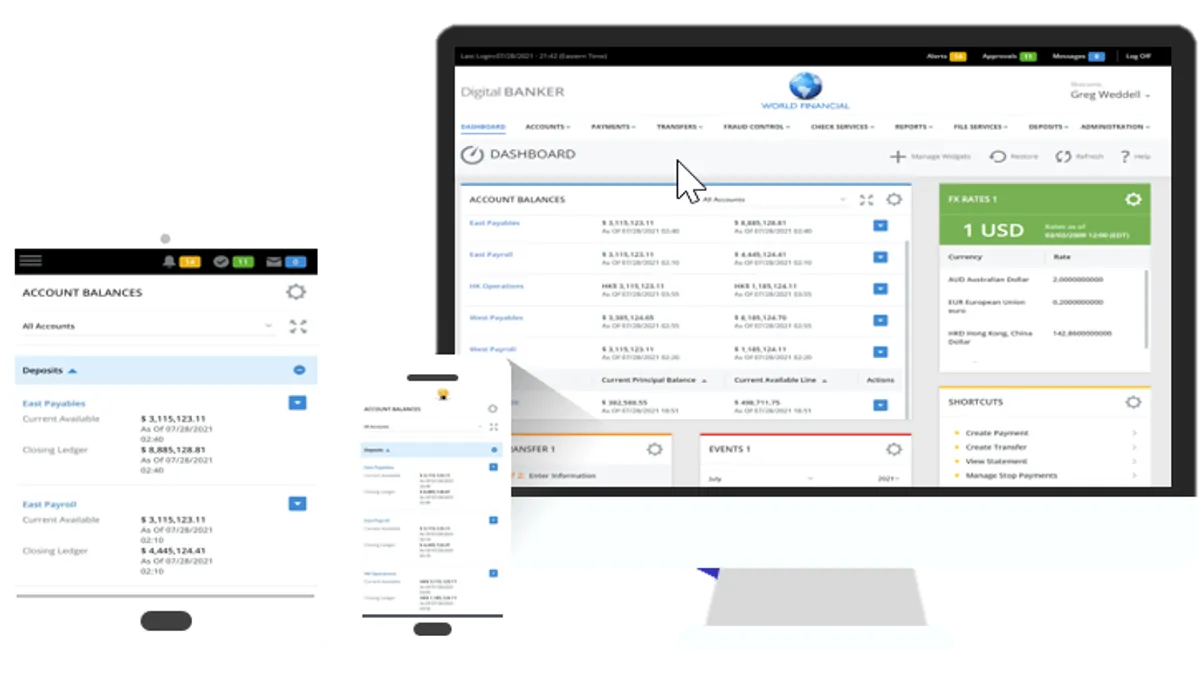

Cash management firm Dragonfly dives into ‘composable’ banking

An update to its Universal Online Banker technology gives customers like Utah-based Zions Bank the ability to offer digital-first business banking services at scale, giving them a leg up in competition against neobanks and fintechs.

By Gabrielle Saulsbery • May 31, 2023 -

Marqeta shuts down Australia operations

The fintech has eliminated about 10 jobs in that country and two more in Singapore, a spokesperson said.

By Lynne Marek • May 30, 2023 -

LGBTQ+ fintech Daylight to close its doors

Customer money can be accessed for transfer until June 30, the company's last day of banking operations, CEO Rob Curtis said in a blog post.

By Rajashree Chakravarty • May 25, 2023