Commercial: Page 50

-

Wells Fargo names Steven Black chairman, replacing Charles Noski

Noski stepped into the role amid heightened political scrutiny last year, stemming from the bank’s handling of its 2016 fake accounts scandal.

By Anna Hrushka • Aug. 10, 2021 -

Circle seeks national charter to start digital currency bank

Circle co-founder and CEO Jeremy Allaire said the company intends to operate under the supervision and risk management requirements of the Fed, Treasury, the OCC and the FDIC.

By Anna Hrushka • Aug. 9, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Brex withdraws ILC, deposit insurance applications

The San Francisco-based fintech, which filed the applications in February, said it will “modify and strengthen” its applications and plans to resubmit at a later date.

By Anna Hrushka • Aug. 9, 2021 -

Citizens Financial to buy valuation consulting firm

Citizens, which plans to grow its customer base by 1 million next year, said its acquisition of Willamette would place it among the top valuation services providers in the country.

By Anna Hrushka • Aug. 6, 2021 -

Retrieved from Senate Banking Committee.

Retrieved from Senate Banking Committee. Overdraft alternatives

Overdraft alternativesOCC conducting review of overdraft policies, acting comptroller says

Acting Comptroller Michael Hsu’s remarks come as more banks are revamping their overdraft policies and as Democrats are calling for legislation that would rein in the practice.

By Anna Hrushka • Aug. 4, 2021 -

NY regulator asks financial institutions to share diversity data

Superintendent Linda Lacewell cited the impacts of the COVID-19 pandemic, racial injustice and climate change as primary reasons entities should boost diversity.

By Anna Hrushka • July 30, 2021 -

SBA launches streamlined PPP forgiveness portal

The agency said more than 600 banks have opted in to the program, representing 30% of loans $150,000 or less that have not yet applied for forgiveness.

By Anna Hrushka • July 28, 2021 -

Citizens Financial to acquire Investors Bancorp in $3.5B deal

The transaction, expected to close in the first or second quarter of 2022, will put Citizens’ assets above $200 billion, and propel the bank to the top 10 in deposits among retail and commercial banks in the New York City market.

By Anna Hrushka • July 28, 2021 -

Sen. Cory Booker clarifies SAFE Banking Act support

“For me, a good bipartisan bill like the [SAFE] banking bill is a necessary sweetener to get people to move along on the equitable justice elements that are really critical,” he said.

By Anna Hrushka • July 27, 2021 -

M&T Bank to cut more than 700 jobs following People’s United takeover

The Buffalo, New York-based bank anticipates it will save about $330 million in annual expenses that would otherwise be duplicated as a result of its $7.6 billion acquisition of People’s United.

By Anna Hrushka • July 26, 2021 -

Plaid taps former bank execs to help reach data-sharing goal

The company’s mission to forge stronger relationships with banks and increase its API traffic comes amid a sometimes less-than-amicable interplay between data aggregators and financial institutions.

By Anna Hrushka • July 23, 2021 -

Column // Return to the office

Bank of America, Deutsche and the case of the summer sequel

Commitments to de-emphasize overdraft fees, boost junior banker pay and refresh banks’ card suites are hardly new. This week offers deeper tread on well-worn narratives.

By Dan Ennis • July 21, 2021 -

OCC to rescind Trump-era revamp to anti-redlining rule

“While the OCC deserves credit for taking action to modernize the CRA through adoption of the 2020 rule, upon review I believe it was a false start,” Acting Comptroller Michael Hsu said in a statement.

