Fintech: Page 12

The latest fintech news for banking professionals.

-

Viva Wallet CEO sues JPMorgan, claiming bank is limiting growth

Haris Karonis alleges JPMorgan, which owns 48.5% of Viva, is seizing on "perverse incentives" that allow the bank to take full control of the fintech if its value falls below €5 billion next year.

By Gabrielle Saulsbery • Feb. 15, 2024 -

Plaid names Cloudflare vet as its first president ahead of ‘eventual’ IPO

The fintech's hiring of Jen Taylor, Cloudflare's ex-chief product officer, comes months after Plaid appointed its first CFO and named another executive as head of Europe.

By Dan Ennis • Feb. 14, 2024 -

Explore the Trendline➔

Explore the Trendline➔

da-kuk via Getty Images

da-kuk via Getty Images Trendline

TrendlineArtificial intelligence

Banks are enthusiastic about AI’s promises. But can they get customers on board, and will regulators let the innovation happen?

By Banking Dive staff -

Q&A

Adyen eyes growth in North America

Davi Strazza, North America president at Adyen, pointed to the Dutch processor’s single technology platform as setting it apart in a crowded field of payments players.

By Caitlin Mullen • Feb. 14, 2024 -

Citi moves deeper into e-commerce through digital couponing

The bank recently launched a browser extension that searches for coupons on merchant checkout pages, suggests applicable codes and can activate cash-back offers.

By Suman Bhattacharyya • Feb. 12, 2024 -

Dutch neobank Bunq withdraws application for US banking charter

Bunq is the latest in a line of European neobanks to back out of pursuing a U.S. banking charter, though it stated plans to reapply, American Banker reported.

By Rajashree Chakravarty • Feb. 8, 2024 -

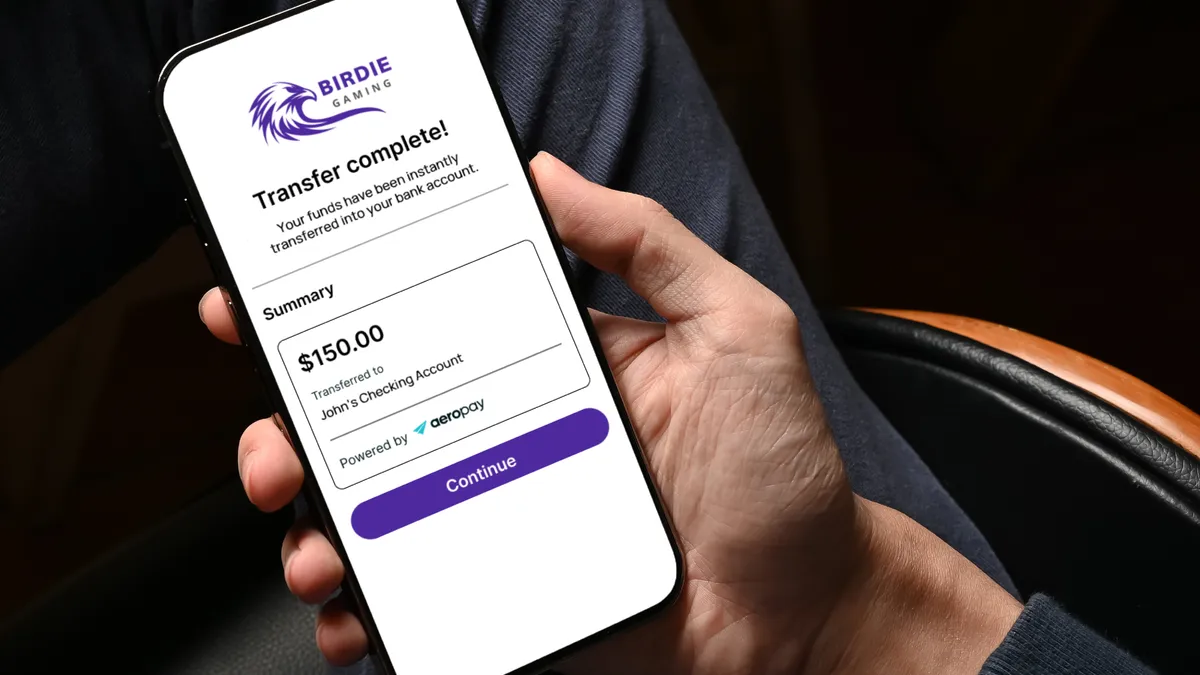

Aeropay partners with Cross River, UBank on gaming payouts

A record 67.8 million people are expected to place bets on this year’s Super Bowl, the American Gaming Association said Tuesday. Aeropay aims to get winnings paid out as fast as possible.

By Gabrielle Saulsbery • Feb. 7, 2024 -

MoneyLion, EY partner to co-build ‘turnkey’ solutions for banks

The partnership will help to drive deposits for mid-sized banks and help diversify their existing revenue streams by implementing comprehensive digital marketplaces inside their ecosystems.

