Commercial: Page 62

-

Midsize-business loan vehicle is among Fed's $2.3T rollout of initiatives

Companies with up to 10,000 workers or less than $2.5 billion in revenue can get four-year loans, with principal and interest payments deferred for a year under the Main Street Lending Program.

By Dan Ennis • April 9, 2020 -

TD Bank sees remote work in new light amid 9,500-employee transition

The Canadian lender is shifting 500 call center employees a day into a work-from-home capacity, offering them 10 extra personal days to help with day care, and the ability to change schedules and do split shifts.

By Dan Ennis • April 9, 2020 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Kabbage finds partner bank for SBA loans, awaits guidance to become direct lender

The online lender, which has been lobbying Congress to help with the SBA's loan program since the start of the coronavirus crisis, has had to retool its business model because of the pandemic.

By Anna Hrushka • April 8, 2020 -

Mnuchin seeks extra $250B for SBA loans as AML rules, access issues slow aid

The application process has been fraught with delays, including a four-hour outage to the agency's loan processing system Monday and the need to comply with anti-money laundering regulations.

By Dan Ennis • April 8, 2020 -

Fifth Third hiring 950 employees amid higher loan, mortgage demand

The Cincinnati-based bank joins Bank of America in boosting its headcount during the coronavirus outbreak.

By Dan Ennis • April 7, 2020 -

Fed alters Wells Fargo's asset cap to continue support of SBA loans

Lifting the cap, instituted after a 2016 fake-accounts scandal, would help the bank lend to more small businesses affected in the coronavirus pandemic, CEO Charlie Scharf has argued.

By Anna Hrushka • Updated April 8, 2020 -

Wells Fargo cites asset cap in closing SBA loan portal

The bank said it would lend up to $10 billion as part of the U.S. government's coronavirus relief program but estimated it had hit that ceiling two days after the effort launched.

By Anna Hrushka • April 6, 2020 -

Crush of demand, hurried timeline plague SBA program launch

The $350 billion Paycheck Protection Program rolled out hours after the agency issued more guidance. The setup leaves banks reallocating resources and questioning risk.

By Dan Ennis • April 3, 2020 -

Kabbage cuts credit to small businesses, shifts focus to SBA loans

The online lender is dealing with the loss of loan origination revenue, as well as losses on the performance of existing loans as the coronavirus pandemic brings the economy to a near standstill.

By Anna Hrushka • Updated April 2, 2020 -

Barclays aims for net-zero carbon emissions by 2050

The commitment represents a step back from what investors sought when they pressured the bank to phase out fossil fuel lending in a resolution filed in January.

By Dan Ennis • April 1, 2020 -

North Carolina de novo organizers buy bank in Tennessee

Community Bank of the Carolinas failed to raise enough money to open, but its investors found a path forward in Brighton Bank.

By Dan Ennis • March 31, 2020 -

Banks, fintechs prepare for flood of SBA loan applications

As small businesses across the country shutter amid the pandemic, many fintech lenders are concerned traditional lenders won't be able to process loans quickly enough to get business owners the cash they need.

By Anna Hrushka • March 31, 2020 -

National Institute of Allergy and Infectious Diseases. (2020). "Novel Coronavirus SARS-CoV-2" [Image]. Retrieved from https://www.flickr.com/photos/nihgov/49565662436/in/album-72157713108522106/.

National Institute of Allergy and Infectious Diseases. (2020). "Novel Coronavirus SARS-CoV-2" [Image]. Retrieved from https://www.flickr.com/photos/nihgov/49565662436/in/album-72157713108522106/.

Standard Chartered pledges $1B toward pandemic relief, freezes hiring

The bank's backing will come in the form of loans to drug companies, health care providers and non-medical firms that have volunteered to make ventilators, face masks, sanitizers and protective equipment.

By Dan Ennis • March 31, 2020 -

BNY Mellon names interim CEO to top role permanently

Todd Gibbons' long tenure at the bank — he's worked there since 1986 — should act as a stabilizing force. He has served as interim chief since Charlie Scharf left to become CEO of Wells Fargo.

By Dan Ennis • March 30, 2020 -

BofA CEO: Capital levels allow us to focus on operations amid crisis

"It’s much different than walking down 6th Avenue in 2007-08 and being worried about risk," said Brian Moynihan. "Now it’s much more about how do we operationalize and help the economy get back on its feet?"

By Anna Hrushka • March 30, 2020 -

Morgan Stanley pledges no job cuts in 2020 — and several banks follow

Citi, Wells Fargo and Bank of America all vowed to maintain staffing levels throughout the coronavirus crisis, while European lenders such as HSBC and Deutsche Bank, which were planning layoffs, put them on hold.

By Dan Ennis • March 27, 2020 -

Regulators urge banks to offer responsible small-dollar loans

Five agencies promise future guidance on the lending vehicle, which some trade groups advocated long before the coronavirus pandemic sent the economy into a spiral.

By Anna Hrushka • March 27, 2020 -

Fintech lenders find an opening in $2T coronavirus relief package

"The language does include opportunity for fintechs to support, but it's now up to the Treasury to finalize the definition," said Kabbage's Sam Taussig. "This is not the time to debate the definition of a bank."

