Commercial: Page 57

-

Azlo launches subscription-based banking service

The account is the main thrust of revenue diversification the challenger bank is introducing this year, CEO Cameron Peake said.

By Anna Hrushka • Sept. 29, 2020 -

Citi taps Morgan Stanley exec as new controller, accounting chief

The bank's latest executive hire comes as it tries to improve its risk management and controls, and follows reports that regulators have been pushing the bank for years to make such improvements.

By Anna Hrushka • Sept. 28, 2020 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

How Citi's innovation lab is tackling COVID-19 challenges

The unit, for example, built a digital whiteboarding solution to help job candidates and managers interact through an on-screen notebook when interviews can't take place face to face.

By Anna Hrushka • Sept. 23, 2020 -

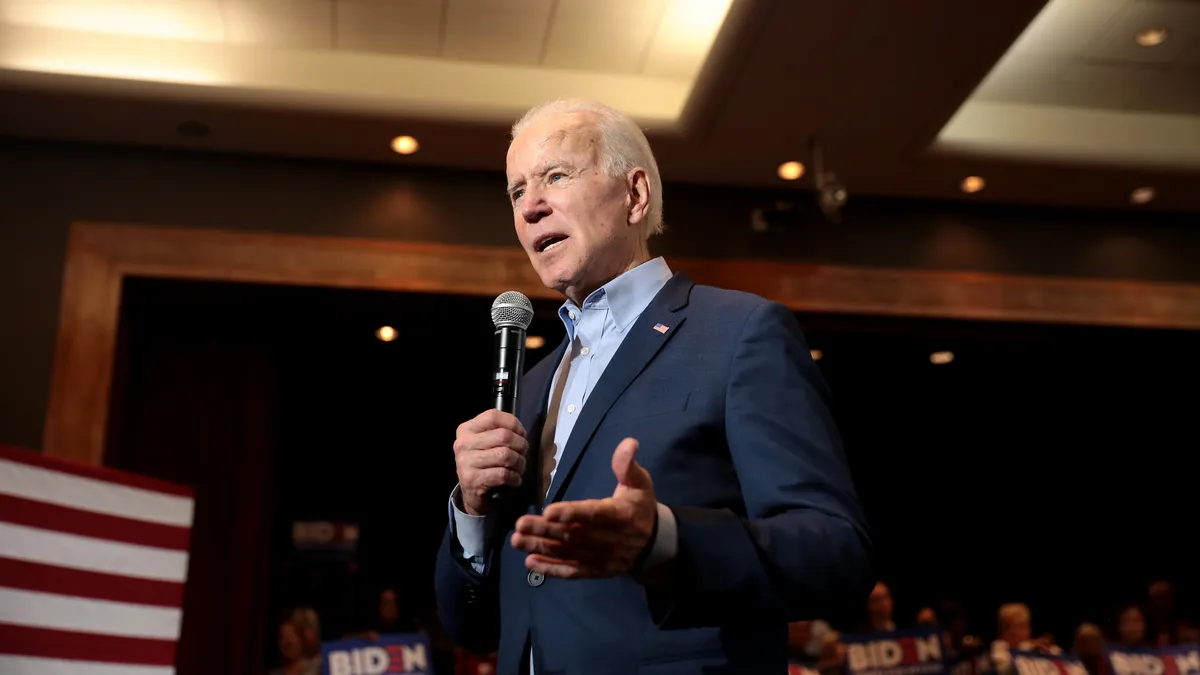

Biden tax plan could cost top 10 banks $7B per year, report finds

The plan would raise the corporate tax rate from 21% to 28%, partially rolling back changes enacted under the 2017 Tax Cuts and Jobs Act.

By Anna Hrushka • Sept. 17, 2020 -

Deutsche extends remote option until July 2021 for NY-area employees

The bank laid out a tiered approach in calling its U.S. investment bankers back to the office. Risk takers "involved in committing the firm's capital" will likely return full time "Client-facing" staff can work remotely one day a week.

