Commercial: Page 52

-

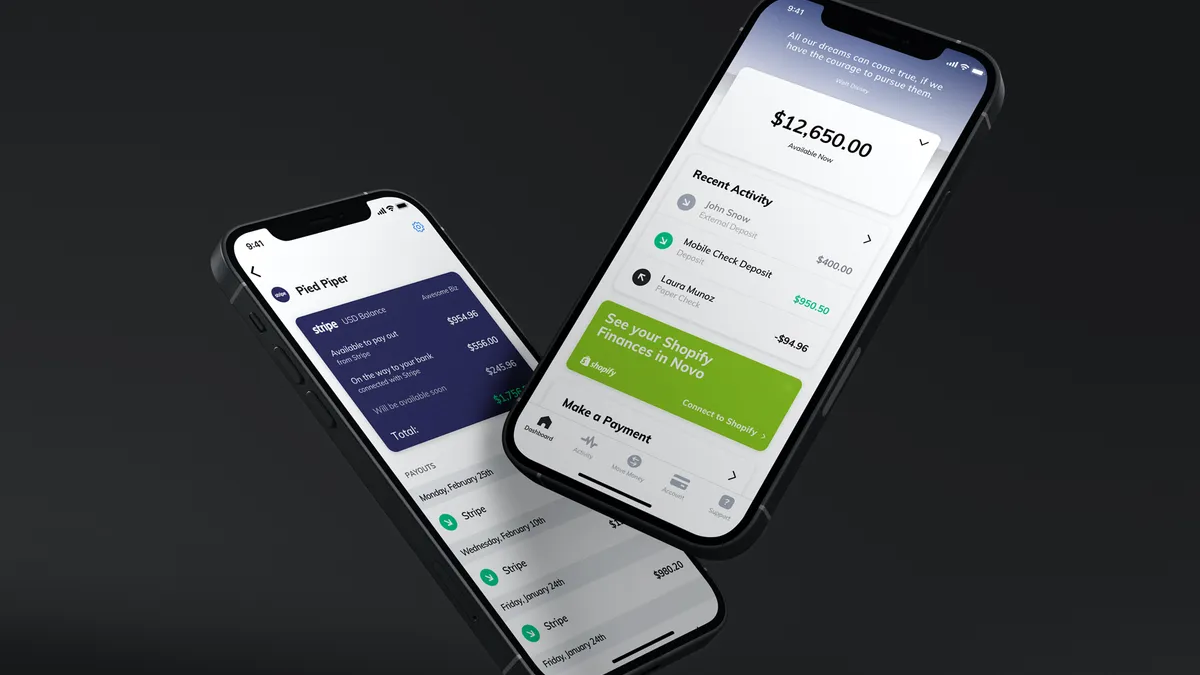

Novo expands products, welcomes surge in users from Azlo

Novo said it gained 20,000 former Azlo customers in the 2½ months since Spanish lender BBVA said it planned to shutter the entrepreneur-focused startup.

By Anna Hrushka • March 23, 2021 -

Revolut applies for California charter, launches Revolut Business

The challenger bank is showing it's expanding its target to include small and medium-sized U.S. businesses, in addition to the consumer accounts that fellow digital players Chime and Varo Bank are chasing.

By Anna Hrushka • March 22, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Stripe faces building pressure for a go-public strategy

Stripe's Irish co-founder brothers will be balancing the views of management, investors and bankers in deciding the best path to fund the company's future.

By Lynne Marek • March 22, 2021 -

House lawmakers reintroduce cannabis banking bill

While supported by bank trade groups and cannabis advocates, not all stakeholders are convinced the bill would have a sweeping effect on how banks respond to serving the industry.

By Anna Hrushka • March 19, 2021 -

Column

Crypto, ESG and office returns: Banks show when they would — and would not — rather be first

As Morgan Stanley and BNY Mellon look to one-up each other on digital assets, JPMorgan and Bank of America find themselves in opposing camps over how they will host summer internships.

By Dan Ennis • March 18, 2021 -

Bank branches will be extinct by 2034, fintech study finds

Figures released by Self Financial hinge on the acceleration of closures from 2012 to 2018. Particularly, the rate of closure doubled from 0.81% per year between 2012 and 2015 to 1.6% between 2015 and 2018.

By Dan Ennis • March 17, 2021 -

Brian Brooks, former OCC acting chief, joins blockchain startup

The new role places Brooks in a position where he can continue his push for the inclusion of blockchain and cryptocurrency in the financial sector, actions he took during his tenure at the helm of the bank regulator.

By Anna Hrushka • March 15, 2021 -

Column

How Citi can vanquish Revlon's ghost

The bank is barring the companies it sued from participating in debt deals — and is adding safeguards to its debt contracts. But a quicker office return via a COVID testing pilot may turn Citi's fortunes.