By Anna Hrushka • July 20, 2021 -

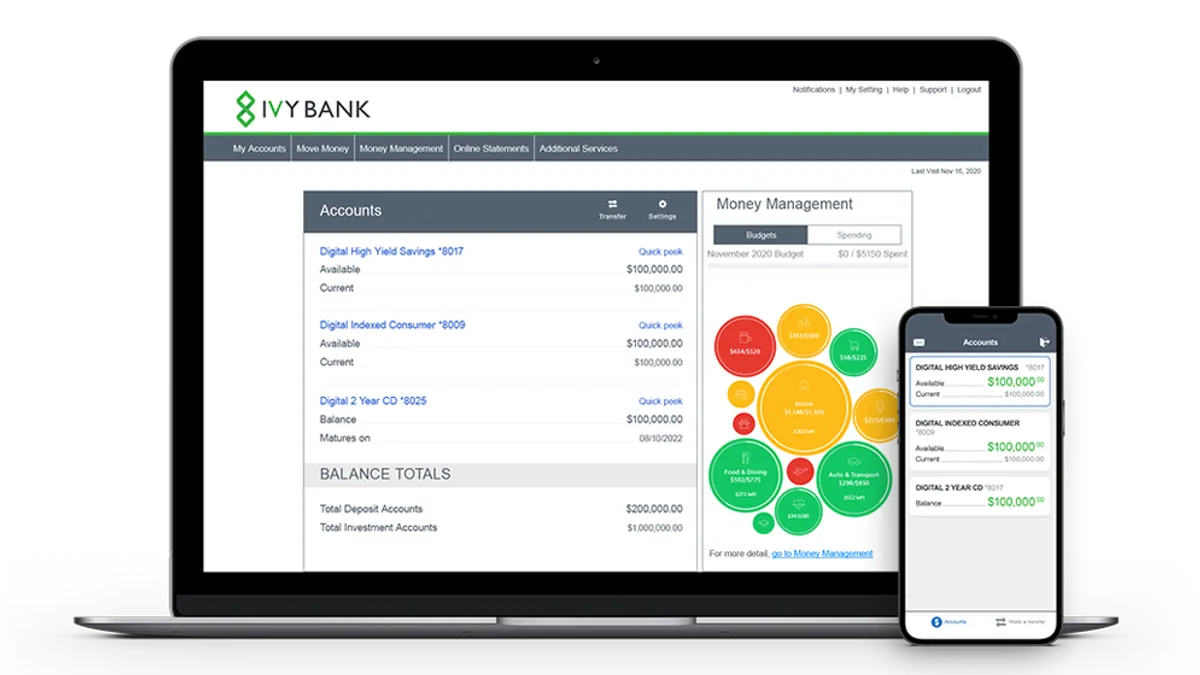

Cambridge Savings Bank launches digital bank to expand national reach

The Massachusetts-based bank said its “Ivy Bank” platform has been in the works for the past two years and will aim to compete with other digital-only banks in the marketplace.

By Anna Hrushka • July 19, 2021 -

Sponsored by Statflo

The frictionless customer journey in banking starts with text messaging

Find out how to create the frictionless digital banking experience customers now expect.

July 19, 2021 -

SAFE Banking secondary to comprehensive pot reform, Senate Democrats say

The new bill, unveiled Wednesday, could become a setback for the future of the SAFE Banking Act, after lawmakers said the comprehensive reform would take priority over the more narrow banking bill.

By Anna Hrushka • July 16, 2021 -

Truist reports 73% Q2 profit amid loan-loss reserve release

“To thrive in today’s world requires a deep commitment to continuously re-evaluating yesterday’s activities and expenses associated with that, so that we can afford to invest in new activities for today’s demands,” CEO Kelly King said.

By Anna Hrushka • July 15, 2021 -

Bank of America’s Q2 profit soars as low interest rates dent revenue

A $2.2 billion loan-loss reserve release buoyed the nation’s second-largest bank as it anticipates an economic rebound from the COVID-19 pandemic.

By Anna Hrushka • July 14, 2021 -

JPMorgan’s Q2 profit more than doubles amid slight drop in revenue

The bank said its reserves for credit losses remain at $22.6 billion, an amount CFO Jeremy Barnum said reflects the remaining uncertainty around the COVID-19 pandemic and the shape of the economic recovery.

By Anna Hrushka • July 13, 2021 -

Deep Dive // Overdraft alternatives

Rethinking overdraft

While many stakeholders would agree banks need to revamp the fee-based model, it remains to be seen whether change will come through legislation or the market.

By Anna Hrushka • July 12, 2021 -

U.S. Bank boosts unit to advise local governments on asset management

The deal to acquire PFM Asset Management for an undisclosed sum is at least the second move in the past seven months aimed at bolstering the Minneapolis-based bank’s noninterest income.