By Dan Ennis • Updated June 3, 2021 -

Citi's Fraser paves the way, but more needs to be done, experts say

Banks need to do more than just hope that female leadership will create a "trickle-down" effect on organizational culture, one consultant said.

By Anna Hrushka • Sept. 14, 2020 -

FinCEN business loan fraud reports jump 84% for 4th straight monthly record

Financial institutions filed 1,922 suspicious-activity reports in August, up from 1,044 in July and about 14 times the monthly average since the watchdog's database was established in 2014. July's total itself was more than double June's 489.

By Anna Hrushka • Updated Sept. 25, 2020 -

Citi taps Jane Fraser to be CEO when Corbat retires in February

Fraser will become the first woman to lead a major U.S. bank. Before stepping into Citi's No. 2 role last October, she served as CEO of the bank's Latin American operations.

By Anna Hrushka • Sept. 10, 2020 -

Fewer banks servicing pot businesses, FinCEN report finds

The agency attributed the decline to several factors, including new guidance for hemp-related businesses, as well as the impact of the coronavirus pandemic.

By Anna Hrushka • Sept. 8, 2020 -

Banks went all in on construction lending in Q2, despite delinquencies

Wells Fargo was by far the leading nonresidential construction lender. But Arkansas's Bank OZK boosted its nonresidential loans by the greatest percentage. Construction accounts for 36.4% of the bank's outstanding loans.

By Joe Bousquin , Jennifer Goodman • Sept. 4, 2020 -

City First-Broadway merger would create largest US Black-led bank

The combined institution will maintain bicoastal headquarters, as well as its CDFI status, which requires it to deploy at least 60% of its lending into low- to moderate-income communities.

By Anna Hrushka • Aug. 27, 2020 -

Wells Fargo resumes much-anticipated job cuts

Initial layoffs will affect employees who were told before the pandemic their roles would "ultimately go away," CEO Charlie Scharf previously said. "It's like an onion: The more we do, the more clearer the next round will become."

By Dan Ennis • Aug. 21, 2020 -

Scotiabank fined $127M over price manipulation scheme

For more than eight years, four Scotiabank traders placed thousands of unlawful orders for precious metals futures contracts in an effort to manipulate prices to benefit themselves and the bank, authorities said.

By Anna Hrushka • Aug. 20, 2020 -

Rakuten again withdraws application for deposit insurance

If the e-commerce giant decides to submit a third application, industrial loan company charter opponents, which have railed against the model for more than a decade, will likely continue their fight.

By Anna Hrushka • Aug. 19, 2020 -

Banks eye loan specialists, marketers as pandemic boosts debt, digital demands

"Four months ago, a workout specialist couldn't find a job anywhere," said Paul Schaus, president, CEO and founder of the consulting firm CCG Catalyst.

By Anna Hrushka • Aug. 14, 2020 -

Deep Dive

Banks rethink office space, branch strategy to sync with new customer, employee habits

With 70% of bank staff working remotely and more clients using digital channels, cutting back on square footage is the new efficiency.

By Anna Hrushka • Aug. 13, 2020 -

BankMobile to transition from bank to tech company after Customers spinoff

"It gives us the runway, while we still have the stability of Customers partnership," BankMobile's Luvleen Sidhu said of the planned acquisition by Megalith Financial Acquisition Corp.

By Anna Hrushka • Aug. 12, 2020 -

Customers Bancorp to sell BankMobile for $140M

BankMobile launched in 2015. The digital bank's banking-as-a-service platform is prolific among colleges and universities, serving more than 2 million account-holders at 722 campuses.

By Anna Hrushka • Aug. 7, 2020 -

EBay partners with LendingPoint for merchant loans

The tie-up gives merchants an alternative to PayPal Working Capital, a financing solution eBay sellers have used in the past. PayPal's five-year operating agreement with eBay expired last month.

By Anna Hrushka • Aug. 6, 2020 -

PPP cases against JPMorgan, Bank of America, Wells Fargo to stay separate

A panel of judges denied motions to consolidate cases alleging the banks favored larger loans over first-come, first-served processing. JPMorgan Chase called the claims a "jigsaw puzzle of unmatched pieces."