By Rajashree Chakravarty • Feb. 7, 2024 -

Fiserv CEO details special bank charter pursuit

The processing and acquiring company, which seeks a “very specific” special bank charter, doesn’t intend to compete with its financial institution partners, Fiserv CEO Frank Bisignano said Tuesday.

By Caitlin Mullen • Feb. 7, 2024 -

Fleet fintech ditches Visa for Mastercard

Fuel card startup AtoB, with $112 million in financial backing, plans to take on dominant fleet service rivals Wex and Fleetcor.

By Lynne Marek • Feb. 6, 2024 -

Republican lawmakers raise concerns over FDITech

“[D]uring your tenure, the FDIC has moved innovation backwards,” the GOP lawmakers noted in the letter to the Federal Deposit Insurance Corp. Chair Martin Gruenberg.

By Rajashree Chakravarty • Feb. 5, 2024 -

Genesis Global settles SEC suit for $21M

The settlement will, among other things, "eliminate the risks, expenses, and uncertainty associated with protracted litigation against the SEC."

By Gabrielle Saulsbery • Feb. 2, 2024 -

SellersFi, Amazon team up to offer up to $10M in credit lines

The SellersFi credit lines are offered through Citi, which, with asset manager Fasanara Capital, led a $300 million credit facility for the company.

By Suman Bhattacharyya • Jan. 31, 2024 -

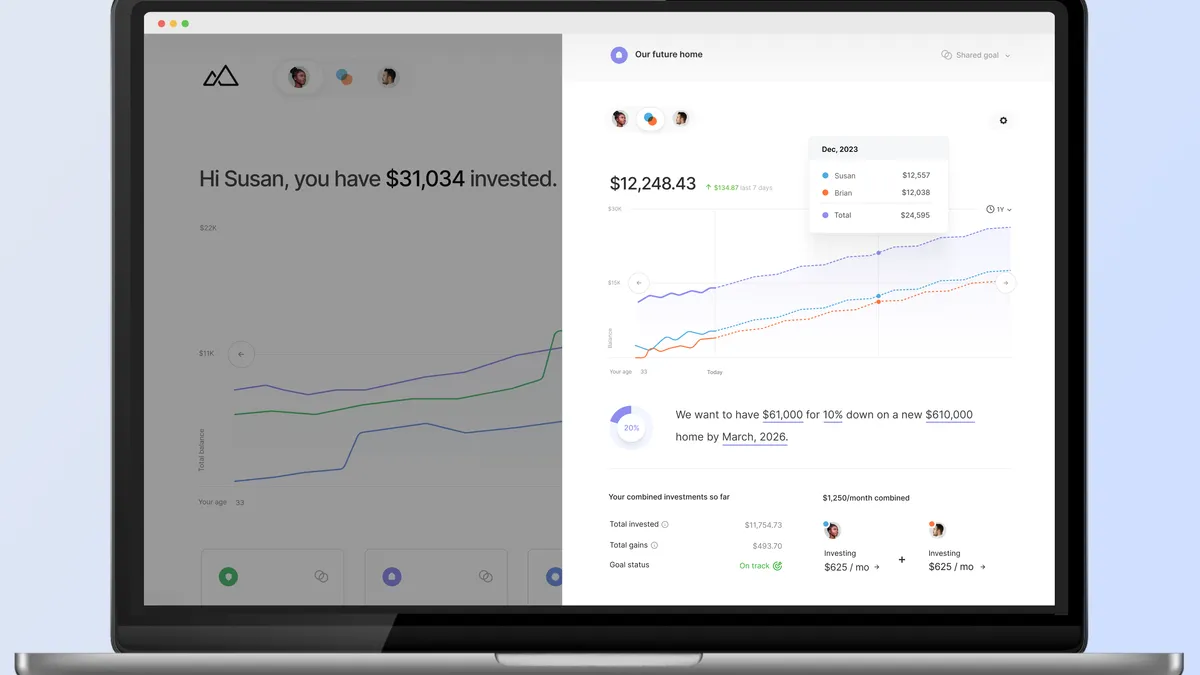

Plenty aims to help couples build wealth together

Emily Luk and Channing Allen fell in love while working together at a fintech startup. Now, they want to help other couples manage and grow their money.

By Gabrielle Saulsbery • Jan. 31, 2024 -

Nasdaq to cut jobs to streamline operations: report

The second-largest U.S. stock exchange is planning to cut its workforce as it integrates software provider Adenza into its business to improve efficiency, Bloomberg reported.

By Rajashree Chakravarty • Jan. 31, 2024 -

The banking industry outlook on 2024: The year of wait-and-see

A capital requirements proposal, fintech regulation and the CFPB itself hang in the balance as opinions (from the public and a court) and an ever-ticking clock loom large.

By Dan Ennis • Jan. 30, 2024 -

One in four companies ban GenAI

The research by Cisco found that generative artificial intelligence tools are putting many companies’ sensitive data at increased risk of public exposure.

By Alexei Alexis • Jan. 30, 2024 -

Retrieved from OCC.

Retrieved from OCC.