By Dan Ennis • March 12, 2021 -

Lawmakers introduce plan to extend PPP deadline to May 31

The bill, which also gives the Small Business Administration until June 30 to process PPP applications, passed the House by a 415-3 vote.

By Anna Hrushka • Updated March 17, 2021 -

Colorado credit union spinoff has ambitions beyond pot banking

Partner Colorado CEO Sundie Seefried plans to leave her post in July to lead a new entity that will launch lending products for cannabis companies. She's also eyeing the growing crypto and psychedelic mushroom space.

By Anna Hrushka • Updated June 23, 2021 -

SBA's delay in onboarding new PPP guidance squeezes applicants, lenders

Banks have exacerbated the crunch with early cutoffs. Bank of America has stopped taking new loan paperwork. JPMorgan and Citi's cutoffs are next week. The Fed extended the PPP facility, but only Congress can push the deadline.

By Dan Ennis • March 10, 2021 -

Biden's SBA nominee gives fintechs hope for inclusion beyond PPP

Funding Circle executive Ryan Metcalf said he was "heartened" by what he heard from a candidate to lead the agency that oversees the 7(a) program, for which the company applied to be a lender in 2019.

By Anna Hrushka • March 9, 2021 -

SoFi to buy community bank in $22.3M deal to speed charter

Sacramento, California-based Golden Pacific Bancorp and its three branches would operate as a division of SoFi Bank once the transaction closes by year's end, pending regulator approval, SoFi said.

By Dan Ennis • March 9, 2021 -

Deep Dive

In serving the Amish, Lancaster County bankers find 'make-a-difference' work

Banking some of Pennsylvania's most conservative people means forging creative solutions around mobile banking, photo IDs, flood insurance and even picnic-table business deals.

By Anna Hrushka • March 4, 2021 -

Citi marks a quiet transition as Fraser takes the reins

The Wall Street bank's first woman CEO announced an ESG initiative on her first day, but risk-management fixes and potential reorganization stand as a tougher test.

By Dan Ennis • March 2, 2021 -

PPP changes get mixed reactions from banking industry

"Many lenders are questioning whether the two-week exclusive window for smallest businesses is truly necessary," one bank consultant said.

By Anna Hrushka • Feb. 24, 2021 -

Wells Fargo sells its asset-management unit for $2.1B

The bank will keep a 9.9% equity interest in the spun-off operation after the deal closes. That's expected in the second half of this year.

By Dan Ennis • Feb. 23, 2021 -

Fintech Brex applies for ILC charter

The FDIC has received more than a dozen deposit insurance applications from proposed ILCs since 2012, to the chagrin of a number of lawmakers and trade groups.

By Dan Ennis • Feb. 22, 2021 -

Retrieved from Gage Skidmore/Flickr.

Retrieved from Gage Skidmore/Flickr.

Smallest businesses get exclusive 2-week PPP window, Biden admin says

The administration also announced changes to the way loans are calculated for businesses without employees, such as sole proprietors, independent contractors and the self-employed.

By Anna Hrushka • Feb. 22, 2021 -

Moriah Solomon. (2021). [Photograph]. Retrieved from Unsplash.

Moriah Solomon. (2021). [Photograph]. Retrieved from Unsplash.

Prior business relationships influence PPP coronavirus lending, study finds

Three-quarters of "relationship-borrowers" got a PPP loan, compared with 18% of "non-relationship firms," a study by researchers at Washington University in St. Louis, Boston College and the University of Geneva found.

By Jim Tyson • Feb. 18, 2021 -

Wells Fargo asset cap closer to ending as Fed reportedly OKs overhaul plan

The nation's fourth-largest bank has operated for three years under a $1.95 trillion asset cap set by the Federal Reserve in response to a 2016 fake-accounts scandal that has cost the bank billions of dollars in fines.

By Anna Hrushka • Feb. 18, 2021 -

Citi on the hook for $500M blunder, judge rules

In a 101-page decision in which a judge called the error "one of the biggest blunders in banking history," asset managers are not required to return the money. However, the judge said a freeze on the funds should remain in place.

By Anna Hrushka • Feb. 16, 2021 -

Virginia-based bank provides Bitcoin access at ATMs

Blue Ridge Bank's announcement comes as larger players such as BNY Mellon and Mastercard are showing greater acceptance of digital assets. Bitcoin traded above $50,000 for the first time Tuesday.

By Anna Hrushka • Feb. 12, 2021 -

OppLoans rebrands, will go public through merger with SPAC

The Chicago-based loan servicer looks to reach upmarket with a credit-card rollout this year and a payroll deduction secured installment loan, currently in beta.

By Suman Bhattacharyya • Feb. 12, 2021 -

Opinion

3 steps for scaling as an alternative lender

Leaning on a growing segment of borrowers (small-business owners), leaning into digital transformation and picking the right solution can help alternative lenders scale through a downturn.

By Jorge Sun • Feb. 12, 2021