By Dan Ennis • Aug. 6, 2020 -

Tech hurdle will slow banks' approach to crypto custody services

"Security and technology is the foundation of making this work," Kudelski Security's Scott Carlson said. "If you don't get that right, the entire system could collapse."

By Anna Hrushka • Aug. 4, 2020 -

Second half of 2020 may yield same dearth of M&A as first, analysts say

Some banks may have bigger concerns, such as padding loan loss reserves. However, PPP success may have others looking on the bright side — while still more look for a master acquirer.

By Ken McCarthy • Aug. 3, 2020 -

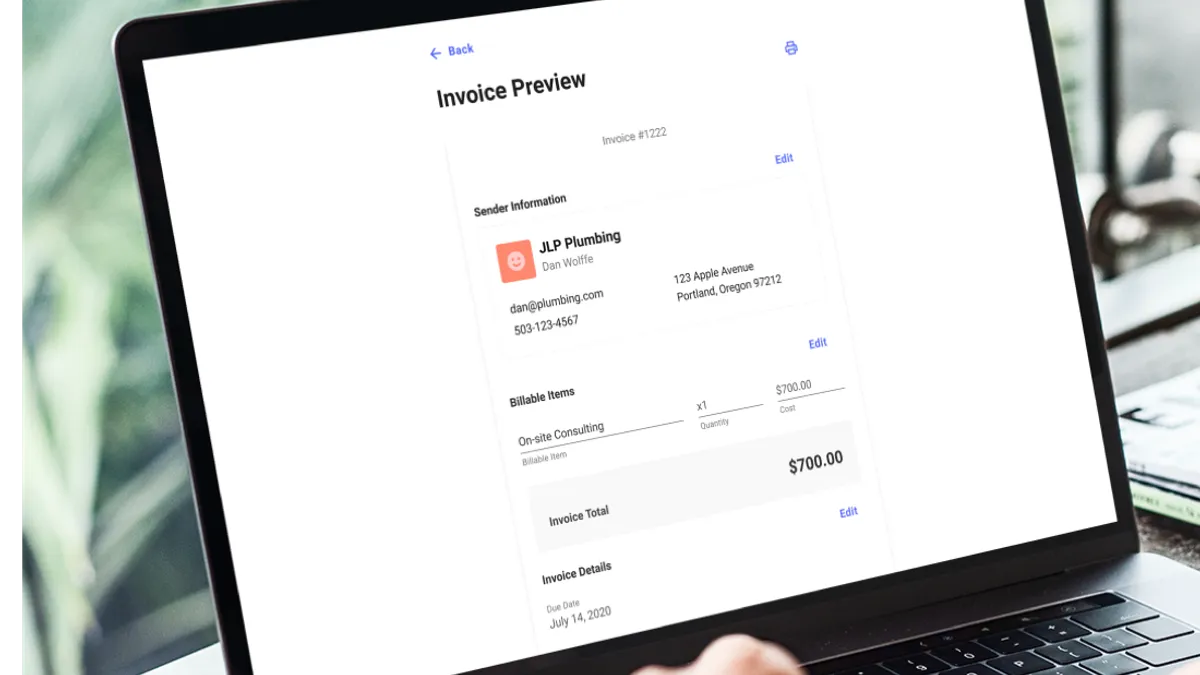

ZenBusiness acquires entrepreneur-focused challenger bank Joust

Joust's client base grew more than 600% between January and March, CEO Lamine Zarrad said. "Ultimately, [the goal] is to build the marketplace," said Ross Buhrdorf, CEO and co-founder of ZenBusiness.

By Suman Bhattacharyya • July 30, 2020 -

OnDeck Capital lands with Enova in $90M deal

Before being acquired Tuesday, OnDeck was pursuing a bank charter — a process Enova CEO David Fisher said the combined company could explore.

By Dan Ennis • July 29, 2020 -

JPMorgan Chase, Marqeta partner to launch virtual corporate cards

The deal comes as payment networks have seen contactless transactions spike by as much as 150% since March 2019.

By Anna Hrushka • July 29, 2020