By Dan Ennis • July 12, 2021 -

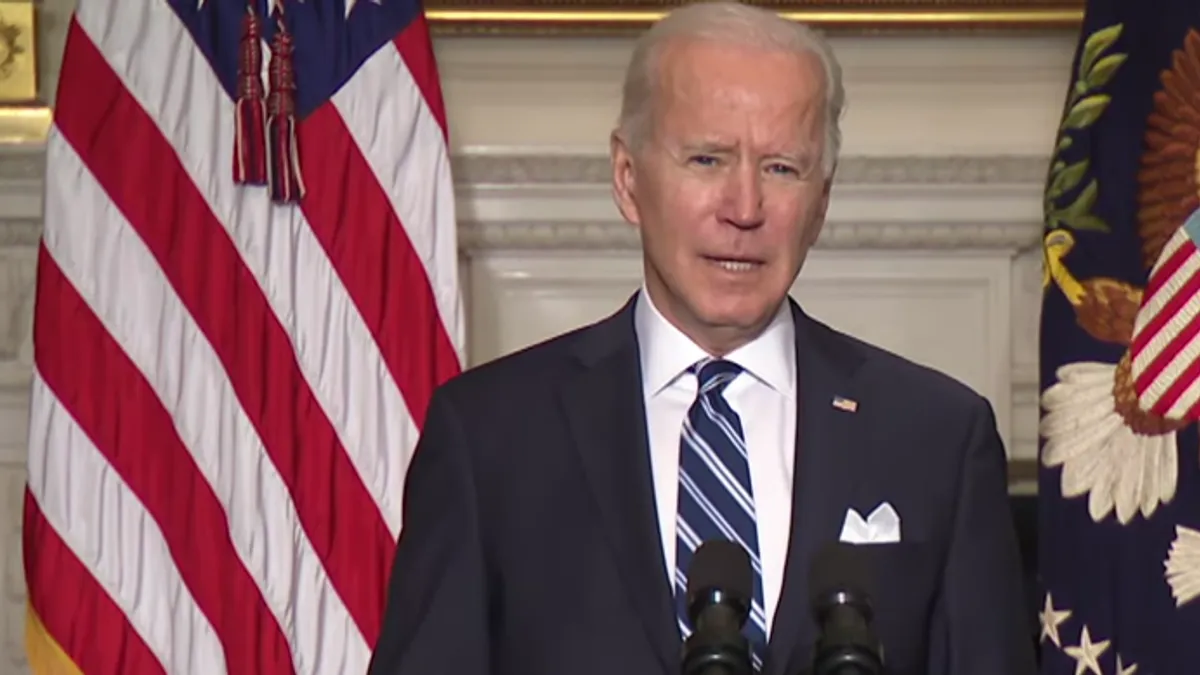

Retrieved from The White House/YouTube on January 29, 2021

Retrieved from The White House/YouTube on January 29, 2021

Biden executive orders target bank mergers, financial data sharing

One measure requires the Justice Department and bank regulators to update guidelines to boost merger scrutiny, while another encourages the CFPB to issue rules giving customers greater access to their financial data.

By Anna Hrushka • July 9, 2021 -

Szekely, Pedro. (2017). “Chicago Skyline” [Photograph]. Retrieved from Flickr.

Szekely, Pedro. (2017). “Chicago Skyline” [Photograph]. Retrieved from Flickr.

Billie Jean King-backed de novo to open this fall

Chicago-based First Women’s Bank said it raised more than $30 million through its private placement offering with the support of an investor group including Bank of America, Fidelity Investments and the tennis legend.

By Anna Hrushka • July 8, 2021 -

Fintech Karat aims to become influencers’ bank, raises $26M

The company plans to move beyond credit cards and offer a suite of tools, including bank accounts and tax preparation services, for the creator economy.

By Anna Hrushka • July 2, 2021 -

Column // Return to the office

Banks prepare for 2021’s second act with office-return, banker-pay pledges

Like any good drama, last week provided a recap of several long-running narratives in banking before the industry launches into 2021’s latter half.

By Dan Ennis • July 2, 2021