By Anna Hrushka • March 26, 2020 -

National Institute of Allergy and Infectious Diseases. (2020). "Novel Coronavirus SARS-CoV-2" [Image]. Retrieved from https://www.flickr.com/photos/nihgov/49565892277/in/album-72157713108522106/.

National Institute of Allergy and Infectious Diseases. (2020). "Novel Coronavirus SARS-CoV-2" [Image]. Retrieved from https://www.flickr.com/photos/nihgov/49565892277/in/album-72157713108522106/.

Santander chair, CEO give half of their pay to bank's virus-related medical fund

The bank's canceled dividends free up $97 billion to lend to coronavirus-affected businesses. "We need maximum flexibility so that we can do even more for the communities in the months ahead," Chairman Ana Botín said.

By Dan Ennis • Updated April 3, 2020 -

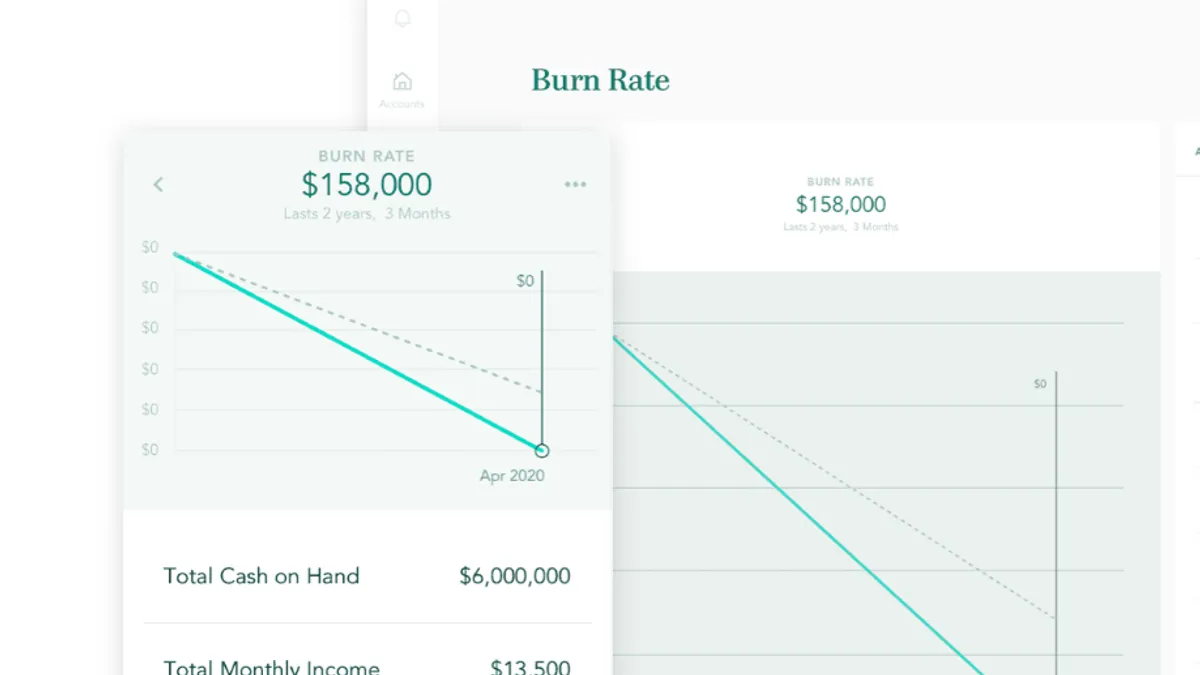

How Grasshopper Bank supports clients during COVID-19 pandemic

For the digital bank, which caters to the entrepreneur and venture capital market, the virus has created an environment where its clients rely on tailored offerings to navigate the crisis.

By Anna Hrushka • March 24, 2020 -

JPMorgan freezes hiring as coronavirus impact felt industrywide

Managers have been told to pull non-immediate job postings, and the company has delayed bringing new recruits into the bank until April 20, Bloomberg reported. Units such as home lending are exempt from the freeze.

By Dan Ennis • March 24, 2020 -

Citi, Wells, U.S. Bank boost compensation for front-line employees

Both Capital One and U.S. Bank have opted for pay raises, with the former offering an additional $10 an hour to branch workers. U.S. Bank, meanwhile, is giving an extra 20% to branch, call center and field office staff.

By Dan Ennis • Updated March 27, 2020 -

Goldman Sachs gives CEO a nearly 20% pay raise

The $4.5 million jump makes David Solomon the second-highest-paid CEO among Wall Street's big banks.

By Dan Ennis • March 23, 2020 -

Regulators ease loan modification rules amid coronavirus pandemic

Examiners will exercise judgment in reviewing loan modifications, including troubled debt restructurings, according to a joint statement by five agencies and an organization of state regulators.

By Anna Hrushka • March 23, 2020 -

Wells Fargo asks Fed to lift asset cap

Adding deposits or loans may be one way the nation's fourth-largest bank could help businesses and customers hit hard by the coronavirus outbreak.

By Dan Ennis • March 23, 2020