‘Troubled’ Blue Ridge Bank enters consent order with OCC

The OCC alleged that Blue Ridge’s BSA/AML program experienced “systemic internal controls breakdowns,” among other issues, in its second regulatory action against the bank in 18 months.

By Gabrielle Saulsbery • Jan. 29, 2024 -

Carlyle expands its reach on student loans as banks back out

The private-equity firm bought a $415 million portfolio, reportedly from Truist, and invested in student loan specialist Monogram.

By Dan Ennis • Jan. 25, 2024 -

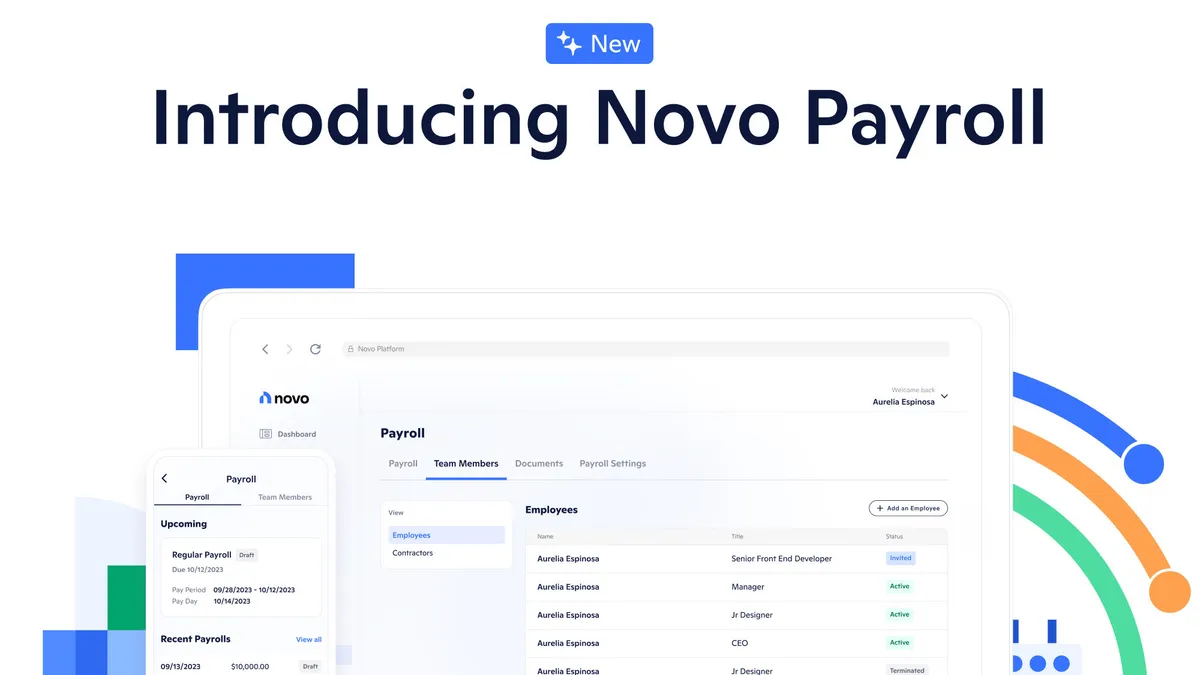

Novo rolls out an embedded payroll tool for small businesses

Powered by Check, the new tool, Novo Payroll, aims to help small businesses manage their finances from a single platform.

By Rajashree Chakravarty • Jan. 24, 2024 -

ModernFi raises $18.7M in Series A

“Faced with fundamental shifts in the behavior of deposits, institutions benefit from modern tools to manage and grow their funding,” said Paolo Bertolotti, ModernFi CEO, who cofounded the fintech with a Columbia University chum.

By Gabrielle Saulsbery • Jan. 24, 2024 -

Brex cuts workforce by 20% in profitability push

The company’s chief tech officer, who is transitioning to an advisory role, shared on LinkedIn a spreadsheet of employees impacted by the job cuts. Nearly 175 opted in, and 71 had “software engineer” in their title.

By James Pothen • Jan. 24, 2024 -

Klarna adds subscription plan

With an IPO on the horizon, the BNPL firm is offering customers a subscription service for $7.99 per month.

By Caitlin Mullen • Jan. 24, 2024 -

Figure eyes SEC approval for interest-bearing stablecoin

The company’s token would be redeemable at 1 cent per certificate, rather than $1, and interest would accrue daily and be paid monthly to the user, according to paperwork filed with the agency.

By Dan Ennis • Jan. 23, 2024 -

BaaS to require strong commitment, investment in 2024, experts say

While demand for embedded banking services will continue to propel the BaaS space, experts say regulatory scrutiny will likely separate committed banks from those with a casual interest in the model.

By Anna Hrushka • Jan. 22, 2024 -

Neobank Arc looks to fill SVB gap with venture debt platform

Arc Technologies CEO and co-founder Don Muir likened Arc Capital Markets to Uber Black, describing the platform as a dedicated concierge service that meticulously vets its lenders.

By Anna Hrushka • Jan. 17, 2024